Publications

- Category: Labor and employment

The Federal Supreme Court (STF) ordered on Thursday, May 25, national suspension of the processing of all labor executions related to the issue controverted in Topic 1.232 of the General Repercussion Issues Management, pending definitive judgment of the extraordinary appeal.

Extraordinary Appeal 1.387.795 (RE 1.387.795) is the leading case, handled by the labor law practice of Machado Meyer.

The subject under discussion is whether it is possible to include a company belonging to an economic group that did not take part in the trial phase as a defendant in the labor execution phase.

The decision handed down by Justice Dias Toffoli was based on the grounds presented in writing in the case, in which Machado Meyer was able to demonstrate, in the words of Justice Toffoli, "relevant grounds that call attention to the situation of dissenting case law in multiple labor claims that convey a matter pertaining to the subject, notably as to the application (or not), in the labor field, of article 513, paragraph 5, of the current Code of Civil Procedure - which provides that it is not possible to enforce a judgment against a co-liable party that did not participate in the trial phase."

The gravity of the situation was highlighted in the Justice's decision, since, in innumerous proceedings in the labor execution phase, the assets of companies that did not participate in the trial phase have been seized. In this manner, despite supposedly being part of an economic group, the company did not have the opportunity to, at least, respond previously regarding the specific and precise requirements that indicate it is (or is not) part of an economic labor group - which is only provided after the judicial bond, in a motion to stay execution.

Based on these arguments, one applies the provisions of article 1,035, paragraph 5, of the CPC, to suspend the processing of all labor executions proceeding in the national territory and dealing with the matter discussed in Topic 1,232.

The national suspension of proceedings is justified for reasons of legal security, stabilization of case law, equal protection, exceptional social interest, and procedural economy. The non-suspension of cases has triggered successive conflicting decisions in the non-plenary bodies of the Labor Courts. This situation aggravated the legal uncertainty, which had been spreading due to divergent case law on the merits of the matter.

Thus, the STF stops the proliferation of conflicting decisions that have caused harmful effects to legal and economic relations in the country. The order is that all bodies of the labor court system are to be informed of the decision.

- Category: Labor and employment

Published on April 24th, Law 14,553/23 brings in changes to the Racial Equality Act (Law 12,288/10). The new law creates an obligation to include employees' racial and ethnic information in corporate documents containing individualized information about them. The obligation also applies to administrative records directed to bodies and entities of the Public Administration.

The information must be filled out according to self-classification criteria based on previously delimited groups, that is, the employee must inform the employer of which ethnic and racial segment he identifies with.

According to the law, information about race must be included in the following documents:

- employment hiring and dismissal forms;

- work accident forms;

- registration done in the National Employment System (Sine);

- Annual Corporate Information Report (Rais);

- registration of insured persons and dependents with the National Institute of Social Security (INSS); and

- survey questionnaires conducted by the Brazilian Institute of Geography and Statistics (IBGE).

Law 14,553/23 also provides that the IBGE will carry out surveys, every five years, to identify the percentage occupation of each racial and ethnic group employed in the public sector. This information will serve as a basis for creating and implementing public policies that promote racial equality.

The changes brought about by Law 14,553/23 also serve as support for companies to monitor racial equity issues and promote an environment aligned with ESG issues.

The new law does not specify when this information will start to be required from companies. We believe, however, that any document containing individualized information on workers prepared after the law enters into effect must include a specific field for filling in ethnic and racial information.

- Category: Litigation

Issued on April 25, 2023 by the Secretariat of Management and Innovation of the Ministry of Management and Innovation in Public Services, Ordinance Seges/MGI 1,769, which repealed Ordinance Seges/MGI 720/23, provides for the transitional regime referred to in article 191 of Law 14,133/21 – the new Bidding Law.

The transitional regime was established so that the public manager can choose, until December 30, 2023, to bid and contract according to:

- the new Bidding Law;

- the previous Bidding Law (Law 8.666/93);

- the Auction Law (Law 10.520/02); or

- the Differentiated Regime of Public Contracting – RDC (Law 12.462/11).

In addition to these legally established hypotheses, Ordinance Seges/MGI 1,769/23 also refers to Decree No. 7,892/2013, which regulates the Price Registration System. In addition, the new Bidding Law also prohibits – in its article 191, paragraph 1 – the combined application of its rules with the provisions of any of the other rules mentioned.

Thus, Ordinance Seges/MGI 1,769/23 establishes that the bidding processes and contracts filed and instructed based on these previous rules are based on the assumptions that:

- "the publication of the notice or the authorizing act of direct contracting occurs until December 29, 2023" (article 2, I); and

- "the option chosen is expressly indicated in the notice or in the authorizing act of direct contracting" (art. 2, II).

In a didactic way, based on Ordinance Seges/MGI 1,769, public managers must observe the following schedule:

| RITE | DESCRIPTION | INSTRUMENT | DEADLINE FOR INSERTION INTO THE SYSTEM | DEADLINE FOR PUBLICATION IN THE OFFICIAL GAZETTE |

|

All bidding modalities provided for in Laws 8,666/93, 10,520/02 and 12,462/11, including bids for price registration. | Edict | Until December 28, 2023, at 4 p.m. | Until December 29, 2023 |

|

All waivers and unenforceability of bidding whose values do not exceed those provided for in items I and II of article 24 of Law 8,666/93 (according to Normative Guidance AGU 34/11). | Notice or act of authorization/ratification | Until December 29, 2023 | Not applicable |

|

All bidding waivers not contemplated in item (2). | Act of authorization/ratification | Until December 28, 2023, at 4 p.m. | Until December 29, 2023 |

|

All unenforceability not mentioned in item (2). | Act of authorization/ratification | Until December 28, 2023, at 4 p.m. | Until December 29, 2023 |

In addition to these deadlines, Ordinance Seges/MGI 1.769/23 establishes that:

- the minutes of price registration governed by Decree 7.892/13, during their validity, may be used by any organ or entity of the federal, municipal, district or state Public Administration that has not participated in the bidding process, with the authorization of the managing body (article 4);

- contracts entered into with an indefinite term of validity must be terminated by December 31, 2024 and subsequent contracts must be made in accordance with the new Bidding Law (article 5);

- the "accreditations carried out, pursuant to the provisions of the caput of article 25 of Law No. 8,666, of 1993, shall be extinguished by December 31, 2024" (article 6).

Thus, despite the survival obtained by the previous rules through Provisional Measure 1,167/23 – which extended them until December 30, 2023 – the situation is headed so that, based on the time limits mentioned above, the new Bidding Law becomes, finally, the only valid rule on the matter, which is already taking a long time to occur.

- Category: Tax

The Federal Revenue Service of Brazil (RFB), through its General Coordination of Taxation (Cosit), published, on April 12, the Private Letter Ruling Cosit 85/23 (SC Cosit 85/23), to determine the limits of the restriction on the use of tax Net Operating Losses (NOLs) in situations involving the change of branch of activity by a legal entity submitted to the real profit regime.

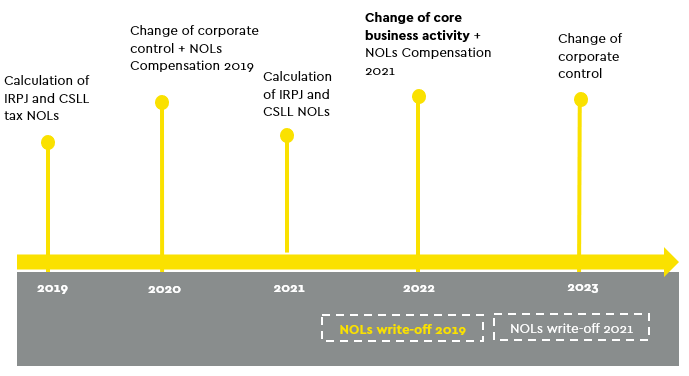

The compensation of tax losses, NOLs, of Corporate Income Tax (IRPJ) and Social Contribution on Net Income (CSLL) is subject to a series of limitations in the legislation – lock-limit of 30%, compensation of operating losses only with operating profits, restriction of compensation in case of corporate merger operations, spin-off or incorporation, write-off of the right to compensation in case of extinction, among others. We highlight here the situation that involves the change of corporate control and branch of activity (Decree-Law 2.341/87, art. 32).[1]

According to this rule, the legal entity cannot compensate NOLs of IRPJ and CSLL in case of cumulative change of corporate control and branch of activity. The idea behind this specific limitation is to make it impossible for third parties who did not participate in its generation to take advantage of losses and thus prevent the implementation of corporate operations that aim to allow the use of these amounts in transactions involving acts of simulation and abuse.[2]

The normative provision, however, gave rise to discussions about what would effectively be considered as modification of the branch of activity (for example, adoption of new activity, suppression of core or secondary activity, change of branch of business).

SC Cosit 85/23 is the first formal and binding manifestation of the RFB on the change of branch of activity and its impacts for the purpose of using NOLs credits by taxpayers. The issue had already been analyzed in some decisions of the administrative case law in Carf (Administrative Tax Court of Appeals).[3][4][5]

According to SC Cosit 85/23, the modification of the branch of activity that leads to the write-off (loss) of the right to compensation of tax NOLs of IRPJ and CSLL calculated in the period prior to the modification of the corporate control is that related to the main and core business activity. There is no limitation to compensation in situations where only some of the secondary activities are modified.[6]

Thus, according to RFB's position in this response to the consultation, if the legal entity has calculated IRPJ and CSLL NOLs and has undergone a change in its corporate control, it will lose the right to offset these credits calculated before the change of control, if it has also modified its activity of a core business nature. There are no negative impacts, however, in case of modification only of secondary activities.

The situation can be represented by the following timeline:

RFB follows interpretations given in similar situations

In our view, the understanding of the RFB is in line with other interpretations already adopted by the body in similar situations. Cases involving the analysis of the application of certain tax regimes linked to the main and core activity carried out by taxpayers.

This is, for example, the evaluation carried out by the RFB on the definition of the application of the so-called "payroll exemption regime", which implies the payment by legal entities of the Substitutive Social Security Contribution on Gross Revenue (CPRB) in replacement of the Employer's Social Security Contribution (CPP-INSS), which focuses on the payroll. In this situation, the taxpayer's framework is linked to the code of the core activity indicated in the National Classification of Economic Activities (CNAE).

In this case, analyzing the correct framing of a corporate taxpayer in the payroll exemption regime from the definition of its core business activity, the RFB understood that the core activity – or preponderant – should be understood as the one that represents the majority of the revenue earned in the previous calculation period or of the expected revenue for the current period – if it is the period of beginning of the company's activities (SC Cosit 106/17).

This understanding ensured the full application of the guidelines imposed by the National Classification Commission (Concla), of the Brazilian Institute of Geography and Statistics (IBGE), for the definition of the core activity in the CNAE (CNAE 2.0 Manual, items 1.6[7] and 1.7).[8]

Although it is recognized that SC Cosit 85/23 is an important manifestation of the RFB on the limitation related to the compensation of IRPJ and CSLL NOLs in cases of modification of branch of activity, we understand that this private ruling does not eliminate the discussion nor precisely delimit the scope of the expression "modification of the branch of activity".

There are situations in which all secondary activities are changed or even in which, due to market opportunity or economic moment, the secondary activity begins to overlap with the core activity, which leads to the need to change the company's CNAE.

These situations are not covered in the SC Cosit 85/23 analysis. Nor should they, in our opinion, trigger any prohibition regarding the use of IRPJ and CSLL NOLs, even if combined with a change of control.

Even with the direction of SC Cosit 85/23, it still seems important to consider the specific analysis of the peculiarities of each concrete case to evaluate the correct tax treatment.

Our team is available to review the understanding adopted by companies on the subject and help define the next steps.

[1] Decree-Law 2.341/87, "Art. 32. The legal entity may not offset its own tax losses if between the date of the calculation and the compensation there has been cumulatively a modification of its corporate control and the branch of activity."; Provisional Measure 2.158-35/01, "Art. 22. The provisions of the articles shall apply to the negative calculation basis of the CSLL. 32 and 33 of Decree-Law No 2,341 of 29 June 1987."

[2] Explanatory Memorandum 169/87, "Article 32 provides for the non-compensation of tax losses calculated by legal entities, when, after the calculation of losses, there has been a change in the corporate control and the company's branch of activity. That rule is intended to restrict the absorption of one legal entity by another for the purpose of compensating for tax losses."

[3] "COMPENSATION OF TAX LOSSES AND NEGATIVE BASIS. CHANGE OF CORPORATE CONTROL AND BRANCH OF ACTIVITY. CUMULATIVITY OF EVENTS. EFFECTS. (...) In the present case, in which the controversy rests only on the occurrence or not of a change of branch of activity, even if the objective elements revealing the questioned change (amendment of the Statute, of classification of economic activity in the CNAE and CNPJ) are disregarded, the data contained in the information statement submitted to the Federal Revenue Service leave out of doubt the occurrence of the fact imputed by the autuante authority." (Carf, Judgment 1302-000.333, August 4, 2010). In this case, the possibility of maintaining tax losses by a company with holding activity (investment in "companies that dedicate themselves: (i) to forestry projects; (ii) the manufacture and sale of forest products, including wood, newsprint, press papers or other types of paper, derived from wood pulp", etc.), which had already been submitted to the change of control and included new activities in its object ("production of press paper, industrialization and trade of wood, management of forest resources"). These new activities were included through the incorporation of other companies of the group, and the holding activity was maintained. As a result of the judgment, in the absence of proof by the taxpayer of the financial preponderance (assets and revenues) of the holding activity in relation to the others, the directors decided by majority (5x1) that the inclusion of new activities in these circumstances would characterize a modification of the branch of activity (holding company for paper production). Consequently, the rule limiting the compensation of tax loss and negative basis would apply.

[4] "I. R. P. J. — MODIFICATION OF SHAREHOLDING CONTROL AND CHANGE OF ACTIVITY — NON-EXISTENCE — Not materializing the imputed tax charge consistent in the cumulative change of branch of activity and shareholder control, does not proceed to gloss of the losses ascertained in previous years by the defendant itself. (...) The incorporation of its subsidiary, (...), on 12/30/94, whose object was insurance brokerage, did not imply a change of branch of activity, since, from then on, it became Rcte. to carry out jointly the activities and brokerage of insurance and interests in other companies, even if in some period of time, in view of the sale of the shareholding and, until the acquisition of a new interest, the income from participations has been temporarily replaced by financial revenues. The sale of the equity interest in (...) occurred in 1996 and the occasional absence of income from participations until the new payment of the capital of (a (...)), as found by the Fiscalização, without alteration of the bylaws, is not capable of changing the corporate purpose of the company." (Carf, Judgment 101-93.760, March 19, 2002).

[5] "COMPENSATION OF LOSSES AND THE NEGATIVE CALCULATION BASIS OF CSLL. INCORPORATION IN REVERSE. WRITE-OFF OF COMPENSATION. BURDEN OF PROOF. ART. 513, RIR/99. (...) If the appellant did not succeed in demonstrating the maintenance of corporate control, nor the absence of a change of branch of activity between the period of calculation of the tax loss and its compensation, the appeal claim does not deserve to be accepted. (...) Based on the ordinance collected above, what is verified is that in fact there was a change in the branch of activity of the incorporating company, with the authorization to operate with capitalization securities, between the date of calculation and the compensation of the tax loss." (Carf, Judgment 1301-005.767, October 18, 2021).

[6] Private Letter Ruling 85/23, "ACCUMULATED TAX LOSS. CHANGE OF BRANCH OF ACTIVITY. The legal entity will not be able to offset its own tax losses if between the date of the calculation and the compensation there has been cumulatively a modification of its corporate control and the branch of activity. The cessation of one of the secondary activities with the maintenance of the other activities already carried out by the legal entity does not correspond to a change in the branch of activity, for the purpose of compensation of accumulated tax loss."

[7] Manual of CNAE 2.0, Introduction to the National Classification of Economic Activities - CNAE 2.0, "1.6 Economic activity and statistical units. (...) Economic activity translates into the creation of added value through the production of goods and services, with the use of labor, capital and inputs (raw materials). The main activity of a statistical unit is defined as its main production process, which contributes most to the generation of added value. In item 1.7 it will be explained how, in practice, the main activity of a production unit must be determined to classify it according to the CNAE. The secondary activity is an activity whose production is intended for third parties, but whose added value is lower than that of the main activity. Most producing units carry out more than one activity and, therefore, have one or more secondary activities. Since, by definition, the unit of production must have a single main activity, in cases where it produces products (goods and/or services) associated with other classes of the classification of activities, these are considered secondary production (...)."

[8] Manual of CNAE 2.0, Introduction to the National Classification of Economic Activities – CNAE 2.0, "1.7 Methods of classification. (...) As recommended by CIIU/ISIC 4, the main activity of a unit with multiple activities is determined through the analysis of the composition of the value added, that is, the analysis of how much the goods and services produced contributed to the generation of this value. The activity with the highest added value is the main activity. In practice, however, data on the value added by individual goods and services are not available. It is recommended, in these cases, that the main activity be determined using an approximation to the value added. The variables used as substitutes for value added can be: on the production side: – the value of the production of the unit that is assigned to the goods and services associated with each activity; – the value of sales of the product groups (goods and services) in each activity. On the input side: – the proportion of people employed in the different activities of the unit – the wages and other remuneration attributed to the different activities (...)."

- Category: White-Collar Crime

Presented on April 24 by Senator Augusta Brito (PT/CE), Bill 2.091/23 (PL 2.091/23) introduces five new criminal types in Law 6.385/76 (Capital Markets Act) aiming at fighting capital markets frauds.

According to the justification contained in the bill's text, the attempt to create new criminal types is motivated by the lack of "specific offenses" and "enforcement" of the existing regulatory provisions.

Also, according to the justification, a recent situation involving a retail company would have occurred for two main reasons:

- concealment of information to analysts, investors, audit firms and the Brazilian Securities and Exchange Commission (CVM); and

- repeated failures by directors, managers, officers, executives, board members and independent auditors to fulfill their duties.

The goal of PL 2.091/23, therefore, would be to insert in the Brazilian criminal legislation adequate mechanisms to punish actions and omissions and to introduce duties for agents with management positions in capital markets.

The proposal is to include eight new articles (articles 27-F to 27-M) in the Capital Markets Act, to introduce the following crimes:

- Inducement to error in the capital market

"Art. 27-F: To induce or maintain in error an investor, shareholder or competent government department, regarding the operation or financial, accounting or equity situation of the company:

Penalty - imprisonment, from 1 (one) to 4 (four) years, and fine."

The conduct punishable will be defrauding and acting to give the investor or the regulatory agencies a misleading view regarding the company's operational or financial situation. The legislator's idea is that criminalization would contribute both for inspection purposes and to ensure investor protection, considering the principle of publicity of publicly traded companies.

- Accounting fraud

"Art. 27-G Fraud in accounting or auditing, inserting non-existent operations, inaccurate data or not including operations effectively carried out:

Penalty - imprisonment, 2 (two) to 6 (six) years, and fine."

Similarly to the previous crime, conducts that falsify the true situation of the company, with the inclusion of false or inaccurate information about accounting and financial operations, are criminalized. To incur in this crime it would not be enough to present erroneous data, it would also be necessary the specific intention of defrauding the company's accounting or auditing.

- Improper Influence

"Art. 27-H. Exerting improper influence on audits, by means of coercion, manipulation, fraud or by any other means:

Penalty - imprisonment, from 1 (one) to 4 (four) years, and fine."

Under this crime, the conduct of coercion, fraud, or manipulation that may cause deviation in audits conducted to verify the veracity of accounting and financial statements would be criminalized. Again, not only company managers can be held responsible for this provision, but there is also the possibility of punishing auditors.

- Ideological falsehood in manifestation

"Article 27-I. Omitting information or providing it falsely or differently than it should be provided to alter the truth about a fact that is legally or economically relevant for the purposes of this Law:

Penalty - imprisonment, from 1 (one) to 5 (five) years, and fine."

According to this crime, the falsification or omission of information that must be provided by the company would be criminalized, provided that it deals with an economic or legally relevant fact. Thus, the omission or falsification of information that must be disclosed in communications to the market, for example, would be prohibited. This is a specific figure of the crime of misrepresentation in which, in addition to the criminally relevant omission or misrepresentation, it is also necessary to have the specific intention of altering the truth of the facts covered by the Capital Market Act.

- Unfaithful administration

"Art. 27-J. Damaging the interests of shareholders or investors by not diligently performing the duties imposed by law:

Penalty - imprisonment, from 2 (two) to 6 (six) years, and fine.

Sole Paragraph. If the crime arises from negligence:

Penalty - imprisonment, from 1 (one) to 3 (three) years, and fine."

With this crime, directors and managers of companies that do not fulfill their duties of care, diligence, information, suitability, technical qualification, financial capacity, among others, causing damage to shareholders and investors, may be criminally liable. The failure to comply with these various duties may occur both intentionally, with the aim of harming shareholders and investors, and by negligence, carelessness and imprudence.

In addition to the crimes, PL 2.091/23 expressly lists, in article 27-K, the subjects that have the legal duty to act, to the limit of their responsibility, in case they identify the conduct typified in the previous articles, they are:

- directors;

- managers;

- administrators;

- executives;

- directors (de facto or de jure);

- independent auditors; and

- consultants and securities analysts

Article 27-L, on the other hand, provides for increased penalties (from half to double) for the conduct typified in the PL if they have severe effects, such as:

- shaking of confidence in the national financial system;

- number of victims; and

- value of the undue advantage or loss suffered by the victims.

In cases of recidivism, the penalty may be applied up to three times.

Finally, article 27-M determines the effects of a conviction for any of the crimes described above:

- the inability to exercise a business activity;

- the impediment to holding a position or function in a board of directors, fiscal council, executive board, or management; and

- the impossibility to manage a company by mandate or business management.

These effects must be presented in the condemnatory sentence and will be communicated to the Public Registry of Mercantile Companies.

As is the guiding principle of criminal law, which is expressly stated in PL 2.091/23, not only those responsible for the management of companies may be held criminally liable, but also any third party that contributes to the practice of the conduct described in the criminal types mentioned, such as independent auditors, consultants, and securities analysts.

It is also noted that the proposed crimes are broad and require complementation by concepts provided in other rules, as is common in the so-called "white-collar" crimes. The crimes described in articles 27-I, 27-J and 27-M, for example, make reference to duties or parameters regulated not only by the Capital Market Act, but also by rules and resolutions of other bodies, such as the CVM.

There are also many applicable punishments, considering that there is already the possibility of civil and administrative liability. The crimes provide for sanctions that present a very extensive variation. In case of conviction for the conduct typified in PL 2.091/23, there will be not only the imposition of a criminal fine but also restrictive penalties that can be increased up to three times, in addition to disqualification or impediment to exercise a position or function in a board of directors for an indefinite period.

- Category: Banking, insurance and finance

The Central Bank of Brazil (Bacen) and the National Monetary Council (CMN) published on Tuesday, May 23, the Joint Resolution 6/23. It provides for the sharing of data related to evidence of fraud by financial institutions, payment institutions, and other institutions authorized by Bacen to carry out transactions with one another.

The rule aims to reduce the asymmetry of information among these institutions by establishing a minimum set of data and information that must be shared by them in their procedures and internal controls for fraud prevention.

Who is subject to the rule?

- Financial institutions, payment institutions and other institutions authorized to operate by Bacen.

- Administrators of purchasing consortia are expressly excluded from the scope of the resolution.

- Institutions subject to the rule may participate in the sharing system both in terms of registration and access to registered data and information.

What must be shared?

- Information identifying those who allegedly have carried out fraud or attempted to do so, according to available probable cause, when applicable. This verification, in turn, should occur from procedures and criteria defined and documented by the institutions in a way that is detailed and compatible with their risk profile, legislation and regulations in force. This includes, as a minimum requirement, the verification of data from systems, registers and other databases available for consultation.

- The description of probable cause of the occurrence or attempt of fraud.

- Information identifying the institution responsible for registering of the data and information.

- The data of the recipient account and its holder if there has been a transfer of funds or payment.

The registry does not apply to confidential data and information - in the terms expressed in specific legislation - related to probable cause of laundering or concealment of assets, rights and valuables, and financing of terrorism.

Is it necessary for the customer to consent?

- Institutions must obtain prior and general consent from the customer with whom they have a relationship to record their data and information for the purpose of processing and sharing information on probable cause of fraud under the terms of the resolution.

- Consent may be included in the agreement signed between the customer and the institution, in a highlighted clause, or obtained through another valid legal instrument. In both cases, the documentation must be made available to Bacen.

- The provisions of the resolution do not remove the duty of confidentiality, protection of personal data and free competition to be observed by the institutions.

How will data be shared?

The resolution provides for the implementation and use of an electronic system that allows, as a minimum requirement, for the registration of data and information on probable cause of occurrence or attempted fraud identified by the institutions, as well as their alteration, removal and consultation.

- Sharing must also observe the principles listed in the standard, which include security and privacy, as well as full and non-discriminatory access by institutions to the system's functionalities.

- Joint Resolution 6/23 also establishes security, data protection and interoperability requirements to be observed by the institutions. Among them, it is worth mentioning the need to identify and segregate the data recorded by means of physical or logical controls, as well as to adopt a single and common communication standard that allows the system functionalities to be executed.

- Institutions must also adopt control mechanisms to ensure effective compliance with the resolution, including the definition of processes, tests and audit trails, metrics and indicators, as well as the identification and correction of any deficiencies.

- The institution may hire third parties to provide the data sharing service, remaining responsible for compliance with the resolution and for observing the applicable regulations (mainly Bacen Resolution 4,893/21, concerning the contracting of data processing and storage and cloud computing services).

Roles of Bacen

- Institutions must share with Bacen documentation about the electronic system and compliance with the requirements applicable to its implementation - including security, data protection and interoperability.

- The data shared by the system and the documentation containing the criteria and procedures for identifying the person possibly responsible for the fraud attempt must remain available for ten years.

- Data, records, and information about the application of the system's control mechanisms must remain available for five years from each application of the controls.

- Bacen may adopt the necessary measures for executing the resolution, such as establishing additional functionalities for the electronic system, observing the minimum content expected, and detailing the parameters on service level agreements in the execution of the functionalities.

- Compliance with the provisions of Joint Resolution 6/23 does not exempt the institution from the responsibility to carry out procedures and controls for fraud prevention provided for in the regulations in force or to report information on fraud to the competent authorities, as provided for by law.