Publications

- Category: Labor and employment

Several countries have already adopted some new types of arrangements. Examples are the zero-hour contracts in the UK, the lavoro intermittente established by Italian legislation and the minijobs in Germany. Similar working arrangements are also found in Ireland, Netherlands, Switzerland, and others.

In Brazil, the recent Labor and Employment Reform (Law No. 13,467/2017), which was approved by the Brazilian National Congress on July 2017 and came into effect on November 2017, implemented several changes and updates to Brazilian labor and employment laws.

Most of these changes and updates aimed at modernizing Brazilian legislation, increasing the level of legal certainty in labor relations and creating new jobs and working arrangements.

In this context, and following the global trend of new flexible working arrangements, one of the most important updates implemented by the Brazilian Labor and Employment Reform was the introduction of a new type of contract that allows the engagement of individuals under an employment relationship: the intermittent contract of employment.

According to the recently enacted law, intermittent contracts of employment are those through which individuals are engaged under an employment relationship to render services under a non-continuous basis, in alternate periods of work and inactivity that may be determined by hours, days or months, regardless of the activities of the employer or the employee. Only aircrew personnel cannot be engaged under intermittent contracts of employment.

These legal definition guarantees to individuals working under intermittent contracts of employment the status of employees and employment and social security protection.

From an employment perspective, the employee’s hourly salary cannot be lower than the minimum hourly wage or than the hourly salary of other employees of the company who work in the same position pursuant to an intermittent or regular employment contract. At the end of each service period, employees must immediately receive the respective salary and pro-rata labor and employment rights, such as (ii) proportional vacation payments; (iii) proportional 13th salary; (iv) the paid weekly rest; and (v) mandatory legal allowances, if any.

In addition to that, employers are required to collect employment charges and social security contributions on the amounts paid to intermittent employees on a monthly basis.

From a social security standpoint, the intermittent nature of the services does not automatically exclude intermittent employees from social security coverage. In order to maintain this coverage and avoid gaps in contributory periods, they may voluntarily collect social security contributions whenever they receive less than a minimum monthly wage for working few hours in a given month.

In fact, one of the main purposes of the Government by introducing this new form of flexible working engagement was the creation of a type of employment contract that would allow employers to engage individuals under an employment relationship to provide intermittent services, while also ensuring employment and social security protection to workers.

According to the Government’s expectations and estimates, this new form of flexible engagement will allow the creation of new formal jobs by bringing under the coverage of employment laws workers who currently are under precarious types of engagement simply because the nature of their work did not fit into a regular full-time employment contract.

From the employer’s perspective, this new form of flexible engagement without any guarantee of minimum work or pay was especially desired by the services and retail sectors, which have peaks of demand linked to specific events or periods of the year.

As introduced by the Brazilian Labor and Employment Reform, however, this new flexible working arrangement not only is good to employers but also addresses employees’ needs.

In this sense, from the employees’ perspective, although the law does not establish a minimum number of work hours per month nor requires the payment of a minimum monthly allowance or salary, intermittent contracts of employment gives them flexibility because they do not require availability from employees. Therefore, employees may freely execute several simultaneous intermittent contracts of employment and adjust their working schedule as they see fit, by refusing work calls when they have already accepted to work for a certain employer or if they simply do not feel like working on a certain day.

This gives especial flexibility to individuals who want to enter the workforce and start having their own income but also have other activities – for example, college students who need to conciliate their working schedule with studies and classes. Thus, although employers may call employees when they need their services, employees may also freely deny work calls.

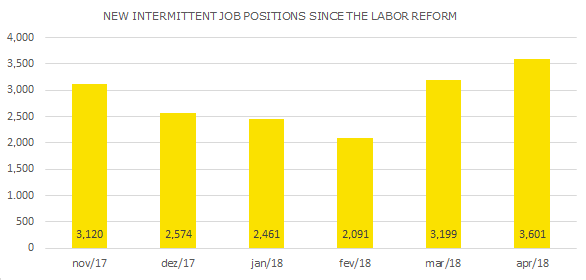

According to official data from the Labor Ministry (Caged), between November 2017 (when the intermittent contract of employment was introduced) and April 2018, 17,046 job positions were created under this type of contract, as follows:

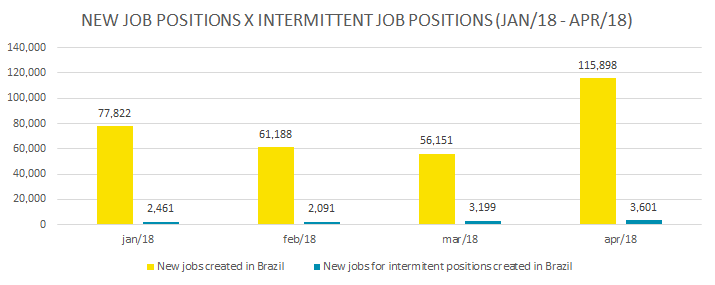

Since the beginning of this year, 3.6% of the new jobs in Brazil were created under an intermittent employment contract:

Of course, although we may see some restrictions and resistance from certain labor unions and authorities, the numbers above indicate that intermittent employment contracts have been consistently adopted by companies and employees in Brazil.

The way the Brazilian Reform structured the contract for intermittent employment not only guarantees employment and social security protection to employees but also allows both employers and employees to create flexible working schedules, as they need.

The intermittent employment contract, as implemented by the Brazilian Labor and Employment Reform, not only addressed an old agenda of companies doing business in Brazil but also was a big step for Brazil to update its labor and employment laws in line with the most modern trends seen across other countries.

- Category: Corporate

Publicly-held companies registered in category A of the Brazilian Securities and Exchange Commission (CVM) that submitted the Reference Form without completely filling in item 13.11 of Exhibit 24 of CVM Instruction No. 480/09 (ICVM 480) must resubmit the document including the information required regarding the remuneration of their officers and directors by June 25, 2018.

The instructions are contained in Circular Letter No. 4/2018, published by the CVM on June 13, based on article 57 of ICVM 480. Representatives of the companies responsible for providing this information that do not comply with the requirement set forth in the official letter are subject to possible liability.

The release of the official letter was done after the victory obtained by the CVM in the Federal Circuit Court of Appeals of the 2nd Circuit (TRF-2) in relation to the requirement to disclose the minimum, maximum, and average salary of members of the management of publicly-held companies associated with the authority.

In a ruling issued on May 23, the TRF-2 granted the appeal filed by the CVM against the trial judgment in favor of the Brazilian Institute of Finance Executives - Ibef of Rio de Janeiro, which prevented the authority from requiring the disclosure, as provided for in item 13.11 of the Reference Form.

ICVM 480, which instituted the Reference Form, obliged publicly-held companies to disclose a series of fairly detailed pieces of information regarding the amount and composition of management compensation. Among the rules that most caused controversy when the instruction came into force is the rule that provides that the issuer should indicate, for the last three fiscal years, the minimum, maximum, and average amount of the individual remuneration of the members of the board of directors, of the board of executive officers, and of the audit committee.

At the time, Ibef filed an application for injunctive relief against the requirement to disclose the remuneration in the terms requested by the rule, therein alleging, in particular, an affront to provisions of the Brazilian Corporations Law and the officers and directors’ right to privacy. The entity also alleged that there would be risks to the safety of the officers and directors as a result of the disclosure of the information requested. The trial judgment fully accepted Ibef's arguments and concluded that the Brazilian Corporations Law had been violated and expressly cited the issue of safety as one of the reasons for the non-mandatory nature of the disclosure in the terms required by ICVM 480.

The decision by the TFR-2 that revoked the injunction was reached by 3 votes to 0. The court recognized that the rule of ICVM 480 does not violate the Brazilian Corporations Law and that individual rights to intimacy and privacy cannot override the public interest, and publicly-held companies must comply fully with the regulatory standards to which they are subject, in view of the interest of the investing public in general. In relation to safety, the judges were of the understanding that this is a question that afflicts the Brazilian population in a generalized manner. According to them, there is evidence that disclosure of information on the compensation of other public servants did not contribute to an increased risk of violence. Ibef will still appeal the ruling, but the application of the rule became valid immediately.

- Category: Capital markets

A few months after Law No. 13,506/2017 coming into force and a broad debate with various market participants, the Brazilian Securities and Exchange Commission (CVM) submitted for public hearing a draft new instruction that will regulate its sanctioning activity, therein adapting it to the new legislation. Comments can be presented until August 17, 2018.

The draft instruction provides more clarity about CVM’s sanction proceedings, and creates clear and objective criteria for measuring penalties provided for in Law No. 13,506.

The CVM will use the draft instruction in order to consolidate into a single norm the agency’s own scattered rules on the same topic. Upon consolidation, CVM Resolutions 390/2001, 538/2008, and 542/2008, as well as Instruction No. 491/2011, will be revoked.

Law No. 13,506 was published in November 2017 and provides for administrative sanction proceedings in the areas of activity of the Central Bank of Brazil (BCB) and the CVM. On the same date, the BCB published Circular No. 3,857, regulating the new law and setting forth procedures for administrative sanctions under purview of the BCB (see more details in this article).

Among the main innovations of Law No. 13,506, we highlight the increase in the ceiling of fines that can be imposed by the BCB and the CVM, the express provision for the possibility of substitution of the administrative sanction proceedings by other means of supervision, the introduction of the administrative settlement in a supervisory proceeding (also known as the leniency agreement), as well as rules on the procedure for the determination of infractions and procedural rules, judgments, and production of evidence, appeals, simplified proceedings, and consent orders. These improvements were considered reinforcement of the regulatory instruments that can be used by the BCB and the CVM in the exercise of their supervisory and sanctioning functions in the financial and securities markets.

Below, we highlight some of the main topics proposed in the draft CVM instruction.

Determination of administrative infractions. The proposal for the initiation of an administrative inquiry should be submitted by the superintendencies to the General Superintendency (SGE), which may formulate an indictment or propose the initiation of an administrative inquiry. The administrative inquiry will be conducted by the Sanction Proceedings Superintendency (SPS), together with the Specialized Federal Prosecutor's Office (PFE), within 180 days from the date of filing, subject to extensions. Thereafter, the SPS and PFE will file an indictment or propose to the General Superintendency that the inquiry be closed when there is insufficient evidence to formulate an indictment, there is no persuasion as to the commission of the infraction, or in the event that the statutes of limitations have run. As an alternative to the initiation of a sanction proceeding, the CVM shall have the option to apply a preventive and guiding proceeding, observing the following criteria proposed in the draft instruction, among others: (i) the degree of reprehensibility or repercussion of the conduct, (ii) the significance of amounts associated or related to the conduct, (iii) the significance of the harm, even if only potential, to investors and other market participants, (iv) the impact of the conduct on the credibility of the capital markets, (v) the prior history of the persons involved, (vi) the good faith of the persons involved.

Application and measurement of penalties. Among the changes mentioned above, we highlight the adoption of parameters and procedures for measuring penalties. Law No. 13,506 modified the limits of fines, which may not exceed: (i) R$ 50 million; (ii) twice the value of the offering or irregular transaction; (iii) three times the amount of the economic advantage obtained or the loss avoided as a result of the illegal act; or (iv) twice the loss caused to investors as a result of the unlawful act. Law No. 13,506 also establishes that the fine applicable by the CVM may be tripled in cases of recidivism or in the event of combination of penalties. In this sense, the CVM established in the draft instruction objective criteria and procedures that should be observed in the measurement of penalties: (i) setting the base penalty (which should take into account the seriousness of the conduct and the economic capacity of the offender); (ii) application of aggravating[1] and mitigating[2] circumstances, which may result in an increase or reduction of 10% to 20% of the base penalty for each circumstance found; and (iii) the application of a cause for reduction of a penalty, which may reduce it from one to two thirds if the financial damage to investors or minority shareholders is fully repaired before a judgment on the proceeding at the trial level. In an exhibit to the draft instruction, the CVM will divide the penalties into five groups according to severity, varying from R$300 thousand to R$20 million.

Consent order. The CVM may conclude a settlement to close the sanction proceeding, without confession as to the matter of fact or acknowledgment of the illegality of the conduct. The interested party must express its intent to conclude a settlement within the deadline for the presentation of a defense, therein undertaking to cease the practice of activities or acts considered illegal, if any, and to correct the irregularities alleged, including by paying compensation for the individualized damages or diffuse or collective interests within the securities market. The Consent Order Committee (whose composition and operation will be disciplined later) shall deliberate on the proposal for the consent order for a maximum period of 30 days, considering, among other elements, the opportunity and appropriateness of entering into the settlement, the nature and the seriousness of the offenses in question, the prior history of the accused or investigated or their good faith collaboration, and the actual possibility of punishment in the specific case. Unlike BCB Circular No. 3,857, which prohibited the BCB from entering into consent orders in cases of certain serious infractions, the draft instruction contains no express prohibition on consent orders according to the types of infraction.

Supervisory settlement. The supervisory settlement is a mechanism introduced by Law No. 13,506 in the scope of the CVM's administrative sanction proceedings, thereby reinforcing the regulatory mechanisms that can be used by the CVM in the supervision of the securities market. The supervisory settlement will have a similar function to leniency agreements, and does not affect the performance or legal prerogatives of the Public Prosecutor's Office or other public entities, such as the BCB and the Administrative Council for Economic Defense (Cade), within the scope of attributions or competencies of these agencies (with which the CVM will seek to establish coordinated action).

Supervisory settlements may be proposed at any time up to the judgment at the trial level and kept confidential until all the accused are tried. It will be the responsibility of the Supervisory Settlement Committee (whose composition and functioning will be governed later) to evaluate the admissibility of the proposed settlements, therein responding within 30 days from the submission of the proposal and extendable for the same period. Once the settlement is concluded, with an express confession to participation by its signatories in an unlawful act, the following effects will be granted: (i) extinction of the punitive action by the public administration, in the event that the proposal was submitted without the CVM’s prior knowledge of the infraction reported, or (ii) a reduction by one-third to two-thirds of the penalties applicable in the administrative sphere, in the event that the CVM has prior knowledge of the infraction reported. If the proposed supervisory settlement is rejected, there will be no confession as to the matter of fact, nor acknowledgment of the illegality of the conduct that is the object of the proposal, of which no disclosure shall be made.

Effects of appeals to the CRSFN. The draft instruction establishes that appeals to the National Financial System Board of Appeals against a decision that imposes penalties of a warning or fine shall suspend the applicable sanctions until final judgment, while decisions with temporary disqualification, temporary prohibition, or suspension of authorization or registration shall apply immediately, and the accused shall be entitled to request suspension of sanctions to the board within 10 days counting from the notice of the decision.

A controversial point of the draft instruction is the possibility, provided for in article 70, that the CVM may “prohibit the accused from entering into contracts with official financial institutions for a period of up to five (5) years and from participating in bids for the acquisition, sale, and concession of public construction and services, within the scope of the federal, state, district, and municipal public administration and the entities of the indirect public administration.” With the same wording of its supporting Law No. 13,506, article 70 has been challenged by market participants and legal scholars since it exceeds the legal mandate of the CVM, which is to regulate and supervise the capital market, and not regulate the public administration generally.

[1] These are aggravating circumstances, according to article 67: (i) recidivism, if it was not considered in the establishment of the base penalty; (ii) systematic or repeated practice of irregular conduct; (iii) great prejudice caused to investors or minority shareholders; (iv) express advantage gained or intended by the offender, provided that the base penalty was not fixed based on the economic advantage obtained; (v) the existence of material damage to the image of the securities market or the segment in which it operates; (vi) the commission of an infraction through fraud or deceit; (vii) compromise or risk of compromise of a publicly-held company's solvency; (viii) breach of fiduciary duties arising from the position, role, or function that it occupies; and (ix) concealment of evidence of the infringement through trick, fraud, or deceit.

[2] These are mitigating circumstances, according to article 68: (i) confession of the offense or the provision of information regarding its materiality; (ii) the prior good record of the offender; (iii) the regularization of the infraction; (iv) the good faith of the accused; or (v) the effective adoption of internal mechanisms and procedures for integrity, auditing, and incentive to report irregularities, as well as the effective application of codes of ethics and conduct within the legal entity.

- Category: Litigation

The new Code of Civil Procedure (CPC) brought in several innovations aimed at ensuring greater effectiveness and speed in proceedings. Among them, article 139, item IV, of the CPC confers on the magistrate the power to "determine all inducive, coercive, mandamus, or subrogatory measures necessary to ensure compliance with a judicial order, including in actions that have as their subject matter a money payment", thus authorizing the application of atypical measures to ensure fulfillment of obligations.

One of the main problems in the Brazilian Judiciary is the lack of effectiveness in executions, which often drag on for years, especially because of the impossibility of locating assets of debtors sufficient to satisfy the debt, even after numerous diligence measures. In this context, many judges have ordered, on the basis of article 139, item IV, of the CPC, the seizure or suspension of judgment debtors' national driver's licenses (CNH) and passports as a means of compelling them to fulfill their obligations.

However, there is still divergence as to the possibility of suspension/seizure of these documents. The constitutionality of such coercive measures, which could, in theory, violate constitutional precepts such as the guarantee of freedom of movement and the right to come and go is debated.

The matter was submitted to the Superior Court of Justice (STJ) for review recently in the judgment on an appeal on habeas corpus filed against a decision by the São Paulo State Court of Appeals, which ordered the suspension of the passport and driver's license of a debtor in default of almost R$ 17,000 (RHC 97.876/SP).

In the case, the STJ found that seizure of the passport was disproportionate and unreasonable, offending the debtor’s constitutional right to come and go. However, with regard to the CNH, the STJ decided that the suspension of the document was due since there was supposedly no disrespect to the right of movement, since, even if the debtor is not authorized to drive a car, his right to come and go is guaranteed.

The same decision also pointed out that the seizure of the passport could prove adequate in another context, as in searches for assets of debtors who have money abroad.

In two other decisions, the STJ also confirmed the possibility of suspending the right to drive of debtors in default, adding that this coercive measure does not impede the right of movement (RHC 88.490/DF and HC 428.553/SP).

Thus, the STJ indicates that suspension or seizure of the CNH of defaulting debtors is a valid measure as a means of compelling them to fulfill obligations to pay.

In any case, as explained by recent decisions issued by the STJ, the application of atypical coercive measures authorized by article 139, item IV, of the CPC depends on a factual analysis of each case, which will allow for a finding regarding their proportionality and suitability. It is understood that such measures are applicable only when other measures defined in the Code of Civil Procedure have already been exhausted and are not fruitful.

The subject must be reviewed by the Federal Supreme Court (STF), due to a direct action of unconstitutionality filed in May of this year by the Workers' Party. The plaintiff in the action claims that the suspension and seizure of documents to compel the debtor to pay a debt, based on article 139, item IV, of the CPC, violates fundamental rights of freedom of movement and the dignity of the human person. It will be up to Justice Luiz Fux, the reporting judge in the case, to review the action for the STF to issue its decision.

- Category: Environmental

The Federal Supreme Court (STF) has recognized the existence of general repercussion of an appeal regarding the inapplicability of the statute of limitations on a claim aiming at civil compensation for environmental damage, in a judgment issued on June 1, 2018. Most of the Justices agreed with the reporting judge's opinion.

Extraordinary Appeal No. 654.833, object of the judgment in question, is related to the public civil action filed by the Federal Public Prosecutor’s Office in the 1980s to redress material, moral, and environmental damages resulting from invasions in the Ashaninka-Kampa indigenous community.

In the judgment of the special appeal, the Superior Court of Justice (STJ) understood that, since the right to a healthy and balanced environment is an inalienable fundamental right, actions that seek to redress environmental damage are among the few considered not subject to any statute of limitations.

The appellants claim that, even if no statute of limitations on actions aiming to redress environmental damages is recognized, since it is an inalienable fundamental right, it is not possible to rule out the statute of limitations of compensation amounts of a material and moral nature.

Thus, they petitioned for a distinction to be made between the amounts intended for redress the environmental damage, considered as not subject to the statute of limitations, and those amounts related to personal or individual compensation, aiming at the moral and material indemnification of the individuals of the indigenous community. The latter would be subject to the five-year limitation period provided for in the Law of Citizen Suits (Law No. 4,717/1965) - since the facts precede the promulgation of the 1988 Federal Constitution.

The STF decided that there was general repercussion due to the impact of the issue on legal relations, which has as a background a claim for civil compensation arising from damages caused to the environment.

The reporting judge, Justice Alexandre de Moraes, emphasized in his opinion "the importance of establishing accurate and safe limits on the application of the statute of limitations in peculiar cases involving individual or collective rights harmed, directly or indirectly, due to environmental damages caused by human action."

The merits of Extraordinary Appeal No. 654.833 are still pending judgment by the STF en banc session. Once the issue is closed, it is expected that the judges of the courts where the lawsuits were originally filed will apply the legal theory adopted by the STF, as determined by the Code of Civil Procedure.

- Category: Tax

Taxpayers will no longer be able to offset federal tax credits with debts related to the monthly collection due to IRPJ and CSLL estimates, according to Law No. 13,670/2018, published on May 30 (inclusion of item IX in paragraph 3, article 74, of Law No. 9,430/1996). In 2008, Presidential Decree No. 449 had already included this restriction in tax legislation, but it was not converted into law, and the measure ceased to be effective as of 2009.

According to the explanatory memorandum of Law No. 13,670/2018, the purpose of the rule is to prevent the offsetting of debts that constitute an advance of the tax due in order to expedite the collection of debts and to inhibit the presentation of undue offsets.

However, this restriction tends to generate significant cash flow impacts for taxpayers, who must make monthly disbursements to pay the estimates.

There is a good legal basis to support the argument that the limitation would not be applicable to the calculation of the monthly advances by interim balance sheet suspension or reduction. This is because, while the estimate is a presumption of realized profit, suspension or reduction of the interim balance sheet reflects an effective calculation of the real profit for the period and, in this sense, would be outside the scope of the law.

It is worth noting, however, that the estimates and the suspension or reduction of the interim balance sheet system are collected under the same revenue code, which may cause an operational restriction on the taxpayers at the time of registration of the PER/DCOMP. In this case, it is recommended that taxpayers file a preventive judicial measure to effect offsets.

According to Law No. 13,670/2018, the new rule came into effect on May 30, 2018, the date of its publication. However, we believe that the prohibition on offsetting estimates could only be effective if the principle of legal certainty is observed. In this regard, taxpayers may also run into practical restrictions on the registration of PER/DCOMP, and preventive judicial measures are necessary to carry out offsets.