Publications

- Category: Real estate

Brazil stands out in the international market as one of the main exporters of agricultural products in the world. In 2020, agribusiness represented 26.6% of the Brazilian GDP.[1] Climate and soil conditions have become major attractions for foreign investments in rural activities conducted in the country. The problem, however, is that Brazilian legislation provides for restrictions on the acquisition and leasing of rural properties by foreign companies or individuals authorized to operate in Brazil.

The restrictions on the acquisition of rural properties by foreign individuals or legal entities and the persons treated thereto are provided for in Federal Law No. 5,709/71 and Decree No. 74,965/74. In addition to regulating the conditions that allow this acquisition, the two rules stipulate the need for a prior procedure to obtain authorization for the business that involves acquisition of rural properties.

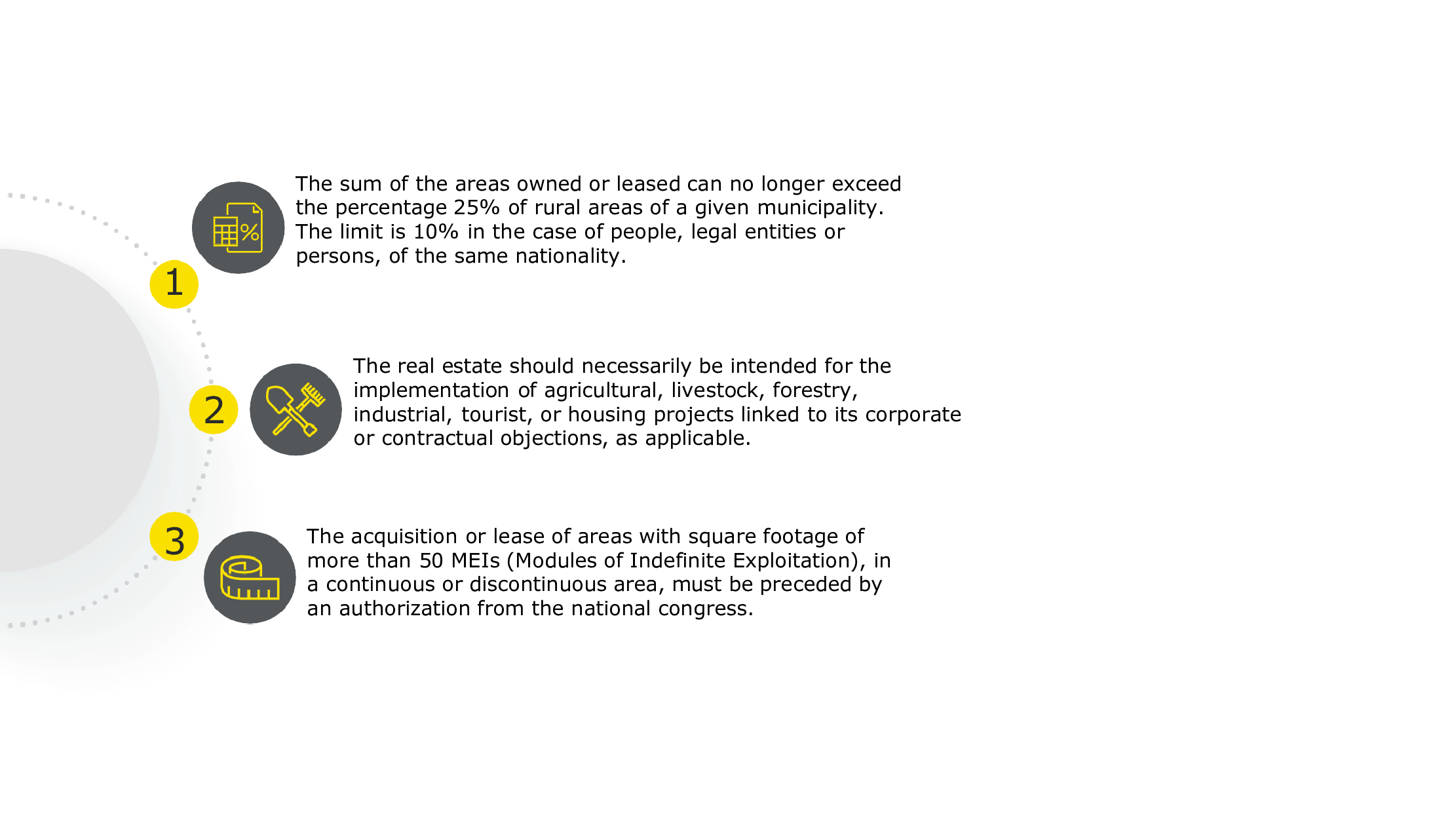

Among the restrictions brought in by the legislation, the following limiting parameters stand out:

The discussions began when Federal Law No. 5,709/71, in its article 1, paragraph 1, extends such limitations to Brazilian companies that have foreign control, equating them to foreign companies and individuals for the purpose of acquiring rural real estate.

Much was discussed regarding the applicability of this law to Brazilian companies with foreign control, especially after the entry into force of the Federal Constitution of 1988, since some legal scholars believed that the new Constitution had not adopted paragraph 1 of article 1 of the law.

However, in 2010, the Federal Attorney General's Office issued opinion AGU LA 01/10 through which it recognized the possibility of applying restrictions to Brazilian companies with foreign control.

The prior authorization procedure for the acquisition or lease of rural properties is carried out by Incra, which, in turn, established in Normative Instruction No. 88/17 and its subsequent amendments the process for foreigners to obtain authorization for the acquisition of rural property, which includes evaluation of compliance with legal requirements, permitted percentages, location of the properties, and plan for the operation of the areas.

The request for this authorization is a complex procedure, which, in some cases, may require approval by the Brazilian Congress. The often time-consuming procedure does not meet the agility of the market, especially when the acquisition of rural property by a foreigner takes place in the context of corporate transactions, such as mergers and acquisitions, or stock exchange trades, which are also subject to the scrutiny of federal law. In addition, purchases made in non-compliance with the legislation may be declared null and void at any time, so that all acts subsequently committed lose their legal validity.

In this context, and considering that, in order to obtain financing, licenses, and authorizations necessary for the development of activities, it is necessary to present/prove the relationship with the property to be used, various institutes are used as an alternative to acquisition via sale and purchase or lease, to allow Brazilian legal entities equated to foreign entities to use rural properties in the conduct of their economic activities.

Among the possible alternatives, such as corporate structures that rule out the establishment of foreign control and disqualification as rural properties, there are other real estate rights that may be constituted on real estate and do not imply transfer of ownership, modalities of contracts, among others. They need to be checked on a case-by-case basis, after careful study of the activity that is intended to be conducted, of the company that intends to acquire such rights, and the target property.

A widely explored option in alternative models is the creation of surface rights. It is a real property right, enforceable against third parties, which presupposes the unfolding of full ownership between the owner and the holders of surface rights. The first follows as holder of the property, but in a limited way, since use and possession are exercised by the surface rights holder.

The surface rights holder then has broad power over the object, and is able to exploit it as it sees fit and within the limits set with the owner of the property, in a manner similar to a lease.

The creation of the surface right is mandatorily by means of public deed (even if free of charge), which must be submitted for recording in the registration of the property. ITBI is levied on the acquisition, assignment, and cancelation of the surface right. It is necessary to confirm the tax rate in the municipality where the property is located.

Surface rights were reintroduced into the Brazilian legal system by the Civil Code of 2002 and the City Statute in 2001, that is, when Federal Law No. 5,709/71 and Federal Law No. 8,629/93 were enacted, it was not possible to insert a prohibition on the use of this institute by foreigners and those equated thereto, since it did not exist in the Brazilian legal system.

Although surface rights are not expressly covered by Federal Law No. 5,709/71 and, therefore, are not subject to the restrictions imposed by it thus far, Incra has already indicated that it intends to monitor transactions for acquisition of surface rights carried out, because it believes that the matter may be subject to restrictions in the future.

In Incra’s analysis, surface rights resemble a lease, which has restrictions provided for by law, but the two institutes are distinct. A lease expresses an agreement of will between the parties, on a mandatory basis, and rural lease are necessarily for charge, while surface rights are real property rights, enforceable against third parties and which may be without charge.

The similarities between lease and surface rights are only in the occurrence of delivery of the property to a third party, who, in fact, will be responsible for exploiting or using it, without transfer of ownership. However, the two institutes are distinct and cannot be equated for the purposes of applying the restrictive measures imposed by Federal Law No. 5,709/71.

The restriction of rights must be preceded by legal regulation of the matter, in compliance with the principle of legality, provided for in the Federal Constitution. The application of restrictions on the establishment of surface rights on rural properties in favor of foreign and/or equated surface rights is lacking in legal regulations.

Despite the absence of legal regulation to this effect, it is common for officials of registry offices of deeds and real estate to resist the drafting or recording of deeds for the creation of surface rights, as they are aware of the penalties applicable in the event of drafting of deeds dealing with rights on rural properties and legal entities equated to foreign entities without compliance with the provisions of law.

Although there is no express legal prohibition or even a specific administrative procedure to examine cases of creation of surface rights, before choosing this structure, it is recommended that one consult whether there is position on the part of the responsible person with Judicial Internal Affairs.

Another alternative structure used to enable the use of rural properties is assignment of the right of use, a contract of a personal nature that resembles a lease governed by the Civil Code. It allows the owner to assign the use of a property, for a specified period, upon payment of monthly rent. For that reason, it is not a question of a real property right, but a personal right between the parties.

This structure is widely accepted by banking institutions. For this reason, it is common to require recording or registration of the instrument in the registration of the property, thus ensuring public notice of the transaction. The Judicial Internal Affairs Offices of some states, such as Bahia, have already taken the position that one must require that assignment of use must be formalized through a public instrument.

The assignment of the right of use is not to be confused with the granting of the right of use, a dissolvable real property right usually used in relations between individuals and entities of the public administration.

In order to provide security to foreign investors and to the operations maintained by them in Brazil, it is essential to carry out planning and a prior study of possible legal alternatives based on an analysis of which structures best suit the development of the activities intended.

There are bills in progress that discuss the restrictions applicable to foreigners and, in particular, their application to companies equated to Brazilian companies, with emphasis on Bill No. 2,963/19, which was approved at the end of 2020 by the Federal Senate and merits monitoring due to the changes it intends to bring about for the topic.

[1] Source: Center for Advanced Studies in Applied Economics - ESALQ/USP.

- Category: Litigation

Litigation often represents a strategic agenda for the litigating parties, and a well-conducted process is a central aspect of the outcome, whether a loss or win. In lawsuits, communication between lawyer/judge needs to be above all objective, without losing the analytical character of the topics addressed.

A measure capable of facilitating this communication is providing the judge with the best presentation of briefs, allowing him to analyze the case (petitions, arguments, and events in the case) in a very objective, almost illustrative way. This is possible with the preparation of an analytical map, with a prior presentation and informative of everything that is being discussed. For example, the complaint is the most important document in the case, on which all the proceedings will be based, as well as the answer, and objections in general.

The facts didactically presented, points at issue, legal theory, especially the constitutional and infraconstitutional provisions under discussion should be addressed on the map. The lawyer has the duty to map absolutely all these points to enable knowledge and due ruling by the second instance, the reviewer of the case on appeal. Only in this way is it possible to raise the arguments (associated with the facts analyzed by the trial court) to the higher courts through exceptional appeals.

What we call a "map" here may consist of a didactic and visual presentation of the occurrences of the case, greatly facilitating review by the judges and even the lawyer’s meeting with the judges. This may (or should) go in the middle of petitions or memoranda/closing arguments.

It is very important that the lawyer conduct the case seeking to enable admission of any appeals to the higher courts (STJ, STF, TST, TSE, among other courts). And the fundamental basis for this is the careful, concise, objective, analytical, and didactic filings with the appellate courts (second level of appeal - TJs, TRFs, TRTs etc.). Preparation of an analytical map of the proceeding is fully aligned with the strictest criteria of procedural conduct, inasmuch as it requires at the same time completeness, conciseness, and creativity.

The client must be sure that the lawyer will appropriately handle the case in the courts of ordinary jurisdiction, to enable, if applicable, the admissibility of appeals to the higher courts, especially in view of the limitations imposed by the courts themselves for the admission of appeals.

This is what we seek as a guide for excellence in the provision of our legal services in the context of litigation.

- Category: Labor and employment

Companies ordered to pay compensation for harassment for misconduct committed by their employees or former employees not only bear the high financial costs of labor suits in which they are involved, but also suffer damage to their reputation and image. Not to mention, of course, the cost of replacing lost talent and removal of employees due to illnesses resulting from the harassment suffered.

Organizations capable of actively managing the work environment, providing effective and efficacious training to their professionals in order to avoid and prevent practices characterized as harassment from occurring and adopting means of penalizing harassers, are able to mitigate the harmful effects of such situations and are better prepared to face them if they happen.

Thus, in order to minimize the financial impacts of harassment, companies have sought ways to obtain from the harassers reimbursement of amounts paid in judgments. This was recently the case with a company in Pernambuco that succeeded in a lawsuit filed against a former manager who committed harassment against his subordinates.

Mentioned in several lawsuits in which compensation for harassment was sought due to bad practices in dealing with subordinates, the former manager was ordered to reimburse the company for half of the amount of damages it was ordered to pay in decisions that have already become final.

The Regional Court of Labor Appeals (TRT) for the 6th Circuit found that, although it is unusual for companies to file an action for reimbursement seeking compensation for the amounts of compensation paid for moral damages caused by misconduct by their employees, there is no doubt that they may be brought. The position of the courts has been that the liability for compensating victims of harassment is not exclusive to the company. The harasser must also answer for the acts he commits.

Thus, companies should be aware that, although actions for reimbursement to obtain compensation is not so common in the labor sphere, review thereof is fully possible, especially in situations of harassment. This action is not intended to eliminate the company's liability for the damage caused to its employees, but rather to demonstrate that those who committed the misconduct that caused the compensation for harassment are as liable as the company, and must therefore financially bear part of the damage.

In addition to the importance of providing training to make employees aware of the severity of harassment practices and the implications of such acts for the company and employees, companies should constantly investigate the occurrence of such practices to demonstrate, by means of evidence, harassment in the workplace. Once these cases have been proven, they should seek appropriate legal assistance to ensure that the harasser is properly held accountable.

- Category: Restructuring and insolvency

The Plenary of the National Council of Justice (CNJ) passed on May 18, an actthat orders State Courts to create and keep a Registry of Judicial Administrators/Trustees.[1] The purpose is to standardize the treatment given by the courts to the appointment and execution of the duties of said professionals.

The act, which was written by the working group created to improve court’s supervision on in-court and out-of-court reorganization and bankruptcy proceedings, sets forth the criteria to be adopted by judges when appointing trustees, whose duties are vital to the proper development (and success) of insolvency proceedings.

According to the rule, both individuals and legal entities can be registered at the Court's Registry of Judicial Administrators/Trustees, except for those who hold public offices, that are forbidden to work as trustees. As to legal entities, the act determines that they should preferably be founded to perform the specific duties of trustees and that the name of the individual representing the company must be appointed, pursuant to the sole paragraph of article 21 of Law 11,101/05 .

Registration must be renewed annually and it will be possible to so through an online platform. All interested in the registration must submit the documents and informations enumareted in article 4. Among a variety of data, it is required for the parties to provide information on the professional association in which the trustees are enrolled and to prove that all payments due to such association are paid. In addition, they are also required to provide an updated tax and criminal regularity certificates. It will also be necessary to submit a list of all in-court and out-of-court reorganization and bankruptcy proceedings for which they have been appointed on the two years prior to enrollment, followed by a full description of the respective cases, including the names of the judges in charge of the proceedings, along with information on any dismissal from the position of trustee.

In Article 5, paragraph 3, the act sets an equitable rule for appointments, preventing trustees from serving simultaneously in more than four in-court or out-of-court reorganization proceedings and four bankruptcies. This rule should consider the distribution of cases among judges when the court is served by more than one. For the purposes of control, pursuant to article 6, III, of the act, trustees are required to report the court of their appointment and the particulars of the case (including the name of the judge in charge of the respective proceeding) within 15 days of their appointment.

Any appointment that could qualify as nepotism is strictly prohibited. It is the trustee's burden to disclosure his/her degree of partiality and any relations he/she may have with parties to the case, in order to provide the required transparency.

The act restates the obligation of trustees to work diligently and in good faith, in compliance with all the duties imposed by Law No. 11,101/05 – recently expanded by the changes brought forth by Law No. 14,112/20. The courts will have 60 days as of June 2nd – the date the act was published – to create its respective Registry of Judicial Administrators/Trustees and/or adjust the existing ones to the terms of act. Professionals not enrolled in the Registry may be appointed to the position, however the act recommends judges to prioritize the registered professionals.

[1] The full resolution can be accessed through the link: < https://atos.cnj.jus.br/atos/detalhar/3954>

- Category: Infrastructure and energy

Fabio Falkenburger, Marina Estrella Barros, Pedro Amim, Vitor Barbosa and Vittoria Psillakis Mickenhagen

The aviation sector was one of the most affected by the economic chaos generated by the Covid-19 pandemic. Extremely affected by traffic restrictions, airport operators, airport service providers and airlines have seen demand plummet dramatically during the pandemic, suffering severe impacts on their revenues.

Data released by the National Civil Aviation Agency (Anac) indicate that, in 2020, demand reduction was 48.7% in the domestic market and 71% in the international market. With vaccination advancing at slow pace, 2021 also presents itself as a challenge for all companies in the sector.

While the scenario is not one of the most encouraging for the market in general, long-term planning keeps airport concessions as an attractive option for investors. During the 6th round of airport concessions, announced during the pandemic and held on April 7, 22 federal airports were auctioned, divided into three regional blocks. In the so-of-turn of the sector's economic downturn, auction achieved significant result, yielding to the federal government more than R$ 3 billion in grants, with an average premium of 3,822.61%.

State concessions

At the state level, São Paulo takes a swing at the success of federal concessions and heats up the market in July. Through the Agência Reguladora de Serviços Públicos Delegados de Transporte do Estado de São Paulo lo (Artesp), the state government will conduct the concession for expansion, maintenance, operation and realization of investments necessary for the operation of 22 airports, divided into two blocks of 11 airports. Available on the Artesp website, the bid notice stipulates that the the proposal and other envelopes for participation shall be personally filed y the proponents on July 15, in a public session at B3's head office.

The block concession strategy has become common in the aeronautical sector and its main objective is to enable investment in airports that would not be attractive in individual bids. Airports with significant passenger movements and, in some cases, surpluses, with not so expressive airports, or airports with different investment demands, are grouped into the same block. The idea is that the balance between initial revenue and investment forecasts will make the block attractive to the private investor, also considering the expected evolution of less attractive airports.

Considering the assets of the current concession, the 11 airports of the northwest block, which includes São José do Rio Preto, have a minimum contribution of R$ 6.8 million and planned investments of R$ 181.2 million over the 30 years of the concession. For the 11 airports in the southeast block, headed by Ribeirão Preto, investments of R$ 266.5 million are planned over the 30 years of concession and the minimum contribution is R$ 13.2 million.

In addition to the minimum fixed contribution to be paid as a condition for signing the concession agreement, the new cocessionaires will pay variable contribution corresponding to 1% of the gross revenue obtained from the 13th month of the beginning of the concession.

Brazilian or foreign legal entities may participate in the bidding process, alone or in a consortium. Prooftechnical qualification will be evidenced by means of demonstrating previous experience (at least 12 months) in the management / administration of infrastructure assets in the sectors of communication, transport or logistics of transport, energy, production, distribution or refining of fuels, basic sanitation, housing or provision of public services. For the northwest block, the assets used for purposes of demonstrating experience shall have a minimum value of R$ 31,173,143.00. For the southeast block, the minimum value is R$ 37,779,483.00. Prior to the signing of the concession agreement, the winning bidder must also demonstrate its own experience, or experience of third party subcontractor, in the operation of at least one airport that has processed at least 50,000 passengers.

The possibility of hiring a third party to meet the requirements of proof of experience in the operation of airports was a innovation received with enthusiasm in the 6th round of federal concessions and that should be trend in the sector, since it allows the participation of a greater number of bidders, increasing competition.

Federal rebidding processes

Anac has already published the first draft of the rebidding notice of The Airport of São Gonçalo do Amarante. Subject to the first round of federal concessions in 2011, the airport is being returned by the current concessionaire under the Rebiding Law, enacted in 2017. With the signing of the amendment agreement for the rebidding and the first draft of the notice published, it is expected that the auction will take place between the end of 2021 and the first half of 2022.

Viracopos Airport, granted in the 2nd round of federal concessions in 2012, will also be returned and will go through the rebidding procedure. The amendment agreement was signed at the end of 2020. However, unlike São Gonçalo do Amarante, the project is still in the study phase and there is no forecast for the publication of the draft notice or holding the auction.

7th round of federal concessions

Another project that promises to increase the attractiveness the sector is the 7th round of federal airport concessions, currently in the process of contracting technical studies to support the modeling of concessions for exploration, maintenance and operation of 16 airports in the North and airports between Rio de Janeiro–Minas Gerais and São Paulo–Mato Grosso do Sul .

In the northern block, the most attractive airport is Belém Airport, due to the tourist potential of the region. Between Rio de Janeiro–Minas Gerais and São Paulo–Mato Grosso do Sul attention turns to two of the country's main airports in terms of passenger movement and location – Santos Dumont Airport (RJ) and Congonhas Airport (SP). The dispute promises to be fierce and beat the record of premiums achieved by the federal government in the other rounds.

Aviation sector will still feel the effects of the pandemic for some time, mainly due to the significant change in behaviour caused by the adoption of remote work on a large scale. However, air transport remains of vital importance in the globalized and complex economic scenario we live in. The industry is already learning to reinvent itself and the future remains promising.

- Category: Litigation

Published with the objective of modernizing brazil's business environment, Provisional Measure No. 1,040/21, also known as The Business Environment MP (MPAN), provides for the facilitation of the opening of companies, the protection of minority shareholders and the facilitation of foreign trade, among other issues. Article 32 drew attention by inserting Article 206-A a into the Civil Code to provide that: "'The intervening statute of limitations shall comply with the same limitation period of the claim.' (NR)". It is, therefore, a pacification by the legislation activity of the deadline to be considered for the recognition of the institute.

This text does not intend to exhaust doctrinal concepts and/or currents about the institute, nor even discuss the writing of the new device inserted in the Civil Code. The objective is simply to analyze whether or not there is novelty about the period to be considered for the recognition of intervening statute of limitations, based on the consensus that it concerns the statute of limitations in the course of an action and observing the same period thereof for the exercise of the original claim (i.e., the period terms listed in Art. 206 CC). Therefore, the answer is negative.

As for the deadline applicable for the recognition of the intercurrent limitation of action in the process, the courts, especially the Supreme Court (STF) and the Superior Court of Justice (STJ), have long recognized that it coincides with the limitation period for the exercise of the initial claim.[1]

To elucidate the theme, ruling 150 of the Supreme Court recommends that "prescribes the execution within the same period of prescription of the action". Although it deals with execution processes, the ruling has been applied since its edition to support the understanding that the intercurrent statute of limitations will observe the same period of the prescription of the action.[2]

Recently, in deciding the first incident in its history, inserted in the new Civil Procedure Code (CPC), named as “Incidente de Assunção de Competência”, which is remitted by the rapporteur of an appeal to be tried by the full bench of the appellate court in order to prevent or to settle divergences in case law (IAC 1), instituted in the judgment of Special Appeal to the STJ No. 1,604.412/SC, seeking to regulate the period of intercurrent statute of limitations applied to proceedings governed under the aegis of the revoked CPC, fixed the thesis in which "the intercurrent statute of limitations is related, in the causes governed by the CPC/73, when the exequente remains inert for period longer than that of prescribing the vindicated material right, according to interpretation extracted from Art. 202, sole paragraph, of the Civil Code of 2002".

Therefore, of course, there has been no change in the understanding that the period of intercurrent limitation is identical to that legally provided for the statute of limitations of the action or, in other words, of the original claim.

The 2015 CPC,[3] Nor did it bring an express provision as to the period to be applied for the recognition of intercurrent statute of limitations, but the understanding enshrined in the country jurisprudence since the 1950s has not ceased to be applied, now substantiated in the newly inserted art. 206-A of the Civil Code.

[1] Under the STJ, we highlight the following judges: REsp 1.340.553-RS, rel. Min. Mauro Campbell Marques, First Section, judged on 12.9.2018; IAC 1/STJ, under the system provided for in Articles 947 of cpc/15 and 271-B of the RISTJ, in REsp. 1,604,412, judged on 6.27.2018. Within the Scope of the Supreme Court, we highlight the following remains: ARE 732,027 AgR, rel. Min. Carmen Lucia, Second Class, judged on 7.5.2013; RE 107878, rel. Min. Djaci Hawk. Second Class, judged on 3.6.1986.

[2] From this perspective, stands out the menu of one of the precedents that led to the edition of the summary, the RE 34.944/DF, rapporteurship of minister Luiz Gallotti, judged on 22.8.1957: "Prescription. Dissidium jurisprudential on whether the execution prescribes within the same period of the action. Decision in the affirmative." Available in: <http://redir.stf.jus.br/paginadorpub/paginador.jsp?docTP=AC&docID=135367>. Access: 1.5.2021.

[3] Statement 196 of the Permanent Forum of Civil Proceduralists (FPPC) provides that "the term of intercurrent limitation is the same as the action".