Publications

- Category: Labor and employment

The publication of Ordinance No. 604/19 of the Special Secretariat of Welfare and Labor, which deals with work on Sundays and holidays, from a practical point of view, brought in important impacts to various sectors, especially trade and tourism.

One of the main changes for employers is permanent authorization for work on Sundays and holidays, with the elimination of the obligation for collective bargaining or administrative requests to the competent authorities for this purpose.

Compared with the ordinance previously in force, the number of categories (from 72 to 78) authorized to work on Sundays and holidays was expanded, including new economic sectors: the vegetable oil and biodiesel extraction industry, the wine and grape derivatives industry, the aerospace industry, commerce in general, tourism establishments, and aerospace maintenance services.

All activities for which work on Sundays and holidays has been authorized are identified in the schedule attached to the ordinance. Except for some specific sectors, office jobs are excepted.

Companies legally authorized to operate on these days, regardless of the economic sector in which they operate, must organize shift schedules, ensuring that workers enjoy time off on certain Sundays, within the legal norms.

When work occurs on Sundays or public holidays, employees shall be entitled to compensatory weekly rest on any other day within the same week, and there is no need to remunerate such work as overtime. However, if the compensatory break is not granted in the same week, that day must be paid double.

As article 6 of Law No. 10,101/2000 has thus far not been repealed, there will be discussions regarding whether or not there is a need for municipal legislation authorizing the activities of commerce in general on Sundays.

All discussion regarding work on Sundays and holidays for categories not covered by Ordinance No. 604/19 may be near the end. The Joint Committee set up to review the bill to convert Provisional Measure (MP) No. 881/19 into law, known as the Economic Freedom MP, on July 11 approved the opinion of Deputy Jeronimo Goergen (Progressive Party) that article 68 of the Consolidated Labor Laws (CLT) should be amended. With the change, all categories are authorized to work on Sundays and holidays, with paid weekly rest guaranteed on Sundays once every four weeks of work, which should end potential debates on the subject.

However, the bill regulating the MP still needs to go through the House and Senate en banc before being submitted for signature by the President of Brazil. Only if the text is approved as it was drafted, will work on Sundays and holidays be guaranteed for all categories.

The current government has shown its intent to stimulate the country's economy through changes in regulations to create opportunities for consumption and, most likely, jobs. It also demonstrates that it is trying to fulfill its promise to reduce red tape regarding labor relations made during the election campaign.

This type of regulation brings about security in labor relations and creates more opportunities for production and consumption. There is a clear need for various sectors to operate on Sundays and holidays, which makes it absolutely necessary to disentangle the operation of business establishments, with the removal of numerous rules regarding work on these days.

- Category: Labor and employment

Resolution No. 241 of the Superior Council of the Labor Judiciary (CSJT), in force since June 6, amends some of the rules of Resolution No. 185, bringing in important changes in the use of the Electronic Judicial Procedure (PJe).

For the practice of labor law, there are some changes, such as the possibility of submitting an answer, counterclaim, and documents accompanying them under seal, without the magistrate being able to order them excluded, and the obligation to use the PJe-Calc tool to submit calculations of judgment debt.

The changes were provided for by law, respectively, in paragraphs 4 and 6 of article 22 of the new resolution. In the past, it was possible to file an answer, counterclaim, and documents in a confidential manner, provided that the parties supported the confidentiality based on the scenarios set forth in article 770, head paragraph, of the CLT (Consolidated Labor Laws) and articles 189 or 773 of the CPC (Code of Civil Procedure).

The first opportunity in positive law to file the briefs in question under seal arose with Resolution No. 94/13 of the same council. However, the change made by Resolution No. 185 created a paradox: either the documents were filed without confidentiality, exposing the theory in defense before the hearing, which changes the practice observed at the time of physical proceedings and relativizes the provision of article 847, head paragraph, of the CLT, or the briefs were presented under seal, delivering them for the subjective review of the magistrate.

In this subjectivity, of course, there are appellate decisions that modify the striking of documents ordered by trial judges and also those that uphold them.

Setting aside the decision by the trial court that ordered the striking of the answer and documents presented by the company, the judgment handed down in the record of case No. 0000622-18.2018.5.21.0009, of the authorship of appellate judge Ronaldo Medeiros de Souza, of the 2nd Panel of the Court of Appeals for the 21st Circuit, addressed in detail the topic of confidentiality:

"Law No. 11,419/2006, which provides for the computerization of judicial proceedings, promoted a radical change in the way the procedural acts are performed, so that, today, we are improving the electronic mechanisms and changing the procedural legislation order to ensure greater compatibility between the two.

However, it is the PJe-JT System and its peculiar rules that are subject to labor procedural legislation, not the other way around. In this sense, article 847, head paragraph, of the CLT indicates that the opportune time for the presentation of the answer in a labor claim is after the first attempt at settlement has been frustrated, being an option of the party, to do so orally or, per the terms of the sole Paragraph of the legal provision in question, to present it in writing via the electronic judicial proceeding system before the hearing.

As the respondent has pointed out well, the fact that it submits its defense in advance through the PJe-JT System does not imply that the opposing party must have access to it before the appropriate procedural moment, i.e., after the first attempt at settlement. The logic that presides over this system is, as the respondent said, to "foster and preserve good dialogue in negotiation, delaying the adversarial nature of the process" (675).

Interestingly, the same court has a decision in the entirely opposite direction, ratifying the exclusion of the answer and its documents, as seen in the headnotes below:

HEADNOTES

Answer. Confidential nature. Non-receipt. Curtailment of defense. Nullity cured. Absence of prejudice. Ripe Cause. Decision on the request. The filing of the answer under seal does not impose an obstacle on the Court blocking its review, still more so when the time limit set by it for it to be presented is observed. Moreover, the scenario at bar does not challenge the application of the provisions of paragraph 2, of article 9, of TRT21 Act No. 634/2013, since, at the time of the filing of said briefs, the first hearing had not yet taken place. However, even rejecting the answer, the trial court did not declare default, and validated all the evidence submitted by the defendant, in addition to, during the course of the pre-trial phase, granting it full exercise of the right of defense, such that the suit was duly instructed, in such a manner that it is not possible to declare the nullity, due to application of the provisions set forth in article 794 and 796, a, of the CLT. (TRT-21 - ROPS: 00002731520185210009, Date of Decision: November 6, 2018, Date of Publication: November 9, 2018. Opinion drafted by: Ricardo Luís Espíndola Borges)

Thus, Resolution No. 241 of the CSJT comes in good time to end the debate regarding the use of the “confidentiality" option in filing the answer, counterclaim, and documents. The magistrates are expected to accept the content of the resolution, which, we should agree, did nothing more than ensure compliance with the head paragraph of article 847 of the CLT for lawsuits proceeding via electronic means.

The other important novelty brought about by Resolution No. 241 of the CSJT was the mandatory use of PJe-Calc, a tool developed to standardize the presentation of calculations in labor suits. This is a very complete solution that, although considered "didactic" and "intuitive" by its creators, has a complex instruction manual and several videos explaining its operation. Perhaps for this reason compulsory use was delayed until January of 2020.

Resolution No. 241 of the CSJT, therefore, brings the PJe closer to the labor practice, making technology work for the practice of law, and not vice versa, as it is not uncommon to find situations where practices affecting physical proceedings are hampered by the characteristics and functionalities of the electronic procedure.

Keywords:

- Category: Tax

For some time the classification of ICMS tax incentives as an investment subsidy has long been debated in the tax courts. The relevance of this discussion stems from the possibility of excluding income from investment subsidies from the IRPJ (Corporate Income Tax) and CSLL (Social Contribution on Net Income) calculation bases.

The Federal Revenue Service of Brazil (RFB) often questions exclusions of this nature on the grounds that, in fact, these are revenues from funding subsidies. The questions suffered by taxpayers are as varied as possible, such as: failure to invest funds from the subsidy in the projects incentivized, lack of synchronization between the amounts invested in the projects and recognition of revenues from subsidies, improper classification of presumed ICMS credit benefits as investment subsidies, and limitation on the exclusion of revenues from investment subsidies up to the values of the projects subsidized.

With the promulgation of Complementary Law No. 160/2017 (LC 160/2017), the legislator provided that ICMS incentives must be considered investment subsidies for the purposes of the IRPJ and CSLL and forbade mandating any other requirements not provided for in article 30 of Law No. 12,973/14.

Through LC 160/17, the legislator also provided that the above treatment applies also to administrative and judicial proceedings not yet definitively adjudicated, as well as to ICMS incentives granted in disagreement with the constitutional requirements. In the latter case, the law required the granting states to register and deposit their respective normative acts with Confaz (the National Council for Finance Policy), following the solution proposed for the context of the “tax war.”

At the same time, on recent occasions, the Superior Court of Appeals (STJ) has reviewed the application of the IRPJ and CSLL on income arising from ICMS incentives. On these occasions, the Court approached the discussion in a manner that was quite broad and dissociated from the provisions of LC 160/17 on the subject. In this context, the First Section of the STJ found that the benefits granted by the states of the Federation in the form of presumed ICMS credits should not be subject to application of the IRPJ or CSLL, under penalty of offense to legal certainty, the federative pact, and reciprocal immunity (article 18 and 150, VI, “a”, of the Federal Constitution).[1] In the STJ's view, taxation of these amounts by the Federal Government would have an impact on the benefit granted by the state (Motion to Resolve Divergence in Special Appeal 1.517.492-PR).

As may be seen from the deciding vote cast in that judgment, presumed ICMS credits cannot be considered corporate profit, as they correspond to waiver of revenue by the state government, which acts within its competence and in accordance with its tax policy. Thus, it is fitting for the Federal Government to tax such amounts, since it would "obliquely withdraw the tax incentive which the Member State, in the exercise of its tax competence, granted."

It is important to highlight that this judgment does not address the classification of tax benefits as an “investment subsidy”, nor does it address any requirements established by article 30 of Law No. 12,973/14.

Subsequently, the STJ was urged to rule on the maintenance or modification of the position adopted in EREsp 1.517.492/PR, in view of the supervening enactment of LC 160/2017. At all times, the Court found that it was not the appropriate time to review the effects of LC 160/2017, as the law came into force after the National Treasury filed special appeals and it had not been challenged by the local court (issue not previously raised). In any case, the decisions expressly state that the entry into force of LC 160/2017 would not be able to change the position established in EREsp No. 1.517.492-PR regarding the violation of the federative pact.[2]

Admittedly, this position should not be considered definitive, since the provisions of LC 160/2017 on the subject have not yet been specifically analyzed by the STJ en banc, which should occur shortly. In addition, the guiding basis for the STJ's decision on the merits is constitutional in nature. In principle, the last word on the matter should be the responsibility of the STF (Federal Supreme Court), which may review the decisions in question in the context of an Extraordinary Appeal.

The STF itself has previously recognized the general repercussion regarding the taxation of presumed ICMS credits for PIS and Cofins (RE No. 835 818-PR), which, although dealing with different taxes, has as one of its arguments precisely the offense to the federative principle and the interference of the Federal Government in the exercise of the competence of a state tax.

In summary, based on the recent precedents of the STJ that the Federal Government cannot tax benefits granted by states, as this represents an affront to legal certainty, the federative pact, and reciprocal immunity, it is possible to discuss the need regarding whether or not to observe the requirements established by article 30 of Law No. 12,973/14. Among them, the most relevant for taxpayers is the obligation to allocate income from subsidies in a tax incentive reserve account, i.e., a profit reserve.

From the STJ's position on the subject, even without settling the controversy, it may be inferred that there are legal arguments to support the possibility of excluding the subsidized amounts from the IRPJ and CSLL calculation bases, despite the accounting of these amounts in a profit reserve.

[1] Article 18. The political and administrative organization of Federative Republic of Brazil includes the Federal Government, the States, the Federal District, and the Municipalities, all autonomous, per the terms of this Constitution. (...).

Article 150. Without prejudice to other guarantees provided to taxpayers, the Federal Government, the States, the Federal District, and the Municipalities are prohibited from: (...) VI - instituting taxes on:

- a) property, income, or services from one to the other; (...)

[2] In this sense: Interlocutory Appeal in Special Appeal No. 1.306.878-RS; Interlocutory Appeal in Special Appeal No. 1.726.562-RS; Interlocutory Appeal in Motion to Resolve Divergence in Special Appeal 1.462.237-SC; Interlocutory Appeal in Special Appeal No. 1.794.524-PR; Interlocutory Appeal in Special Appeal No. 1.725.131-SC; Interlocutory Appeal in Special Appeal No. 1.729.965-SC; Interlocutory Appeal in Special Appeal No. 1.675.331-PR.

- Category: Corporate

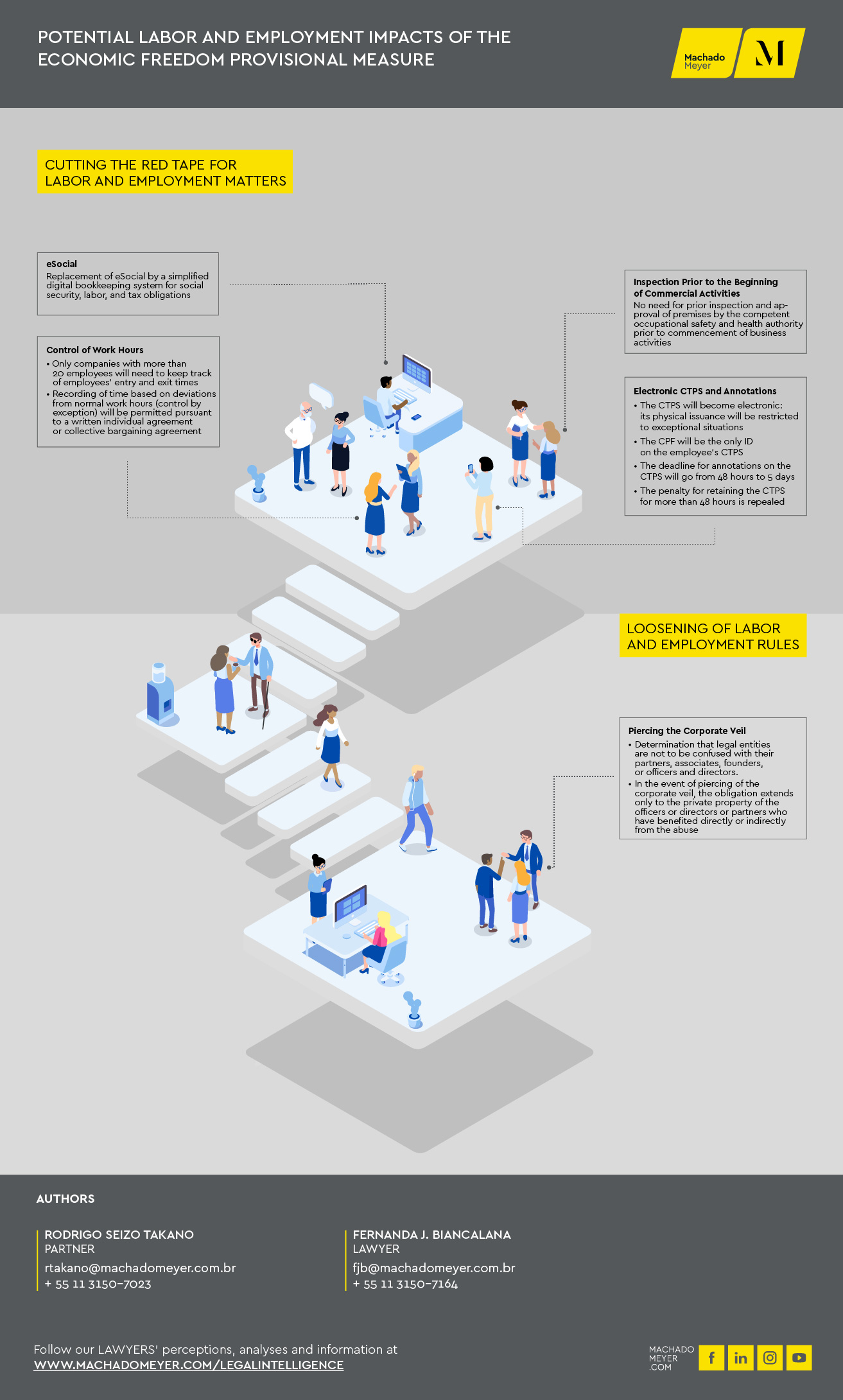

Presidential Decree (MP) No. 881, published on April 30 of this year, instituted the Declaration of Economic Freedom Rights and amended a series of legal provisions of a corporate, civil, real estate, and tax nature.

In this article, we shall analyze the main provisions of the MP, classified according to their nature.

Corporate

The provision that most attracted attention from the corporate point of view was the inclusion of a sole paragraph into article 1,052 of the Civil Code that authorizes the formation of limited liability companies by only one partner. The requirement to have at least two partners to form a limited liability company is an old discussion that culminated in 2011 in the establishment of the Individual Limited Liability Company (Eireli). Even though it may be formed by only one owner, the Eireli did not fully meet the expectations of the business world.

In order to comply with the provisions of the MP, the National Department of Business Registration and Integration (Drei) issued Normative Instruction No. 63, published in the Official Federal Gazette on June 14, to deal with the registration requirements and procedures for the individually owned limited liability companies. According to the rule, this type of company may originate from an original incorporation, departure of partners from the company by means of an amendment to the articles of association, as well as transformation, merger, spin-off, etc. The instruction also establishes that all the rules pertaining to limited liability companies organized by two or more partners must apply to individually owned limited liability companies.

The presidential decree also amended the provisions of the Civil Code dealing with Eirelis so as to make it clear that, except for cases of fraud, only an Eireli's assets are used to satisfy the company's debts, but they are not to be mixed in any situation with the assets of the owner of the Eireli.

Also in the context of personal liability, the Presidential Decree officialized the institute of inverse piercing the corporate veil by including a new paragraph in article 50 of the Civil Code to deal expressly with the subject. That is, the obligations of partners or managers may be extended to the legal entity is cases of abuse characterized by misuse of purpose or intermingling of assets.

In addition to defining what misuse of purpose and intermingling of assets is, the MP introduced into the Civil Code, in a clear manner, a provision according to which, in cases of abuse, the judge may effectively pierce the corporate veil. Previously, article 50 dealt in a more generic manner with the extension of the effects of certain relationships of obligations with the private assets of partners and managers, without expressly mentioning piercing the corporate veil per se.

Article 50 also provided in paragraph 4 that the mere existence of an economic group does not lead to piercing of the corporate veil. The insertion is important, since it seeks to increase the legal certainty of companies that are part of economic groups, sometimes held liable due to the simple fact that they are part of the same group and without due observance of the legal requirements for piercing the veil.

The requirements of the MP to give rise to piercing of the corporate veil should be considered, as regards real estate issues, when acquiring real estate belonging to specific purpose entities or companies that, in general, may be part of economic groups in situation of crisis or debt restructuring, but which in themselves do not pose a risk to the acquirer.

The latest change to the Civil Code of a corporate nature relates to the inclusion of provisions that define the investment fund, delegating to the Brazilian Securities Commission (CVM) the responsibility for disciplining it, but establishing that such a fund may, observing the rules issued by the CVM: (i) establish the limitation of liability of each condominium to the value of its units/quotas; and (ii) authorize the limitation of liability of fiduciary service providers vis-à-vis the condominium and among them, to the fulfillment of the particular duties of each one of them, without joint and several liability. If a fund established without limitation of liability wishes to adopt limited liability, this limitation will only cover the facts that occurred after this change.

With regard to the Brazilian Corporations Law, the MP brought in two novelties. The first of these is the possibility for the CVM to issue regulations that waive certain requirements set forth in the same law for companies that it defines as small and medium-sized, in order to encourage and facilitate the access of these companies to the capital markets. The second innovation consists of dispensing with the signature of shareholders subscribing shares on the subscription list or form, in the event of a public offering, the settlement of which occurs through systems managed by entities managing the organized securities markets.

Civil

The MP also amended the articles of the Civil Code dealing with contracts in general so as to provide that, in addition to the freedom to contract within the limits of the social function of contracts, the provisions of the Declaration of Economic Freedom Rights and minimum intervention by the State in private contractual relations must also be observed.

The provisions of the Civil Code on adhesion contracts have also been amended. The old wording provided that, in cases of ambiguous or contradictory provisions in adhesion contracts, construction should done in the manner more favorable to the adherent (i.e., the party who did not draft the contract). The new wording only changed "ambiguous or contradictory" to "that cause doubt regarding construction." In addition, it was established that the same logic should apply to non-adhesion contracts, but in which one of the parties did not draft the provision. That is, in contracts, even if they are not adhesion contracts, the provisions should be construed for the benefit of those who did not draft them, in the event of doubts.

Also in the civil sphere, the MP amended Law No. 11,101/05, which governs judicial reorganization, including a new article 82-A, which deals with the extent of the effects of bankruptcy. This inclusion, in and of itself, is questionable, since this law already has other mechanisms for third-party liability in the event of bankruptcy.

Moreover, although extension of the effects of bankruptcy had already been applied and accepted by a significant portion of the Brazilian courts, there was no legal provision governing it, which ultimately created uncertainty regarding the effects of such a measure (for example, on the time limit to be fixed for the companies/persons affected by the extension).

By introducing the institute through the presidential decree, the legislator has apparently attempted to mitigate lessen uncertainty and ensure some predictability regarding its use. As per the provisions of article 82-A, however, the attempt may not yield the fruit desired. Due to the seriousness of the alternative that the legislator has opted for, detailed regulations on its requirements (which should not be exactly the same as those for piercing of the corporate veil, as proposed), limits of application, effects, and extension would be recommendable, which is not seen in the text of the MP.

In order to reduce the bureaucracy related to the printing and storage of physical documents and to preserve the environment, the MP also changed the wording of Federal Law No. 6,015/1973 in order to permit the preparation and storage of public records in digital media, giving them the same validity as physical documents for all legal purposes.

Likewise, Federal Law No. 12,682/2012, which regulates the preparation and archiving of public and private documents on electromagnetic media, was also amended.

Real Estate

Another provision brought in by MP 881 concerns the amendment of Decree-Law No. 9,760/46, which deals with properties owned by the federal government, including naval lands. The new text alters the jurisdiction to hear appeals relating to decisions on demarcation of naval lands.

The task was assigned to the Minister of Planning, Budget, and Management, but was transferred, with the new norm, to the hierarchical superior of the secretary of Coordination and Governance of the Assets of the Federal Government of the Special Secretariat of Privatization and Divestment of the Ministry of Economy. In general, the change may accelerate the response to appeals filed by parties interested in proceedings before the Secretariat of Assets of the Federal Government (SPU).

Tax

Among the changes promoted by the presidential decree in the tax area, one may highlight the following points:

- Creation of a committee composed of members of the Administrative Council of Tax Appeals, the Special Secretariat of the Federal Revenue of the Ministry of Economy, and the National Treasury Attorney-General to promulgate restatements of law by the federal tax administration (article 14 of the MP - inclusion of article 18-A into Law No. 10,522/2002).

In the article in question, the restatements must be observed in the administrative, regulatory, and decision-making acts of said bodies, which are under the Federal Public Tax Administration.

- Expansion of the scenarios provided for in article 19 of Law No. 10,522/2002, in which the Attorney-General of the National Treasury (PGFN) will be exempt from answering, offering counter-arguments, and appealing or withdrawing from appeals (article 14 of the MP).

Among the scenarios provided for are the topics judged on the basis of concentrated and diffuse control of constitutionality, as well as repetitive appeals reviewed by the Federal Supreme Court (STF) and the Superior Court of Appeals (STJ), in addition to the provisions in binding precedents. This provision is in line with the new provisions of the Code of Civil Procedure of 2015, which seeks procedural speed and economy through the standardization of case law understandings.

MP 881 also ended up bringing in as a scenario for exemption from challenging/appealing the issues decided by the STF, the STJ, or by the Panel for Uniformization of Case Law (an integral part of the Federal Justice Council) when there is no possibility of reversing the theory settled in a sense unfavorable to the National Treasury, according to criteria defined in the act of the attorney-general of the National Treasury.

Likewise, the possibility of exemption of the PGFN from contesting/appealing was inserted in relation to cases that are the subject of a precedent of the federal tax administration, provided for in article 18-A, discussed above.

- Change and inclusion of specific procedures for exemption from establishment of a tax liability and collection by the Public Administration in the cases of exemption dealt with in article 19 of Law No. 10,522/2002 (article 14 of the MP - amendments and inclusions promoted in articles 19, 19-A, 19-B, 19-C, and 19-D of Law No. 10,522/2002).

Rights of economic freedom

In addition to amending legislation, MP 881 established the rights of economic freedom, assigned to every person, whether an individual or legal entity, and considered essential for Brazil's economic growth and development, two of which we highlight.

The first is the right of any person, whether an individual or legal entity, to develop a low-risk activity, for one’s own sustenance or that of one’s family, on private property or that of consenting third parties, without the need for licenses, authorizations, registration, and other acts that are required by public agencies before the exercise of the economic activity.

The Ministry of Economy published Resolution No. 51/2019, which defines the concept of low risk for the purposes of exemption from the requirement of public acts for release for operation or functioning of an economic activity. Examples of low-risk activities include news agencies, psychology, language instruction, tire installation services, etc. In such cases, supervision of the exercise of this right shall be carried out ex post facto, ex officio, or as a result of a complaint by a third party.

From the point of view of real estate law, it is possible that certain activities may be exempted from municipal licenses for installation and operation in order for them to operate.

The other right that we highlight is that the private party requesting a license, authorization, registration, enrollment, permit, or other acts required as a precondition for the exercise of an economic activity (upon presentation of all documents and elements necessary to support the process) shall be informed immediately regarding the maximum time limit for examination of the respective application.

After such period has elapsed without the authority having responded, the request shall be deemed tacitly approved, except for those cases expressly prohibited by law and when the request has been made by a public agent or relatives at certain levels of the administrative authority of the body itself in which the activities are carried out. MP 881, however, makes exceptions for cases in which such right will not be applicable, as in relation to tax matters and situations considered to have justifiable risk.

It should be noted that the entrance into force of the right to guarantee reasonable time limits is suspended for 60 days as of the date of publication of the presidential decree.

A review of the main changes made allows one to conclude that MP 881 may stimulate entrepreneurship in Brazil through the establishment of more flexible rules for certain types of business, but many of the new provisions depend on future and specific regulations for their effectiveness to be ensured.

Currently in progress before the National Congress, the text needs to be converted into law within 60 days (extendable once for an equal period) in order not to lose its effectiveness.

- Category: Infrastructure and energy

Now that the euphoria with the result of the 5th Round of Airport Concessions has passed, an analysis of the results obtained reveals a maturation of the concessions model adopted by the federal government. Choices made in the past, however, still pose challenges for the most varied of players in the industry, both in the public and private spheres. The proposal to classify 22 airport concessions as being priority in the Investment Partnerships Program (PPI) creates expectations for the coming year.

On May 14, Machado Meyer hosted the meeting of the Infrastructure Committee of Ibrademp (the Brazilian Institute of Business Law) to discuss the different views on airport concessions, lessons learned, challenges, and new opportunities. Marcelo Allain, an economist, partner of BR Infra Group and former member of the Secretariat of the Federal PPI, and David Goldberg, engineer and partner at Terrafirma, under the supervision of the coordinator of committee José Virgílio Enei, participated in the discussion.

The discussions were started based on the success of the 5th Round of Concessions, held in March and marked by exponential interest, auctions with fierce bidding, and participation by global operators. The removal of the restriction on the participation by groups already benefited by other airport concessions proved to be correct, and did not harm competitiveness, nor the success of new entrants such as the Spanish group Aena and the Brazilian group Socicam.

The model of the block concession, combining more profitable airports with smaller ones (“bone-in steak”), was also a viable alternative to not burden Infraero with only deficient airports, which opens space for its potential liquidation after the privatization of all the airports it administers.

The strategic (and ideological) error of keeping Infraero with a minority stake (49%) in the airports of the 2nd and 3rd rounds (Guarulhos, Viracopos, and Brasília; Confins and Galeão) was also discussed. Initially, the government left money on the table at the auction, selling only a 51% stake in airports at the height of market optimism. It ended up being penalized once again, as Infraero was obliged to bear the necessary investments and losses resulting from an actual demand much lower than what was originally projected. Given the low return of these airports and the limited rights of governance recognized for Infraero in the concessionaires, there is uncertainty about the value that it could obtain from the sale of these stakes.

Due to the precarious financial conditions of these first airports, the difficulty of effecting a consensual return is evident. Although Law No. 13,348/2016 has given legal authorization in this regard, the lack of regulations, especially as regards the criteria for indemnification for investments not amortized for the concessionaire that returns the asset, aggravates the scenario of uncertainty. The concern of the granting authority seems to be that if, on the one hand, the accounting criterion is more appropriate (and consistent with the letter of the law), as opposed to, for example, the asset or market replacement value, construction contracts with related or oversized parties may lead to discussions, especially with the supervisory bodies.

Some factors help explain the difficulties faced by airports for which concessions were granted in the first three rounds. One of them would be the frustration of demand, due to the greatest economic crisis ever experienced by Brazil. However, this fact has not been recognized in the administrative sphere as force majeure and, therefore, has not led to any economic and financial rebalancing of the contracts.

In addition, the significant bids offered in those rounds were translated into payments of fixed annual grants, increasing the risk of insolvency and pressure on the concessionaires’ cash. This risk has been mitigated in the most recent rounds, either because the most significant bids are payable at the time of the concession (lesser burden on future cash flow, especially if financed with equity), or because the concessionaires now have a grace period to start paying the annual grant installments.

The contractual rigidity of the first rounds was also pointed out, in which investments were required throughout the concession, regardless of the materialization of the demand estimated. This problem was once again corrected in the latest rounds, which conditioned investment obligations on certain demand triggers, as was already the case in road concessions.

Other factors further sharply deteriorated the economy of some of the first airports for which concessions were granted. The Viracopos concessionaire, for example, bet on a business model, freight transport, which did not materialize. With the development of new models of passenger aircraft capable of holding larger volumes of cargo, other airports eventually ended up gaining a share of that market.

Galeão Airport was impacted even more intensely by the Rio de Janeiro crisis and the frustration of demand, which was far below the national average. Finally, São Gonçalo do Amarante Airport (1st round) suffered due to the lack of access construction works for which the Rio Grande do Norte state government was in charge.

In an analysis of what the industry should expect in terms of new projects, a scenario was presented at the event based on some 600 public airports in Brazil, 10% of which are only under federal control, although they concentrate 95% of the passengers. Very few regional airports (of states or municipalities) would be eligible for concession or privatization without public subsidies or consideration, as in the public-private partnership (PPP) model. Even those that are theoretically self-sustaining could be subject to the granting of a concession for an investor profile very different from international operators interested in federal airports.

Regarding the 6th Concessions Round, announced by the federal government for 2020, it is already known that the block model will be maintained. Twenty-two airport concessions will be tendered, structured into three blocks: South, North, and Central. Per the profile of the assets, it is difficult to predict whether the result of this round will repeat the high bids of the prior one.

The Congonhas and Santos Dumont terminals ended up being included only in the 7th and last round of concessions. The strategy of keeping the crown jewels for the end was supposedly structured as a way to compensate investors for less attractive federal airports, in the logic of cross-subsidization of the blocks.

Over the years, the feeling that has resulted, therefore, is that the modeling of airport concessions has been evolving based on the successes and mistakes of past experiences. The balance is positive and the challenges to be faced are not few.

- Category: Labor and employment

"After undergoing various changes for approval by the Chamber of Deputies on August 13, 2019, the bill arising in response to the Economic Freedom Executive Order went to vote in the Federal Senate.

On August 21, 2019, the Federal Senate approved the text of the bill with the removal of one more point that impacted on labor and employment law: the authorization to work on Sundays and holidays.

Initially, the bill authorized work on Sundays and holidays, which payment must be remunerated at twice the usual amount (100% premium), unless a compensatory day off is granted to the employee, and the weekly rest must only be on a Sunday, once every four weeks.

Because of this exclusion, the rule for work on Sundays and holidays should remain as currently provided for by labor and employment law.

If the bill is signed, the labor law will have the following impacts:"