Publications

- Category: M&A and private equity

Law No. 13,874/19 which established the Declaration of Rights of Economic Freedom,[1] was enacted in order to address many claims of the business community to improve the business environment in Brazil. Among the principle based provisions and legislative changes, it should be highlighted the new rules inserted into the Civil Code relating to investment funds,[2] in particular the possibility of limiting the liability of quotaholders and service providers of the investment fund.

In this sense, new article 1368-D of the Civil Code states that the by-laws of investment fund may, subject to the regulations of the Brazilian Securities and Exchange Commission (CVM), limit the liability of quotaholders to the value of their quotas and the liability of service providers of the fund,[3] before the condominium (the fund) and among them, to the performance of their respective duties, without joint and several liability. Although this new provision is not immediately effective due to to the lack of regulations by CVM, such provision establishes the legal basis for the regulator to update the current rules aligned with the most advanced regulatory models.

In the Brazilian legal system, investment funds have always been considered as condominium, as originally referred to in article 49, II, of Law No. 4,728/65 and subsequent legal and infralegal rules, such as CVM Normative Instruction No. 555/14,[4] related to investment funds in general, Law No. 8,668/93[5] and CVM Normative Instruction No. 472/08,[6] both applicable to real estate investment funds (FIIs), and CVM Normative Instruction No. 578/16,[7] relating to private equity investment funds.

As for the liability of the investment fund's quotaholders, civil law establishes that the condominium members are liable, in proportion to their shares, to bear the burdens and debts to which the condominium’s assets are subject to (articles 1,315 and 1,317 of the Civil Code) unless joint and several liability among them is stipulated. In compliance with these legal limits, CVM’s regulations applicable to investment funds generally require quotaholders to be liable for any negative net worth of the fund (article 15 of CVM Normative Instruction No. 555/14). On the other hand, the quotaholders of real estate investment funds are an exception to the rule, supported by the express legal provision limiting their liability to the payment of the subscribed quotas (article 13, II, of Law No. 8,668/93), which, in turn, was mirrored by CVM in the respective regulations regarding FIIs (article 8, II, of CVM Normative Instruction No. 472/08).

Therefore, the Economic Freedom Act established the legal grounds enabling CVM to regulate investment funds more freely, by amending the Civil Code (i) affirming the condominium nature of investment funds, but expressly carving out the applicability of the general rules on condominiums (new article 1368-C) and (ii) allowing investment funds’ by-laws to limit the liability of quotaholders and their service providers, to the extent CVM’s regulations are complied with (new article 1368-D).

It is reasonable to expect that the regulator will consider in the new rules criteria such as the type of investment fund, the assets and investments within the investment fund's portfolio, and the target investors, i.e., the investor profile and the degree of risk exposure that such investors are willing to take, or should take. In any case, particular attention shall be devoted to private equity investment funds (FIPs), either because of the role they play in business activity or because of the diversity of investments types they may encompass.

Regarding business activity, FIPs essentially invest in publicly-held companies, privately-held companies, or limited liability companies, and should influence the strategy and management of the invested companies. In this respect, FIPs differ from other funds, which may hold passive equity interests in listed companies for speculative purposes. Therefore, FIPs embody the most entrepreneurial side of the investment fund industry and, as such, these investment vehicles, their managers, administrators and investors should be treated in order to ensure competitiveness in their business activities. Drawing a parallel with an investment holding company, whose partners’ liability is limited to the value of the subscribed capital in the holding company, except in cases of piercing of the corporate veil, there is no reason why the quotaholders of a FIP should be required to cover the negative net worth of the investment fund on an unlimited basis.

As for the various facets that a FIP may adopt, CVM Normative Instruction 578/16 establishes different categories, such as FIP-Seed Capital, Infrastructure, among others and, especially, the FIP-MultiStrategy, intended for FIPs that are not classified into other categories. It is entirely possible for a FIP to invest in special purpose companies focused solely in real estate enterprises, which makes its portfolio potentially identical to that of a FII. Therefore, it is worth considering whether this FIP should not be allowed to adopt a liability regime to its quotaholders similar to the one applicable to FIIs’ quotaholders. Should it be the case that, in these scenarios, the regulations prioritize the essence of the investment over its form and, consequently, grant the FIP’s quotaholders the same liability regime applicable to FII’s quotaholders?

Specifically in relation to the possibility of segregating the liability of the fiduciary service providers, eliminating the joint liability among them, this provision seeks to solve an increasingly frequent obstacle in the relations among agents in the sector. Over the years, the investment fund industry has become more sophisticated, resulting in a more segregated and specialized way its agents operates. In this sense, joint and several liability among investment fund service providers has served as a disincentive for the most capable and competent agents to perform these functions, leading to race to the bottom.

With the Economic Freedom Act, the basis for a change have been laid, and it will be up to the regulator to analyze and, together with the market players, consider the paths in which regulation should follow. Regardless of the course chosen, it is clear that one cannot delay or waste the opportunity to improve outdated rules and to sort out relevant issues to the investment fund industry, promoting economic activity and fostering the development of Brazil’s capital markets.

[1] Derived from Executive Order No. 881/19.

[2] New Articles 1368-C to 1368-F of Law No. 10,406/02 (the Civil Code).

[3] Fiduciary service providers are understood to be administrators, asset managers and custodians.

[4] Article 3. The investment fund is a communion of resources, organized in the form of a condominium, intended for investment in financial assets.

[5] Article 1. Real Estate Investment Funds are established, without legal personality, characterized by the communion of funds raised through the Securities Distribution System, in the manner set forth in Law No. 6,385, of December 7, 1976, intended for application to real estate developments.

Article 2. The Fund shall be organized in the form of a closed-end condominium, prohibited the redemption of quotas, with a determinate or indeterminate term of duration.

[6]Article 2. The FII is a communion of funds raised through the securities distribution system and intended for investment in real estate developments.

Paragraph 1. The fund shall be organized as a closed-end condominium and may have an indeterminate term of duration.

[7] Article 5. The FIP, organized as a closed-end condominium, is a communion of funds intended for the acquisition of shares, subscription warrants, simple debentures, other securities convertible or exchangeable into shares issued by companies, publicly or privately held, as well as as securities representing participation in limited liability companies, which must participate in the decision-making process of the invested company, with effective influence on the definition of its strategic policy and its management.

- Category: Litigation

Two ordinances amended the rules governing recall campaigns in Brazil earlier this half of the year. The standards modernize the regulations of the procedure imposed by the Consumer Protection Code (article 10, paragraphs 1 and 2) whenever the supplier becomes aware of the possibility of having introduced into the Brazilian market a product or service that poses a risk to the health or safety of the consumer.

The consumer protection agencies responsible for ascertaining the need for a recall are often quite strict in this analysis: if there are doubts about the lack of safety of a particular product, the tendency is for them to decide to perform the campaign.

According to Brazilian law, the main objectives of a recall are to ensure the protection of consumers against risks to their health and safety caused by a product or service offered to them, and to provide the public with comprehensive and correct information about the fact that triggered the recall.

It is precisely in the form of communication that the new Ordinance No. 618/19, promulgated by the Ministry of Justice and Public Safety replacing Ordinance No. 487/12, now repealed, presents the greatest advance compared to the previous rule. The paragraphs of article 4 open the possibility of running the campaign through the company's website and digital media on the Internet, in addition to the radio and TV communication previously provided for.

Through this communication, the supplier must inform consumers of the potential risk they are exposed to when using the defective product or service. To do so, they need to present a media plan with a detailed description of the product or service and the defective component, details about the frequency of disclosure, costs involved, campaign start and end dates, and more. The supplier must also highlight that consumers will incur no costs in joining the recall campaign.

Another change made by the new ordinance causes concern. It is the rule that establishes a period of 24 hours for the supplier to inform the National Consumer Bureau (Senacon) of the beginning of investigations regarding the possible introduction of a product or service into the Brazilian consumer market that presents danger or harmfulness. Upon completion of the investigations, the supplier has two business days to report the reasons why the recall campaign will not be necessary or, if necessary, to report this to Senacon and the appropriate regulatory or rulemaking body.

The previous ordinance provided that the initial report of the fact by the supplier, which should then be addressed to the Department of Consumer Defense and Protection (DPDC), must be done “immediately.” Although the standard did not establish what would be interpreted as “immediately,” the prevailing understanding was that the supplier should carry out this report as soon as it became aware of the problem and then start the recall campaign as soon as possible.

While the legislator's attempt to establish a more objective criterion for verifying a supplier’s compliance with the deadlines is laudable, experience shows that the decision to conduct a recall requires an evaluation of often subjective variables, which can hardly be adequately ascertained and addressed within such tight deadlines.

Another novelty in this area was the publication of Joint Ordinance No. 3/19, an initiative of the Ministries of Infrastructure and Justice and Public Safety. It sets forth provisions for recall procedures specifically for the vehicle market. In compliance with this standard, defective vehicle recall campaigns should be reported not only to Senacon but also to the National Traffic Department (Denatran). Once this is done, at most every 15 days, suppliers must provide information on the updated universe of vehicles served, in accordance with the terms of the manual for registration of recalls in the National Vehicle Registration System (Renavam).

The holding of a recall is mandatory in any event where the supplier becomes aware of a potential health or safety risk arising from a product or service offered by the supplier. Failure to conduct the campaign voluntarily and in a timely manner will result in administrative, civil, and criminal sanctions.

- Category: Litigation

The Brazilian Securities and Exchange Commission (CVM) and the Superior Court of Justice (STJ), in two decisions in the first half of the year, made it clear that hotel operators may only be held liable for irregularities or damages in the offering of condo hotels if they participated actively in the efforts to sell the ideal fractions to buyers.

Used in the structuring of these developments, Collective Hotel Investment Agreements (CICs) are securities consisting of a series of contractual instruments publicly offered to investors. These contracts contain a promise of compensation linked to the profit sharing of the development, which is organized through a building condominium.

This development model was driven in Brazil mainly by the need to expand the country's hotel network to meet demand related to the 2014 World Cup and the 2016 Olympics.

Despite the numerous structuring models for this type of development, it is common for construction of the condo-hotel to be made possible through the establishment of a Special Partnership Company (SCP). It is made up of an general partner and other investors who become partners of the SCP at the time of the acquisition of a real estate unit of the development. The company acts as the manager of the finished project and is required to render accounts and pay dividends to investors.

Other relevant participants are the developer, responsible for developing, building, and selling the development, and hotel operators, hired to manage the day-to-day activities of the condo-hotel. The second group of companies is usually formed by large players in the hotel industry with a lot of know-how and prestige. They provide hotel management services and sometimes technical advice during construction, but generally do not participate in the process of buying and selling the ideal fractions by investors.

The filing of administrative proceedings to investigate irregularities in the offering of condo-hotels and the filing of lawsuits by investors who had their expectations frustrated and who seek termination of contract and repair of material and moral damages caused the CVM and the Judiciary to study further the liability of hotel brands in the context of collective investment agreements.

The CVM issued Normative Instruction No. 602/18 in order to define the concept of “offeror” as being the party that, in fact, makes distribution efforts for the CIC hotel. The authority also stated that the hotel operator “usually” is not responsible for the sales efforts of hotel CICs and, consequently, does not fit within the concept of offeror.

Thus, an objective criterion was established to assess the liability of the hotel manager for irregularities in the offering of condo-hotels. According to the standard, it is necessary to review the behavior of the manager during the process of selling the development's units and analyze whether it actually and provenly participated in acts of public distribution of the condo-hotel. Only if it has actively participated in the sales efforts may the operator be held liable.

The CVM applied this understanding in deciding sanctioning proceeding No. 19957.011318/2017-00. In that case, the liability of a hotel operator and its managers for an irregular offering of a condo-hotel was ruled out, given the lack of evidence that it participated in the distribution of the development’s units.

The STJ, in turn, in a recent judgment on the subject (REsp No. 1.785.802/SP), found the lack of standing to be sued of the hotel operator to be liable to the purchasers for losses and damages resulting from non-construction of a development.

According to the STJ, as the operator only undertakes to manage the hotel services after the completion of the construction, it is not part of the supply chain related to the real estate development, and for this reason it cannot be held liable for damages caused to third-party purchasers.

- Category: Labor and employment

In order to encourage the creation of new jobs and inject money into the market, the Ministry of Economy plans to present a package of measures that, among other actions, authorizes the replacement of funds paid by employers as appeal deposits with judicial performance bonds.[1]

The payment of an appeal deposit is a mandatory requirement for the judgment of appeals filed by employers in labor claims. The objective is to ensure that employers initiate payment of judgments, in advance and in part, if the higher courts do not reverse an unfavorable decision.

Currently, for the employer to appeal to the appellate court, the deposit must be made into a judicial account linked to the case, in the maximum amount of R$ 9,828.51. To appeal to the Superior Labor Court (TST), the appeal deposit is limited to R$ 19,657.02.

Deposits are adjusted based on the savings account interest rate, which results in financial losses for employers: while interest for the Labor Courts is 12% per year, appeal deposits have been adjusted at 4.62% over the past 12 months.[2] Such a difference shows that the appeal deposit does not lend itself to guaranteeing payment of the judgment, since it depreciates in relation to the amounts due. It would be more favorable for companies to invest funds in financial investments.

With the entrance into force of the Labor Reform (Law No. 13,467/17) and the inclusion of paragraph 11 into article 899 of the Consolidated Labor Laws (CLT), employers were allowed to use judicial performance bonds to lodge appeals with the higher courts rather than make the appeal deposit with financial institutions.

Thus, in order to appeal against an unfavorable judgment, companies may now purchase a judicial performance bond, keeping their funds invested in more profitable investments or investing such funds in new jobs or in the modernization of their business activity.

Due to internal rules of the Labor Courts, however, employers are not yet allowed to substitute judicial performance bonds for deposit amounts paid prior to the Labor Reform, which remain pending in the accounts linked to the labor claims.

Trial and appellate judges argue that replacement of deposits made before November 11, 2017, would not be possible, as the Labor Reform did not give retroactive effect to paragraph 11 of article 899 of the CLT for appeals filed under the previous law. Such a position was even endorsed by the TST:[3]

"Article 20: The provisions contained in paragraphs 4, 9, 10, and 11 of article 899 of the CLT, as amended by Law No. 13,467/17, shall be observed for appeals against decisions rendered as of November 11, 2017.”

Studies conducted by the Ministry of Economy[4] indicate that the possible replacement of appeal deposits made with judicial performance bonds would free up for employers about R$ 65 billion that is idle in the Labor Courts and could be invested in more advantageous financial investments, in creating new jobs, and in moving the economy forward.

With the proposal of this measure, the federal government has shown its intent to stimulate Brazil’s economy through changes in regulations to create opportunities for employment and consumption.

In order to withdraw the amounts deposited, however, companies will have to file in court a petition for replacement and prove the purchase of a judicial performance bond. They will also need to satisfy the other requirements of the Labor Courts, as well as requirements possibly included in the package of measures being proposed by the Ministry of Economy.

For more information on the topic, please see:

How does one safely substitute an appeal deposit with a performance bond?

[1] Folha de S. Paulo, “Unemployment reduction package releases R$ 65 billion to companies and creates labor agency.” https://www1.folha.uol.com.br/mercado/2019/09/pacote-de-combate-ao-desemprego-libera-r-65-bi-para-empresas-e-cria-agencia-de-trabalho.shtml

InfoMoney, “Guedes says economic team working on package to incentive employment.” https://www.infomoney.com.br/mercados/noticia/9336933/guedes-diz-que-pacote-de-incentivo-ao-emprego-ainda-esta-em-gestacao

[2] https://www.bcb.gov.br/estatisticas/remuneradepositospoupanca

[3] Normative Instruction No. 41 of the TST.

[4] Estado de S. Paulo. "Guedes receives menu of measures for employment that includes release of R$ 65 billion to companies." https://economia.estadao.com.br/noticias/geral,guedes-recebe-cardapio-de-medidas-para-emprego-que-inclui-liberacao-de-r-65-bi-para-empresas,70002999711

- Category: Labor and employment

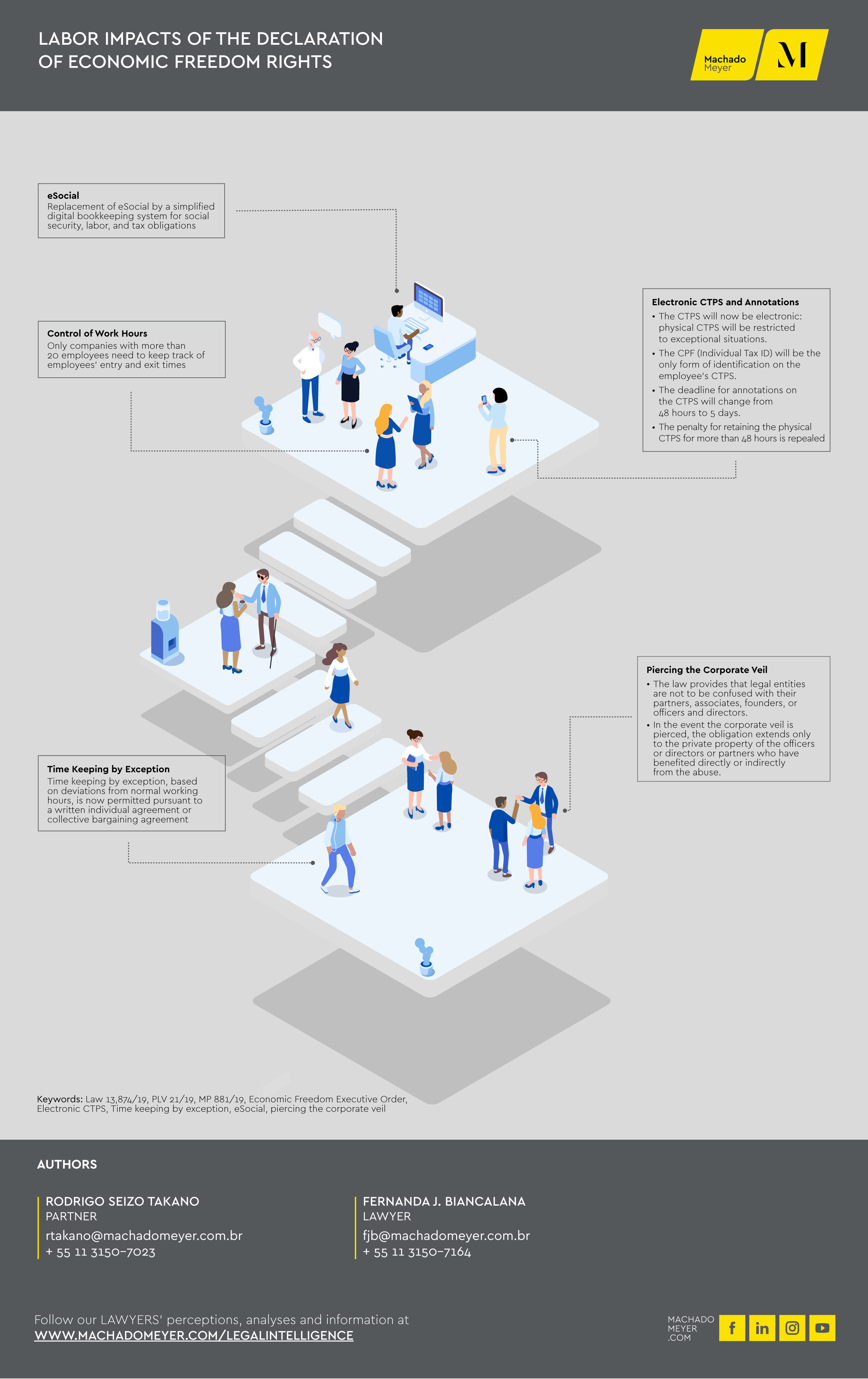

Law No. 13,874/19, enacted on September 20 after the conversion into law of the Economic Freedom Executive Order (MP 881/19), amended various points of labor and employment laws with the main objective of reducing bureaucracy in the procedures to be followed by employers.

The labor and employment impacts of the Declaration of Economic Freedom Rights are as follows:

- Category: Labor and employment

In prior articles, we discussed some preventive measures that startups can take to adjust their internal procedures and thereby avoid possible breaches of labor laws and regulations. Startups may, however, face labor claims filed by their former employees or even by third parties who were not even their direct contractors.

There is an explanation: labor liability may overstep the boundaries of the customer-provider relationship, reaching companies or people who often did not even participate in the irregularities alleged in the case. In the labor courts, in addition to the principal debtor, usually the employer itself, third-party liability can take two forms:

- Secondary liability

In this case, the company must only pay the labor debt if the principal debtor does not. The labor courts are charged with exhausting all attempts to execute against the principal before turning against the secondarily liable party.

There are two main scenarios in which this liability is recognized in the labor courts:

- Liability of the recipient of services from the third-party workers; and

- Liability of partners, officers and directors, investors, and executives for the company's labor debts.

The first situation stems from the mere work done by third parties via the hiring of a service provider. In this scenario, the company receiving the services (customer) is understood to be liable for the sums due from the service provider (vendor) to the outsourced service providers. This is the case, for example, of a company hiring security guard services, which is now liable for the labor sums due to any of its outsourced security guards, even if it is not their employer.

The second scenario, especially relevant in the context of startups, is the individual liability of key persons for the company's labor debts. In some situations and upon due determination, partners, officers and directors, investors, and executives may be personally liable for such debts after attempts to execute against the company have been exhausted.

Given the instability surrounding some startups in their early years, it is only natural that the personal liability of their investors may discourage capital contributions. However, in order to minimize investment risks, shield investors' personal assets, and stimulate capital contributions, in 2016 there was an important amendment to the National Simplified Tax System Law.

With this change, capital contributions to micro and small businesses, the main models for creating startups, do not make up the respective capital stock. Thus, such investors, also known as “angel investors,” are liable for the company's debts up to the limit of the capital contributed. Those who choose to contribute in such conditions will have greater legal certainty and confidence in making investments in startups still in the development phase.

- Joint and several liability

Unlike in the case above, the company jointly and severally liable may be executed simultaneously with the other companies sued in the labor claim. There is therefore no order to be respected by the judge, who may execute any one or even all of the companies at the same time. The main assumptions for joint and several liability in the labor courts are as follows:

- Economic group;

- Succession of companies;

- Agreements among the parties or express legal provision; and

- Fraudulent practices during the term of the agreement.

The concept of an economic group, one of the most frequent cases in labor courts, is present in the Consolidated Labor Laws (CLT), in its article 2 and relevant paragraphs. Although the text has undergone various changes over the years, the current wording requires that, to establish an economic group, it is necessary to prove: (i) a relationship of direction, control, or management between companies; (ii) integrated interest; (iii) an effective communion of interests; and (iv) joint action by the companies.

In addition, with the conversion into law of Presidential Decree No. 881/19 (the Economic Freedom Executive Order), it is expected that the mere existence of an economic group will no longer be sufficient for the recognition of joint and several liability. If the new wording is approved by the National Congress, it will also be required to prove abuse of legal personality, identified by the misuse of its purpose or the mixing of assets. This is a highly relevant change that will have various consequences for the way the labor courts review the subject.

Thus, with regard to secondary liability, startups will have to redouble their care in selecting and hiring service providers, opting for those with better financial health and a high reputation in the market. Investors are advised to exercise caution not only in selecting startups but also, and especially, in choosing the best form of contribution of funds, safeguarding their personal assets.

With regard to joint and several liability, startups will have to closely monitor the financial health of related companies, since under current laws and regulations just a few elements are enough for the establishment of an economic group. It is worth remembering that this scenario may be changed significantly with the conversion into law of the Economic Freedom Executive Order.