Publications

- Category: Labor and employment

One of the main and most important changes promoted by Law No. 13,467 (Labor Reform) is the distinction between two categories of workers: the hyposufficient and the hypersufficient. According to the prevailing understanding in the Brazilian Labor Code (CLT), all workers, without distinction, were presumably hyposufficient and, therefore, would not have bargaining power (autonomy of will) to negotiate with employers. Since 1943, the date of entry into force of the CLT, until now, however, great evolution of the social, legal, intellectual, and economic has occurred in the world. To accept that the rules adopted more than 70 years ago be applied today in the same way, without a contextualized analysis, would be to disregard all this evolution. The factual context has changed, and so have the standards and qualifications of the Brazilian workforce. We see that today senior executives have extensive CVs, national and international work history, vast professional experience, and a rich academic background. They cannot be equated with the truly hyposufficient employees, who have often not even completed basic education and for whom, with some exceptions, the rules of the CLT were drafted. With the evolution of the Brazilian economy, more complex labor relations have become common, especially in large urban centers. Often top executives, because of their technical knowledge and the strategic position they occupy in the market, have even greater bargaining power than their employers. Thinking about this, in the process of the Labor Reform, this single paragraph was included in article 444:[1] "The free negotiation referred to in the head paragraph of this article applies to the scenarios set forth in article 611-A of these Consolidated Laws, with the same legal effectiveness and preponderance over collective bargaining instruments, in the case of an employee holding a higher-education degree and who receives a monthly salary equal to or greater than twice the maximum benefit limit of the General Social Security System.” The interpretation drawn from the text above is that employees who have, at the same time, a higher-level diploma and who receive a monthly salary equal to or greater than R$ 11,062.62 (today's values), have the autonomy to (re)negotiate/loosen the provisions of their existing employment contracts in relation to the topics listed in article 611-A. Moreover, it is clear from the text that this free negotiation has the same legal effectiveness and preponderance over collective instruments. In other words, it is possible to reach the interpretation that the free negotiation between the hypersufficient workers and the companies would have the same weight as those negotiations between the union and the company. In this context, and in conducting a systematic analysis of the labor rules based on the Federal Constitution of Brazil (CRFB/88), a possible interpretation is that it would be possible, then, to renegotiate salary/remuneration with hypersufficient workers. This is a syllogism, as explained below. According to article 7, item VI, of the CRFB/88, the irreducibility of wages is a right of workers, except if provided in a collective convention or collective bargaining agreement. Article 611-A itself ratifies the understanding embodied in CRFB/88, stating that collective conventions and collective bargaining agreements prevail over the law when dealing with compensation, bonuses, and profit sharing. Considering that the sole paragraph of article 444 establishes that negotiations with hypersufficient employees have the same effectiveness as collective bargaining, it could be possible to argue then that workers belonging to this new category could renegotiate their salaries. Notwithstanding the possible interpretation indicated above, which will certainly arouse much debate, it is very important to have caution. Firstly, because of the scenario of great legal instability regarding the Labor Reform. Presidential Decree No. 808/2017 was not even voted on and has already received more than 900 amendments. In addition, there are numerous suits of unconstitutionality filed before the STF, none of which has been reviewed thus far. Therefore, it is possible that article 444 and its sole paragraph may still undergo changes. Second, because the cut-off line differentiating hypersufficient workers established by the Labor Reform, despite representing 2% of the national population, is relatively low and does not necessarily reflect the autonomy in negotiations that article 444 sought. Although there are still no precedents in this regard, since the Labor Reform has been in force for only a month, we see good arguments to defend this negotiation in highly specific situations and for positions of extreme relevance in the companies, called C-levels, provided that such negotiation is conditioned to the granting of other advantages for the worker, such as the possibility of future variable gains, the guarantee of employment itself, among others. It is noteworthy that prevailing labor case law has already authorized, in collective bargaining, conditional reduction in salary, even temporarily. In some situations, for different reasons, monthly remuneration becomes excessively high and outside the applicable benchmark. Not infrequently, in times of crisis and reduction in demand, wages previously paid need to be readjusted to reflect companies’ new reality. It is also not uncommon for employees themselves to see this new reality and prefer to reduce their salaries to current levels and remain in their jobs rather than being fired. That is, the proposition identified in the new rules brought about by the Labor Reform constitutes an instrument capable of giving balance and security to the needs of employers and employees who are hypersufficient. Therefore, while it is necessary to be very cautious on the issue of "wage irreducibility" even for the hypersufficient, this is a debate that deserves attention in times of crisis.

- Category: Labor and employment

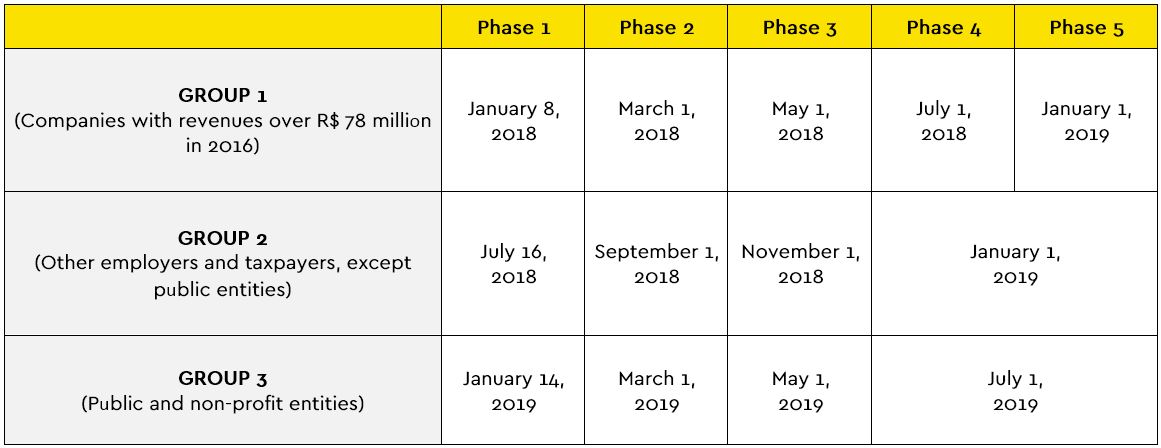

Yesterday, November 30, the Government published a new implementation schedule for eSocial, created by the Management Committee. The main purpose of the rules is to facilitate the implementation of the system by employers and to give greater certainty to the process, in response to various requests submitted by companies and class entities.

Under the new rules, the implementation of the system will be gradual, in five phases. It will begin in the first half of 2018 and should be complied by companies with revenues over R$ 78 million per year.

The entities comprising Groups 2 and 3 may choose to start using eSocial in January 2018, which should be done in an express and irreversible manner, according to regulations published in the future.

The five phases will be devoted to meeting the following obligations:

- Presentation of information related to companies/bodies, with records of data from the employer and tables containing payroll parameters;

- Presentation of information regarding employees/civil servants, their relationship with companies/bodies, and other non-periodic events (vacation, sick leave, termination);

- Submission of payroll and periodic events;

- Replacement of the GFIP form (Social Security Information Form); and

- Presentation of information related to Occupational Safety and Health.

With the implementation of eSocial, the Federal Government hopes to reduce red tape in presenting information regarding tax, fiscal, social security, and labor obligations, since they will all be gathered together in a single environment. This should reduce the number of obligations to be met by employers (eliminating obligations with the same purpose) in order to make Brazil more business-friendly.

The gathering together of information will also facilitate the supervision of companies by the competent authorities, which may cross-check the data available, without tax auditors’ having to appear at the companies or wait for them to present documents.

The expectation is that this will lead to a huge increase in the number of assessments. Therefore, companies should review their current internal policies, also considering the recent Labor Reform (Law No. 13,467/2017 and Presidential Decree No. 808/2017), in order to comply with current legislation, at risk of deemed admission to prohibited practices in providing the information required by eSocial.

It is recommended that the review of practices be started as soon as possible, taking as a lesson the implementation of eSocial for domestic employers, when there were clear complications.

- Category: Real estate

The word arra originates from the Latin arrha, whose meaning, as in the Egyptian aerb, Hebrew arravon, Greek arrabôn, and Persian rabab, which means a guarantee. A millennial institution in human relations, arras guaranteed, initially, the promise of a marriage, with the delivery, by the groom, to the person responsible for the bride or directly to the bride, an object or amount of money. If the marriage does not take place, quadruple of the amount or the thing should be restituted. Subsequently, this limit was reduced to double and replicated for other contractual relationships in order to create an obligation of compliance in the future. For a long time arras were used both to attest to the perfection of a contract and to ensure that "arranged marriages" were performed. However, with the falling out of use of contracts of arranged marriages, the institute of arras came to be applied exclusively within the scope of the obligational rights, but always carrying with itself the idea of a guarantee that the deal desired would be perfected. In Brazil, arras (or earnest money) were originally regulated by the 1916 Civil Code, in the general part on the contracts and with emphasis on its characteristic of preparation for the execution of a contract. In the 2002 Civil Code, the debts began to be treated under the law of obligations, more specifically in the section on default, containing a new characteristic: that of determining the amount of compensation in the cases of established contractual default as agreed upon by the parties. It is now possible to conclude that arras have the function of: (i) confirming the legal deal sought by the parties; (ii) pre-establishing losses and damages in the event the legal deal is not concluded; and (iii) initiating payment of the legal deal, whether in kind or by way of guarantee (in the event that a good is delivered other than that which was agreed upon for payment, such as a ring, that good must be returned after full payment). Much of legal scholarship classifies arras as confirmatory and penitential. Confirmatory arras make the contract compulsory, without the possibility of exercising buyer’s remorse. Penitential arras, in turn, allow for buyer’s remorse and serve as compensation for the injured party. As a rule, arras are confirmatory and, when the intention of the parties is to characterize them as penitential, this must be expressed in the contract. The main effect of confirmatory arras is to demonstrate that the parties are bound and rule out buyer’s remorse. If the contract is not fulfilled, the offender will be subject to penalties for non-compliance. Penitential arras also have a secondary function: to serve as compensation to the party harmed by the exercise of buyer’s remorse. In this case, they serve as the limit of indemnity expressed in the contract. In the buyer’s remorse on the part of the party who gave the arras, they are lost in favor of the other party. On the other hand, in the event that the party who received them has seller’s remorse, it will be necessary to return them in double corrected monetarily. In 1964, penitential arras were subject to restatement by the STF (Precedent 412), which established them as the limit of indemnity in contracts with a remorse provision. However, in a recent judgment (Special Appeal No. 1,669,002 - RJ 2016/0302323-0, published on October 2, 2017, of the authorship of Justice Nancy Andrighi), the STJ presented an innovative interpretation, admitting the possibility of full retention of penitential arras, even without the exercise of remorse. This was an action for rescission of a private instrument promising to assign rights to acquire real property, with a claim for damages and reinstatement of ownership, filed by the sellers. The sellers showed that the buyers, already in possession of the property, were not fulfilling their contractual obligations. The Court of Appeals of Rio de Janeiro (TJ/RJ) decided to terminate the agreement, ordered reinstatement of ownership in favor of the sellers, and authorized full retention of the arras. The arras had been determined in the contract as being penitential. Therefore, if buyer’s remorse were exercised, they would serve as a penalty to the party that withdrew from the deal. The

buyers argued that the full withholding of the arras was unjustifiable and abusive, since there was no buyer’s remorse, but simply delay in the fulfillment of contractual obligations. According to them, according to article 418 of the Civil Code, the full amount of the arras could only be fully retained in the event of exercise of buyer’s remorse by the buyers. The STJ understood that, although termination of the contract does not result from the exercise of buyer’s remorse, once the parties have negotiated the penitential arras, the effect of the indemnity must be applied immediately also in the event of breach of contract. In this sense, it upheld the lower court’s decision, having even stated that an express contractual provision to this effect is not required for the buyer to forfeit the arras. In addition, the STJ considered it reasonable to withhold more than 50% of the value of the deal, since the buyers had been enjoying and using the property for more than eight years, without any consideration to the sellers. The court opined that reduction of the arras defined by the parties in the contract would constitute, in this case, unlawful enrichment of the buyers. At a time when unlawful enrichment in analogous situations has been repeatedly rejected by the higher courts, this important precedent by the STJ deserves to be highlighted. This position in favor of enforcing contracts and maintaining contractual balance, which prizes the principle of a return to the status quo ante, is quite positive and is an advance towards greater legal certainty for parties to a contract.

- Category: Infrastructure and energy

The scope of application of Provisional Presidential Order No. 800/2017, popularly known as the Highways MP, became clearer with Ordinance No. 945/2017, published by the Ministry of Transport, Ports, and Civil Aviation on November 16. Published in September of this year, the MP establishes the rescheduling of investments under federal highways concession contracts, with a view to solving the problem of concentration of investments in the first years of the concession (click here to read more about the “Highways MP”). In its explanatory memorandum, the MP shows its purpose, which, in large part, is to obtain a better conjuncture for the continuity of federal highway concession contracts, which provide for a concentration of investments at the beginning of their performance. In particular, the explanatory memorandum cites the concessions of the 3rd stage of the Federal Highway Concession Program (Procrofe), which were tendered between 2012 and 2014, whose contracts provided for the obligation to fully duplicate the road sections in five years, which, for this reason, were heavily affected by subsequent economic instability, as concessionaires faced a heavy loss of demand and liquidity, as well as great difficulties in obtaining long-term loans under the conditions stipulated at the time of preparation of the Logistics Investment Program), which could, according to the Federal Government, affect the adequate provision of public road services. It is important to emphasize that the scope of the Highways MP was not clear. As can be seen from its explanatory memorandum, the rescheduling of investments established in the MP was applicable to road concessions that included the execution of investments at the beginning of the contract, such as the concessions of the 3rd stage of Procrofe. With the advent of Ordinance No. 945/2017, the rule is now clear to the effect that the contracts that are suitable for rescheduling of investments are those that concentrate more than half the value of the investments on the execution of construction to expand capacity and make improvements in ten first years of the concession. Accordingly, Ordinance No. 945/2017, upon stipulating the term of 10 years, also includes certain concessions of the 2nd stage of Procrofe, tendered between 2008 and 2009. In implementing regulations for the Highways MP, Ordinance No. 945/2017 brought in the terms and conditions according to which the interested parties must support their requests, the documentation necessary, and other requirements for the rescheduling of investments, as well as the time limit for a response by the National Agency of Land Transport (ANTT). Facing little resistance in the National Congress by the opposition, the Highways MP, in force, in theory, until February 2018, assures federal highways concessionaires the right to request the rescheduling of the investments, provided that the requirements and conditions provided by the Highways MP and Ordinance No. 945/2017 are observed. The Mixed Committee of the National Congress, however, has already submitted 34 amendments to the MP, which, on an emergency basis, should soon be voted on to consolidate the Draft Conversion Law. Most of these amendments aim to reduce the maximum period for the rescheduling of investments, set in the Highways MP at 14 years. In line with the objective of Ordinance No. 945/2017, the Federal Government plans to avoid rescheduling of investments in upcoming federal highway tenders. To do so, it will require high initial contributions from companies or consortia winning future bids, thereby avoiding a fall in the price of tolls, in order to mitigate imbalance of contracts due to any fall in demand. Therefore, the higher the discount, the greater the initial capitalization. Ordinance No. 945/2017 and the Highways MP are inserted in a package of measures of the Federal Government for the infrastructure sector, whose purpose is to give more comfort to the market, taking into account the expectation of resumption of private investments in projects with speed, legal certainty, and transparency, even in the face of the still serious political scenario and the convalescent economic situation. What is observed so far is a positive response from investors in the sector regarding the introduction of new mechanisms for concession contracts, such as re-bidding, early extensions, and friendly terminations, which, as with the case of rescheduling of investments, bring in flexibility for the infrastructure sector and private investors and facilitate the provision of new investments.

- Category: Litigation

The case law of the Superior Court of Justice (STJ) on the issue of the government’s right to withdraw from an eminent domain action during the course of the judicial proceeding has recently changed. The issue is of the utmost importance, since eminent domain represents a form of suppressive intervention by the State in private property, and its reversal has relevant practical and legal effects. In the course of an eminent domain action, if the government understands that the reasons that motivated it no longer exist, such as public utility or social interest, it may withdraw from the proceeding and return the good to the owner. However, the STJ has established in the past some limits on the exercise of this prerogative by the public entity. More specifically, the court determined that withdrawal from the eminent domain action can only be done before full payment of the indemnity (Special Appeal 38.966/SP and Interlocutory Appeal in Special Appeal 1,090,549/SP) and it presupposes the return of the condemned property in the same conditions as the government received it from the owner. A request for withdrawal is therefore not possible when the condemned property is substantially altered by reason of occupation by the government (Special Appeal 722.386/MT). Despite this understanding, there is still doubt in the case law with respect to who is responsible for proving that the condemned property is no longer in the conditions in which it was delivered to the condemnor, thus preventing withdrawal. This uncertainty was finally settled with Special Appeal 1,368.773/MS, which decision was published earlier this year. According to the STJ's understanding, when the owner wishes to prevent withdrawal, it is incumbent exclusively on him to prove a any impediment to the exercise of this right by the public entity. The STJ's reasons follow the precepts of the Code of Civil Procedure itself in relation to the burden of subjective proof - it is incumbent upon the plaintiff to prove the facts that give rise to his right and, on the defendant to demonstrate the existence of a fact impeding, modifying, or extinguishing the plaintiff’s right. Therefore, when the impossibility of restoring the property to the previous state constitutes a fact impeding the condemnor's right, in this case withdrawal from the eminent domain action, it is the defendant property owner’s burden to prove whether this fact actually exists. In addition, according to the STJ, in this scenario there is no viable argument in favor of reversing the burden of proof to the detriment of the public entity, since granting this measure would violate due process of law, enshrined in the Federal Constitution. Finally, to force the public power to keep an asset that it does not need, because there is no longer any necessity, public utility, or social interest, would violate the public interest and the constitutional rules that discipline the institute of eminent domain. In this context, defendants in eminent domain actions must act diligently to demonstrate, through documentary evidence, testimony, experts, and other forms of evidence admitted by law, that the condemned property is somehow substantially altered and unfit for the use for which it was originally intended, which would cause the condemnor to no longer have the ability to withdraw. If the existence of an impending fact is raised and proved by the owner, there will be no alternative left to the public entity other than the continuation and conclusion of the eminent domain action, with the payment of just compensation after the final judgment in the eminent domain action. On the other hand, if it is not proved that the property has undergone significant changes that would prevent its use as prior to the eminent domain case (or if it is proved that the damages suffered are of little relevance), the owner must simply receive the property back and seek redress for damages and losses caused to the property by the condemnor in a separate suit seeking compensation. The scenario in which the eminent domain action is abandoned will normally be more favorable to the owner, since he will receive the property supposedly fit for the use he made of it before, without the need to wait for payment by the State. Only specific damages, of a relatively small amount, shall be awarded for the disturbance of quiet enjoyment caused by the public entity during the period in which it limited possession of the property. However, if the property really exhibits significant changes after the withdrawal by the public entity, it may be disadvantageous for the owner to accept the return. For this reason, he must take all the necessary precautions to fully prove, on the record of the eminent domain action, that the asset is no longer fit for the intended use. However, in adopting this position, the owner will most likely have to wait a considerable period of time to receive fair compensation. Consequently, the owner must adhere to the STJ's new understanding in agreeing to the restitution of the property, in the event that the public entity withdraws from the eminent domain action, or, if it considers this procedure not to be feasible, present in court all evidence corroborating the existence of significant changes to the asset during the possession of by the condemnor, under penalty of having to forcibly receive the property back and be compelled to seeks damages and losses by means of subsequent suit for compensation.

- Category: Labor and employment

One of the most striking and controversial changes promoted by Law No. 13,467/1207 (Labor Reform), later complemented by Presidential Decree No. 808, was the end of the obligation to pay union contributions. Also called the union tax, this contribution was collected annually from employees and companies and sent to unions, federations, confederations, trade unions, and even the Ministry of Labor. Between applause and criticism, most of the news and commentary on this change referred only to the end of employees’ obligation to contribute. In fact, the new wording of article 582 of the Consolidated Labor Laws (CLT) is clear and states that employers shall only deduct the union contribution from employees who have previously and expressly authorized collection. Article 582. Employers are required to deduct the union contribution in March of each year from the payroll of their employees who have expressly authorized in advance collection for their respective unions. However, although it received little comment, the Labor Reform also made union contribution to employers’ unions optional for companies. The old wording of Article 578 of the CLT was imperative in determining that union contributions would be "paid, collected, and applied" in the manner established. However, the Labor Reform added at the end of article 578 the expression "provided that they are expressly authorized in advance": Article 578. Contributions owed to trade unions by participants in economic or professional categories or professions represented by said entities shall be paid, collected, and applied in the manner established in this Chapter, provided that they are expressly authorized in advance. The conclusion that the union contribution will also no longer be mandatory for companies is strengthened by the new wording given to article 587 of the CLT by the Labor Reform: Article 587. Employers who choose to collect union contributions must do so in January of each year, or for those that come to be established after that month, at the time they apply to the authorities for registration or a license for the exercise of their respective activity. The end of the obligation will come into force in 2018, unless some proposed amendment to Presidential Decree 808 or a new law on this subject is enacted. It is important to note that the Labor Reform did not mention other forms of contribution to unions. Thus, there is nothing to prevent collective rules from establishing other payments to be made by companies and employees, with questionable obligatoriness for those not associated with the unions.