Publications

- Category: Infrastructure and energy

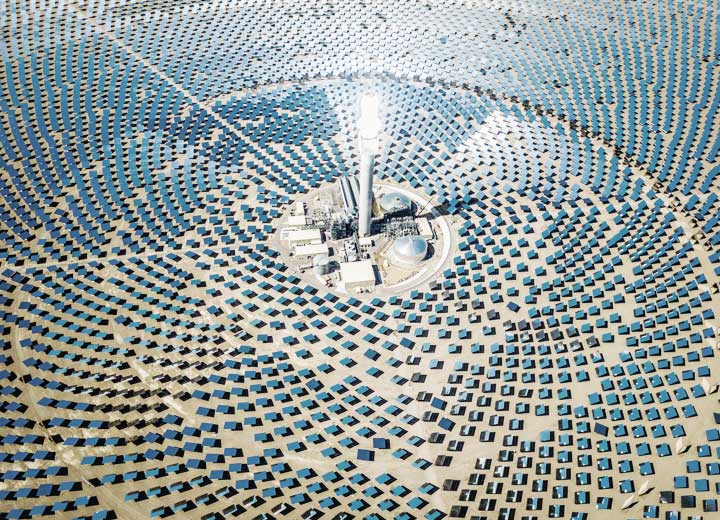

The Ministry of Mines and Energy (MME) submitted to the President of Brazil a proposed bill (PL) relating to the reform of the electric sector and covering a variety of significant changes to the sector that have long been awaited. The final text of the bill is the result of discussions held under Public Consultation No. 33/2017, undertaken by the MME with widespread participation by the entire sector. The proposed changes cover a number of issues, but here we will address only two issues: (i) the new policy for granting subsidies to renewable energy sources; and (ii) the change in the rule of occupation of rural areas by foreigners, an obstacle also observed in other sectors, but which in the electric sector is of greater importance due to regulatory requirements that developers prove their right to use the area to be used by the projects. Regarding the first topic, it is important to highlight that the subsidies to which the PL refers are discounts granted to certain projects and applicable to Tariffs for the Use of the Electric Transmission (Tust) and Distribution Systems (Tusd). Current legislation provides that, pursuant to Article 26, paragraph 1-A, of Law No. 9,427/96, projects based on solar, wind, biomass, and qualified cogeneration sources, whose power injected into the systems is greater than 30,000 kW and less than 300,000 kW, are entitled to a discount of at least 50% on these tariffs. According to the same provision, this percentage is established by Aneel, in Normative Resolution No. 77/2004, which establishes a 50% discount for projects based on renewable sources and whose characteristics fit within the specifics of the subsections of Article 2 of that Resolution. Subsequently, its fourth paragraph establishes a differentiated and specific percentage for projects based on solar sources that went into commercial operation before December 31, 2017. They are entitled to a discount of 80%, applicable in the first ten years of operation, and 50% in subsequent years. With the proposal, MME intends to institute a new regime for granting these subsidies (Article 6 of the PL’s proposal), according to which the discounts will continue to be granted after the reform, but under two new conditions: (i) a requirement for consideration to the beneficiaries consistent with the purpose of the subsidy; and (ii) subjection to access criteria that consider environmental issues and the social and economic conditions of the target public. This possible change, however, has raised concerns on the part of current grant recipients, as the new scheme may be more rigorous. In this sense, according to the PL's explanatory memorandum, in event of approval of the bill, grants granted before December 31, 2020, would maintain the right to discount in the current framework until the end of their deadlines. Any extensions, however, would occur under the new framework. This provision is in line with one of the basic elements of the vision for the future on which the reform is based: the protection of existing contracts, which is emphasized throughout the PL’s explanatory memorandum. This is due to the need to balance the necessary reform of the sector with the maintenance of legal certainty for sector participants, and also establish appropriate transitional rules for relations established during the transition period in order to reduce the risks of judicial disputes with respect to the issue. Thus, the reduction in subsidies sought by the PL does not mean extinction of the discounts currently granted, but rather a search for greater supervision and control over the subsidies, as the new framework maintains the possibility of a discount, but only conditions it on pre-established criteria, which allows for greater oversight by the public administration. In this manner, it can exercise its regulatory role without ceasing to incentivize renewable sources. With regard to the proposal to amend Law No. 5,709/71, which regulates the acquisition of rural properties by foreigners, the PL's text sought to overcome a situation that has lasted for almost a decade. The excitement arises from the interpretation conferred by Opinion No. LA-01/2010 of the Federal Attorney-General’s Office, which reinvigorated the restrictions provided for in Law No. 5,709/71 with respect to Brazilian companies controlled by foreign capital. Until then, they were excluded by an earlier opinion issued by the Federal Attorney-General's Office, issued in 1994, on the grounds that equating Brazilian companies with majority ownership by foreign capital to foreign companies, as done by Law No. 5,709/71, was not preserved by the Federal Constitution of 1988. Thus, since 2010, Brazilian companies controlled by foreign capital have restrictions on the acquisition and rental of rural properties, which, in short, limits the rural area to be occupied and requires prior authorization from the National Institute for Colonization and Agrarian Reform (Incra). In the electricity sector, such restrictions have culminated in almost insurmountable obstacles, since, in the vast majority of cases, generation projects are implemented in rural areas and, on the other hand, foreign investors are also large in number. In this context, and considering that proof of the right to use the area is a regulatory requirement for the implementation of such projects, many companies have started to use legal instruments not included in the restrictive interpretation by the Attorney-General’s Office, such as in the case of assignments of the right of use, granting of surface rights, or other arrangements of a similar nature, which make the process more complex, whether from a tax, contractual, or recording point of view. Thus, Article 2 of the PL's proposal provides for an amendment to Law No. 5,709/71 so as to allow the acquisition of rural properties by a Brazilian legal entity controlled by a foreign individual or legal entity. The permission is conditional on the use of the property exclusively to carry out the activities of generation, transmission, and distribution of electric energy. If approved, the PL will therefore allow Brazilian companies with foreign capital to freely acquire rural properties necessary for the implementation of projects in the electricity sector, thus making it considerably easier to develop such projects. Although positive, the change does not provide for the removal of the same restrictions with respect to rural leases or the issue of properties located in border strips, as the latter restriction arises from an express provision of the Federal Constitution. In summary, the proposal brings in changes aimed at modernization of the sector. The bill stems from a growing desire of the public power to modernize the Brazilian energy grid, which it seeks to achieve through changes that allow for a reduction in regulatory and legislative obstacles. The ultimate goal is to encourage the development of the Brazilian electricity sector and, in particular, to maintain the growth of renewable energy sources in the Brazil's energy grid.

- Category: M&A and private equity

Mergers and acquisitions (M&A) are the result of a very complex process, the conduct of which is dictated by the objectives and the interests of the parties. However, with the maturation of the Brazilian market, some practices end up being similar, such as is the case, for example, in the negotiation phases or in the format adopted to formalize the will of those involved. Among the documents used to formalize what will be the beginning of negotiations that will culminate in an M&A transaction, the parties customarily enter into a confidentiality agreement, memorandum of understanding, term-sheet, or letter of intent, among other documents. The objective is to establish the preliminary bases of the deal, predominantly the scope of the transaction, the terms and conditions that should guide future negotiations, and the initial terms of the legal relationship to be constructed.

The preliminary document is not a contract, and is, in principle, a non-binding instrument that lists the terms to be defined later between the parties.[1] However, its non-binding nature does not represent an absolute guarantee of exemption from liability of those involved, since, at this preliminary stage, parties run the risk of being compelled to compensate the counterparty (reparatory relief) or even complete the transaction (specific performance).

Therefore, in addition to accurately and completely documenting the initial premises with a non-binding nature, it is also recommended that one consider the conduct of the parties during the negotiations with respect to the preliminary documents, considering that their liability may stem both from the terms of a document as well as their behavior. In other words, it is especially relevant for the parties to act with trust, loyalty, and good faith in their relationship in order to avoid the possibility that one of them may be able to subsequently argue violation of the principles of objective good faith and raise the prohibition on contradictory behavior (venire contra factum proprium or “objection to one’s own acts”), or claim breach of trust or legitimate expectation created in the other party.[2] If such behaviors are found, it could lead to penalties pursuant to the terms of Law No. 10,406, of January 10, 2002, as amended (the Brazilian Civil Code).

There are, however, certain measures that can be undertaken to mitigate the risks of the parties’ liability in the event that the deal does not come to completion.

First of all, as mentioned above, special attention must be paid to the terms in which the preliminary document itself is drafted in order to avoid the risk of it constituting a preliminary contract or pre-contract that allows the other party to require the final contract to be signed, pursuant to article 463 of the Brazilian Civil Code.[3]

At this point, it is necessary to draw a distinction between the preliminary documents and the preliminary contracts provided for in the Brazilian Civil Code (articles 462 to 466). Preliminary contracts, as a rule, oblige the parties to enter into another contract, which will be the principal contract. Preliminary documents do not, in principle, involve commitments by or obligations for the interested parties. Their purpose is only to guide the preliminary negotiations stage and define the conveniences and interests of the parties.[4]

Secondly, it is also necessary to consider the conduct of the parties and the communications maintained between them during the entire negotiation phase. It is important to avoid unreasonable disruption of the negotiations and to maintain at all times a conduct characterized by cooperation and loyalty, aimed at achieving the economic and social objectives desired with the transaction. This reduces the risk of pre-contractual liability on grounds of breach of the principle of objective good faith.

This principle is intended to govern contractual relations and must be respected at all stages of formation of the contract, including during the preliminary or negotiation stages. Thus, the duty to respect objective good faith has given new contours to the freedom to negotiate and to the principle of the autonomy of the will (pacta sunt servanda), thus relativizing the legal effects of clauses such as the non-binding effect clause. In other words, the classic principle of freedom of contract, which allows parties to decide freely on whether or not to enter into contracts that are not prohibited by the legal system,[5] must be interpreted in the light of the modern principle of good faith, as guided by current contract law.[6]

However, despite the cautions that may be undertaken, determining whether binding effect shall be given to a preliminary document is a controverted issue in the legal system and depends on a review of the concrete circumstances of each case.

In the context of an M&A transaction, in which the parties signed a non-binding memorandum of understanding, the São Paulo Court of Appeals denied a claim for compensation by one of the parties for costs incurred in the due diligence process and loss of opportunity negotiated with other potential buyers, on the following grounds: (i) the parties negotiated on equal terms, as they were advised by specialized law firms and international consultancies; (ii) various communications between the parties showed that non-binding effect was an important condition for both parties; (iii) the principles of good faith and loyalty were respected, and breach of the legitimate expectation of the selling party through acts of the buyer that could give rise to confidence that the deal would be effectively carried out was not established; and (iv) there was no evidence of loss of a business opportunity (TJSP - Appeal No. 0005452-31.2013.8.26.0100, opinion drafted by appellate judge Carlos Alberto Garbi, 2nd Chamber Specialized in Business Law, adjudicated on December 14, 2016).

In turn, the Rio de Janeiro Court of Appeals has ruled that termination of a memorandum of understanding, without just cause, if proved, obliges the discontinuing party to reimburse the expenses incurred by the counterparty during the structuring phase of the transaction (TJRJ - Appeal No. 0009297-72.2013.8.19.0001, opinion drafted by appellate judge Juarez Fernandes Folhes, 14th Civil Chamber, adjudicated on December 7, 2016).

In light of the above, it is recommended that (i) the non-binding clause clearly and unequivocally express that the preliminary document is not binding; (ii) the parties reserve the right to terminate the negotiations unilaterally at any time; (iii) the parties take certain precautions in the exchange of communications, in order that in the future they will not be used as documentary evidence to establish the binding nature of the deal and breach of good faith due to violation of ancillary duties such as, for example, those of loyalty or cooperation between the parties; and (iv) particular attention be given to the terms and form in which the preliminary document is drafted.

1. GOMES, Orlando. Contratos [“Contracts”]. Rio de Janeiro: Forense, 2007. p. 68.

2. In relation to the duty of trust and honesty, Principle of Law and Order No. 363 of the Federal Judicial Council states that: "The principles of honesty and trust are matters of public order, and thus the injured party is only obliged to demonstrate the existence of the breach of such principles."

3. Article 463. Upon conclusion of the preliminary contract, in compliance with the provisions of the preceding article, and provided that there is no buyer’s repentance clause, either party shall have the right to demand the execution of the definitive agreement, thus providing a time limit for the other party to do so.

4. PEREIRA, Caio Mário da Silva. Instituições de direito Civil [“Institutions of civil law”], vol. III, 15th ed. Rio de Janeiro: Forense, 2011. p. 69.

5. ZANETTI, Cristiano de Sousa. Responsabilidade pela Ruptura das Negociações [“Liability for Breakdown off Negotiations”]. São Paulo: Ed. Juarez de Oliveira, 2005, p. 82.

6. NEVES, Karina Penna. Deveres de consideração nas fases externas do contrato: responsabilidade pré e pós-contratual [“Duties of consideration in the external stages of the contract: pre-and post-contractual liability”]. São Paulo: Almedina, 2015, p. 124.

- Category: Tax

Although it is part of the Base Erosion and Profit Shifting (BEPS) Project to counteract multinationals’ tax planning that uses the loopholes of the international system to reduce their overall tax burden, Brazil has not signed the Multilateral Instrument (MLI) to implement the changes suggested in bilateral treaties to avoid the double taxation (double tax treaties) in the form of a single negotiation. In the case of Brazil, the policy adopted thus far is the individualized amendment of each of the existing double tax treaties through new bilateral ones, which is also one of the possibilities provided by the BEPS Project, conducted by the Organization for Economic Cooperation and Development (OECD) and the Group of 20 (G-20). To commence this process, Brazil signed, on July 24, 2017, the protocol of amendment to the bilateral agreement entered into with Argentina on May 17, 1980. In addition to other measures for alignment with the OECD and United Nations (UN) models and the treaty enforcement policies of one or other country, the text of the protocol can be seen as the beacons of the Brazilian position within the scope of the BEPS Project, which are:

- Inclusion of the intention to avoid double non-taxation, as in situations of tax evasion and avoidance, and to restrain situations of abuse of the treaty;

- Mention of the objective of cooperation in tax matters, one of the pillars of the BEPS Project;

- Introduction of the concept of "person closely related to a company”, a relationship of control of a person over a company, of a company over a company, or of companies under common control;

- Modification of the list of scenarios that do not qualify as permanent establishment, including the situation of "maintaining a fixed place of business solely for the purpose of carrying out, for the enterprise, any other activity" of an auxiliary and preparatory nature;

- Introduction of the concept of a dependent agent, one who serves in one of the signatory States on behalf of a company of another signatory State and enters into contracts in the name of the company, with respect to goods of that company or for the provision of services by that company;

- With respect to the distribution of dividends, to qualify for the reduced income tax rate at 10%, the following requirements must be fulfilled: hold at least 25% of the company's capital for at least 365 days, including the dividend payment day;

- With regard to methods to avoid double taxation, an amendment was put in place to adopt the credit system to replace the exemption in Brazil for dividends from companies in the same group in Argentina and exemption in Argentina for all types of taxable income received in Brazil;

- Access to the mutual agreement procedure in any of the signatory States;

- Access to the mutual agreement procedure to discuss situations of abuse of the double taxation agreement;

- Implementation of the resolution achieved through a mutual agreement procedure regardless of the deadlines provided in domestic legislation;

- Adoption of the Principal Purpose Test (PPT), on the basis of which the benefits of the double tax treaty will not be applicable whenever it is reasonably concluded that obtaining such benefits was one of the main objectives of the transaction under the agreement;

- Limitation of benefits of the double taxation agreement to situations where a company resident in a signatory State which has received income from the other signatory State has more than 50% of its actual holding held by a beneficial owner non-resident of the first signatory State (an exception for the event that that company exercises substantive economic activity in the country in which it is resident); and

- Introduction of an anti-abuse clause for permanent establishments located in a third State.

In light of these elements of the protocol, it can be concluded that the most significant changes are those that seek to counteract abuse of treaties and non-taxation situations, mainly by including the PPT, which brings in a subjective analysis to the scenarios for application of the double taxation agreement, in line with the interpretation currently adopted by the Brazilian Federal Revenue Service (RFB), which considers the “business purpose" or the "real intention of the parties" in transactions. Regarding the changes in the permanent establishment qualification, there will apparently be no significant changes in Brazilian tax policy, as this criterion of withholding tax is not used by the domestic rule. With regard to dispute settlement methods, Brazil maintained its position of not adopting mandatory and binding arbitration. The inclusions made in the protocol regarding the mutual agreement procedure represent only alignment with the minimum standards of action 14 of the BEPS Project. In this context, although Brazil has committed itself to guaranteeing access to the mutual agreement procedure in cases involving the application of transfer pricing legislation, the adoption of a system of fixed margins under Brazilian law may in practice make resolution of a conflict unfeasible. The Brazilian government did not adopt all the solutions proposed by MLI in negotiating the double tax treaty with Argentina. Recommendations have been elected that essentially maintain Brazil's tax policy. Along these lines, an article was included in the protocol to equate technical service and administrative assistance to royalties, calling for the application of withholding tax, under the terms of Interpretative Declaratory Act of the General Coordination of Taxation (Cosit) No. 5/2014. The protocol is currently under review y the Chamber of Deputies and, after its approval, will be sent to the Senate and for enactment by the President of the Republic for it to become part of the Brazilian legal system.

Cooperation between Bacen and Cade for joint action in cases involving the National Financial System

- Category: Competition

The memorandum deals with the jurisdiction of each agency and establishes rules and procedures that must be observed in the interaction between them.

The provisions on the need to file mergers with both Bacen and Cade are highlighted, and each agency will conduct its own review through a specific process and according to a joint regulation on the terms and conditions to be enacted by them. Transactions may be consummated only after conclusion of the review of both agencies. However, in cases where there is a risk to the soundness and stability of the National Financial System (BNF), Bacen will inform Cade and may unilaterally clear the transaction, although in relation to only one of the markets involved,[1] and Cade is charged with adopting the basis for the Bacen decision in its review.

Regarding antitrust violations, Bacen and Cade undertake to report to each other any activities that may constitute anticompetitive conduct. In addition, Cade should consult Bacen before imposing penalties for anticompetitive conduct on markets and entities regulated by Bacen.

The Memorandum of Understanding also provides for greater sharing of information and data among the agencies, releasing guidelines, training, seminars, and joint studies.

Considering that the document establishes the possibility of revising regulations to make the actions of the agencies compatible, it is important to monitor the enactment of the next standards related to subjects that may impact not only on the application of the Antitrust Law by Cade, but also the implementation of the recent Law No. 13,506/2017, which brought in new rules for administrative sanctioning process in the scope of action of Bacen and the Brazilian Securities and Exchange Commission (CVM).

However, the signing of the memorandum of understanding represents an important step towards ensuring greater legal certainty and predictability in the implementation of competition protection in the banking market.

1. The national financial system is composed of four markets, each regulated by specific norms and agencies: banking market (Law No. 4,595/1964), capital market (Law No. 4,728/1965 and No. 6,385/1976), private insurance market and capitalization (Decree-Law No. 70/1966), and supplementary pension market (Complementary Law No. 109/2001).

- Category: M&A and private equity

The Federal Government's PPIs - Overview

In March 2017, the federal government announced the launch of a new round of concessions from the Investment Partnership Program (PPI). The estimate is that about R$ 45 billion in investments will be raised, and the main targets are the energy, transportation, and sanitation sectors.[1] In all, 35 power transmission lots (distributed in 17 states), two highway concessions, 11 port terminals, five railways, and 14 sanitation projects were announced.

Subsequently, in July 2017, the government announced a program in the amount of R$ 11.7 billion in credit facilities for financing and supporting infrastructure works and concessions in several states and municipalities. As in the previous program, investments in works in the sanitation, urban mobility, lighting, and solid waste management sectors will be considered priorities. Again, in August 2017, the government announced its intention to sell 14 airports (including Congonhas-São Paulo), 11 electric power companies (including the Eletrobrás system), 15 ports, two highways, and the Casa da Moeda, among other important assets.

The government's main objective in launching these programs is to overcome the economic crisis, which has lasted from 2014 and resulted in a reduction in Brazilian GDP of 3.8% in 2015 and 3.6% in 2016.[2] The expectation is to finance the works through funds made available by Caixa Econômica Federal and Banco do Brasil, amounts deposited by the FGTS, and, especially, through partnerships with the private sector. For this reason, the vehicles used by private investors to provide funds in these projects stand out, with the main one being the Infrastructure Investment Fund (FIP-IE).

FIP-IE was created in 2007 during the Lula government, at a time of significant incentives for the development of Brazil's infrastructure sector. Ten years later, in another movement to develop the sector, the FIP modality focused on infrastructure is gaining in importance, with new regulations by CVM and tax advantages.

FIP-IE

FIPs, vehicles used by investors to generate profits through the purchase of securities of corporations and limited liability companies, are generally regulated by CVM Instruction 578, of August 30, 2016 (ICVM 578). It is an investment in variable income organized in the form of a closed-end condominium, whose units can only be redeemed at the end of their duration or if their liquidation is resolved in a meeting of unitholders.[3]

One of the main requirements of ICVM 578 for an FIP to acquire a stake in a particular company is for the fund to effectively participate in the decision-making process of the invested company, with an influence on the definition of its strategic policy and its management, including via appointment of members of the board of directors.

The criteria for participation in the decision-making process of the invested company are not clearly delimited by law. It may occur in a number of ways, such as: (i) by holding shares that are part of the respective control block; (ii) by the execution of a shareholders' agreement; or (iii) by adopting a procedure that assures the fund effective influence in the definition of its strategic policy and management. There is, therefore, no definite rule on how the FIP should influence the decision-making process of a company. Confirmation of whether this requirement has been met is done on a case-by-case basis.

In addition to the general rules mentioned above, ICVM 578 reflected and regulated in detail the creation of the various specific categories of investment funds, such as FIP - Seed Capital, FIP - Emerging Companies, FIP - Multistrategy, and FIP-IE. Specifically in relation to FIP-IE, ICVM 578 did not innovate and replicated the articles set forth in the former CVM Instruction No. 460/2007 (repealed by ICVM 578) and reflected the provisions of Law No. 11,478/2007 (Law 11,478).

The FIP-IE (together with the FIP - Intensive Economic Production in Research) was instituted by Law 11,478 and has as its object, under the terms of the law, investment in Brazilian territory in new infrastructure projects. For the purposes envisaged therein, the law considers "new infrastructure projects” to be those implemented by companies specifically created for this purpose in the areas of (i) energy; (ii) transportation; (iii) water and sanitation; (iv) irrigation, and (v) other areas considered priorities by the Federal Executive Branch. Investments may also be made in the expansion of existing projects, implemented or in the process of being implemented, provided that the investments and the results of the expansion are segregated through the organization of a special purpose company.

The close relationship between this investment vehicle and the Investment Partnership Program created by the federal government is therefore evident.

As required by Law No. 11,478, the special purpose companies provided for therein must necessarily be organized as corporations, either publicly or privately-held. In addition, the law requires that at least 90% of the equity of the FIP-IE be invested in shares, warrants, debentures, whether convertible or non-convertible into shares, or other securities issued by special purpose companies that invest in the sectors mentioned above. Thus, a maximum of 10% of the portfolio can be allocated to other investment modalities, always observing the other limits set forth in ICVM 578.

FIP-IEs must have a minimum of five unitholders, each of which may not hold more than 40% of the units issued by the FIP-IE or earn an income of more than 40% of the fund's total income.

Similar to ICVM 578, Law No. 11,478 requires that the FIP-IE participate in the decision-making process of invested companies with effective influence in the definition of its strategic policies and management, notably through the appointment of members to the board of directors, the holding of shares that are part of the respective control block, the execution of a shareholders' agreement, the execution of an agreement of a different nature, or the adoption of a procedure that assures the fund effective influence in the definition of its strategic policy and management.

Pursuant to the same law, income earned from the redemption of FIP-IE units, including when arising from the liquidation of the fund, is subject to the application of withholding income tax at a 15% rate over the positive difference between the value of redemption and cost of acquisition of the units. In the case of the sale of FIP-IE units, the gains will be taxed: (i) at a zero (0%) rate, when earned by individuals in transactions carried out on the stock exchange or off the stock exchange; (ii) as a net gain, at a 15% rate, when earned by a legal entity in transactions carried out on or off the stock exchange; and (iii) at a zero (0%) rate, when paid to a beneficiary resident or domiciled abroad, whether an individual or group, that carries out financial transactions in Brazil in accordance with the rules and conditions established by the National Monetary Council, except in the case of a beneficiary resident or domiciled in a country with favored taxation, pursuant to article 24 of Law No. 9,430, of December 27, 1996. In the case of redemption or amortization of units by an individual, the income is exempt from withholding tax and the annual tax adjustment return for individuals.

As can be seen, through tax advantages, the federal government is aiming to stimulate investments in infrastructure projects by individuals (retail investors) and foreign investors (with the entry of capital into Brazil).

As of December 2017, only 21 FIP-IEs were registered with the CVM. The funds that publicly offered their units, however, constitute less than half of that number. Despite the low representativeness of the IFP-IEs found until then, an increase is expected in the activity of this type of investment vehicle in 2018, considering the relevant infrastructure assets recently placed into the federal government's privatization program. FIPs-IEs and infrastructure-sponsored debentures are therefore interesting alternatives for raising private funds for the implementation of government programs.

2. According to information from the World Bank, available at: http://databank.worldbank.org/data/reports.aspx?source=2&series=NY.GDP.MKTP.KD.ZG&country=BRA#. Accessed on: December 12, 2017.

- Category: M&A and private equity

Individuals and legal entities resident, domiciled or with headquarters in Brazil, as provided for in tax law, must report to the Central Bank of Brazil, on an annual basis, the assets and amounts held by them outside the country. The reporting is mandatory to those holding assets abroad (assets and rights, including corporate interests in companies, fixed-income securities, shares, real properties, deposits, loans, investments, among others) amounting to or exceeding the equivalent to US$100,000 (one hundred thousand US Dollars), on December 31, 2017.

Furthermore, the individuals and legal entities mentioned above must also deliver to the Central Bank of Brazil an additional quarterly report relating to assets held abroad on March 31, June 30 and September 30 of each year, in case the total amount of such assets amounts to or exceeds the equivalent to US$100,000,000 (one hundred million US Dollars).

The report referring to December 31, 2017 must be delivered by means of the Brazilian Capital Abroad (CBE) reporting form available in the internet website of the Central Bank of Brazil at: www.bcb.gov.br, from February 15th, 2018 through 6PM of April 5th, 2018.

The manual containing detailed information about the content and requirements of the reporting is also available in the website of the Central Bank of Brazil.

The late delivery, lack of reporting, or the submission of false, inaccurate or incomplete information subjects the violator to the imposition of a fine by the Central Bank of Brazil of up to R$250,000 (two hundred and fifty thousand Brazilian Reais).

(CMN Resolution 3,854, of May 27, 2010, BCB Circular 3,624, of February 6, 2013, BCB Circular 3,830, of March 29, 2017 and BCB Circular 3,857, of November 14, 2017).