Publications

- Category: Litigation

In the midst of the serious coronavirus pandemic that is worsening the reality of the population of the state of Rio de Janeiro, Governor Wilson Witzel issued Decree No. 47,057/20 on May 5 to regulate the charging of a new levy to be borne by companies in Rio de Janeiro.

The decree now requires payment into the state coffers of the equivalent of 10% of the tax benefits granted by the state to ICMS taxpayers (Tax on Circulation of Goods and Services).

The discrepancy of this charge which, among other ills, seeks to revoke tax benefits granted for a fixed term and under onerous conditions, will certainly be the subject of intense debate in the case law. However, what is most surprising in the measure is the indifference with which the state government treats the serious economic crisis caused by the pandemic.

The OECD (Organization for Economic Cooperation and Development) recommendations to avoid increased levies during the pandemic, mainly through the institution of new taxes, do not seem to find a voice in the Rio de Janeiro government.

As Insper professor Ana Monguilod rightly points out, "the message from the OECD is that states need to adopt measures to give breath, lifelines for businesses to survive and maintain jobs.”

The important measures adopted by the State of Rio de Janeiro to contain and confront the pandemic are not denied. However, it is not untimely to remember the constraining financial situation of the Rio de Janeiro business community which, for the time being, does not have any sign of when it can return to its full operational activities.

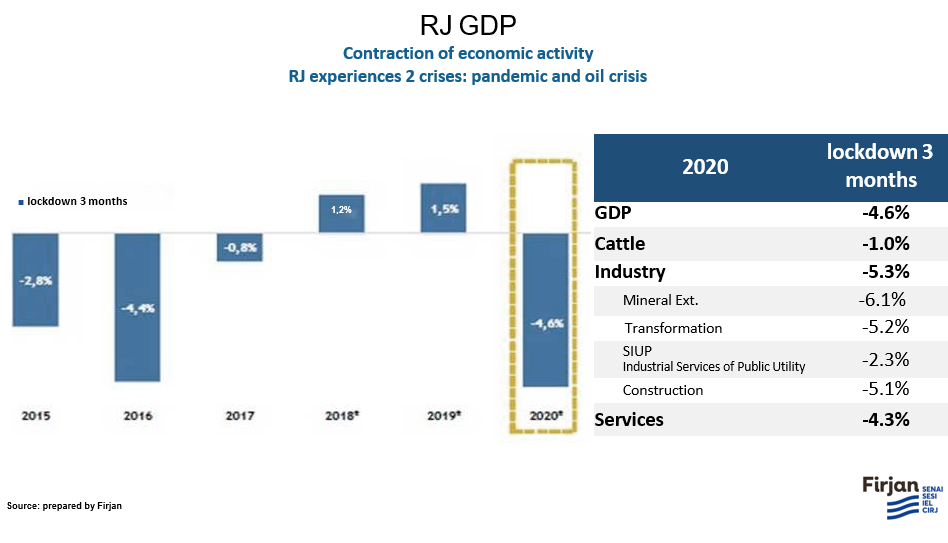

Data collected by Firjan already estimate an economic deficit in 2020 equivalent to 4.6% of the GDP of the state of Rio de Janeiro:

Faced with this delicate context, it would be good if the Rio authorities had the sensitivity to rethink as soon as possible the levying of this new tax on the already shaken and recovering business community in the state.

- Category: Labor and employment

Amidst the scenario initiated by the coronavirus (covid-19) and the focus given by the Federal Supreme Court (STF) on the lawsuits directed to the issue, the Court recently decided en banc, in a virtual session, that the appeal deposit is unnecessary for the admission of extraordinary appeals.

Established in 1968, an appeal deposit is required from the defendant, usually employers, in the act of filing their appeals. The amount is limited to the amount of the judgment and the ceilings set annually by the Superior Labor Court (TST), whichever is lower. Although it is a requirement for admissibility of the appeals, the deposit does not represent a judicial fee, but rather funds intended to guarantee the judgment, that is, it will be allocated to payment of the labor debt at the end of the trial and, if the suit is dismissed, returned to the defendant.

Regarding the case reviewed by the STF, a telephone operator filed a labor complaint against a telecommunications company, claiming various rights. The claim reached the TST, which ended up denying review to the extraordinary appeal filed by the defendant with the STF, in view of the absence of proof of payment of the appeal deposit for that purpose. In the face of this denial, the defendant filed an interlocutory appeal, forcing the Supreme Court to review the appeal.

In reviewing the issue, the Justices of the STF approved the following theory of general repercussion, binding the other instances and courts: "It appears incompatible with the Federal Constitution to require a prior deposit as a condition for admissibility of the extraordinary appeal, in which the provision contained in paragraph 1 of article 899 of the Consolidated Labor Laws has not been accepted, with the provisions contained in the head paragraph of article 40 of Law No. 8,177/1991 being unconstitutional and, by extension, subsection II of Normative Instruction No. 3/1993 of the Superior Labor Court.

In his opinion, still pending release, the reporting judge, Justice Marco Aurélio de Melo, stated that the requirement is beyond reasonable, since the law cannot condition access to the Judiciary on a prior deposit. In his words: "To appeal to the Supreme Court, one cannot contemplate payment of a certain amount", emphasizing that access to justice and a broad defense are constitutional guarantees.

The Justice also highlighted the STF case law which, in similar cases, also decided there is incompatibility between the requirement of a prior deposit and the aforementioned guidelines of the Federal Constitution, reinforcing the peculiarity and relevance of the extraordinary appeal for the preservation of constitutional guarantees.

The discussions on appeal deposits in the Labor Courts, their consequences, and, especially, their enforceability in accordance with the provisions of the Constitution, are not new, considering precisely the grounds invoked by the STF. However, the recent decision has rekindled them, all the more so in terms of their scope and their impact on other labor appeals.

In this sense, although the decision expressly refers to extraordinary appeals, it may be seen that the theory of general repercussion gives rise, at first and in a literal interpretation, to expansion of its effects, to be confirmed when the appellate decision and its terms is made available, or, at least, a strong basis for discussing the requirement of an appeal deposit in other appeals in labor suits.

The issue is extremely relevant if we consider the compromise to companies' cash flow - currently appeal deposits have as a limit the amounts of R$ 9,828.51 and R$ 19,657.02, depending on the appeal, especially in the cases of non-profit entities, domestic employers, individual micro-entrepreneurs, micro-companies, and small companies, even though, for such people, the Labor Reform (Law No. 13,467/17) has reduced those amounts in half.

According to the balance sheet prepared by Caixa Econômica Federal, the entity competent for the custody of these funds, appeal and judicial deposits totaled approximately R$ 90 billion in the first quarter of 2020. Without forgetting the judgments that these deposits are intended to secure, the funds are undoubtedly needed by employers, especially considering the economic crisis predicted as a result of the new coronavirus pandemic.

To those who oppose the end of the appeal deposit, it is worth remembering that procedural law provides other tools capable of guaranteeing future enforcement of the judgment. Therefore, it is not justifiable, nor reasonable, to bind and limit access to Justice based on advance of the fulfillment, in part or in full, of the penalty, which, by the way, upon the presentation of the appeal, will still be under discussion.

In any event, the issue is far from settled, mainly due to the fact that the STF issued its specific decision on the enforceability of the appeal deposit for the filing of extraordinary appeals. For this reason, the non-collection of appeal deposits should be weighed against due and extreme caution.

- Category: Banking, insurance and finance

Due to the covid-19 pandemic and its consequences for the operation of certain services on a global scale, the Central Bank of Brazil (BC) changed the schedule for submission of the Brazilian Assets Abroad Survey (CBE) by means of Circular No. 3,995/20, , provided for in another circular, No. 3,624/13.

The survey is provided for in Resolution 3,854/10, which provides that individuals or legal entities resident, domiciled, or headquartered in Brazil are required to provide to the BC, by electronic means, a declaration of assets and securities that they own outside Brazilian territory. Individuals or legal entities must provide information on capital arising from financing, portfolio investments, leasing, direct investments, investments in derivative financial instruments, and other modalities provided for in the rule.

Also in accordance with Resolution No. 3,854/10, declarants who have assets and/or securities equal to or greater than USD 100 thousand (or a corresponding amount in other currencies), on the base date of December 31 of each year, must submit the survey annually. Those with assets and/or securities abroad equal to or in excess of USD 100 million must submit surveys on the base dates of March 31, June 30, and September 30 of each year.

The periods for the submission of CBE surveys are set forth by BC Circular No. 3,624/13 for each of the base dates.

The deadline for annual CBE survey with a base date of December 31, 2019, has been extended to June 1, 2020, while the period for quarterly CBE surveys with a base date of March 31, 2020, has been changed to between June 15 and July 15, 2020.

Failure to submit the surveys described herein or submission thereof in disagreement with the applicable BC regulations may result in fines of between BRL 2,500 and BRL 250,000. The amounts may increase by 50% if the CBE surveys are not reported, amended, or supplemented when requested by the BC, in accordance with Circular No. 3,857/17.

- Category: Competition

Since the declaration of the state of public calamity, the Administrative Council for Economic Defense (Cade) has indicated that there will be no relaxation of the application of the Antitrust Law (Law No. 12,529/11) because of the covid-19 pandemic. Bill No. 1,179/20, which establishes emergency and transitory changes to regulate private law legal relations due to the Covid-19 pandemic and, in its final version, contemplated changes suggested by Cade itself in the relevant articles, should not promote any significant change in the agency's actions or vacate its jurisdiction.

The bill clearly states that the amendments proposed to the Competition Law apply expressly to acts performed and effective from March 20 to October 30 of this year or for the duration of the state of public calamity, recognized by Legislative Decree No. 6, of March 20, 2020.

If the bill is signed by the President of Brazil, the effectiveness of sections XV and XVII of paragraph 3 of article 36 of the Antitrust Law will be suspended, which means that Cade may not sanction companies for the sale of goods or rendering of services unjustifiably below cost price (predatory pricing), or for partial or total cessation of activities without just cause during the period delimited by the bill. Besides being unlikely in practice, conduct of this nature has not been the subject of punishment by Cade thus far. The bill also provides that Cade should consider the extraordinary circumstances arising from the pandemic when analyzing other potential anticompetitive conduct under the Competition Law.

With respect to mergers, the PL provides for suspension of the effectiveness of subsection IV of article 90 of the Antitrust Law, which imposes the need for reporting transactions that constitute an associative agreement, consortium, or joint venture, provided that the parties meet the turnover thresholds. However, the provision does not rule out the possibility of subsequent review by Cade of acts of concentration or finding of antitrust violations due to agreements that are not necessary to combat or mitigate the consequences of the pandemic.

Cade has expressed the view that business cooperation mechanisms related to the pandemic, regardless of the nature of their contractual arrangement, should be brought to the agency's attention in advance.

In this context, companies should remain alert to the competitive risks of their business practices, as the emergency and transitory changes promoted by the bill in the application of the Antitrust Law do not represent any type of antitrust immunity due to the covid-19 pandemic.

- Category: Real estate

In Rio de Janeiro the deadline for payment of the balance of the Urban Property Tax (IPTU) and the Home Garbage Collection Tax (TCL) for the year 2020 ends on June 5, with no increase for arrears and with a 20% discount. The incentive was granted by Municipal Law No. 6,740/20, signed by the mayor on May 11 as part of the measures to alleviate the impact of the covid-19 pandemic.

Bills due or open until the date of publication of the law may be paid in a single installment. For bills due or falling due up to the month of July of 2020, the payment may be made, without additions for arrears, within up to five monthly installments starting in August, provided that the amount of the installment is greater than R$ 50.00.

Law No. 6,740/20 provides that the benefits have no retroactive effect and that no amount relating to the IPTU or TCL for the fiscal year 2020 paid previously will be refunded, even for those who have already made full payment of the IPTU for the fiscal year 2020 with the discount of 7% at the beginning of the year.

To qualify for the benefit, interested parties should request the discount from the Municipal Treasury Department (SMF) using the application available at the Carioca Digital website (https://carioca.rio/) by June 4 (for full payment) and by August 30 (in the event of installment payment). Taxpayers who seek to make installment payments can also submit the request by e-mail to

Law 6,740/20 also brings about benefits for taxpayers in the hotel sector, including inns and hostels. In their case, IPTU tax debts may be discharged with a discount, whether or not they are registered as outstanding debt, when their triggering event is prior to 2020 and they do not meet the conditions for the 40% reduction set forth in article 3 of Municipal Law No. 3,895/05, which grants tax benefits to hotels. The discounts are up to 40% on the amount of the tax due and up to 80% on the default charges, by means of a single payment, in cash, by the last business day of August of 2020.

The forms for payment of debts not registered at outstanding debt will be available on the SMF website until August 21. To look up, pay in cash, or obtain an installment plan for debts registered as outstanding debt, hotel taxpayers must access Carioca Digital (https://carioca.rio/).

In addition to benefiting taxpayers with a significant discount to settle their tax debts, the measure is also an attempt by the city government to minimize the effects of the significant drop in tax collection observed during the pandemic.

- Category: Labor and employment

This guide summarizes procedures that your company should follow to resume activities safely.

In it, you will find information about:

- How to identify activities that can be resumed

- Prior preparation of the working environment

- Measures to be maintained during the pandemic

Click here to see complete guide.