Publications

- Category: Corporate

Legal entities and investment funds incorporated in Brazil must submit a report to the Central Bank of Brazil detailing investments in their quotas and/or shares held by foreign investors, or the outstanding short-term trade debts owed to non-residents, on December 31 of the previous fiscal year, in the following situations:

(a) legal entities must submit this report when, on December 31, 2019, they had a net worth equivalent to or in excess of one hundred million US dollars (USD 100,000,000.00), and, simultaneously, any direct ownership held by non-resident investors in their capital stock, regardless of the amount;

(b) legal entities must submit a report with respect to their current liabilities with non-resident lenders by means of debt instruments when, on December 31, 2019, they had an outstanding balance in short-term trade debts (due within 360 days) equivalent to or in excess of ten million US dollars (USD 10,000,000.00), regardless of any foreign equity ownership in their capital stock; and

(c) investment funds must submit a report when, on December 31, 2019, they had a net worth equivalent to or in excess of one hundred million US dollars (USD 100,000,000.00) and, simultaneously, quotas directly held by non-resident investors, regardless of the amount.

The reporting obligation mentioned above does not apply to the following persons and administrative bodies:

(a) individuals;

(b) direct administrative bodies of federal, state, Federal District, and municipal governments;

(c) legal entities who are debtors in the transfer of foreign loans granted by institutions headquartered in Brazil; and

(d) nonprofit entities maintained by the contributions of non-residents.

The report must be electronically submitted to the Central Bank through the website www.bcb.gov.br between July 1, 2020 and 6 PM on August 15, 2020.

The manual containing detailed information on the content and requirements of the report is available on the same website.

Those responsible for this report must store the supporting documentation for five (5) years, counted as of the base date of the report, available for submission to the Central Bank upon request.

Failure to submit the report or submitting a report that does not comply with the applicable regulations, subjects the violator to a fine of up to two hundred and fifty thousand Brazilian Reais (R$250,000.00), pursuant to article 60 of BCB Circular No. 3,857/2017.

The Census of Foreign Capital in Brazil aims to compile statistics of the external sector, especially the International Investment Position, in order to subsidize the development of the economic policy and support the activities of the economic researchers and international agencies.

(BCB Circular No. 3,795/2016, Law No. 13,506/2017; and BCB Circular No. 3,857/2017).

- Category: Labor and employment

With the beginning of the containment of the impacts of the coronavirus and the disclosure of plans to reopen the states in recent weeks, the protocols for resumption of in-person activities have been the focus of discussions and consideration at companies.

In São Paulo, for example, State Decree No. 64,994/20, which instituted the São Paulo Plan, regulates the economic reopening based on a system of classification of the regions of the state according to their health status. In the city of São Paulo, currently in phase 3 of the plan, the reopening of bars and restaurants was authorized on July 6, 2020. With this measure, discussions on the return to in-person work at companies have gained momentum, and actual return should occur in the near future.

As this matter is subject to concurrent jurisdiction, companies must observe not only the protocols implemented at the federal level, but also those created at the state and municipal levels, which establish health guidelines, social isolation, and even order of preference in returning to in-person activities, among others.

It is essential, therefore, that companies carefully analyze not only federal decrees, but also state and municipal decrees, ordinances, and other guidelines issued by the competent authorities, such as the Special Bureau of Welfare and Labor and the Ministry of Health, which establish protocols and measures that must be observed according to their location, particularities, and economic activity.

An important issue for the return to in-person activities, considering the restrictions imposed by the authorities, is defining which groups of employees will return to activities at the first moment and what the order of return will be.

Joint Ordinance No. 20, of June 18, 2020, of the Ministry of Health and the Special Bureau of Welfare and Labor, for example, establishes that (i) workers who are 60 years old or older or who present clinical conditions of risk for the development of covid-19 complications[1] must receive special attention, prioritizing having them stay at their residence via telework or remote work or, further, in an activity or place that reduces contact with other workers and the public, when possible; and (ii) for the workers in the risk group, when unable to stay at their residence or work remotely, work in a work space that is ventilated and sanitized at the end of each work shift must be prioritized.

Joint Ordinance No. 20/2020 encourages companies, therefore, to keep employees in the risk group in remote work for the moment. Based on this rule, we believe this group should be the last to return to in-person activities.

Also, although there is no specific provision in Ordinance No. 20/2020, some health protocols establish that, in addition to employees in the risk group, those who have dependents and, in order to carry out their duties, use the services of day care centers, schools, and the like that have not yet resumed their regular activities should not return to in-person work.

This is the case, for example, of Ordinance No. 605/20 of the São Paulo City Government, which authorizes the attendance to the public at vehicle dealers and resellers and offices rendering services. It provides for the sanitary protocol of these sectors and establishes that companies must allow telework for employees who do not have someone to take care of their minor dependents during the period when day-care centers, schools, or homes are closed. If teleworking is not possible, the employer must agree with the employee on an alternative way of maintaining the job, and may use the resources provided for in current laws and regulations. In São Paulo, companies should take into account that the return to classes in the state education system is expected in the coming months.

Once these major groups and other groups have been mapped based on the restrictions applicable in each location, many companies have chosen to conduct surveys among their employees to identify the level of comfort regarding return to in-person work and interest in returning to the office.

From these studies, they are able to identify how many employees should not return to in-person work at this time, how many would like to return, and how many are comfortable doing so. This allows companies to calculate whether it is necessary to establish shifts, relays, or rotations of employees for in-person work, taking into account any applicable occupation ceiling and physical space restrictions arising from the minimum social distancing rules.

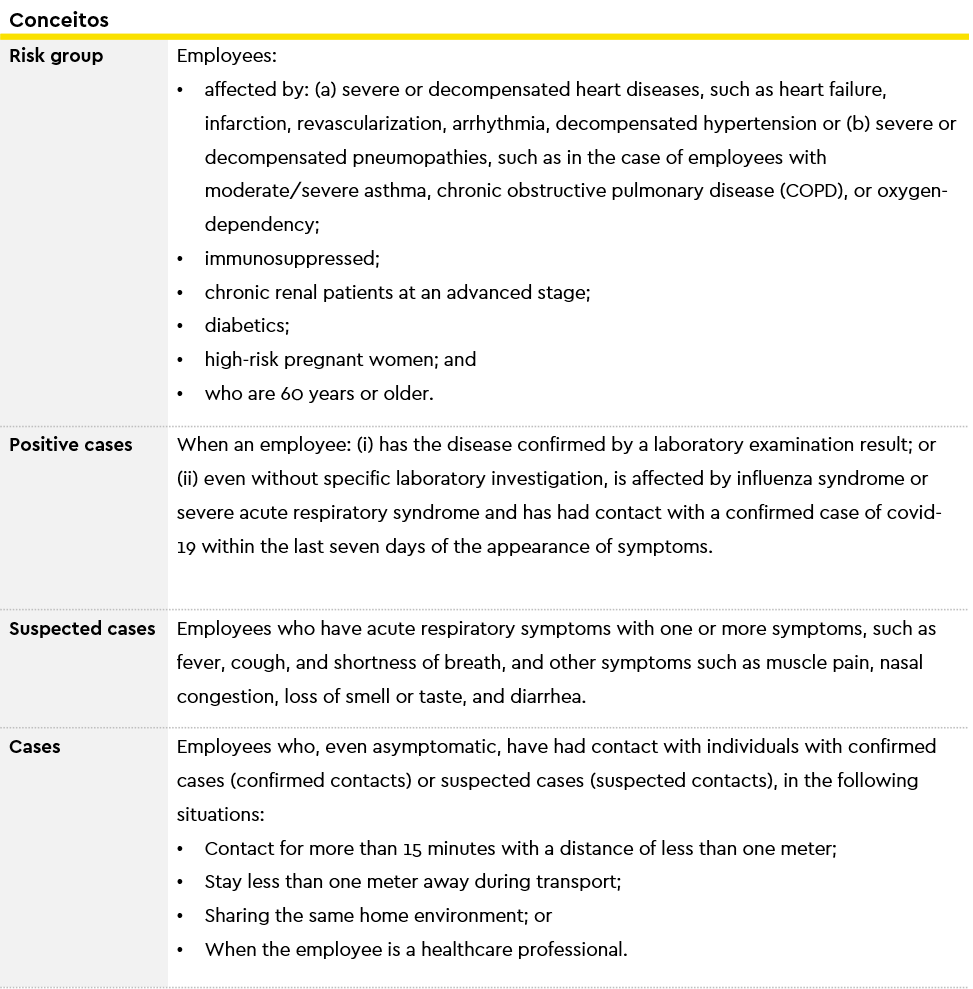

[1]According to item 2.11.1 of Joint Ordinance No. 20/2020, the following are considered clinical conditions at risk for the development of covid-19 complications: severe or decompensated heart diseases (heart failure, stroke, revascularization, arrhythmia, decompensated hypertension); severe or decompensated pneumopathies (oxygen-dependence, carriers of moderate/severe asthma, chronic obstructive pulmonary disease - COPD); the immunosuppressed; chronic renal patients at an advanced stage (grades 3, 4 and 5); diabetics, according to clinical judgment, and high-risk pregnancies.

- Category: Restructuring and insolvency

Renata Oliveira, Marcos Costa e Gustavo Inacarato Marques

As the “silo of the world", Brazil has in agribusiness a segment of unquestionable relevance for the economy. The sector shows its productive strength in the GDP result for the first quarter of 2020 as the only one to show growth in the period, albeit timid growth. With the global economic crisis that is looming as a result of the covid-19 pandemic, however, it is reasonable to imagine that this great pivot of the Brazilian economy may experience difficulties, which is why it is important that the judiciary and the legislature be patient with regard to how to approach this situation, always bearing in mind the legal certainty necessary.

Accordingly, it is important to discuss the issues surrounding the matter, including in light of Bill No. 1,397/20, drafted to alter for the moment some of the requirements of the cases provided for in the Bankruptcy and Reorganization Law (Law No. 11,101/05 - LFR), with the objective of facilitating its use and creating some new means to mitigate the abrupt drop in revenues of companies as a whole, legal stoppages, and preventive negotiation.

The LFR aims to rescue only businessmen and business companies, concepts that do not include, a priori, rural producers without prior registration with the commercial board. Those entitled to apply for judicial reorganization must prove the regular exercise of activities for more than two years, a matter that is quite controversial with regard to rural producers and whose case law diverges among the state courts.

The São Paulo State Court of Appeals has a settled understanding to the effect that registration of rural producers is declaratory in nature. As a result, the period of activity prior to registration must be taken into account in order to fulfill the requirement for at least two years of activity set forth in the head paragraph of article 48 of the LFR, considering that even debt claims taken on prior to registration are subject to judicial reorganization.[1]

In a diametrically opposite sense, the case law of the courts of the states of Mato Grosso and Goiás hold that registration has a nature of creation of rights. Thus, debt claims prior to registration are not covered in any judicial reorganization.[2]

The divergence has not yet been resolved by the Superior Court of Appeals (STJ). Although upon ruling on the issue in an appeal from the judicial reorganization of the J.Pupin Group, the STJ authored livre=@cod=%270664%27">case law report No. 0664, of February 28, 2020, in order to, supporting restatement of law No. 202 of the Third Civil Law Working Group,[3] express the understanding that: (i) registration is declaratory in nature; (ii) calculation of the two-year period of article 48 of the LFR includes those years prior to registration; and (iii) the debt claims taken on prior to registration must be covered by the judicial reorganization, since the exercise of the activity already occurred in the past.

The report in question has no binding effect and, since then, there have been no new judgments to the same effect, which has maintained the scenario of uncertainty.

On June 9, the Fourth Panel of the STJ brought for judgment three new appeals dealing with the possibility, or lack thereof, for rural producers to avail themselves of judicial reorganization, without having been registered with the commercial board more than two years prior.[4]

On that occasion, there was no discussion regarding the merits of the controversy; only Justice Luiz Felipe Salomão's preventive jurisdiction was defined to examine the appeals. However, in discussions during the session, the Justices of the Fourth Panel considered the need to allocate the topic to the procedure for repetitive appeals in order to prevent divergent judgements between the Third and the Fourth Panel. Justice Luiz Felipe Salomão, when acknowledging his preventive jurisdiction, stressed that he will evaluate this possibility, but that the absence of case law by the STJ on the matter may be an impediment in that regard.

In our opinion, the arguments defending the position that registration is constitutive are good. This interpretation is reinforced by the principle of good faith, since such fact is taken into consideration in the review of the risk of the loan to the rural producer and there can be no change in the subjection, or lack thereof, of the debt claim to judicial reorganization by unilateral and subsequent act of the rural producer itself.

Another point to be discussed concerns Bill 1,397/20, which, by creating the stay and the preventive negotiation mechanism, expressly extended the possibility of using such instruments to rural producers and self-employed professionals who regularly perform their activities,[5] which was not done in connection with the in-court reorganization, out-of-court reorganization, and bankruptcy proceedings provided for in the LFR.

However, by relaxing the requirements of article 48 of the LFR during the pandemic period,[6] the Bill moves away from the two-year rule of prior and regular activities prior to filing for in-court reorganization. Indirectly, this ends up allowing rural producers to make use of this judicial procedure and leads to resumption of the judicial debate without a resolution that waits in the Judiciary. Not so clearly, the Bill ends up destabilizing the recent attempt of the STJ to create more legal certainty on the subject, something essential to the development of a healthy economic environment.

This issue, which apparently was not taken into account by the legislator when proposing a change of this caliber to the LFR, may also lead to serious repercussions for rural producers, who would be classified within the concept of economic agent and exempted from the requirements of article 48 of the LFR.

In a scenario of great risk aversion in the economy, creating even more instability is something that should be avoided, as it can make an entire production chain unviable, aggravating the already troubled economic scenario. It must be said that the current situation has already led to a number of difficulties in accessing credit.

Specifically in the case of rural producers, the valuation of the dollar to a record level raises the cost of imported resources and ultimately the cost of production. The demand for affordable credit tends to grow. It follows that the feasibility of taking out financing depends intrinsically on legal certainty. For this reason, we believe that the Bill should be rethought, at least with regard to the points dealt with in this article.

[1] TJSP, Interlocutory Appeal No. 2225271-32.2019.8.26.0000; opinion drafted by Appellate Judge Sérgio Shimura, 2nd Chamber of Business Law, decided on May 4, 2020; TJSP, Interlocutory Appeal No. 2149200-86.2019.8.26.0000; opinion drafted by Appellate Judge Sérgio Shimura, 2nd Chamber Reserved for Business Law, decided on April 4, 2014.

[2]TJMT, N.U 1001934-32.2019.8.11.0000, Dedicated Chambers of Private Law, opinion drafted by Appellate Judge Rubens de Oliveira Santos Filho, decided on December 4, 2019; TJMT, N.U 1004785-44.2019.8.11.0000, Dedicated Chambers of Private Law, opinion drafted by Appellate Judge Sebastião Barbosa Farias, First Chamber of Private Law, decided on September 10, 2019; TJGO, Interlocutory Appeal No. 5100130-57.2018.8.09.0000, opinion drafted by Appellate Judge Alan Sebastião de Sena Conceição, 5th Civil Chamber, decided on February 18, 2019, published in the Electronic Gazette of the Judiciary on February 18, 2019.

[3]"The registration of rural businessmen or companies with the commercial board is optional and of a constitutive nature, subjecting them to the business legal framework. This framework shall not apply to rural businessmen or companies who do not exercise this option.”

[4] Special appeals No. 1834452/MT, 1834932/MT, and 1834936/MT.

[5] It should be noted that Amendment No. 8, presented in the Senate by Senator Roberto Rocha, restricts the application of the legal moratorium and preventive suspension to microenterprises (ME), small businesses (EPP), and individual microentrepreneurs (MEI), which may prevent rural producers who do not fit within the ME, EPP, and MEI classification from taking advantage of these institutes.

[6]Although article 13, subsection I, of the Bill is not very clear and provides confusing wording, it dispenses with proof of the requirements provided for "in subsections II and III of the head paragraph of article 48” of the LFR during the term of the Bill. Subsections II and III relate to the showing by the party that it has not, within the last five years, been granted in-court reorganization. The head paragraph of article 48 requires proof of regular exercise of activities for more than two years. Therefore, upon mentioning the head paragraph of article 48, the Bill implies that such a requirement would also be waived during this period of crisis in which the law will apply.

- Category: Labor and employment

The Special Secretary of Social Security and Labor published, on June 18, in conjunction with the Ministry of Health, Joint Ordinance No. 20/2020, which seeks to establish minimum measures to be observed by employers to prevent, control, and mitigate risks of covid-19 transmission in the workplace.

The ordinance brings in important definitions that can help companies in their preparation to resume activities and in contingency plans, in addition to guidance and information on conduct to be adopted.

Ordinance No. 20/2020 establishes measures to prevent transmission of covid-19 and to return to business activities that must be observed by employers, together with the other mandates contained in state and municipal health decrees and regulations, as well as the measures for occupational hygiene and safety provided for in collective bargaining agreements. The most restrictive measure should always be observed.

An example of this is the minimum distance of one meter between workers established by item 4.2 of Annex I of the ordinance. In São Paulo, according to the health protocols applied in the state, the minimum distance is one and one half meters.

We highlight below the main measures provided for by the ordinance:

Guidance measures

— Obligation to disseminate guidelines or information protocols to workers, indicating the measures necessary to prevent, control, and mitigate the risks of transmission of covid-19. These guidelines can be transmitted during training sessions or through safety dialogues, or physical or electronic documents. The guidelines should include:

- Prevention measures in work environments, in common areas such as cafeterias, bathrooms, changing rooms, rest areas, and in the transportation of workers, when provided by the employer;

- Actions for early identification and removal of workers with signs and symptoms compatible with covid-19;

- Procedures for workers to report, including remotely, signs or symptoms compatible with covid-19 or possible contact with a confirmed case of covid-19;

- Hand sanitation instructions and respiratory etiquette; and

- Forms of infection, signs, symptoms, and care needed to reduce transmission in the work environment and community.

Conduct to be adopted in confirmed, suspected, and contact cases

— Immediately remove from in-person work activities workers with confirmed cases, suspected, cases and confirmed cases of contact with covid-19, for a period of 14 days. Suspected cases may return to work in a shorter period provided that (i) it is proven by laboratory examination that there has been no contamination by covid-19 and (ii) they are asymptomatic for more than 72 hours;

— Guidance to workers on leave regarding the need to remain at their place of residence, with pay maintained during the period of leave;

— Establishment of procedures for identifying suspected cases, including:

- Communication channels for workers to report the appearance of compatible signs or symptoms, as well as contact with confirmed or suspected covid-19 cases; and

- Screening at the entrance to the establishment in all shifts. Touchless body temperature measurement or the like can be used.

— Gathering of information on contacts, activities, workplace, and common areas frequented by the worker with suspected or confirmed covid-19;

— Guidance to contacted persons of suspected covid-19 cases regarding the contact and the need to report immediately to the company the appearance of any sign or symptom related to the disease;

— Up-to-date record keeping with the following information:

- Workers by age group;

- Workers with clinical conditions at risk for developing complications related to more severe covid-19 conditions (the disease should not be specified, preserving confidentiality);

- Suspected and confirmed cases;

- Workers on leave who had contact; and

- Measures taken to adapt work environments to prevent covid-19.

— Referral of suspected cases to the organization's medical outpatient facility, where available, in order to perform an appropriate evaluation and monitoring. The care of symptomatic workers should always take place separately from other workers, providing masks to all those present at the outpatient facility.

Common areas of the company

For the common areas of the work environment, Ordinance No. 20/2020 established a series of obligations and recommendations to be followed by employers, ranging from the cafeterias to the transport offered to workers.

Cafeterias:

— It is forbidden to share glasses, plates, and cutlery without sanitization.

— Self-service should be avoided or, when it cannot be avoided, control measures should be implemented, such as:

- hand sanitizing before and after serving oneself;

- cleaning or frequent change of shared kitchen utensils, such as ladles, handles, and spoons;

- installation of food protector over self-service structures; and

- use of masks and guidelines to avoid conversations during service.

— Provide frequent cleaning and disinfection of table surfaces, benches, and chairs, as well as adopting a minimum spacing of one meter between people in line and at the tables in the dining areas, advising on the fulfillment of respiratory etiquette recommendations and the need to avoid conversations. When the front or side distance is not observed, a physical barrier must be used on tables at least one and one half meters above the ground.

— Distribution of workers into different time slots at meal places;

— Removal of containers for spices (oil, vinegar, sauces), salt and pepper, as well as napkin holders for shared use, among others; and

— Delivery of set of sanitized utensils, individually packaged.

Locker rooms

— Avoid crowding of workers at the entrance, exit, and during the use of locker rooms;

— Adopt a procedure for monitoring the flow of entry into locker rooms and guide workers to maintain a distance of one meter from each other;

— Guide workers on the order of removal of clothing and equipment, so that the last protective equipment to be removed is the mask;

— Availability of sink with water and liquid soap, as well as disposable towels or sanitizer dispensers suitable for hands, such as 70% alcohol, at the entrance and exit of the locker rooms.

Transportation offered by the employer

— Implementation of procedures for reporting, identifying, and removal of workers with symptoms before boarding, thus preventing the entry of symptomatic persons in the vehicle;

— Obligation to wear protective masks when boarding workers;

— Guidance to workers to avoid crowding when embarking and disembarking transport, with the implementation of measures to ensure a minimum distance of one meter between each person;

— Maintenance of safe distance between workers, following spacing inside the transport vehicle;

— Maintenance of natural ventilation inside vehicles and, where the use of the air conditioning system is necessary, recirculation of air should be avoided;

— Drivers should frequently sanitize their hands and workstation, including the steering wheel and surfaces that are most frequently touched; and

— Record keeping of the workers who use the transportation, listed by vehicle and trip.

Other measures to be adopted

— Cleaning and disinfecting workplaces frequently by cleaning the surfaces of tables, benches, and chairs in between shifts or whenever a worker is assigned to occupy another's workplaces, keyboards, handrails, door handles, payment terminals, elevator buttons, tables, chairs must also be cleaned and disinfected;

— Priority should be given to natural ventilation in workplaces or the adoption of measures to increase as much as possible the number of exchanges of air in enclosures, bringing clean air from outside and avoiding the recirculation of conditioned air;

— Creation and review of procedures for the use, sanitation, packaging, and disposal of PPE (Personal Protective Equipment) and other protective equipment used, with the employees being advised on the use, sanitation, disposal, and replacement of masks, sanitation of hands before and after their use, and even limitations of their protection against covid-19;

— Participation by the SESMT and CIPA in the prevention actions implemented by the organization;

— Provision of surgical or fabric masks for all workers, with use required in shared environments or in those where there is contact with other workers or the public (the wearing of masks and their replacement every three hours or when they have become dirty or wet is mandatory);

— Changing drinking fountains installed in the work environments so that the inclined-jet type is adapted and water consumption is possible only with the use of a disposable cup;

— Guidance to employees to engage in frequent hand sanitizing, with the provision of resources for this purpose near work stations, including water, liquid soap, disposable paper towels, and a trash can (with no manual contact to open) or adequate hand sanitizer, such as 70% alcohol, and guidance on not sharing towels or products for personal use;

— For cases where minimum physical distance cannot be observed, surgical masks, face shield, and goggles must be provided, in addition to waterproof partitions installed in the fixed work stations;

— Adoption of measures to limit the occupation of elevators, stairways, and restricted environments, including sanitary facilities and changing rooms, as well as demarcation and reorganization of places and spaces for queues and waiting with at least one meter between people;

— Prioritization of schedules for attending to the public and distribution of the workforce throughout the day to avoid concentration of people in the workplace;

— Indispensable in-person meetings may take place, provided that the minimum social distance for each location is maintained;

— Workers aged 60 and over or who present clinical conditions of risk for developing covid-19 complications should receive special attention, with priority in staying in the home via telework or remote work;

— No requirement for laboratory testing as a requirement for resuming in-person work (when adopted, the test must comply with the guidelines of the Ministry of Health);

— Professionals responsible for screening or pre-screening workers, laundry workers (dirty area) and those who perform cleaning activities in restrooms and living areas must receive PPE according to the risks to which they are exposed, in accordance with the guidelines and regulations of the Ministries of Economy and Health;

— SESMT medical and health care professionals, such as nurses, assistants, and doctors, should receive PPE or other protective equipment according to the risks, in accordance with the guidelines and regulations of the Ministries of Economy and Health;

— The individual signature of workers on spreadsheets, forms, and controls, such as meeting attendance lists and safety instructions, should be waived;

— When the activities of a certain sector or of the establishment itself are shutdown as a result of covid-19, the following procedures must be adopted before the activities return:

- sanitizing and disinfecting the workplace, common areas, vehicles used;

- enhance communication to workers; and

- implement screening of workers, ensuring removal of confirmed cases, suspect cases, and contacts with confirmed covid-19 cases.

- Category: Labor and employment

Following the procedure for conversion of Executive Order 936/20 into federal law, the Federal Senate approved the Conversion Bill (PLV) on June 16, contemplating various changes in the original text proposed by the Federal Government.

The proposed changes in the PLV directly impact on: (i) the new agreements to be entered into to reduce wages and hours or suspend contracts; (ii) obligations and guarantees to employees and employers during the period of public calamity; and (iii) various rights provided for in labor legislation.

The amendments are set out below and will enter into force only if they are ratified by the President of Brazil.

a. Agreements on reduction of work hours and salary and temporary suspension of employment contracts

One of the main objectives of MP 936 was to implement alternatives for confronting the crisis resulting from covid-19 in the area of labor relations, which were subject to targeted changes by the PLV:

- In line with the understanding already defended even before the PLV, it was expressly ratified that both measures may be implemented in a sectoral or departmental manner, for part or all job positions;

- Although the limitation on the maximum periods of reduction (90 days) and suspension of contracts (60 days) has been maintained, the PLV signals the possibility of extending these limits by an exclusive act of the Executive Branch;

- The possibility was confirmed for pregnant employees to join agreements to reduce work hours and salary or suspend employment contracts, without prejudice to maternity leave;

- The guarantee of employment for a pregnant worker who has been subject to a reduction in work hours and salary or suspension of her employment must be counted from the end of the period of her job stability due to pregnancy, that is, from the fifth month after birth;

- Companies with annual gross revenues exceeding R$ 4.8 million in the 2019 calendar year may only enter into individual agreements to reduce salaries and working hours by more than 25% or suspend contracts with employees who are legally considered to have adequate bargaining power or have salaries equal to or under R$ 2,090.00 (the original wording provided for this possibility for salaries equal to or under R$ 3,135.00);

- Individual agreements are authorized, regardless of the employee's salary, when the final amount to be received, already factoring in the Emergency Benefit and the Compensatory Aid, does not result in a reduction in the monthly amount received by the employee;

- It is now authorized for retired employees to have their wages and working hours reduced or employment contract suspended in the manner set forth in MP 936, provided that the agreement meets specific requirements under the PLV;

- The possibility for individual agreements to be entered into by any effective physical or electronic means is ratified;

- Employees submitted to reduction in salary and work hours or suspension of employment may supplement monthly social security contributions in order to avoid losses in future benefits;

- Compensatory aid paid by the employer as of April 2020 may be deducted from: (i) income from the individual's non-salaried work; (ii) taxable income received by in-home employer; and (iii) profits from rural activity, as an expense paid in the base year; and

- The prevalence of collective bargaining agreements over individual agreements where they conflict is ratified, unless they are more favorable to employees.

In order to protect companies that have already entered into their individual or collective agreements for reduced work hours and salary or suspension of employment, the PLV expressly provides that the above rules apply exclusively to agreements signed after their conversion into law, except for the prevalence of collective agreements over individual agreements.

Although all the changes listed above have a significant impact on the new agreements to be entered into by employers, the possibility for the Executive Branch to extend the maximum time limits for reducing work hours and salaries and for suspending employment contracts deserves special mention.

This is because, although the crisis resulting from covid-19 is still felt in various sectors of the economy, it is a fact that companies first to pursue the execution of agreements have already reached the deadlines for their validity, which has been harming the employment rate.

In addition, it is also worth noting that the Brazilian Congress, with the changes proposed in the PLV, ratified the understanding that the payment of compensatory aid can be made at a percentage greater than 30% and as a mechanism for relieving payroll, a practice that had already been adopted by various employers.

b. Period of public calamity

The PLV has provided for some new rules to be observed by employers during the state of public calamity:

- The provisions of collective agreements that have expired or are due to expire, except those that provide for salary adjustments and their repercussions on other provisions of an economic nature, shall remain valid as long as the state of public calamity persists, and may only be modified or suppressed by means of new collective bargaining; and

- It is now forbidden for people with disabilities to be dismissed without cause.

Also with regard to the period of public calamity, employees shall be assured:

- Opting for the renegotiation of loans, financing, credit cards, and leasing transactions granted by financial institutions and leasing companies contracted via payroll direct deposit or available remuneration; and

- Payment of the emergency benefit, in the amount of R$ 600 per month, for a period of three months from the date of dismissal, in the event that the employee does not meet the requirements for qualification for unemployment insurance.

c. Changes in labor law

The PLV included some targeted changes in labor laws, some of which were reused from Executive Order No. 905/19, revoked by the President of Brazil on April 30, 2020. Among the changes by the PLV, we highlight the amendment of the rules for entering into and paying the PLR, such as: (i) the validity of negotiation via employee committee without labor union participation, provided that, after notice, the labor union was silent for ten days; and (ii) the possibility of entering into an agreement at least 90 days before the date of payment of the single or final installment.

d. Act of state

Much has been discussed regarding the possibility of application of article 486 of the CLT, which supposedly authorized employers to pass on to the government the payment of severance pay for employment contracts terminated by reason of the stoppage or suspension of their activities.

In order to stave off this risk, the PLV expressly prohibits the application of article 486 of the CLT due to the public health emergency resulting from covid-19.

For further information regarding the alternatives provided for in Executive Order 936 and other measures to tackle covid-19, click below on our Special Bulletin and E-book regarding the topic:

MP 936: NEW LABOR AND EMPLOYMENT MEASURES TO CONFRONT COVID-19

CORONAVIRUS - ANALYSIS OF THE GENERAL IMPACTS OF COVID-19 AND MP Nos. 927 AND 936 ON LABOR RELATIONS

- Category: Infrastructure and energy

The National Electric Power Agency (Aneel) tried Administrative Proceeding No. 48500.001841/2020-81 at the 17th Ordinary Public Meeting, in May, in order to deny the Group A consumers claim, who requested alleviation from the collection of electric bills during a period of forced restrictions on economic activities as a result of the measures to combat the covid-19 pandemic.

Group A is made up of high-voltage consumers, who receive electrical energy at or above 2.3 kV or are served from an underground distribution system at a secondary voltage. For the most part, the group comprises medium and large sized companies and commercial establishments.

In order to supply their energy demand, these users shall previously report the necessary power usage for a monthly cycle. With this, the responsible energy distributor schedules the amount of power from the grid that can be demanded by the consumer. In other words, Group A consumers sign contracts with distributors for previously acquired demand. These contracts have a fixed value and a variable value proportional to the amount of electricity actually consumed.

For this reason, the billing of consumers belonging to Group A are made up of two tranches. The former corresponds exactly to the payment of the power demand, calculated by means of the higher demand measured or by the contracted demand, as a fixed charge. The second refers to the payment proportional to the amount of electricity consumed.

When those consumers faced a drop in electricity consumption caused by the impacts of social isolation measures, such as a reduction in economic activity, Group A consumers brought administrative lawsuits seeking to change the metrics for billing of the demand contracted. The objective was to establish a single payment for the demand measured or postponement of billing until after the crisis period.

Although Aneel had considered the arguments demonstrating that shopping malls, hotels, and some industries, all belonging to Group A, were strongly affected by the effects of the economic and health crisis, the agency chose to deny the requests. Aneel recommended, under current regulations, that distributors undertake negotiations regarding the deferral and installment payments of the amounts of the demand contracted that exceed the demand measured.

The agency reasoned that the contracted demand has the nature of a fixed charge and it referred to previously contributed investments, made by the energy distributors, in order to provide the necessary infrastructure to the energy consumer. Moreover, it showed that contracted demand only falls within the range of 14.13% to 17.92% of total billing to the consumers.

Along those lines, Aneel found that the current regulations already allow distributors to negotiate deferrals or other actions with consumers who are having payment difficulties, managing so that the level of default does not increase even more. The agency has concluded that no further legal act would be necessary on the matter. Therefore, the provisions of Normative Resolution No. 414/10 continue in force, which establishes, in its article 63, the possibility of reducing the demand contracted, provided that it is requested a minimum of 90 days in advance for consumers in subgroup A4 and 180 days for other subgroups.

With this decision, Aneel's executive board sought to prevent the potential negative consequences that the changes in billing rules for Group A consumers could cause for the generation, transmission, and distribution sectors, as well as for other energy consumers. By choosing to deny the request of companies with strong presence in the Brazilian economy, Aneel reiterated the posture that it is necessary to foster dialogue among the various segments of the electricity sector so that all agents can contribute to minimize the effects of the health crisis.