Publications

- Category: Infrastructure and energy

Liliam F. Yoshikawa, Roberta Danelon Leonhardt, Carolina Castelo Branco, and Camila de Carli Rosellini

On May 18, the National Mining Agency (ANM) published Resolution No. 32, which changes the rules for inspection and safety of dams in Brazil, initially instituted by Ordinance No. 70,389/17 of the then National Department of Mineral Production (DNPM), which created the National Registry of Mining Dams and the Integrated System for Mining Dam Safety Management. In addition, on May 19, the House of Representatives unanimously approved Bill No. 550/19 of the Federal Senate, which amends the National Dam Safety Policy (PNSB), Federal Law No. 12,334/10, with the aim of increasing dam safety requirements.

The new resolution amends some provisions of the abovementioned DNPM ordinance and revokes article 15 of ANM Resolution 13/2019, which established regulatory measures for mining dams, notably those built or elevated using the so-called "upstream" method or by a method declared to be unknown.

Among the principal changes, the resolution provides that there will be an automatic change to “high” in the risk category of the dam in the following cases:

- detection of anomalies, such as those of a structural nature with reduced slope capacity and without corrective measures, rise in downstream areas with material loading, increasing flow or infiltration of contained material with the potential to compromise the safety of the structure, or the existence of cracks, rebounds, or slips with the potential to compromise the safety of the structure;

- failure to send the Stability Statement (DCE) within the six-month period between the 1st and 31st of March and the 1st and 30th of September, or a finding of non-stability of the dam;

- failure to achieve safety factors, including those determined by ABNT Technical Regulation No. 13,028; and

- structure classified as Emergency Level 1, 2, or 3.

Another change relating to preparation of the flood map. Previously, the developer had to prepare it to support the classification of the Associated Potential Damage (DPA) of all its mining dams, individually, within up to 12 months from the entrance into force of the DNPM Ordinance, with it being possible in some cases to even make use of a simplified study. With the new resolution, the flood map should be more detailed and will serve as an aid both in classifying the DPA and in supporting the other actions described in the Emergency Action Plan for Mining Dams (PAEBM). There has also been a change in the timeframe for preparing and sending the flood map according to the level of the DPA. The new deadlines are:

- High DPA: by December 31, 2020

- Medium DPA: by February 28, 2021

- Low DPA: by April 30, 2021

In addition, the ANM may, at its discretion, lay down separate deadlines and obligations provided for in the new resolution in exceptional and duly justified cases.

The rule also provides that the individual with the highest authority in the hierarchy of the company that signs the DCE together with the technical person responsible for its preparation must be a Brazilian or naturalized Brazilian citizen, a mandate not previously provided for by the DNPM Ordinance.

The following are highlighted as the main amendments to Bill No. 550/19, which amends the PNSB:

- prerogative assigned to the ANM to demand or not demand security, insurance, guarantees, or other financial or real guarantees from developers to repair damage to human life, the environment, and public property.

- requirement to immediately notify the oversight agency, the environmental agency, and the competent civil protection and defense agency of any change in the safety conditions of the dam that could result in an accident or disaster.

- mandatory Emergency Action Plan (EAP) for all mining tailings dams and dams with associated medium-level potential damage.

- revision of the amount of the fine (previously R$ 20 billion) to a minimum of R$ 2 thousand and a maximum of R$ 1 billion, plus compensation for the families affected.

- change in the provision for payment of royalties, i.e., the obligations to pay the Financial Compensation for Exploration of Mineral Resources (CFEM) to the municipalities affected were removed from the Federal Senate’s text, even if there is interruption in activities and cessation of production.

- exclusion of the provision for modification of Law No. 8,072/90 (Heinous Crimes Law) to classify as heinous the crime of environmental pollution resulting in death. In the text approved by the House of Representatives in the alternative, the chapter on administrative infractions was detailed, establishing deadlines for the handling of cases and types of penalties that can be applied to offenders.

The current context and legislative changes put pressure on mining companies to meet the new requirements and eliminate any dams built by the upstream method as soon as possible, giving greater effectiveness to the PNSB.

- Category: Banking, insurance and finance

The Central Bank of Brazil (BC) and the National Monetary Council (CMN) issued, in early May, rules governing the use of book-entry trade notes in order to provide more security for financial institutions to use bills to offer credit.

Following the trend of dematerialization of financial assets and securities[1] seen in the Brazilian market in recent decades, the new rules face the issue at two levels:

- CMN Resolution No. 4,815 deals with financing transactions based on book-entry trade notes; and

- BC Circular No. 4,016 regulates the bookkeeping activity of these securities, creating a series of rules aimed at providing greater security for their issuance, registration, settlement, and trading.

More specifically, CMN Resolution No. 4,815 regulates market receivables discounting operations carried out by financial institutions and loans guaranteed by those receivables.

The main change brought about by the rule for these transactions was the mandatory use of registered and book-entry trade notes under BC Circular No. 4016. According to article 4 of the resolution, financial institutions should require their counterparts, in particular forward sellers who wishes to accelerate their receivables, to issue book-entry trade notes in sales or services.

The trade notes issued or receivables to be created in the future (in the case of so-called "smoke credits”), the institutions to which payments will be made, and the conditions for release of funds paid by debtors of the trade notes, in the case of loans guaranteed by such securities should also be specified via contract (article 5).

Also according to the resolution, the commands in the registration systems or centralized deposit in which the trade notes will be registered must be made by the creditor financial institution (article 6), including exchange of ownership and creation and cancelation of liens and encumbrances.

BC Circular No. 4,016, in turn, provides the necessary support for trading with electronic trade notes to grow in scale, without prejudice to security for the parties and the financial system as a whole. For this purpose, the agents responsible for operating the electronic bookkeeping systems (bookkeepers) must obtain prior authorization from the BC (article 11) and ensure that, concerning trade notes, such systems allow (article 3):

- the performance of all appropriate acts of exchange;

- control of payments;

- trading and exchange of ownership, registration, and centralized deposit in systems authorized to operate by the BC;

- input of encumbrances and lines on trade notes in such systems;

- input of information regarding the transactions carried out, issuance of statements; and

- interoperability with other systems of the same nature.

In a complementary manner, such agents must also observe a series of minimum service and governance standards, including the creation of internal risk management policies, the performance of services with minimum operational reliability, and care for the quality of information recorded in conducting the activity, among other requirements provided for in article 7 of BC Circular No. 4,016.

Also, emphasis should be placed on[2] the provisions of BC Circular No. 4,016 which require association between the trade notes and the respective electronic invoice by the bookkeeper (article 3, sole paragraph) and registration of the trade note in a system for registration or centralized deposit authorized by the BC that interoperates with the others (articles 14 and 19). These requirements are seen as important tools to prevent fraud that was considered an obstacle to the development of this market, such as the issuance of "cold" or duplicate trade notes.

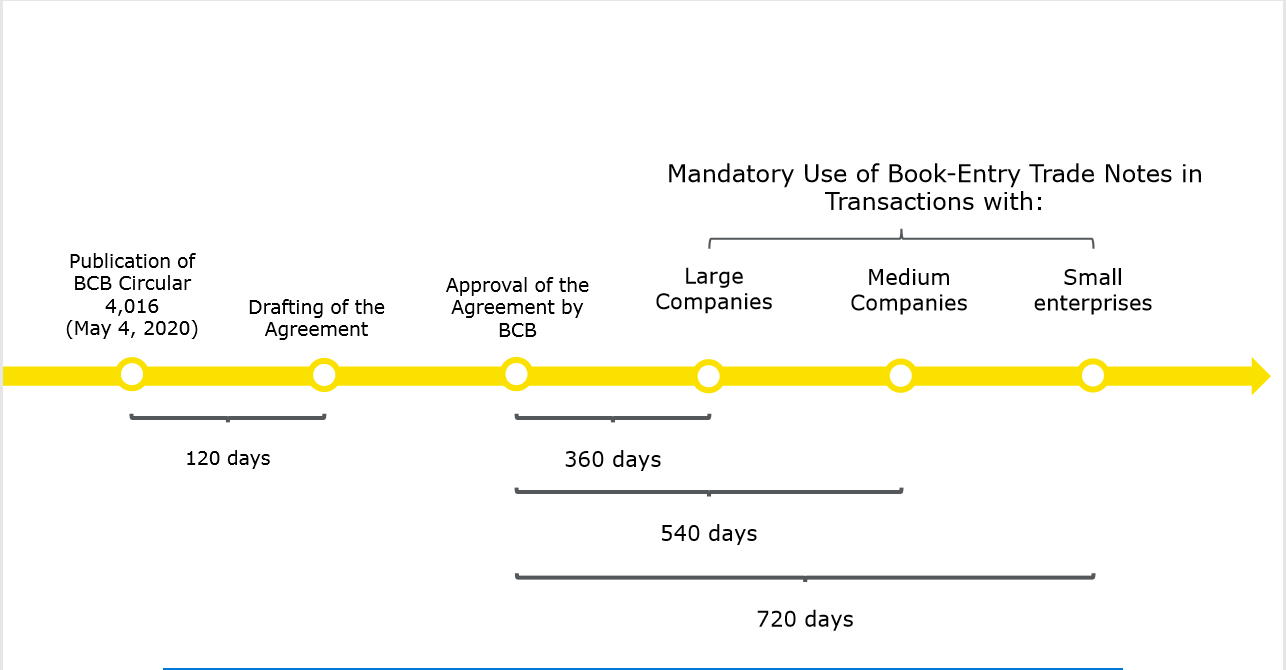

Considering the technical challenge represented by the implementation of these new systems, the mandatory issuance of book-entry trade notes for the negotiation of commercial receivables by financial institutions will only become effective after approval of the agreement between registrars and depositories provided for in BC Circular No. 4,016 and within deadlines that vary according to the size of the clients financed, as shown in the figure below (article 3 of CMN Resolution No. 4,815):

The system of book-entry trade notes established by BC Circular No. 4,016 and CMN Resolution No. 4,815 represents an effort to give this market security and robustness in the bookkeeping infrastructure already established by the national regulatory framework for other financial assets and securities. Figures such as bookkeeping agents, registration and centralized deposit systems, settling banks, and supervision closest to the BC itself may be new to the trade notes market in particular, but the fact is that this model and its effectiveness and solidity are already widely known by the financial market and its clients in general.

At the same time, applying these new rules to a segment as traditional as trade notes, with their own vices and virtues, may lead to the emergence of a set of new challenges, particularly cultural adaptation. Add to this the current unprecedented crisis resulting from the covid-19 pandemic, which makes it even more difficult to implement a technologically complex process.

In fact, security and predictability have their cost. But what is perhaps seen today as another concern by many can easily become a source of new opportunities. With significant adherence by financial institutions to loans and financing backed by book-entry trade notes, many companies will be able to access new, cheaper forms of credit. In addition, another opportunity is created for financial asset registrars. The financial market and its infrastructure providers therefore have the mission of adapting to this new regulatory reality and of seeking to achieve the objectives expected of them, which can certainly contribute to the resumption of economic development in Brazil.

[1] A more complete description of this process can be found in WELLISCH, Julya. “Títulos Nominativos: da Cártula ao Depósito Centralizado” [“Registered Securities: from Card System to Centralized Deposit”]. In: Revista de Direito Bancário e do Mercado de Capitais [“Review of Banking and Capital Markets Law”], vol. 66/2014, pp. 35-62.

[2] Other noteworthy provisions in the circular are the rules on the security of financial settlements relating to the payment of trade notes (Chapter III, Section II), minimum information to be made available to drawees (article 6), duties of the registration and centralized deposit systems (Chapter VI, Section I), and the execution of an agreement among the entities that manage them, which shall be prepared with the participation of the BC and deal with operational issues such as layouts and informational content of the files, procedures, times of exchange of information, fees, among others (article 20).

- Category: Infrastructure and energy

On May 18, the Federal government published Decree No. 10,350, which regulates Provisional Measure No. 950/20 and provides for the creation of an account for the energy sector to face the state of public calamity recognized by Legislative Decree No. 6/2020, called the Covid-Account.

The new decree seeks to mitigate the cash impacts suffered by distribution concessionaires as a result of the fall in energy consumption and increase in defaults caused by the covid-19 pandemic. According to article 1 of the decree, the Covid-Account will receive funds from the contracting of credit transactions with financial institutions. The objective is to cover deficits or accelerate revenues for energy distribution concessionaires.

The Covid-Account should alleviate the effects caused by the distributors’ over-contracting of energy and ensure neutrality of sectorial charges for distributors, among other repercussions. According to the first paragraph of article 1, the Electric Energy Trading Chamber (CCEE) is charged with contracting credit transactions intended to cover the Covid-Account, taking advantage of a lower cost of operation, since the Selic rate is now close to 3%, compared to 11% at the time of the creation of the ACR account, due to the crisis in the electric sector in 2014.

In order to receive the funds from the Covid-Account, distributors will have to expressly accept, on an irrevocable and irreversible basis, certain conditions, such as:

- prohibition until December of 2020 on requirements to suspend or reduce the volumes of energy acquired through power purchase agreements;

- limitation, in case of intra-sectorial default, on the distribution of dividends and interest on equity payments to the legal minimum percentage of 25% of net profit;

- the possibility of reimbursement by distributors of administrative and financial costs incurred in credit transactions and borne by consumers, subject to certain requirements; and

- waiver of the right to litigate, in a judicial or arbitral context, these conditions of acceptance.

It is not known whether all distributors will accept these conditions to receive the funds from the account, mainly because some of them generate discussions in the energy sector, such as limiting the distribution of dividends and interest on equity payments to the legal minimum percentage of 25% of net profit.

The costs of the financial transactions contracted will be passed on in full to the Energy Development Account (CDE, in Portuguese) and paid by consumers. Those who migrate to the free market during the financing period will not be exempt from paying the loan.

The decree also provides for the possibility of bilateral negotiation between distributors and Group A consumers, upon mentioning, in article 3, paragraph 3, subsection IV, that the amounts to be paid by the Covid-Account to the distributors will be approved by Aneel and will consider, among other factors, any deferred payment installments, by the distributors, of outstanding obligations related to the invoice of the demand contracted for Group A consumer units.

This possibility is in line with Order No. 1,406, of May 19, 2020, which, under Administrative Proceeding No. 48500.001841/2020-81, filed by Group A consumers, allows distributors to freely negotiate deferred payment installments of amounts related to invoices based on contracted demands instead of measured demands, under the terms of applicable regulations.

Although still subject to regulation by Aneel, the decree has been facing opposition, such as that of Legislative Decree Bill No. 231/20, filed by Federal Representative José Guimarães (PT-CE). The parliamentarian intends to halt the effects of the decree on the argument that there is no stipulation of a maximum amount for loans, which would mean a blank check to Aneel.

Although some of its points are controversial, Decree No. 10,350/20 constitutes an important emergency measure for the energy sector, since, as far as possible, it preserves the payment flow of the entire chain of the sector. It is not, therefore, a definitive solution to the problem, which is why it mentions that Aneel will be able to evaluate the need to restore the economic and financial balance of concession contracts, upon a justified request of the interested party.

- Category: Litigation

Bill No. 1,179/20, which adapts private law legal relationships (contractual, corporate, real estate, and agricultural, among others) during the covid-19 crisis, is proceeding for presidential signature. The matter was sent to the Office of the President for signature on May 21, and this is expected to occur by June 10 of this year.

The text approved follows the terms of the substitute presented by Senator Simone Tebet (MDB-MS) for the text initially prepared by the President of the Federal Supreme Court (STF), Justice Dias Toffoli, and presented by Senator Antonio Anastasia (PSD-MG).

The proposal approved is transitional and emergency in nature and considers the beginning of the pandemic to have occurred on March 20, 2020. In this spirit, the draft establishes a series of rules that modify Brazil's legislation on a transitional basis. Among other measures, the proposal:

- Suspends or prevents the running of the periods for peremption and the statute of limitations, from the entrance into force of the legislation until October 30, 2020.

- In the operation of legal entities, it establishes that, until October 30, 2020, face-to-face meetings and assemblies in the scope of associations, foundations, and companies must respect the health restrictions of the local authorities, expressly providing that general meetings may take place by electronic means, including for the purposes of statements and responses by participants, which must have the same effects as statements and responses with in-person signature, regardless of provision in the corporate documents of the legal entity.

- With regard to termination, rescission, and revision of contracts, it provides that the consequences arising from the pandemic will not have retroactive effects for purposes of default due to unforeseeable circumstances or force majeure, and that the impacts of inflation, foreign exchange rate variation, or devaluation and replacement of the exchange rate standard arising from this situation cannot be considered unforeseeable for the exclusive purposes of the Civil Code (force majeure, unforeseeable circumstances, or theory of unpredictability).

- In consumer relations, it establishes that the rules for arguing situations of force majeure, unforeseeable circumstances, acts of God, or theory of unpredictability cannot be applied in the context of consumer relations, in addition to suspending the right of buyer’s remorse and withdrawal periods for products and services delivered at home until October 30, 2020.

- In lease agreements, the granting of injunctions for eviction from urban real estate is suspended until December 31, 2020, within the scope of the eviction proceedings up to March 20, 2020.

- As for adverse position, accrual periods are suspended until October 30, 2020.

- In building condominiums, the owners association's powers are extended to restrict (a) the use of common areas to prevent covid-19; and (b) private areas for meetings, festivities, and the use of vehicle shelters by third parties. In no case may medical access and care be restricted. In addition, owners association meetings may take place on an emergency basis, in an electronic manner, whereby the statements and responses by the parties must also have the same validity as that done in person. All measures are also valid until October 30, 2020.

- In competition law, some practices prohibited by Law 12,529/11 are suspended (article 36, XV and XVII), among them (a) selling goods or rendering services unjustifiably below cost price; (b) partially or totally ceasing the company's activities, without just cause, while the other infractions of article 36 should be analyzed with a view to the pandemic situation, when performed during the period of applicability of the law. Finally, application of the provision that defines the execution of an association contract as an act of concentration (and article 90, IV, of Law No. 12,529/11 – article 21, of the Bill).

- In private paid transportation and delivery services by mobile phone application, there must be a reduction in the percentage of retention of the value of the trips by at least 15%, ensuring the transfer of this amount to the driver or deliverer.

- It establishes that the rules of the Brazilian Traffic Code may be relaxed by the National Transit Bureau (Conatran) to optimize efficiency in the logistics of transportation of goods and inputs and in the provision of services related to combating the effects of the pandemic.

- It provides that the effective date of the General Data Protection Law, for imposition of sanctions, will occur in August of 2021. Thus far, the effective date of the LGPD continues to be postponed to May 3, 2021, as per MP No. 959/2020, which is pending deliberation in the Brazilian Congress.

Senator Simone Tebet emphasized orally that the proposal does not deal with relations between consumers and public service providers, which depend on the actions of regulatory agencies, nor with bankruptcy and judicial reorganization issues, nor with labor or health legislation. These topics may be addressed in specific bills.

If the matter is vetoed, in whole or in part, by the Brazilian President, the bill will return to the Brazilian Congress for further deliberations.

Click here to see the infographic that summarizes the subject.

- Category: Environmental

Aline Barreto de Moraes e Castro Philodemos,Eduardo Ferreira e Maria Beatriz Cardoso Nascimento

The Ministry of Environment (MMA), the Brazilian Institute of Environment and Renewable Natural Resources (Ibama), and Chico Mendes Institute for Biodiversity Conservation (ICMBio) regulated in January this year, by means of the joint normative rulings Nos. 1 and 3, direct and indirect modalities for conversion of environmental fines.

Provided for in the Federal Decree No. 6,514/08 (amended by Decrees No. 9,179/17 and No. 9,760/19), the conversion allows the agencies and entities that compose the National Environmental System (Sisnama) to convert simple environmental fines into services related to the preservation, improvement, and recovery of environmental quality, with the exception of fines arising from environmental violations that result in human deaths.

Although the new joint normative rulings do not change the procedure for the implementation of the conversion of environmental fines, they regulate some details that are relevant to the operation of the Fine Conversion Program.

Joint Normative Ruling No. 1, -responsible for regulating the direct modality of conversion of environmental fines, establishes that the defendant must implement by its own means the project for the provision of services related to the preservation, improvement and recovery of environmental quality. The Federal Environmental Public Administration will offer to the defendants the assessed project or project quota to be implemented, and may even indicate the adhesion to the indirect modality.

Projects submitted under the Administrative Procedure for Project Selection (PASP) or under a specific internal procedure, and approved by the institution responsible for organizing the selection, will only be part of the conversion projects portfolio after approval by the president of the agency or any other designated public agent . With such approval, the competent environmental authority will then indicate to the defendant the project which it considers to be compatible with the amount of the set fine.

In the direct modality, the defendant will be responsible for monitoring the environmental project and for bearing any related environmental costs. Implementation and monitoring reports must be periodically submitted to the competent environmental agency in order to verify the progress of project implementation and the achievement of the proposed results. After the request for direct conversion has been approved, the defendant must sign a commitment term in which will be established the conditions to be met.

Regulated by Joint Normative Ruling No. 3, the indirect modality of conversion of environmental fines provides, in its turn, that the defendant must contribute to the Environmental Fine Conversion Fund (FCMA) with the amount resulting from the fine, after application of the discount. The contribution will be allocated to cover the costs for the provision of services related to the preservation, improvement, and recovery of environmental quality. The defendant, in this case, is not directly involved in the implementation of environment’s beneficial measures.

When requesting the indirect conversion of environmental fines, the defendant must sign two different documents. The first is a commitment term, undertaking to pay to the FCMA the amounts involved in the conversion of the fine. The contribution to the FCMA must follow schedules that will be individually established with the competent environmental agency. The defendant that chooses this type of conversion must also sign an Instrument of Adhesion to the Fine Conversion (TACM), which will establish the conditions for the fulfillment of its obligations, with no responsibilities related to the monitoring or execution of the project.

As set forth in the two joint normative rulings, the conversion of environmental fines may be requested at three different moments, regardless of the chosen modality: (i) to the Environmental Conciliation Center, by the time of the environmental conciliation hearing, in which case a discount of 60% from the consolidated fine will be granted; (ii) to the judging authority, until the first instance decision, in which case a discount of 50% from the consolidated fine will be granted; and (iii) to the higher authority, until the judgment of the appeal, in which case a discount of 40% from the consolidated fine will be granted. Thus, the discount will not be based on the conversion arrangement chosen, but on the time when interest in conversion is expressed.

Another relevant aspect regulated by the joint normative rulings relates to the updating of the time frame provided for in Decree No. 10,198/20, published on January 3. The Decree postponed the date for the defendants who have already pleaded the conversion under Decree No. 9,179/17 to (i) withdraw the request submitted; or (ii) to submit a petition requesting the adjustment of its plea, in order to guarantee the application of a 60% discount from the amount of the consolidated fine (in this case, it will also be allowed to change the initially chosen modality of conversion of the environmental fine).

The original deadline was January 6, 2020, but it was extended to July 6. In case the defendant does not manifest an opinion on the new aspects of the regulation, tacit withdrawal of the request will occur. This will allow the authority that established the fine to continue with the environmental administrative proceeding.

The regulation on the conversion of environmental fines facilitates the resolution of administrative proceedings. However, notwithstanding the benefits herein indicated, it is important to remember that signing the respective commitment terms related to the conversion of environmental fines implies withdrawal of judicial and administrative challenges to the imposed fines and assumption of obligations that require time and investments.

- Category: Infrastructure and energy

After a broad process of regulatory review with public participation, the Brazilian National Electric Energy Agency (Aneel) identified the need to consolidate the rules regarding the obtaining of grants for alternative sources of power generation in order to simplify the procedures for submission, analysis of requirements, and management of grants.

As a result, on March 13, 2020, the agency published Normative Resolution No. 876/20, which established the requirements and procedures necessary to obtain authorization to operate wind, photovoltaic, thermoelectric, and other alternative power sources, including any request for changes in installed capacity. It also established rules for reporting the implementation of generating plants with reduced installed capacity for alternative non-hydraulic sources, such as wind, photovoltaic, and thermal power plants, among others.

On March 16, Aneel published another regulation, NR 875/20, which establishes the requirements and procedures necessary for (i) approval of hydroelectric inventory studies for hydrographic basins, (ii) obtaining authorization to operate hydroelectric power plants, (iii) reporting the implementation of hydroelectric power plants with reduced installed capacity, and (iv) approving technical and economic feasibility studies for hydroelectric power plants subject to concession.

In total, the new resolutions, in effect since April 1st, consolidate 11 normative resolutions in effect, standardizing rules, which until then were sparse, in accordance with Decree No. 10,139/19, and establish that all lower normative acts published by agencies and entities of the direct federal, instrumental, and foundational entities of the government must be reviewed in order to be consolidated.

In the case of NR 875, seven resolutions were unified concerning the preparation and approval of basic plans for Hydroelectric Power Plants (CGH), Small Hydroelectric Power Plants (SHP), and the use of hydraulic potential other than SHP, hydroelectric inventory studies, adjustment of deadlines for granting of SHPs, and granting of authorization for the use of hydraulic potential between 5 and 50 MW.

NR 876, in turn, has consolidated four normative acts that address the inclusion of the implementation schedule in authorizing acts and the granting of authorization for reduced capacity plants, wind power plants, and photovoltaic power plants.

In general, the new resolutions did not interfere with the merits of the normative acts consolidated, nor did they prejudice any potential subsequent improvements. The consolidation of the procedures was well received by players in the power sector, since the proceedings for obtaining and managing grants were simplified. The measure strengthens the legal and regulatory security of the Brazilian power sector and, consequently, favors the formation of a more secure and beneficial environment for business in the sector.