- Category: Labor and employment

On June 7, the Individual Disputes Section (SDI) of the Superior Labor Court (TST) decided to apply the three-year statute of limitations for civil suits in a suit filed by a deceased employee's family seeking damages caused by the death of the family member due to a workplace accident or occupational disease.[1]

The decision came to resolve the divergence of understandings among the circuit courts regarding the statute of limitations applicable in such cases: whether the one provided for in labor law or whether that of civil law.

According to the Justices of the SDI, in suits in which the successors seek, in their own name, moral or material damages resulting from the death of a family member due to an accident at work or an alleged occupational disease, labor rights of the former employee are not at issue, but rather the civil rights of the family members, whose injury originates in alleged wrongful acts committed by the employer of the deceased, albeit in a reflexive or indirect manner. For this reason, the statute of limitations applicable is three years, provided for in article 206, paragraph 3, item V, of the Civil Code.

On the other hand, the TST defined that, in suits in which the successors plead payment of compensation for damages caused to the deceased in the course of the employment relationship, because it is an action seeking compensation for damages suffered by the deceased, the debate is labor in nature, for which reason the position to be take is that the labor statute of limitations applies, which is two years as of the termination of the employment contract, per the terms of item XXIX, article 7, of the Federal Constitution.

With this understanding, the TST affirms that, although the jurisdiction for trying and adjudicating such suits is that of the labor courts by virtue of Constitutional Amendment No. 45/2004 and the final part of Precedent No. 392 of the Superior Labor Court, the substantive right in dispute is of a civil nature and, therefore, the statute of limitations is that provided for in civil law.

The recent decision handed down by the SDI of the Superior Labor Court points to a consolidation of the position of the highest labor court and certainly constitutes a precedent for decisions in cases similar to the one decided.

Considering that the understanding of some circuit labor courts is still that, for all matters within the jurisdiction of the labor courts, the limitations period for filing suit is the labor limitations period (two years), the recent decision by the SDI may generate impacts for the business community in similar situations that have not yet been reviewed by the Superior Labor Court.

Since this is a constitutional matter (whether or not the labor statute of limitations provided for in the Federal Constitution applies), the matter may still be discussed before the Federal Supreme Court.

1. Case No. 10248-50.2016.5.03.0165, published on June 15, 2018.

- Category: Tax

- Concept of logistics operator

According to article 1 of the ordinance, a logistic operator is considered to be a company whose economic activity is the provision of logistics services and that, predominantly, carries out the storage of goods from third-party ICMS taxpayers, with responsibility for the custody, conservation, and movement of such goods in the name and on behalf of third parties; - ICMS in the shipment of products to logistics operators

In accordance with article 5 of the ordinance, when the goods are shipped internally to a logistics operator, the depositor establishment must issue a tax invoice, which must contain, in addition to the other requirements set forth in the legislation: (a) the state registration of the logistics operator; (b) the nature of the operation: "Other Shipments - Remittance to Temporary Deposit"; (c) CFOP 5,949; (d) in the Supplementary Information field, the expression: "Shipment to Temporary Deposit - CAT Ordinance 59/2018"; and (e) highlighting of the ICMS, if the depositor establishment falls within the periodic calculation regime - RPA. - ICMS in the logistics operator's return operations

Pursuant to the terms of article 6 of the ordinance, on the occasion of the return of the goods to the depositor establishment, the latter shall issue the invoice related to the entry of the merchandise in its establishment, which shall contain, in addition to the other requirements set forth in the legislation: (a) the state registration of the logistics operator; (b) the nature of the operation: "Other Entries - Return from Temporary Deposit"; (c) CFOP 1,949; (d) in the Supplementary Information field, the expression: "Return from Temporary Deposit - CAT Ordinance XX/2018 (indicate the number of this ordinance)"; (e) highlighting of the ICMS, if the depositor establishment is included in the periodic calculation regime - RPA; and (f) an indication, in the group "Referenced Tax Document Information", of the access keys for the invoices related to the shipments for temporary storage that contain the items of the Return from Temporary Deposit. - Triangular operation (direct exit of the merchandise from the logistics operator)

Pursuant to the terms of article 7 of the ordinance, in the case of goods leaving directly from the facilities of the logistics operator to a person other than the depositor, the latter must:- issue an invoice containing, in addition to the other requirements set forth in the legislation: a) the value of the transaction; b) the nature of the operation; c) highlighting of the taxable amount, if due, if the depositor is included in the periodic calculation regime - RPA; d) indication that the merchandise will leave temporary storage - logistics operator, the address and the numbers of the state registration and CNPJ of the latter; e) indication of the number, series, and date of issue of the invoice referred to in item II;

- issue an invoice for the purposes of symbolic return from the temporary storage, observing the provisions of article 6, and explaining, in relation to the expressions contained in items II and IV of the article, that it is a "symbolic return";

- send to the logistics operator the data from the invoices referred to in items I and II, to be kept at the disposal of the Tax Authorities.

The Coordinator of the Tax Administration, in view of the provisions of article 489 of the ICMS Regulation, approved by Decree 45,490, of November 30, 2000, issues the following ordinance:

Article 1. Logistics Operators who do not carry out operations subject to ICMS, who receive goods belonging to taxpayers of said tax established in the São Paulo territory must observe, in addition to the other provisions set forth in the legislation, the provisions of this ordinance.

Sole paragraph. For the purposes of this ordinance, a Logistics Operator is considered to be a company whose economic activity is the provision of logistics services, primarily by storing goods from third-party ICMS taxpayers, with responsibility for the custody, preservation, and shipment of these goods, in the name and on behalf of third parties.

Article 2. Logistics Operators established in this State must register in the register of taxpayers of the ICMS with code 5211-7/1999 of the National Classification of Economic Activities - CNAE, through the use of the Online Collection - PGD Program of the CNPJ (CNPJ Web version) available on the website of the Brazilian Federal Revenue Service, however, in relation to the activity covered by this ordinance, the issuance and bookkeeping of tax documents and books is exempted, without prejudice to the joint and several liability provided for by law, especially in items XI and XII of article 9 of Law No. 6,374, of March 1st, 1989.

Article 3. The provision of the logistics services provided for in article 1 shall be documented by a private agreement between the depositor and depositary parties.

Paragraph 1. The depositor establishment shall prepare a monthly statement under the heading "Physical Control of Goods Stored with a Logistics Operator", which shall present at least the following information:

1 - access key, number, series, and date of the Invoices relating to the entry and exit of goods during the month; and

2 - amounts shipped for deposit, returns, and balance of stock held at the depositary establishment at the end of each month.

Paragraph 2. Logistics Operators shall maintain at the disposal of the Tax Authorities a computerized accounting and stock control system, which shall enable the monitoring of operations carried out in the manner governed in this ordinance, and shall demonstrate, in an individualized manner for each depositor, at least the following information:

1 - access key, number, series, and date of the Invoices relating to the entry and exit of goods during each month;

2 - date of actual receipt of the goods for deposit and, if applicable, the respective date of exit from the depository establishment; and

3 - amounts received for deposit, returns, and remaining balance of inventory at the end of each month.

Paragraph 3. The documents and information referred to in this article shall remain at the disposal of the Tax Authorities for the period provided for in article 202 of the ICMS Regulation, approved by Decree No. 45,490, of November 30th, 2000.

Article 4. The ICMS taxpayer that sends goods for deposit at the Logistics Operator's premises must indicate at least the following data from the contract referred to in article 3 in the book Registration of Use of Tax Documents and Model Terms:

I - the name of the company hired and the respective state registration;

II - the dates of commencement and termination of the contract.

Article 5. On the occasion of the internal shipment of merchandise destined to the Logistics Operator, the depository establishment shall issue an Invoice, which shall contain, in addition to the other requirements set forth in the legislation:

I - the state registration of the Logistics Operator;

II - the nature of the operation: "Other Exits - Shipment for Temporary Deposit";

III - CFOP 5,949;

IV - in the field Supplementary Information, the expression: "Shipment for Temporary Deposit - CAT Ordinance XX/2018 (indicate the number of this ordinance)";

V - highlighting of the ICMS, if the depositor establishment falls within the periodic calculation regime - RPA.

Sole paragraph. In the event that a depository establishment that collects ICMS under the simplified tax regime, taxation shall occur only on the exit referred to in article 7, in accordance with what is set forth in paragraph 1 of article 3 of Complementary Law No. 123, of December 14th, 2006.

Article 6. Upon the return of the goods to the depositor establishment, the latter shall issue an invoice relating to the entry of the merchandise in its facilities, which shall contain, in addition to the other requirements set forth in the legislation:

I - the state registration of the Logistics Operator;

II - the nature of the operation: "Other Entries - Return from Temporary Deposit";

III - CFOP 1,949;

IV - in the field Supplementary Information, the expression: "Return from Temporary Deposit - CAT Ordinance XX/2018 (indicate the number of this ordinance)";

V - highlighting of the ICMS, if the depositor establishment falls within the periodic calculation regime - RPA.

VI - indication, in the “Referenced Tax Documents Information" group, of the access keys of the Invoices related to the shipments for temporary deposit that contain the items of the Return from Temporary Deposit.

Paragraph 1. In the case of a depository establishment within the periodic calculation regime - RPA, it may be credited with the amount of the tax levied in the operations referred to in article 5, in the same period of calculation in which the return of the merchandise occurs.

Paragraph 2. In the event of a depository establishment that collects ICMS under the simplified tax regime, taxation shall occur only on the exit referred to in article 7, in accordance with what is set forth in paragraph 1 of article 3 of Complementary Law No. 123, of December 14th, 2006.

Article 7. In the event of exit of goods directly from the Logistics Operator's facilities to a person other than the depositor, the latter must:

I - issue an Invoice containing, in addition to the other requirements set forth in the legislation:

a) the value of the operation;

b) the nature of the operation;

c) highlighting of the amount of the tax, if due, if the depositor is included in the periodic taxation regime - RPA;

d) indication that the merchandise shall leave temporary deposit - Logistics Operator, the address and the state registration and CNPJ numbers of the latter;

e) indication of the number, series, and date of issue of the Invoice referred to in item II;

II - issue an Invoice for the purposes of symbolic return from temporary deposit, observing the provisions of article 6, and explaining, in relation to the expressions contained in items II and IV of said article, that it is a "Symbolic Return";

III - to send to the Logistics Operator the data from the Invoices referred to in items I and II, to be kept at the disposal of the Tax Authorities.

Paragraph 1. The merchandise shall be accompanied in its transportation by the Invoice provided for in item I of the head paragraph.

Paragraph 2. In the event that a depository that collects ICMS under the national simplified tax regime, the operation referred to in item I shall be included in the calculation basis for purposes of taxation under said regime.

Article 8. The Invoice referred to in article 6 or item II of article 7, as the case may be, shall be registered by the depository in the book Registration of Entries, according to the terms established in the legislation.

Article 9. In the internal exit of merchandise for delivery to the Logistics Operator, in the name of and to the account and order of the acquiring establishment, both located in this State, the acquiring establishment shall be considered the depositor, and the sender must issue an Invoice, which shall contain, in addition to the other requirements set forth in the legislation, the following information:

I - as addressee: the acquiring establishment;

II - as place of delivery: the establishment of the Logistics Operator, therein stating the company name, address, and state of registration and CNPJ;

III - highlighting of the ICMS.

Paragraph 1. The acquiring institution (depositor) shall:

1 - register the Invoice referred to in the head paragraph in the book Registration of Entries;

2 - issue an Invoice regarding the symbolic exit to the Logistics Operator, with emphasis on the tax, also stating the number and date of the tax document issued by the sender.

Paragraph 2. The acquiring establishment (depositor) and the Logistics Operator shall observe, as appropriate, the other provisions of this ordinance.

Paragraph 3. The credit of the tax, when applicable, shall be granted to the acquiring establishment (depositor).

Article 10. This ordinance shall enter into force on the date of its publication.

- Category: Tax

Considering the changes made, ICMS Convention No. 190/17 will become effective with the following deadlines to be observed by the states and ICMS taxpayers:

December 28th, 2018 - for publication of normative acts not in force on August 8th, 2017.

July 31st, 2019 - for Confaz to be able to postpone, in specific cases and subject to the quorum of a simple majority, the compliance with the requirement of publication of the previous normative acts. The request by the applicant state must be accompanied by an identification of the normative acts covered by the application, as indicated in the model contained in the Sole Annex to ICMS Convention No. 190/17.

August 31st, 2018 - for registration and deposit in Confaz of the acts in force on the date of registration and deposit.

July 31st, 2019 - for registration and deposit in Confaz of acts not in force on August 8th, 2017.

December 27th, 2019 - for Confaz to be able to postpone, in specific cases and subject to the quorum of a simple majority, the compliance with the registration and deposit of the previous acts. The request by the applicant state must be accompanied by supporting documentation that is related to the acts granting the tax benefits.

ICMS Convention No. 51/18 also validates acts of registration and deposit made in the period from June 30th, 2018 until the date of its entry into force.

The seventh section of ICMS Convention No. 190/17 was also amended to exclude the obligation of states to provide information and documents related to operations and installments provided by tax benefits, as well as the economic segment, activity, merchandise or service whose tax benefit was provided (respectively, items XII and XIII of the original version of the ICMS Convention No. 190/17).

- Category: Labor and employment

The National Congress has the prerogative of disciplining legal relations arising from Presidential Decree No. 808/2017 by means of a legislative decree. If a decree is not published, the legal relationships established and arising from acts performed during the validity of Presidential Decree No. 808/2017 will continue to be governed by it.

However, on April 23, 2018, due to the loss of effectiveness of the Decree, the text of the Labor Reform approved in 2017 by the National Congress came back to full force.

DOWNLOAD A TABLE COMPARING THE MAIN POINTS AMENDED BY THE LABOR REFORM

- Category: Labor and employment

Since the Labor Reform came into force in November of 2017, the number of lawsuits filed with the Labor Courts to question the mandatory discounting of union contributions has almost tripled. Between December of 2017 and May of 2018, according to information released by the Superior Labor Court (TST), 15,551 actions involving union contribution were filed. The amount is 161% higher than in the period from December of 2016 to May of 2017, when 5,941 suits were filed on the subject.[1]

On June 29, however, the Federal Supreme Court settled the legal uncertainty regarding the subject and understood the constitutionality of the changes that made the union contribution optional.

The decision was reached during the judgment of Direct Action of Unconstitutionality (ADI) 5.794 - filed by the National Confederation of Workers in Waterway and Air Transport, Fishing and Ports (Conttmaf) on October 16, 2017 - of the Declaratory Action of Constitutionality (ADC) 55, and of eighteen other ADIs with the same subject-matter.

In ADI 5,794, Conttmaf requested the declaration of unconstitutionality of article 1 of Law No. 13,467/17, which amended the rules set forth in articles 545, 578, 579, 582, 583, 587, and 602 of the Consolidated Labor Laws (CLT), thus making union contributions optional and making their payment conditioned on the express authorization of the workers.

ADC 55 was filed by the Brazilian Association of Radio and TV Broadcasters (Abert) on May 29, 2018, and defended the constitutionality of the changes promoted by the Labor Reform regarding the end of the mandatory payment of union contributions.

The judge who drafted the opinion on ADI 5,794, Justice Edson Fachin, opined that the action to declare the formal and substantive unconstitutionality of the legislative amendment that made it optional to collect union contributions was valid. He based his decision on four main arguments:

- Due to its tax nature, union contributions would be subject to a general rule of tax law. Thus, it would be necessary to enact a complementary law to change it, and the amendment promoted by ordinary law by the Labor Reform is not valid;

- The end of the mandatory payment of the union contributions would deinstitutionalize the main source of funding for trade unions;

- Due to the destination specified by law, already 10% of the amount collected is allocated to the Special Employment and Wage Account which is the basis of the FAT, the union contribution constitutes public revenue, which is why amendment of the legislation would violate article 113 of the ADCT and would imply tax waiver by the Federal Government; and

- The legislative amendment would cause the union framework recognized by the Federal Constitution of 1988, which prioritized full and compulsory trade union activity (union unity, mandatory representation, and funding of trade union units via a contribution of a tax nature), and would condemn the entities to bankruptcy due to lack of a source of funding.

Justice Luiz Fux dissented from the reporting judge and voted for the dismissal of the ADIs and for granting relief to the ADCs, due to the formal constitutionality of Law No. 13,467/17. In short, his arguments were that the union contribution is not a tax, since it does not contemplate general rules of tax law and, therefore, does not have to be changed by means of a complementary law. According to the justice, the rule that establishes the need for a specific law for cases of tax credit exclusion, established by article 150, paragraph 6, of the Federal Constitution of 1988, provides an exhaustive list that would not apply to this case.

Regarding the substantive constitutionality of the amendment promoted by the Labor Reform, Justice Luiz Fux was of the position that:

- there is no violation of the principle of tax isonomy, since the criterion is homogeneous and egalitarian as it requires the prior authorization of any or all workers in order to collect the union contribution;

- since it is not a tax, the rules on limitations on the power to tax would be excluded;

- the lack of a constitutional provision for compulsory contribution is the cause of the proliferation of trade union entities in Brazil, which was supposedly corrected by the ordinary legislator with the enactment of the Labor Reform; and

- the compulsory union contribution goes against the constitutional provision of freedom of association and expression.

In addition, regarding the effect of the decision on the financial health of trade unions, the justice argued that unions have various forms of funding, such as the contributions provided in assemblies of the category of workers or in collective bargaining agreements, confederation contributions, and assistance contributions provided for in article 513-E of the Consolidated Labor Laws.

Justices Rosa Weber and Dias Toffoli concurred with the opinion by the reporting judge. Justice Rosa Weber based her vote that the ADIs were valid on the existence of a hybrid nature of the Brazilian trade union system (union unity versus freedom of association) and on the damage to the performance and existence of unions, which would weaken the defense of workers' rights and interests.

Justice Dias Toffoli emphasized the tax and compulsory nature of union contributions and voted to grant relief to the prayers for relief lodged in the ADIs so as to declare the unconstitutionality of the provisions questioned.

They accompanied the dissent raised by Justice Luiz Fux, Justices Alexandre de Moraes, Luís Roberto Barroso, Marco Aurélio Mello, Gilmar Mendes, and Carmen Lúcia, who voted for dismissal of the ADIs and the constitutionality of the Labor Reform in relation to the optional nature of the union contribution.

In his vote, Justice Alexandre de Moraes prioritized the application of the principles of freedom of union association and individual freedom of association and highlighted the existence of a trade union representation deficit in the country, noting that Brazil has more than 16,000 unions and that only 20% of workers are unionized. He added that this stems from the fact that compulsory union contributions are very comfortable for trade unions, which should seek greater representativeness.

Justice Luís Roberto Barroso highlighted the application of the associative union system permeated by freedom of association, and workers can choose whether or not to associate or not to contribute to unions. Justices Barroso and Fux cited in their votes ADI No. 5,522, the objective of which was to declare unconstitutional the rule set forth in article 47 of the Statute of the Brazilian Bar Association, and which was dismissed, thus exempting attorneys from the union contribution due to the fact that they already contribute to the Brazilian Bar Association (OAB).

Justice Marco Aurélio Mello stressed that union contributions do not have the nature of a tax and that the declaration of constitutionality of the change promoted by Law 13,467/2017 would encourage unions to be more efficient and have more members. Justice Gilmar Mendes highlighted the model of free union association elected by the Federal Constitution and that the amendment does not seek the abolition of unions, but only their self-financing and greater efficiency.

With the opinion of Justice Carmen Lúcia, the STF en banc, by a majority vote (6x3), ruled constitutional the changes promoted by Law No. 13,467/2017, which made union contributions optional.

- Category: Banking, insurance and finance

Legal entities and investment funds incorporated in Brazil must submit a report to the Central Bank of Brazil, detailing investments in their quotas and/or shares held by foreign investors, or the outstanding short-term trade debts owed to non-residents, on December 31 of the previous fiscal year, in the following situations:

(a) legal entities must submit this report when, on December 31, 2017, they had a net worth equivalent to or in excess of one hundred million US dollars (USD 100,000,000.00), and, simultaneously, any direct ownership held by non-resident investors in their capital stock, regardless of the amount;

(b) legal entities must submit a report with respect to their current liabilities with non-resident lenders by means of debt instruments when, on December 31, 2017, they had an outstanding balance in short-term trade debts (due within 360 days) equivalent to or in excess of ten million US dollars (USD 10,000,000.00), regardless of any foreign equity ownership in their capital stock; and

(c) investment funds must submit a report when, on December 31, 2017, they had a net worth equivalent to or in excess of one hundred million US dollars (USD 100,000,000.00) and, simultaneously, quotas directly held by non-resident investors, regardless of the amount.

The reporting obligation mentioned above does not apply to the following persons and administrative bodies:

(a) individuals;

(b) direct administrative bodies of federal, state, Federal District, and municipal governments;

(c) legal entities who are debtors in the transfer of foreign loans granted by institutions headquartered in Brazil; and

(d) nonprofit entities maintained by the contributions of non-residents.

The report must be electronically submitted to the Central Bank through the website www.bcb.gov.br between July 2, 2018 and 6 PM on August 15, 2018.

The manual containing detailed information on the content and requirements of the report is available on the same website.

Those responsible for this report must store the supporting documentation for a period of five (5) years, counted as of the base date of the report, available for submission to the Central Bank upon request.

Failure to submit the report, or submitting a report that does not comply with the applicable regulations, subjects the violator to a fine of up to two hundred and fifty thousand Brazilian Reais (R$250,000.00), pursuant to article 60 of BCB Circular No. 3,857, of November 14, 2017.

(BCB Circular No. 3,795, of June 16, 2016, Law No. 13,506, of November 13, 2017; and BCB Circular No. 3,857, of November 14, 2017).

- Category: Intellectual property

The plenary session of the Senate approved on Tuesday, July 10, Bill of Law (PLC) No. 53/2018, which deals with the protection of personal data. The text is now proceeding for signature by the president of Brazil and, if signed, Brazil will have a data protection law in force 18 months after its publication in the Official Gazette.

Waited for a long time, the new law will put Brazil at a level similar to that of developed countries. We highlight below some points of the new legislation.

Main concepts employed, which deal with the scope of application of the rules and the individuals and legal entities covered by the new framework:

Personal data: any information related to an individual (a natural person) that can be identified based on the data collected. This is the central concept of the new legislation whose purpose is to protect the privacy of owners of personal data that is being processed.

Data subject: an individual (natural person) to whom the personal data subject to processing refers.

Processing: is any operation performed with personal data, such as collection, use, processing, storage, and deletion.

Controller: an individual or legal entity responsible for decisions concerning the processing of personal data.

Application: the new legislation applies to individuals or legal entities, private or government entities, who process personal data in Brazil or collect data in Brazil or, further, when the processing has the purpose of offering or supplying goods or services to data subjects located in Brazil.

Scenarios for processing: the processing of personal data can only be carried out in one of the following scenarios: (a) based on the consent of the data subject of the personal data; (b) when it occurs to fulfill a legal or regulatory obligation on the part of the controller; (c) by the public administration, for the execution of public policies; (d) by research bodies, to carry out studies; (e) where necessary for performance under a contract or preliminary procedures for a contract to which the data subject is a party, at the request of the data subject; (f) for the regular exercise of rights in judicial, administrative, or arbitration proceedings; (g) for the protection of the life or physical safety of the data subject or a third party; (h) for protection of health, with procedures performed by health professionals or by health entities; (i) when necessary to meet the legitimate interests of the controller or a third party, except in the event that the fundamental rights and freedoms of the data subject of the personal data that require the protection of personal data prevail; or (j) for the protection of a debt claim.

Children and adolescents: In the case of processing of personal data of children and adolescents, there should be specific and clear consent given by at least one parent or legal guardian.

Rights of data subjects: the new legislation establishes the following rights of data subjects: (a) to obtain information about the existence of processing of their personal data; (b) to access their personal data; (c) to correct incomplete, inaccurate, or outdated personal data; (d) to have unnecessary or excessive personal data or personal data processed in contravention of the legislation anonymized, blocked, or deleted; (e) to carry out portability of personal data to another provider of a service or product (that is, to have someone who holds their personal data transfer it to a third party, at the request of the data subject); (f) to delete their personal data processed on the basis of their consent (that is, the right to revoke their consent given earlier); (g) to obtain information on the public and private entities with which the controller has shared the data subjects' personal data; and (h) to obtain information about the possibility of not giving consent to the processing of their personal data and the consequences of such denial.

International transfer of data: the transfer of personal data outside the territorial limits of Brazil shall be allowed only in the cases provided for by law, including: (i) to countries that provide a degree of protection of personal data equal to that provided for by Brazilian law; (ii) when the transfer is necessary for the protection of the life or physical safety of the data subject or a third party; or (iii) when the data subject has given specific and clear consent to the transfer. Accordingly, controllers should take extra precautions when they transfer personal data, including upon hiring IT service providers who may store data in other countries and thus may violate the rules governing international transfer of data.

Person responsible for the processing of personal data: controllers must appoint a person responsible for the processing of personal data, whose main functions shall be to respond to complaints and requests from data subjects; to receive communications from the national data protection authority (described below); and to take the steps necessary, as well as to guide employees and contractors regarding practices related to the protection of personal data.

Penalties: Among other penalties, the law provides for penalties of up to 2% of the billing of the private legal entity, group, or conglomerate in Brazil in its last fiscal year, excluding taxes and limited to a total of R$ 50 million per infraction. Following the model of the European General Data Protection Regulation (GDPR), the new legislation established fairly stringent penalties, which emphasize the importance of the subject.

Creation of a National Data Protection Authority: The law creates the National Data Protection Authority, whose main function shall be to protect personal data.

In the coming months, people who process personal data subject to the new law, especially Brazilian companies, should take a number of measures to ensure compliance with the new legislation. These include the implementation of appropriate corporate policies, the hiring of information technology resources, and the training of personnel both to respect the rights of personal data subjects (usually customers, employees, and other contractors) and to avoid the penalties provided for.

- Category: Real estate

The Special Body of the São Paulo State Court of Appeals (TJSP) amended a preliminary injunction that had suspended the effects of article 162 of Municipal Law No. 16,402/14 (São Paulo’s Land Subdividing, Use, and Occupancy Law) and restrained almost two thousand cases of licensing for construction projects, activities, and buildings filed under the previous legislation, which caused serious and irreparable harm to the city’s economy and to the industry’s legal certainty. With the decision by the Special Body, the more than 1,900 cases found in this situation (according to the city government, and disregarding those currently being examined by the regional city governments and departments) can resume their normal progress immediately.

Although preliminary, the decision represents a relief for the real estate market, which was experiencing a situation of uncertainty and legal insecurity since February of this year, after a preliminary injunction was granted in a Direct Action of Unconstitutionality (ADIn) brought by the Public Prosecutor of the State of São Paulo by its Attorney General, so as to declare the incompatibility of the so-called "right of filing" with São Paulo´s State Constitution. Set forth in article 162 of Municipal Law No. 16,402/16, the right of filing guarantees that construction license applications will be subject to the legislation in force on the date of their filing with the Municipality of São Paulo, even if supervening laws modify the rules applicable to the land. The contested legal provision aimed precisely at avoiding the frequent conflicts involving the effectiveness of a new law and the validity of the legal relations previous established. It is therefore an example of a rule of transition, with the primary purpose of providing legal certainty and stability for the relations between private individuals and the Public Power.

Grounds for the petition

For the Public Prosecutor's Office, article 162 conflicts with the fundamental right to an ecologically balanced environment, provided for in the Federal Constitution (article 225, paragraph 1, item III), and with the principle of the prohibition of social and environmental retrogression established in the State Constitution (articles 111, 144, 180, items III, IV, and V, 191, 192, and 196). Therefore, the maintenance of the right of filing in Special Environmental Protection Areas would cause individual and private interests to prevail over environmental protection.

In spite of this reasoning, in the order granting the preliminary injunction, Judge Evaristo dos Santos did not make reference to the comprehensiveness of such measure, whether it applies only to lands included in Zepam (Special Environmental Protection Zone), with respect to which the Public Prosecutor’s Office alleges current zoning law should prevail, or whether it is indiscriminately applicable to the more than 1,900 administrative licensing cases filed with São Paulo´s City Government by the date of publication of Municipal Law No. 16,402/16 that have not yet been decided. As a direct result of this decision, the São Paulo City Government had paused all of these proceedings precisely because of the uncertainties arising from the concession of the preliminary injunction.

The petition also appears to have the pretext of curbing allegedly abusive conduct by certain players in the real estate market regarding the right of filing. The Public Prosecutor's Office made indiscriminate use of a legal instrument effective against all, namely the Direct Action of Unconstitutionality, which, in the event it is granted the relief sought, will cause harm even to those who exercised the right of filing in good faith under the purview of a legitimate expectation, and those who acquired the right to have their projects reviewed according to the law in force at the time of the filing (under a presumption of constitutionality), which had never before been challenged .

If existing legislation and case law on the subject were not enough, which restrict the cases in which the right of filing is applicable precisely to prevent its abusive use, the fight against alleged abusive conduct must be done on a case-by-case basis, taking into account individual circumstances, since, otherwise, all those who have legitimately exercised the right of filing will be penalized without differentiation. There is no past unconstitutionality of filings submitted in a lawful manner and pursuant to the legislation then in force. To admit what the Public Prosecutor's Office alleges in this action is to ignore an accrued right and to disregard legal certainty, which cannot be admitted under the rule of law.

The effects of the decision

The written opinion of the winning vote was brief and objective, ruling out from the present case the necessary, essential, and cumulative requirements that legitimize the granting of an injunction, since it found that periculum in mora [danger in delay] was absent since the zoning law had been promulgated in March of 2016, which, therefore, had been more than one year and one day prior.

Although the decision was reviewed in a summary and non-exhaustive manner, the Special Body did, to some extent, anticipate a discussion of the merits, which may be indicative of its position in this regard. In this sense, the prevailing opinion that granted relief to the appeal highlighted that, at the moment, it could not be assumed that filings submitted before Municipal Law No. 16,402/16 was enacted, carried out in accordance with the now repealed municipal legislation, contained an error of unconstitutionality. For that reason, it was understood that the restriction imposed as a result of the suspension of the right of filing was disproportionate, to the detriment of legal certainty and the protection of the legitimate expectations of the parties affected.

Even if this preliminary indication is not confirmed in a final decision on the merits and the TJSP, contrary to what was indicated by the Special Body, decides to rule article 162 unconstitutional, any decision that accepts the Public Prosecutor’s prayers for relief in the scope of the Direct Suit of Unconstitutionality will have to properly modulate the effects of the suspension of the right of filing as a result of the revocation of article 162. It will be necessary to consider its temporal aspects (ex tunc effects, that is, before the decision, or ex nunc, as of the decision) and the comprehensiveness of its scope with regard to the merits, as to its location (whether it will only cover projects located in environmental protection zones) and as to its different stages of the administrative licensing processes (only processes in their initial stage, without any decision issued, or also those that already have an approval certificate issued or even those that already have an occupancy permit and are in an advanced stage of construction, for example), for reasons of legal certainty and exceptional social interest.

Currently, the São Paulo Municipal Government has resumed its review of processes filed before the publication of Municipal Law No. 16,402/16, thus respecting the right of filing and applying the legislation in force at the time of the filing. However, it is expected that the reporting judge will continue the normal course of the suit and that the Public Prosecutor’s Office will file an appeal. Based on current indications, even due to an express demonstration by the Special Body itself in the decision that accepted the appeal, as well as dealing with an essentially legal matter, a final outcome for the Direct Suit of Unconstitutionality should not take long to come about, at least from the TJSP. It is worth remembering, however, that appeals to the higher courts may also be filed.

- Category: Labor and employment

Several countries have already adopted some new types of arrangements. Examples are the zero-hour contracts in the UK, the lavoro intermittente established by Italian legislation and the minijobs in Germany. Similar working arrangements are also found in Ireland, Netherlands, Switzerland, and others.

In Brazil, the recent Labor and Employment Reform (Law No. 13,467/2017), which was approved by the Brazilian National Congress on July 2017 and came into effect on November 2017, implemented several changes and updates to Brazilian labor and employment laws.

Most of these changes and updates aimed at modernizing Brazilian legislation, increasing the level of legal certainty in labor relations and creating new jobs and working arrangements.

In this context, and following the global trend of new flexible working arrangements, one of the most important updates implemented by the Brazilian Labor and Employment Reform was the introduction of a new type of contract that allows the engagement of individuals under an employment relationship: the intermittent contract of employment.

According to the recently enacted law, intermittent contracts of employment are those through which individuals are engaged under an employment relationship to render services under a non-continuous basis, in alternate periods of work and inactivity that may be determined by hours, days or months, regardless of the activities of the employer or the employee. Only aircrew personnel cannot be engaged under intermittent contracts of employment.

These legal definition guarantees to individuals working under intermittent contracts of employment the status of employees and employment and social security protection.

From an employment perspective, the employee’s hourly salary cannot be lower than the minimum hourly wage or than the hourly salary of other employees of the company who work in the same position pursuant to an intermittent or regular employment contract. At the end of each service period, employees must immediately receive the respective salary and pro-rata labor and employment rights, such as (ii) proportional vacation payments; (iii) proportional 13th salary; (iv) the paid weekly rest; and (v) mandatory legal allowances, if any.

In addition to that, employers are required to collect employment charges and social security contributions on the amounts paid to intermittent employees on a monthly basis.

From a social security standpoint, the intermittent nature of the services does not automatically exclude intermittent employees from social security coverage. In order to maintain this coverage and avoid gaps in contributory periods, they may voluntarily collect social security contributions whenever they receive less than a minimum monthly wage for working few hours in a given month.

In fact, one of the main purposes of the Government by introducing this new form of flexible working engagement was the creation of a type of employment contract that would allow employers to engage individuals under an employment relationship to provide intermittent services, while also ensuring employment and social security protection to workers.

According to the Government’s expectations and estimates, this new form of flexible engagement will allow the creation of new formal jobs by bringing under the coverage of employment laws workers who currently are under precarious types of engagement simply because the nature of their work did not fit into a regular full-time employment contract.

From the employer’s perspective, this new form of flexible engagement without any guarantee of minimum work or pay was especially desired by the services and retail sectors, which have peaks of demand linked to specific events or periods of the year.

As introduced by the Brazilian Labor and Employment Reform, however, this new flexible working arrangement not only is good to employers but also addresses employees’ needs.

In this sense, from the employees’ perspective, although the law does not establish a minimum number of work hours per month nor requires the payment of a minimum monthly allowance or salary, intermittent contracts of employment gives them flexibility because they do not require availability from employees. Therefore, employees may freely execute several simultaneous intermittent contracts of employment and adjust their working schedule as they see fit, by refusing work calls when they have already accepted to work for a certain employer or if they simply do not feel like working on a certain day.

This gives especial flexibility to individuals who want to enter the workforce and start having their own income but also have other activities – for example, college students who need to conciliate their working schedule with studies and classes. Thus, although employers may call employees when they need their services, employees may also freely deny work calls.

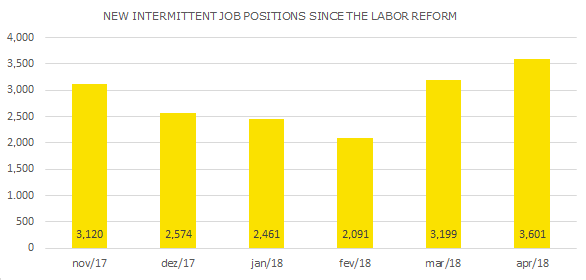

According to official data from the Labor Ministry (Caged), between November 2017 (when the intermittent contract of employment was introduced) and April 2018, 17,046 job positions were created under this type of contract, as follows:

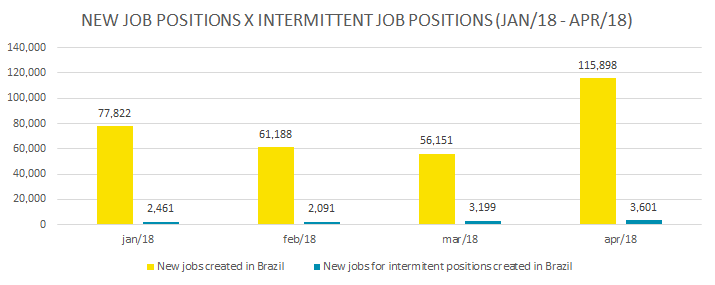

Since the beginning of this year, 3.6% of the new jobs in Brazil were created under an intermittent employment contract:

Of course, although we may see some restrictions and resistance from certain labor unions and authorities, the numbers above indicate that intermittent employment contracts have been consistently adopted by companies and employees in Brazil.

The way the Brazilian Reform structured the contract for intermittent employment not only guarantees employment and social security protection to employees but also allows both employers and employees to create flexible working schedules, as they need.

The intermittent employment contract, as implemented by the Brazilian Labor and Employment Reform, not only addressed an old agenda of companies doing business in Brazil but also was a big step for Brazil to update its labor and employment laws in line with the most modern trends seen across other countries.

- Category: Corporate

Publicly-held companies registered in category A of the Brazilian Securities and Exchange Commission (CVM) that submitted the Reference Form without completely filling in item 13.11 of Exhibit 24 of CVM Instruction No. 480/09 (ICVM 480) must resubmit the document including the information required regarding the remuneration of their officers and directors by June 25, 2018.

The instructions are contained in Circular Letter No. 4/2018, published by the CVM on June 13, based on article 57 of ICVM 480. Representatives of the companies responsible for providing this information that do not comply with the requirement set forth in the official letter are subject to possible liability.

The release of the official letter was done after the victory obtained by the CVM in the Federal Circuit Court of Appeals of the 2nd Circuit (TRF-2) in relation to the requirement to disclose the minimum, maximum, and average salary of members of the management of publicly-held companies associated with the authority.

In a ruling issued on May 23, the TRF-2 granted the appeal filed by the CVM against the trial judgment in favor of the Brazilian Institute of Finance Executives - Ibef of Rio de Janeiro, which prevented the authority from requiring the disclosure, as provided for in item 13.11 of the Reference Form.

ICVM 480, which instituted the Reference Form, obliged publicly-held companies to disclose a series of fairly detailed pieces of information regarding the amount and composition of management compensation. Among the rules that most caused controversy when the instruction came into force is the rule that provides that the issuer should indicate, for the last three fiscal years, the minimum, maximum, and average amount of the individual remuneration of the members of the board of directors, of the board of executive officers, and of the audit committee.

At the time, Ibef filed an application for injunctive relief against the requirement to disclose the remuneration in the terms requested by the rule, therein alleging, in particular, an affront to provisions of the Brazilian Corporations Law and the officers and directors’ right to privacy. The entity also alleged that there would be risks to the safety of the officers and directors as a result of the disclosure of the information requested. The trial judgment fully accepted Ibef's arguments and concluded that the Brazilian Corporations Law had been violated and expressly cited the issue of safety as one of the reasons for the non-mandatory nature of the disclosure in the terms required by ICVM 480.

The decision by the TFR-2 that revoked the injunction was reached by 3 votes to 0. The court recognized that the rule of ICVM 480 does not violate the Brazilian Corporations Law and that individual rights to intimacy and privacy cannot override the public interest, and publicly-held companies must comply fully with the regulatory standards to which they are subject, in view of the interest of the investing public in general. In relation to safety, the judges were of the understanding that this is a question that afflicts the Brazilian population in a generalized manner. According to them, there is evidence that disclosure of information on the compensation of other public servants did not contribute to an increased risk of violence. Ibef will still appeal the ruling, but the application of the rule became valid immediately.

- Category: Capital markets

A few months after Law No. 13,506/2017 coming into force and a broad debate with various market participants, the Brazilian Securities and Exchange Commission (CVM) submitted for public hearing a draft new instruction that will regulate its sanctioning activity, therein adapting it to the new legislation. Comments can be presented until August 17, 2018.

The draft instruction provides more clarity about CVM’s sanction proceedings, and creates clear and objective criteria for measuring penalties provided for in Law No. 13,506.

The CVM will use the draft instruction in order to consolidate into a single norm the agency’s own scattered rules on the same topic. Upon consolidation, CVM Resolutions 390/2001, 538/2008, and 542/2008, as well as Instruction No. 491/2011, will be revoked.

Law No. 13,506 was published in November 2017 and provides for administrative sanction proceedings in the areas of activity of the Central Bank of Brazil (BCB) and the CVM. On the same date, the BCB published Circular No. 3,857, regulating the new law and setting forth procedures for administrative sanctions under purview of the BCB (see more details in this article).

Among the main innovations of Law No. 13,506, we highlight the increase in the ceiling of fines that can be imposed by the BCB and the CVM, the express provision for the possibility of substitution of the administrative sanction proceedings by other means of supervision, the introduction of the administrative settlement in a supervisory proceeding (also known as the leniency agreement), as well as rules on the procedure for the determination of infractions and procedural rules, judgments, and production of evidence, appeals, simplified proceedings, and consent orders. These improvements were considered reinforcement of the regulatory instruments that can be used by the BCB and the CVM in the exercise of their supervisory and sanctioning functions in the financial and securities markets.

Below, we highlight some of the main topics proposed in the draft CVM instruction.

Determination of administrative infractions. The proposal for the initiation of an administrative inquiry should be submitted by the superintendencies to the General Superintendency (SGE), which may formulate an indictment or propose the initiation of an administrative inquiry. The administrative inquiry will be conducted by the Sanction Proceedings Superintendency (SPS), together with the Specialized Federal Prosecutor's Office (PFE), within 180 days from the date of filing, subject to extensions. Thereafter, the SPS and PFE will file an indictment or propose to the General Superintendency that the inquiry be closed when there is insufficient evidence to formulate an indictment, there is no persuasion as to the commission of the infraction, or in the event that the statutes of limitations have run. As an alternative to the initiation of a sanction proceeding, the CVM shall have the option to apply a preventive and guiding proceeding, observing the following criteria proposed in the draft instruction, among others: (i) the degree of reprehensibility or repercussion of the conduct, (ii) the significance of amounts associated or related to the conduct, (iii) the significance of the harm, even if only potential, to investors and other market participants, (iv) the impact of the conduct on the credibility of the capital markets, (v) the prior history of the persons involved, (vi) the good faith of the persons involved.

Application and measurement of penalties. Among the changes mentioned above, we highlight the adoption of parameters and procedures for measuring penalties. Law No. 13,506 modified the limits of fines, which may not exceed: (i) R$ 50 million; (ii) twice the value of the offering or irregular transaction; (iii) three times the amount of the economic advantage obtained or the loss avoided as a result of the illegal act; or (iv) twice the loss caused to investors as a result of the unlawful act. Law No. 13,506 also establishes that the fine applicable by the CVM may be tripled in cases of recidivism or in the event of combination of penalties. In this sense, the CVM established in the draft instruction objective criteria and procedures that should be observed in the measurement of penalties: (i) setting the base penalty (which should take into account the seriousness of the conduct and the economic capacity of the offender); (ii) application of aggravating[1] and mitigating[2] circumstances, which may result in an increase or reduction of 10% to 20% of the base penalty for each circumstance found; and (iii) the application of a cause for reduction of a penalty, which may reduce it from one to two thirds if the financial damage to investors or minority shareholders is fully repaired before a judgment on the proceeding at the trial level. In an exhibit to the draft instruction, the CVM will divide the penalties into five groups according to severity, varying from R$300 thousand to R$20 million.

Consent order. The CVM may conclude a settlement to close the sanction proceeding, without confession as to the matter of fact or acknowledgment of the illegality of the conduct. The interested party must express its intent to conclude a settlement within the deadline for the presentation of a defense, therein undertaking to cease the practice of activities or acts considered illegal, if any, and to correct the irregularities alleged, including by paying compensation for the individualized damages or diffuse or collective interests within the securities market. The Consent Order Committee (whose composition and operation will be disciplined later) shall deliberate on the proposal for the consent order for a maximum period of 30 days, considering, among other elements, the opportunity and appropriateness of entering into the settlement, the nature and the seriousness of the offenses in question, the prior history of the accused or investigated or their good faith collaboration, and the actual possibility of punishment in the specific case. Unlike BCB Circular No. 3,857, which prohibited the BCB from entering into consent orders in cases of certain serious infractions, the draft instruction contains no express prohibition on consent orders according to the types of infraction.

Supervisory settlement. The supervisory settlement is a mechanism introduced by Law No. 13,506 in the scope of the CVM's administrative sanction proceedings, thereby reinforcing the regulatory mechanisms that can be used by the CVM in the supervision of the securities market. The supervisory settlement will have a similar function to leniency agreements, and does not affect the performance or legal prerogatives of the Public Prosecutor's Office or other public entities, such as the BCB and the Administrative Council for Economic Defense (Cade), within the scope of attributions or competencies of these agencies (with which the CVM will seek to establish coordinated action).

Supervisory settlements may be proposed at any time up to the judgment at the trial level and kept confidential until all the accused are tried. It will be the responsibility of the Supervisory Settlement Committee (whose composition and functioning will be governed later) to evaluate the admissibility of the proposed settlements, therein responding within 30 days from the submission of the proposal and extendable for the same period. Once the settlement is concluded, with an express confession to participation by its signatories in an unlawful act, the following effects will be granted: (i) extinction of the punitive action by the public administration, in the event that the proposal was submitted without the CVM’s prior knowledge of the infraction reported, or (ii) a reduction by one-third to two-thirds of the penalties applicable in the administrative sphere, in the event that the CVM has prior knowledge of the infraction reported. If the proposed supervisory settlement is rejected, there will be no confession as to the matter of fact, nor acknowledgment of the illegality of the conduct that is the object of the proposal, of which no disclosure shall be made.

Effects of appeals to the CRSFN. The draft instruction establishes that appeals to the National Financial System Board of Appeals against a decision that imposes penalties of a warning or fine shall suspend the applicable sanctions until final judgment, while decisions with temporary disqualification, temporary prohibition, or suspension of authorization or registration shall apply immediately, and the accused shall be entitled to request suspension of sanctions to the board within 10 days counting from the notice of the decision.

A controversial point of the draft instruction is the possibility, provided for in article 70, that the CVM may “prohibit the accused from entering into contracts with official financial institutions for a period of up to five (5) years and from participating in bids for the acquisition, sale, and concession of public construction and services, within the scope of the federal, state, district, and municipal public administration and the entities of the indirect public administration.” With the same wording of its supporting Law No. 13,506, article 70 has been challenged by market participants and legal scholars since it exceeds the legal mandate of the CVM, which is to regulate and supervise the capital market, and not regulate the public administration generally.

[1] These are aggravating circumstances, according to article 67: (i) recidivism, if it was not considered in the establishment of the base penalty; (ii) systematic or repeated practice of irregular conduct; (iii) great prejudice caused to investors or minority shareholders; (iv) express advantage gained or intended by the offender, provided that the base penalty was not fixed based on the economic advantage obtained; (v) the existence of material damage to the image of the securities market or the segment in which it operates; (vi) the commission of an infraction through fraud or deceit; (vii) compromise or risk of compromise of a publicly-held company's solvency; (viii) breach of fiduciary duties arising from the position, role, or function that it occupies; and (ix) concealment of evidence of the infringement through trick, fraud, or deceit.

[2] These are mitigating circumstances, according to article 68: (i) confession of the offense or the provision of information regarding its materiality; (ii) the prior good record of the offender; (iii) the regularization of the infraction; (iv) the good faith of the accused; or (v) the effective adoption of internal mechanisms and procedures for integrity, auditing, and incentive to report irregularities, as well as the effective application of codes of ethics and conduct within the legal entity.

- Category: Litigation

The new Code of Civil Procedure (CPC) brought in several innovations aimed at ensuring greater effectiveness and speed in proceedings. Among them, article 139, item IV, of the CPC confers on the magistrate the power to "determine all inducive, coercive, mandamus, or subrogatory measures necessary to ensure compliance with a judicial order, including in actions that have as their subject matter a money payment", thus authorizing the application of atypical measures to ensure fulfillment of obligations.

One of the main problems in the Brazilian Judiciary is the lack of effectiveness in executions, which often drag on for years, especially because of the impossibility of locating assets of debtors sufficient to satisfy the debt, even after numerous diligence measures. In this context, many judges have ordered, on the basis of article 139, item IV, of the CPC, the seizure or suspension of judgment debtors' national driver's licenses (CNH) and passports as a means of compelling them to fulfill their obligations.

However, there is still divergence as to the possibility of suspension/seizure of these documents. The constitutionality of such coercive measures, which could, in theory, violate constitutional precepts such as the guarantee of freedom of movement and the right to come and go is debated.

The matter was submitted to the Superior Court of Justice (STJ) for review recently in the judgment on an appeal on habeas corpus filed against a decision by the São Paulo State Court of Appeals, which ordered the suspension of the passport and driver's license of a debtor in default of almost R$ 17,000 (RHC 97.876/SP).

In the case, the STJ found that seizure of the passport was disproportionate and unreasonable, offending the debtor’s constitutional right to come and go. However, with regard to the CNH, the STJ decided that the suspension of the document was due since there was supposedly no disrespect to the right of movement, since, even if the debtor is not authorized to drive a car, his right to come and go is guaranteed.

The same decision also pointed out that the seizure of the passport could prove adequate in another context, as in searches for assets of debtors who have money abroad.

In two other decisions, the STJ also confirmed the possibility of suspending the right to drive of debtors in default, adding that this coercive measure does not impede the right of movement (RHC 88.490/DF and HC 428.553/SP).

Thus, the STJ indicates that suspension or seizure of the CNH of defaulting debtors is a valid measure as a means of compelling them to fulfill obligations to pay.

In any case, as explained by recent decisions issued by the STJ, the application of atypical coercive measures authorized by article 139, item IV, of the CPC depends on a factual analysis of each case, which will allow for a finding regarding their proportionality and suitability. It is understood that such measures are applicable only when other measures defined in the Code of Civil Procedure have already been exhausted and are not fruitful.

The subject must be reviewed by the Federal Supreme Court (STF), due to a direct action of unconstitutionality filed in May of this year by the Workers' Party. The plaintiff in the action claims that the suspension and seizure of documents to compel the debtor to pay a debt, based on article 139, item IV, of the CPC, violates fundamental rights of freedom of movement and the dignity of the human person. It will be up to Justice Luiz Fux, the reporting judge in the case, to review the action for the STF to issue its decision.

- Category: Environmental

The Federal Supreme Court (STF) has recognized the existence of general repercussion of an appeal regarding the inapplicability of the statute of limitations on a claim aiming at civil compensation for environmental damage, in a judgment issued on June 1, 2018. Most of the Justices agreed with the reporting judge's opinion.

Extraordinary Appeal No. 654.833, object of the judgment in question, is related to the public civil action filed by the Federal Public Prosecutor’s Office in the 1980s to redress material, moral, and environmental damages resulting from invasions in the Ashaninka-Kampa indigenous community.

In the judgment of the special appeal, the Superior Court of Justice (STJ) understood that, since the right to a healthy and balanced environment is an inalienable fundamental right, actions that seek to redress environmental damage are among the few considered not subject to any statute of limitations.

The appellants claim that, even if no statute of limitations on actions aiming to redress environmental damages is recognized, since it is an inalienable fundamental right, it is not possible to rule out the statute of limitations of compensation amounts of a material and moral nature.

Thus, they petitioned for a distinction to be made between the amounts intended for redress the environmental damage, considered as not subject to the statute of limitations, and those amounts related to personal or individual compensation, aiming at the moral and material indemnification of the individuals of the indigenous community. The latter would be subject to the five-year limitation period provided for in the Law of Citizen Suits (Law No. 4,717/1965) - since the facts precede the promulgation of the 1988 Federal Constitution.

The STF decided that there was general repercussion due to the impact of the issue on legal relations, which has as a background a claim for civil compensation arising from damages caused to the environment.

The reporting judge, Justice Alexandre de Moraes, emphasized in his opinion "the importance of establishing accurate and safe limits on the application of the statute of limitations in peculiar cases involving individual or collective rights harmed, directly or indirectly, due to environmental damages caused by human action."

The merits of Extraordinary Appeal No. 654.833 are still pending judgment by the STF en banc session. Once the issue is closed, it is expected that the judges of the courts where the lawsuits were originally filed will apply the legal theory adopted by the STF, as determined by the Code of Civil Procedure.

- Category: Tax

Taxpayers will no longer be able to offset federal tax credits with debts related to the monthly collection due to IRPJ and CSLL estimates, according to Law No. 13,670/2018, published on May 30 (inclusion of item IX in paragraph 3, article 74, of Law No. 9,430/1996). In 2008, Presidential Decree No. 449 had already included this restriction in tax legislation, but it was not converted into law, and the measure ceased to be effective as of 2009.

According to the explanatory memorandum of Law No. 13,670/2018, the purpose of the rule is to prevent the offsetting of debts that constitute an advance of the tax due in order to expedite the collection of debts and to inhibit the presentation of undue offsets.

However, this restriction tends to generate significant cash flow impacts for taxpayers, who must make monthly disbursements to pay the estimates.

There is a good legal basis to support the argument that the limitation would not be applicable to the calculation of the monthly advances by interim balance sheet suspension or reduction. This is because, while the estimate is a presumption of realized profit, suspension or reduction of the interim balance sheet reflects an effective calculation of the real profit for the period and, in this sense, would be outside the scope of the law.

It is worth noting, however, that the estimates and the suspension or reduction of the interim balance sheet system are collected under the same revenue code, which may cause an operational restriction on the taxpayers at the time of registration of the PER/DCOMP. In this case, it is recommended that taxpayers file a preventive judicial measure to effect offsets.

According to Law No. 13,670/2018, the new rule came into effect on May 30, 2018, the date of its publication. However, we believe that the prohibition on offsetting estimates could only be effective if the principle of legal certainty is observed. In this regard, taxpayers may also run into practical restrictions on the registration of PER/DCOMP, and preventive judicial measures are necessary to carry out offsets.

- Category: Banking, insurance and finance

The Central Bank of Brazil (Bacen) has completed the regulations necessary for the issuance of Secured Real Estate Letters (LIG), with the issuance of Circular No. 3,895/18, on May 4. The norm provides for the procedures for a centralized deposit of LIGs and for a centralized registration or deposit of the assets that make up the asset-backed portfolio securing the issuance of that instrument.

Created by Law No. 13,097/15 (resulting from the conversion of Provisional Measure No. 656/14), LIGs meet the objectives of real estate development set forth in the BC+ Agenda, Bacen’s Credit Pillar. They present themselves as an advantageous alternative for real estate financing since they are instruments secured both by the issuing institution's equity (as are, as a rule, the Letters of Real Estate Credit - LCIs, commonly issued without collateral) as well as by a portfolio of assets (which endow the LIGs with a kind of backing constituted as equity, similar to the Real Estate Receivables Certificates - CRIs). Fiduciary and/or real guarantees for issuances of LIGs may also be established.

Some of the main features of the regulation on the issuance of LIGs are summarized below:

General characteristics of LIGs: nominative, transferable, and freely negotiable instrument secured by a portfolio of assets, which in turn is constituted as a segregate estate (that is, such asset portfolio is not subject to attachment or any other type of restriction, and will not be affected in cases of insolvency, intervention, extrajudicial liquidation, or bankruptcy of the issuing institution).

Remuneration: based on fixed and/or floating interest rates, as well as other rates, as long as publicly known and regularly calculated.

Issuing institutions: multiple banks, commercial banks, investment banks, credit, financing and investment companies, savings banks, mortgage companies, and savings and loan associations. Among other conditions, issuing institutions must fully comply with regulatory capital rules and must (together with the fiduciary agent) indicate to the Bacen an officer responsible for the LIG issuance transaction.

Special amortization regime: in the event of a decree of intervention, extrajudicial liquidation, bankruptcy of the issuing institution, or recognition of its insolvency by the Bacen, LIGs shall be subject to a special amortization regime, provided that the payment of the principal amount of the LIG is not made at maturity.

Repurchase and early redemption: as a rule, the issuing institution is not allowed to redeem in advance or to repurchase the LIG, in whole or in part, within 12 months of its issuance date.

Early maturity: the early maturity of LIGs is forbidden, except in the event of recognition of insolvency of the asset portfolio, in which case the conditions of payment of the obligations related to the LIG must be established according to the criteria defined in the special amortization regime.

LIG issuance program: issuing institutions may establish a LIG issuance program, thereby making series issuances, composed of one or more LIGs secured by the same portfolio of assets.

Asset portfolio composition: the asset portfolio can only be composed by (i) real estate loans (those consisting of financing for the acquisition or construction of residential or non-residential property, corporate financing for the construction of residential or non-residential real estate and loans to individuals with a mortgage guarantee or clause for sale of residential real estate); (ii) bonds issued by the National Treasury; (iii) derivative instruments (provided that they are exclusively intended to hedge); and (iv) cash and cash equivalents from the assets included in the asset portfolio. The sum of the updated nominal values of the real estate credits, including the value of the derivative instruments, shall represent at least 80% of the total updated face value of the asset portfolio.

Eligibility of real estate credits: real estate loans may only be included in the asset portfolio if they fulfill the eligibility conditions set forth under the regulations, among which are that they: (i) must be performing; (ii) must be free of any type of liens, except those related to the guarantee of the rights of the holders of the LIGs; (iii) must be secured by a first mortgage or fiduciary sale of immovable property (except in cases of credits arising from financing for a legal entity for the construction of residential or non-residential real estate); (iv) in the cases of financing for a legal entity for the construction of residential or non-residential real estate, the real estate development underlying the transaction must be subject to the applicable regime; (v) the credit risk classification of the transaction must not be less than "B"; and (vii) there must be insurance coverage, under the terms of the regulations, in cases of a transaction with an individual for acquisition or construction of residential or non-residential property and a transaction for construction of residential or non-residential property by a legal entity.

Fiduciary agent: the following may act as fiduciary agent: (i) institutions authorized to issue LIGs; (ii) real estate securitization companies; (iii) securities brokerage companies; and (iv) securities distribution companies. The fiduciary agent shall be vested with a mandate to administer the asset portfolio in the event of intervention, extrajudicial liquidation, or bankruptcy of the issuing institution, or recognition of its insolvency by the Bacen.

Deposit and registration: the issuance of the LIGs must be registered with a central depository authorized by the Bacen, under the terms of Law No. 12,810/13, and the assets that make up the asset portfolio must be deposited or registered with an entity authorized by the Bacen.

Notwithstanding the expectation that supplementary regulations will be issued in the coming weeks (mainly related to accounting rules), as of now authorized institutions may issue LIGs, and the market may have one more source of funds for the encouragement and development of the real estate segment in Brazil.

- Category: Public and regulatory law