- Category: Agribusiness

A new development in the judgment of two relevant lawsuits concerning the acquisition of rural properties by foreigners generated significant repercussions: the voting to decide about the entry of the OAB, through its Federal Council (CFOAB), in the Claim for Noncompliance with Fundamental Precept 342 (ADPF 342) and in the Original Civil Lawsuit 2,463 (ACO 2,463).

The cases refer to the same theme: the validity and constitutionality of paragraph 1 of article 1 of Law 5,709/71 (rule that regulates the acquisition and lease of rural properties by foreigners). This provision determines that, for the purpose of land acquisition by foreigners, the Brazilian company considered "controlled" by foreigners, whether by individuals or legal entities, will be subject to the same rules as a foreign legal entity.

The Brazilian Rural Society (SRB) proposed ADPF 342, arguing that the promulgation of the Federal Constitution (CF) of 1988 repealed article 1, paragraph 1, of Law 5,709/71 and, therefore, the interpretation of the Attorney General of the Union (AGU) expressed in Opinion LA/01 – currently in force – is erroneous and does not comply with a fundamental precept.

According to Opinion LA/01, by repealing article 171 of the CF, the Constitutional Amendment 6 of 1995 extinguished the unconstitutionality of Law 5,709/71. Thus, the equalization of Brazilian companies to foreign companies can be considered constitutional, as determined by this law (since article 171 of the CF considered as "Brazilian company the one constituted under Brazilian laws and that has its headquarters and administration in the country").

This opinion, endorsed by the Union and the National Institute of Colonization and Agrarian Reform (Incra), is still the object of ACO 2,463. The action was brought by these same authorities against the Internal Affairs of Justice of the State of São Paulo (Corregedoria-Geral de Justiça do Estado de São Paulo), which adopted in its rules regulating the performance of notaries and registration officers the understanding that Law 5,709/71 is repealed – there would be, therefore, no impediment for Brazilian companies controlled by foreigners to acquire or lease rural properties.

Because of the similarity in the controversies, these two actions are being jointly tried by the Brazilian Supreme Court.

In this context, on March 29 of this year, the CFOAB petitioned in the files of ADPF 342 and ACO 2,463 to request its entry as amicus curiae. It was argued that the matter is key for the defense of national sovereignty and the constitutional order and, therefore, the manifestation of the Council would be relevant.

In addition, because it is a sensitive issue with complex implications, the CFOAB also requested, on a preliminary basis, the suspension:

- of all court cases that have a dispute on the same subject as ACO 2,463 and ADPF 342; and

- of transactions that apply, in any form, paragraph 1 of article 1 of Law 5,709/1971.

Minister André Mendonça, in a monocratic decision published on April 26 of this year, had partially granted the injunction request made by the CFOAB. The minister determined that, until the final judgment of these processes by the STF, all actions involving the equalization to foreigners of Brazilian companies controlled by foreigners, individuals or legal entities, for the purpose of acquiring rural properties, would be suspended. In addition, it granted the CFOAB's request to join the case as amicus curiae.

The request for suspension of transactions was considered unnecessary and, therefore, rejected, pursuant to the decision of Minister André Mendonça, who partially accepted the CFOAB's requests.

This preliminary decision, however, was not endorsed by the plenary of the STF. In a vote that ended in a 5-5 tie, the plenary, bereft of Minister Ricardo Lewandowski, due to his retirement, chose not to endorse the decision of Minister André Mendonça.

The confirmation of the minister's decision depended on the approval of the absolute majority of the plenary, which did not occur. In view of the tie, under the terms of its bylaws, the Supreme Court could:

- suspend the trial until the arrival of a new minister to untie;

- have a tie-breaking vote by the casting vote of the president of the Supreme Court; or

- Apply article 146 of the Supreme Court Internal Bylaws and decide that, in case of a tie, the request will be denied.

The Court, following the trend of the most recent judgments, decided for the third alternative. As a result, the CFOAB's preliminary injunctions were denied.

Although this was the outcome, the CFOAB's requests did not address the merits of the lawsuits and, therefore, ACO 2,463 and ADPF 342 remain on the agenda for final judgment.

The monitoring of the trial of these two lawsuits is key to understand the directions of foreign investments in Brazilian rural properties. If a decision overturns the equalization of Brazilian companies to foreign ones, the process of acquisition of rural properties by foreigners in Brazil may be simplified.

- Category: Succession planning

The slowness of the Judiciary and the bureaucratization of its procedures makes the search for the extrajudicial route an interesting alternative to resolve conflicts, especially in matters related to family and succession.

In order to use the extrajudicial route, however, it is necessary to comply with requirements. For probate proceedings, the Code of Civil Procedure of 2015 is categorical by providing, in its article 610, that: "If there is a will or interested party legally incapable, the judicial probate shall be carried out."

That is, the requirements determined by the legislation for the realization of probate through public deed are: absence of a will and absence of an legally incapable interested party.

Although the norm is clear, there is a tendency to relativize these impositions, superseding the autonomy of the will and the tendency of seeking alternative resolutions for conflicts.

For some time now, both laws and jurisprudence have been moving towards reducing bureaucracy in processes and procedures as a way to effectively hand over jurisdiction to the jurisdictional parties and allow the rapid resolution of certain issues.

The Superior Court of Justice (STJ) has already decided that it is possible to carry out extrajudicial probate and partition when the deceased has left a will, provided that all heirs are in agreement and are capable of performing acts of civil life.

There is also a mobilization to make the possibility of carrying out a more flexible probate, even if there are legally incapable heirs.

There are several decisions from São Paulo’s courts that authorized the drafting of a public deed for cases in which the heir is incapable as long as the division takes place in an ideal way, that is, with equal division of the assets among the heirs.[1]

Acre’s Court of Justice has issued the Ordinance 5.914-12, of September 8, 2021, regarding the Court of Public Records, Orphans and Successions of the District of Rio Branco, which provides for the possibility of extrajudicial probate in case of incapable interested heirs, provided that the final draft is previously authorized by the court, in a simple and unbureaucratic procedure, with no costs.

In addition, in February 2023, Rio de Janeiro’s Code of Rules of the Corregedoria-Geral da Justiça provided, in its chapter XII, section III, the regulation of probate through public deed, even when there is an incapable interested party and unequal division of assets, as long as subjected to prior judicial authorization, under issuance of a permit.

It is important to mention the recent understanding of the state of Santa Catarina, which, in February 2023, began to authorize the carrying out of probate involving minors, provided that the division is ideal, according to Circular 51, of February 24, 2023, of the Corregedoria-Geral da Justiça do Estado de Santa Catarina.

Among the reasons presented for the flexibilization and possibility of carrying out probate with incapable heirs in the application submitted by the Notarial College of Brazil – Section of Santa Catarina (CNB-SC), is:

"The extrajudicial route has singular importance in the realization of this facet of access to justice. This scenario, unless better judged, should also contemplate the legally incapable people, who have an equal right to a multi-door, efficient, fast and safe justice. Depriving them of this possibility could be interpreted as an unjustified restriction of the possibilities to access and achieve their own rights."

The Brazilian Institute of Family Law (IBDFAM) sent a request for measures to the National Council of Justice (CNJ) to regulate on a federal scale the extrajudicial performance of marital dissolution and probate proceedings, when there are incapable heirs and wills, provided that the act is consensual.

The institute reinforces the notion that, since the division is ideal, there is no harm in opting for the extrajudicial route.

It is concluded, therefore, that the corregedorias, judges and courts of Justice themselves are solely taking all the efforts to relativize the requirements and obstacles imposed by the legislation for the use of the extrajudicial route. To date, there is no federal law on the subject, and, consequently, there is a lack of uniformity in the application of the rules by the federative entities.

[1] Examples: processes 1016082-28.2021.8.26.0625 and 0000691-27.2021.8.26.0374.

- Category: Infrastructure and energy

The importance of priority projects in the Brazilian capital market has grown exponentially in recent years, as indicated by the data regarding the issuance of incentivized debentures.

According to the December 2022 Incentive Debentures Report (109th edition) published by the Brazilian Ministry of Finance, the volume of incentivized debentures (i.e., debentures entitled to the tax benefits of Law 12,431/11) was approximately R$ 42.8 billion in 2022. During the same year, 249 authorizing ordinances were published by the Brazilian Government Ministries approving projects as priorities,[1] a higher number than the authorizing ordinances of 2021 (236) and 2020 (179).

According to the Report, the incentivized debentures correspond to 28.9% of the total volume of debentures traded between the beginning of 2021 and the end of 2022. This demonstrates how crucial it is to raise funds through incentivized debentures in the Brazilian capital market.

Data from the March 2023 Capital Market Report published by the Brazilian Association of Financial and Capital Markets Entities (Anbima) shows that the total volume of debentures from the beginning of January to the end of March reached R$ 36.6 billion, through 74 issuances. Of this amount, about R$ 4.4 billion refers to the incentivized debentures, through nine issuances.

In this regard, the Decree 11,498/23 on incentive to priority projects –1 of the 13 measures of the federal government to boost the Brazilian economy – brings important changes to the infrastructure field and the capital market.

The new decree is relevant both for sectors that traditionally have projects considered priorities (such as logistics and transport, urban mobility, energy, telecommunications, broadcasting, basic sanitation and irrigation) and for new categories that it defines.

Decree 11,498/23 amends the Decree 8,874/16, which had regulated Law 12,431/11, and establishes the following measures:

- expands the list of sectors that may have investment projects considered priority projects and, consequently, eligible for the tax benefits of Law 12,431/11;

- establishes a new mechanism of maximum annual volume for the issuance of securities for priority projects, to be determined annually by the Ministry of Finance; and

- Determines that ministerial ordinances approving priority projects must inform the maximum amount that can be raised through the issuance of securities with tax benefits for the approved priority project.

Expansion of the list of sectors

Decree 11,498/23 increases the number of sectors that may have projects considered priority projects. The new sectors are:

- education;

- health;

- public safety and the prison system;

- urban parks and conservation areas;

- cultural and sports facilities; and

- social housing and urban requalification.

According to the Decree 11,498/23, projects developed in these sectors may be considered priority projects because they provide relevant environmental or social benefits.

In addition to this possibility, by the new decree, if projects of these new sectors and traditional sectors are carried out in subnormal agglomerations or isolated urban areas – as defined by the IBGE – they can also be considered projects that provide relevant environmental or social benefits.

In these two scenarios, the need for an ordinance of the competent ministry to approve the project as a priority and make it eligible for the tax incentives of Law 12,431/11 remains in force.

The expansion of the list of projects that provide environmental or social benefits is a fundamental step to give more clarity to this concept and increase the number of projects considered priority projects.

It is, therefore, a positive measure for the project submission process. When promoting environmental or social benefits already recognized by the Brazilian legal system, projects in the sectors mentioned above and/or projects located in subnormal agglomerations or isolated urban areas should be classified as priorities by the competent ministry.

In the case of projects in the new sectors, the amount that may be raised by the issuance of securities with tax incentives is limited to the capital expenditure calculated for the project, with the exception of financial expenses. Also in relation to projects in the new sectors, the benefits of Law 12,431/11 will apply to papers issued from the beginning of 2024.

Maximum annual volume raised by securities issues with tax benefits

Law 12,431/11 defines that priority projects will be granted tax incentives in the case of issuance of incentivized debentures or incentivized certificates. The incentives are:

- reduction to 0% of the Personal Income Tax rate; and

- reduction to 15% of the Corporate Income Tax rate.

There was no form of direct control over the total volume that could be captured through the issuance of securities with these tax incentives. Decree 11,498/23 establishes that the Ministry of Finance may define, by ministerial ordinance, the maximum annual volume that may be raised by issuing securities with tax incentives. The volume can even be broken down by sector.

Although there is still no ordinance published in this sense, by Decree 11,498/23, when the maximum annual volume of issuances is reached, securities with tax incentives in general or for certain sector(s) may no longer be issued until:

- the ordinance in question ceases to have effect – which would occur annually; or

- New ordinance expands the maximum annual volume of emissions for the year in question.

As Decree 11,498/23 is already in force, an ordinance of the Ministry of Finance stipulating the maximum annual volume of emissions with tax may be published still in 2023.

Maximum amount raised by the issuance of securities

As already explained, for a project to enjoy the tax benefits of Law 12,431/11, it is necessary that it be recognized and approved as a priority project through a ministerial ordinance. This must be done by the competent ministry in relation to a specific sector, after the company proposes the project to the ministry.

In addition to the requirements already mentioned, Decree 11,498/23 defines that the maximum amount to be raised by the issuance of securities with tax benefits must be defined in the ministerial ordinance that recognizes the project as a priority project.

This requirement is also already in force and should be followed by the next ministerial ordinances that analyze the possibility of projects being considered a priority project or not.

As it turned out, the changes are relevant and impact both the traditional sectors related to priority projects, by establishing new requirements, and the new sectors, which previously did not benefit from the incentives of Law 12,431/11.

Despite the changes, article 1 of Law 12,431/11 did not suffer any impact. Thus, incentives for foreign investments in the Brazilian capital market proposed by the law can still be used, including in infrastructure projects not covered by Decree 8,874/16 – despite the important sectoral expansion promoted by Decree 11,498/23.

[1] The number of 249 authorizing ordinances encompasses all projects approved as priorities in 2022, including projects that issued and did not issue incentivized debentures.

- Category: Competition

The Tribunal of the Administrative Council for Economic Defense (Cade) sanctioned, in April of this year and for the first time, a hub-and-spoke cartel for defrauding competition in public tenders and private sales in the market for distribution and resale of digital whiteboards. Fines were imposed on 18 companies and 20 individuals in the total amount of approximately R$ 7.9 million. There are at least three other hub-and-spoke cartel investigations ongoing at CADE.

Such antitrust violation consists of the indirect alignment of prices among competitors, facilitated by a common business partner that operates in a different but related market. Usually, the business partner is a supplier or distributor (hub) that has a supply contract with several resellers (spokes) that compete with each other.

It is a type of cartel with a façade of a legitimate commercial relationship between vertically related agents, under which commercial decisions among competitors are made without a direct exchange of information between them.

In the case recently ruled by CADE, the practice occurred as follows: a reseller identified a potential client that would buy whiteboards and projectors and informed the distributor that it has mapped such client, along with the value above which the other resellers should submit coverage proposals to the same client. The distributor informed the other resellers, requesting the presentation of coverage proposals in the bidding of the mapped client. With such arrangement, which lasted for years, there seemed to be effective dispute when, in practice, prices were kept artificially high.

This practice has been the subject of concerns by competition authorities in several countries. For example, in Portugal the competition authority has issued, since December 2020, at least ten decisions condemning hub-and-spoke cartels in the retail distribution market for food products, with fines amounting to a total of more than 675 million euros (approximately R$ 3.7 billion).

In such precedents, the distributors fixed the resale price in supermarkets, reducing competition among their stores, through contacts established through a common supplier. With this, they stipulated prices to final consumers at artificially higher levels than in a free competition scenario.

To prevent and detect practices of this nature, it is important that companies address the issue in their competitive compliance training, highlighting risk situations for the specific activities of the company, both in the hub (instrumental partner) and in spoke (competitor) positions.

- Category: M&A and private equity

The entry into force of CVM Resolution 175/22, the new regulatory framework applicable to investment funds in general, was scheduled to enter into force on April 3, 2023. However, the Securities and Exchange Commission of Brazil (CVM) extended the effective date to October 2 of this year, through the publication of CVM Resolution 181/23.

The purpose of the extension was to meet the demand from market participants for a longer adaptation schedule. The authority has also used the new resolution to correct clerical and formal errors and implement other drafting improvements in the standard.

The deadline for the adaptation of Credit Rights Investment Funds (FIDCs) that are in operation on the date the new regulation goes into effect has also been extended, from December 31 of this year to April 1, 2024. The deadline for the entire investment fund industry to adapt, however, continues to be December 31, 2024.

The change was relevant to allow the market to adapt to the new regulatory framework, which has generated doubts among participants in the fund industry.

In order to clarify them, Joint Circular Letter 1/2023/CVM/SIN/SSE was recently released, from two technical areas of the CVM, the Bureau of Supervision of Institutional Investors (SIN) and the Bureau of Supervision of Securitization (SSE). The document contains 84 answers to specific questions asked by market participants about the new regulatory framework. The answers are divided into 24 topics:

- Timeline of entry into force

- Classes and subclasses

- Calculation of net equity of the class

- Periodic reports

- CVM's website and systems

- Remuneration/Rebate/Charges/Financial Statements

- Adequacy of funds by unilateral act vs meeting

- Documents that must be kept at the service providers' site

- Engagement of service providers

- Distribution of units of a class on an open basis

- Valuation report required

- Establishment and registration of the fund

- Accounting records and financial statements

- Communication with shareholders

- Trading using improper privileged information (Insider trading)

- Supplement A: consent for acknowledgement and assumption of unlimited liability

- Distribution to the account and at the order - bookkeeping license

- Liquidity management

- Sending the administrator a copy of the document signed by the manager

- Financial statements for transfer of management

- General adaptations of other rules (Cofi and Res. CVM 21)

- Related-party voting at a meeting

- Social and environmental funds

- Investment by funds with limited liability

The initiative of the CVM's technical areas is salutary, as it helps market participants and essential service providers to adequately interpret the regulatory framework, which significantly impacts on the investment fund industry in Brazil. These guidelines contribute to bringing legal certainty and mitigating the regulatory risks involved in the sector’s adaptation process.

- Category: Tax

The House of Representatives approved, on March 30, Executive Order 1,152/22, which amends the legislation of the Corporate Income Tax (IRPJ) and the Social Contribution on Net Profits (CSLL) to provide for transfer pricing rules. The approval tally was 369 votes in favor of the final wording and 10 against.

In the Joint Committee's opinion delivered en banc by the rapporteur, Representative Da Vitória (PP-ES), 15 of the 107 amendments presented were approved, summarized below:

| Amendment | Description |

| 2 | Includes paragraphs in article 13 of the MP to set limits on the use of quoted prices, especially in cases where the information so obtained is not reliable or appropriate. |

| 4 | Amends paragraph 1 of article 13 of the MP to depart from the presumption that the PIC method will be the most appropriate for commodities in cases where the magnitude of the comparability adjustments requested affects the reliability of that method itself. |

| 5 |

Amends the wording of the head paragraph of article 13 of the MP to clarify that: (i) even in cases where there is a quotation, internal comparable prices, arising from transactions with unrelated parties, continue to be reliable for application of the PIC method, even with greater reliability than the quoted prices; and (ii) in defining the most appropriate method of transfer pricing control, it is relevant to examine the entire value chain of the commodities and the other elements of paragraph 1 of article 11. |

| 11 | Deletes subsection I of article 45 of the MP was amended to allow deductibility of royalty payments for entities resident or domiciled in a country or territory with favored taxation or which are beneficiaries of a privileged tax system. |

| 13 | Deletes subsection IV of article 17 and article 19 of the MP to eliminate the secondary adjustment mechanism for the calculation basis. |

| 22 | Identical to Amendment 11 |

| 32 | Identical to Amendment 13. |

| 36 | Identical to Amendment 11. |

| 42 | Deletes article 45 of the MP to eliminate the new rules for deductibility of royalty payments. |

| 45 | Gives new wording to articles 17, 18, and 19 of the MP to change the mechanisms of spontaneous, compensatory, and secondary adjustments to the calculation basis. |

| 47 | Identical to Amendment 42. |

| 48 | Amends article 45 of the MP was amended to allow deductibility of royalty payments for entities resident or domiciled in a country or territory with favored taxation or which are beneficiaries of a privileged tax system in cases where it is known that there will be no double non-taxation. |

| 58 | Identical to Amendment 11. |

| 77 | Identical to Amendment 42. |

| 88 | Identical to Amendment 13. |

The matter will now go to the Federal Senate as a Conversion Bill.

We will continue to monitor its progress and will publish updates on developments.

- Category: Digital Law

The Brazilian Data Protection Authority (“ANPD”) published on Wednesday, May 24, the Statement CD / ANPD 1, according to which the processing of personal data of children and adolescents may be carried out based on any of the legal hypotheses provided for in articles 7 and 11 of the Brazilian General Data Protection Law (Federal Law n. 13,709/2018 or “LGPD”).

According to the statement, "the processing of personal data of children and adolescents may be carried out based on the legal hypotheses provided for in article 7 or in article 11 of the Brazilian General Data Protection Law (LGPD), provided that their best interest is observed and prevails, to be evaluated in the specific case, under the terms of article 14 of the Law."

Until this official understanding, there was a controversy over the interpretation of the necessity of the consent defined in article 14, paragraph 1. There were questions as to whether the consent was the only legal hypotheses to support the processing of children's data (under 12 years old) or whether other legal hypotheses of the law (Articles 7 and 11) would also apply to the processing of personal data of children.

The text of Art. 14, §1°, reads as follows: "The processing of personal data of children shall be carried out with the specific and highlighted consent given by at least one of the parents or the legal guardian."

Since the LGPD expressly mentions the need for consent for processing children's data, there was an uncertainty about the possibility of applying the other legal hypotheses. The questioning took place especially in situations in which the practical routine of the companies showed that the risks of processing children’s personal data were small and that it was made for the benefit of the child or adolescent. This is the case, for example, of the inclusion of dependent children for health insurance or for the participation in events at the parent’s company.

The text of the LGPD itself enhances the discussions by indicating an exception provided for in paragraph 3 of the same Article 14. In accordance with this paragraph, personal data of children may be collected without the referred consent of paragraph 1, if there is a need to contact the parents and legal guardians or for the protection of the child. This paragraph also establishes that the personal data of the child may only be collected to be used once and may not be stored or shared with third parties without consent.

The need for consent for these situations causes an undeniable burden for the company that, as data controller, has the duty to collect the consent diligently and to ensure the right of the data subjects to withdraw their consent and store the given consent for accountability purposes (Article 8, paragraph 2, LGPD).

The legislation evaluates the risks that the processing of personal data usually causes in order to define the obligations of companies. Accordingly, the higher the risk, the greater the obligations. Due to that, for example, the legislation distinguishes personal data and sensitive personal data and also defines that data breaches must be informed to the ANPD and to the data subjects since they can cause relevant risks and damages (Article 48, LGPD).

Other public debates also brought this possibility of applying other legal hypotheses to the processing of children’s data, such as Statement 684 of the decision of Civil Law of the Council of Federal Justice, approved in 2022. According to the statement: "Article 14 of Law No. 13,709/2018 (Brazilian General Data Protection Law - LGPD) does not exclude the application of other legal hypotheses, if applicable, taking into account the best interest of the child."

In this context, the new statement of the ANPD is equitable and pursuant to the reality. In addition, the statement reinforces the need for the data controller to be more diligent when evaluating and documenting the best interest of the child and adolescent in the processing activity and electing the appropriate legal hypotheses of articles 7 and 11 of the LGPD.

The statement is binding, especially considering Article 55-J, XX (LGPD), which establishes that the ANPD is responsible for determining the interpretation of the law. All companies must follow the statement’s rules from the date of its publication – May 24, 2023. The companies must, at a minimum:

- re-evaluate their processing activities and data mappings which include personal data of children and adolescents.

- re-evaluate the legal hypotheses for these activities as appropriate and stop using the consent when unnecessary.

- review their privacy policies and agreements, updating the specific sections dedicated to the consents of those data subjects, when applicable.

- evaluate and document the presence of the best interest of children and adolescents for each activity and be prepared to account for the legal hypotheses chosen for data subjects and authorities; and

- maintain the consents collected between the effective date of the law and May 23, 2023, to preserve their liability until the publication of a new statement.

- Category: Environmental

The European Union (EU) is not shy in its climate and environmental goals. In 2019, with the approval of the European Green Deal, ambitious targets were set to guide an effective transition to a low-carbon economy, with the group expected to reach carbon neutrality by 2050.

Until recently, however, these targets were unclear on the relationship of EU countries with the rest of the world, especially with countries responsible for exporting products to Europe.

Developments in recent months have dispelled any mystery or doubt on the matter. Countries that export to the EU will have to comply with rigorous sustainability rules to continue accessing the European market. Among these rules, the ones with the greatest potential effect for Brazilian exporters are the related to combating deforestation and to customs taxation of carbon.

Carbon taxation will be implemented by the Carbon Border Adjustment Mechanism (CBAM), established by Regulation 2023/956 of the European Parliament. Companies exporting products with large carbon footprints will have to purchase CBAM certificates to cover the emissions embodied in their products. As such, the mechanism’s operation will be similar and complementary to the European Emission Trading System (EU ETS).

Although the CBAM will only come into full force in 2026, in October this year, the mechanism will be applied on an initial basis, for select exports to Europe, notably: steel, iron, aluminum, electricity, fertilizers and cement.

With this, Brazilian exporters will have to consider the CBAM customs tariff as a new cost incorporated into exports.

The regulation aimed at fighting deforestation, recently approved by the European Council,[1] aims to bar trade and consumption in the EU of products responsible for generating deforestation in their countries of origin.

The regulation will affect exporters of the following raw materials: palm oil, cattle, soy, coffee, cocoa, wood, and rubber, as well as any product that is fed (mainly considered the raising of animals with soy-based feed) or derived from these raw materials, such as beef, leather, chocolate, wooden furniture and printed paper products, among others.

The direct implication is that companies exporting the abovementioned products will need to create a due diligence process for their supply chain in order to ensure that the final product does not originate from deforested land, as well as demonstrate compliance with existing human rights standards.

The expectation is that the norm will come into effect as early as next year.

Although it is not possible, at this moment, to predict the impacts of the European Green Deal on foreign trade, it is perceived that the European Union more and more asserts itself as a powerful agent in defense of sustainability, imposing goals not only for itself but also for other nations with whom the group relates.

It is clear that compliance with the standards of the European Green Deal represents a challenge for the national market. The new regulations, however, also create opportunities for Brazilian entrepreneurs to effectively engage in the sustainability agenda and, with adequate dedication and investment, emerge as important agents for sustainability in international trade.

[1] For more information, we suggest visiting the European Commission's website page.

- Category: Capital markets

On May 11, the Brazilian Securities and Exchange Commission (CVM) issued CVM Resolution 182, which amends current regulation on issuing Brazilian Depositary Receipts (BDR). BDRs comprise securities issued in Brazil, backed by underlying assets issued abroad by a foreign or Brazilian issuer of either shares, deposit certificates (CDA), or debt instruments,.

On the same date, CVM issued CVM Resolution 183, which amended CVM resolutions 80 and 160. Such resolutions provide the basis for the regulation of public offerings and issuer registration before the CVM.

CVM resolutions 182 and 183 enter into force on June 1st and primarily alter the rules regarding categorization of foreign issuers before the CVM and the requirements for obtaining registration for foreign issuers, as a mandatory step for the issuance of Level II and III BDRs.

In order to issue BDRs, foreign-based issuers must meet the following standards:

- exist as a legal entity;

- shareholder liability limited to the issuing price of subscribed or acquired shares;

- issued securities traded on regulated exchange;

- subjection to oversight of regulating body;

- delegated management, subject to a collegiate board or similar body; and

- shareholder rights regarding voting and dividends, with certain allowed limitations and differentiations given types and classes of shares.

Under previous regulation, in order to obtain registration as a foreign issuer, in addition to having foreign headquarters, issuers were subject to having less than 50% of assets and revenues in Brazil.

Under current regulation, solely the requirement for foreign headquarters was kept, and the CVM has provided three alternatives under which foreign issuers may base their request for registration in Brazil as an issuer of securities:

- foreign issuers’ shares must trade on a stock exchange headquartered abroad, in a country that has either entered into a cooperation agreement with the CVM, or is a signatory to the multilateral memorandum of the International Organization of Securities Commissions (IOSCO). In addition, the stock exchange must be classified as a recognized market; or

- prove status asa foreign issuer for more than 18 months and, in the previous 18 months, prove uninterrupted maintenance of at least 10% of shares in circulation and an average daily trading volume equal to or greater than R$ 10 million; or

- headquarters located in a country whose local supervising authority has signed a specific agreement with the CVM encompassing bilateral cooperation, exchange of information and effectiveness of inspection and supervision measures, including those referring to issuers of securities based in such jurisdiction.

Further regulatory alterations comprise additional disclosure requirements for investment entities – as defined by accounting standards – when such entities issue Level I sponsored BDRs.

With respect to BDR offerings, changes promoted in CVM Resolution 160 refer to:

- registration rites of BDR offerings; and

- removal of restrictions on the secondary asset trading of subsequent offerings of Level I and II sponsored BDRs backed by shares and initial offerings of sponsored BDRs backed by debt instruments, notwithstanding specific rules set forth by CVM Resolution 182.

For simplification purposes, we have systemized the available regimes for offerings involving BDRs. Regarding the qualification of the accessed investors, the following offerings must also observe the same restrictions imposed on the initial public offering of the underlying securities of the BDRs:

| BDR classification | Underlying asset | Type of offering | Offering rite | Target investors |

|

Shares or CDA |

Initial | Ordinary | Professional investors |

| Subsequent | Automatic | Professional investors | ||

| Debt securities | Automatic | Professional investors | ||

|

Shares or CDA | Initial | Ordinary | Professional investors |

| Subsequent | Automatic | Professional investors | ||

| Debt securities | Automatic | Professional investors | ||

|

Shares or CDA | Initial | Ordinary | No restriction |

| Subsequent | Automatic |

– Professional investors – Qualified investors, upon presentation of prospectus and termsheet (Lâmina) – General public, via self-regulatory oversight |

||

| Debt securities | Automatic | Professional investors | ||

| Ordinary | No restriction |

Alterations promoted by CVM Resolutions 182 and 183 are relevant towards the expansion of possibilities and access of foreign issuers to BDRs, without compromising investor protection.

- Category: Labor and employment

After a new extension of the production date for labor lawsuit events, the new version of the eSocial Guidance Manual has set July 1st of this year as the new deadline for the information related to these events.

All final and unappealable decisions handed down in labor lawsuits and decisions approving settlement calculations from July 1, 2023 onwards, as well as in-court settlements and agreements entered into by the Pre-Conciliation Commission (CCP) or the Interunion Conciliation Center (Ninter) after this date must be reported through eSocial event S-2500.

In parallel, the Federal Revenue Service promulgated Normative Instruction 2,139/23, published on March 31st of this year, in which it defined that delivery of the DCFTWeb will be mandatory as of July of 2023 for social security and social contributions arising from conviction or ratification decisions issued by the Labor Courts.

Thus, although the date for the events to go into production has not yet been disclosed, the information regarding social security and social contributions arising from decisions or settlements entered into in the labor sphere must be sent as of July of 2023.

- Category: Labor and employment

Law 14,193/21, which regulates the Soccer Corporation (SAF) - also known as the SAF Law - was enacted in October of 2021. Since then, some clubs, such as Botafogo, Cruzeiro, Vasco da Gama, América-MG, and, more recently, Clube Atlético Mineiro, have joined this institute.

But, after all, what is SAF?

This is the migration of soccer clubs from a non-profit civil association to specific corporations, governed according to the characteristics and principles of the SAF Law, in the club-company model.

The corporate structure of these companies gives clubs the means to restructure their debts, professionalize their management, and raise new sources of revenue, including by issuing financial instruments or even bringing in future investors (shareholders).

SAF also has a differentiated tax system, structured to accommodate the operational and administrative particularities that involve the sports business.

Ways to form an SAF

Article 2 of the SAF Law provides that a Soccer Corporation may be formed:

- by transformation - in which the nature of the club is changed from a non-profit association to an SAF. In this case, all members become shareholders in a company;

- by spin-off - which is a transaction in which a legal entity - in this case, the club - separates part of its assets and transfers them to one or more companies, either incorporated or already existing. In this case, at least a part of the members also become a shareholder of the company; and

- at the initiative of an individual or legal entity or an investment fund - in this case, a new company is formed, which will operate in the soccer business, and there is not necessarily a relationship between this new company (the SAF) and the soccer club from which it originates.

In addition to these three forms, the law establishes, separately in its article 3, that an SAF may be formed by means of a drop down. This form of organization, the most used, is also supported by article 27, paragraph 2, of Law 9,615/98 (Pelé Law).

The drop down has been the form of organization most used by clubs. In this case, the club will be the shareholder of an SAF and will show the subscribed shares on its balance sheet, which will be posted against the write-off, that is, the contribution of the equity transferred to the SAF. There is, in principle, no loss, reduction, or increase in equity. There is only an exchange of positions to reflect the substitution of various assets for shares.

The most appropriate way to form an SAF will depend, fundamentally, on a review of the current structure of each club and the structure that is desired.

Is authorization of the players necessary?

In article 2, the SAF Law regulates the rules for the types of SAF formation. It provides - in particular in paragraph 1 - that the SAF will succeed the club in the following cases:

- in all relations with governing bodies (Fifa, federations, etc.) and with soccer professionals; and

- in the sports rights and status that the club has at the time the SAF is formed, provided that the formation takes place in the form of a transformation (subsection I) or a spin-off (subsection II).

The SAF Law, on this second point, may give rise to a small regulatory inconsistency. In a literal interpretation, if not formed by transformation or spin-off of the club (but formed by asset drop down, for example), an SAF would have to "start over" in soccer, losing the club's original sporting status. In addition, to be able to perform, it would need to seek the express authorization of the players and other professionals of the club, as consideration for their respective employment contracts.

In the context of a transformation, however, nothing is changed regarding the contractual situation of players and other sports professionals. After all, a simple change in the status of the legal entity with which the respective professional maintains an employment relationship is not a sufficient element to legitimize any opposition - if, of course, the other applicable contractual conditions remain unchanged. The contractual relationship remains strictly the same.

The SAF Law, therefore, in paragraph 1 of article 2, only follows the essential corporate principles of Brazilian private law. In this manner, all contracts signed with the players will be maintained when the club is transformed into an SAF.

In the case of incorporation through spin-off of the club (followed by the formation of an SAF from the spun-off assets), there is no need for authorization from the players; transfer of the employment contracts to the SAF is mandatory. This is due to the corporate logic of the spin-off, besides, of course, the express provision in paragraph 1 of article 2 of the SAF Law.

When setting up an SAF by drop down, there will be a new registration of the players with the CBF and a new CNPJ of the employer. Therefore, a new contract will be made. Consequently, the players' signatures will be required.

This, however, should not be seen as requiring players' authorization for the assignment of contracts, but merely as a legal and documentary formality. It would even be possible to find abuse of rights by the professionals who oppose, without just and concrete reasons, assignment of their contracts to the SAFs of the clubs to which they are linked.

The same logic of incorporation by spin-off should therefore be followed without difficulty in the case of incorporation of an SAF by drop down, despite the lack of legal clarity. There is no reason to impose different requirements for the transfer of employment contracts to SAFs based solely on the legal form chosen to organize them.

What is the difference between a club forming its SAF from the spin-off of its soccer assets and another club choosing to form an SAF via contribution of assets - including player contracts?

Is there anything to justify not requiring the players' consent in the first situation, but requiring it in the second?

Clarifying a few facts can help answer these questions.

Initially, it is important to understand how the term "spin-off" should be understood in the legal text analyzed. In our view, the SAF Law employed the broad (not the technical corporate) sense of the word, in order to encompass both the corporate split itself and the separation of assets - to subsequently assign the assets to the SAF (drop down).

It makes no sense to create any kind of sporting distinction between SAFs and clubs just because of the legal format chosen for their organization, especially when all the club's creditor rights are preserved - as occurs in drop down transactions - and when the other options for organization may lead to incorrect or even undesired results - such as making, in the case of transformation or spin-off, the club members (and not the club itself) members of the SAF.

It can, therefore, be interpreted that the legislator, when expressly establishing the forms of organization of an SAF in article 2 and listing the spin-off in subsection II, also considered drop downs. If this understanding prevails, it is easy to conclude that there would be no need for the players' authorization to transfer their contracts if the SAF is set up by means of a drop down.

Guaranteeing this formal right to players could prevent clubs from formatting the most appropriate legal structure to organize their SAFs. In addition, it would make possible actions aimed at taking undue advantage of the club during this process.

In the original wording of the SAF Law (when it was still a draft bill), the structure provided for in subsection II of article 2 was precisely a drop down. Only then was the drop down moved to the article 3, which opened space for inclusion of spin-offs in subsection II (which, it is worth emphasizing, was not contemplated in the original bill).

After this change in the text, however, the wording was not updated in paragraph 1 of article 2. Thus, the express reference to article 3 is no longer made.

In the original wording of the law, therefore, in its paragraph 1, the same consequences now clearly placed on transformation and spin-off were also reserved for drop downs.

It is difficult to know the reasons why the text of the SAF Law failed to make express reference to drop downs when it imposed automatic transfer of club employment contracts to SAFs. It seems clear, however, that the legislator's idea has always been to equate the concepts for this specific purpose.

Many of those directly involved with the legislative process of the SAF Law recognize that the provisions for spin-offs (paragraphs 1 and 2 of article 2) should also be applied, even if by analogy, to drop downs, there being no technical or legal reasons to do otherwise,[1] a position with which we agree.

Thus far, we have no evidence of cases of players and sports professionals who refused to assign their contracts to SAFs.

The topic is current, and it is important that an analysis be done of each transaction. Despite the general position advocated here, specific situations may call for a different approach, especially in simulation cases where establishment of the SAF serves illegitimately to transfer players between sports institutions.

By observing the best practices and complying with the criteria and requirements of the legislation, with personalized evaluation of the impacts, it is possible to ensure greater legal security for all the parties involved.

Machado Meyer Advogados will continue to monitor the evolution of the matter and its potential developments. Keep up with our publications by subscribing to our newsletter.

[1] See MONTEIRO DE CASTRO, Rodrigo R. (Coord.). Comentários à Lei da Sociedade Anônima do Futebol [“Comments on the Soccer Corporations Law”]. Law No. 14,193/2021. São Paulo: Quartier Latin, 2021. Pg. 96: "Paragraph 2 is composed of 7 subsections that regulate situations related to spin-offs. Although silent, all of them should be extended, by analogy, to the modality consisting of the organization, by the club, of the SAF (drop down). The application is necessary because this manner of organization is inserted, expressly, in the system created by Law 14,193/21 and cannot be considered as a foreign element divorced from its content. The integration occurs because of the structural approximation between the organization of the SAF and the spin-off - in both cases there will be a transfer of the club's assets to another person - while this will not occur in transformation or in organization at the initiative of an individual or legal entity or investment fund."

- Category: Labor and employment

In the judgment of a motion for clarification in Extraordinary Appeal 999.435, which occurred in April, the STF established that the requirement of prior labor union intervention applies only to layoffs that occur after publication of the minutes of the judgment on the merits of the case - June 14, 2022.

Layoffs or collective dismissals occurs when a company dismisses a considerable number of employees at the same time or in a short period of time, with the same motivation - which usually derives from financial necessity, unrelated to the performance of the employees.

Up to 2017, layoffs were not formally regulated in legislation. In 2016, an extraordinary appeal was filed to debate the mandatory collective bargaining requirement for layoffs of workers imposed by the Superior Labor Court (TST).

The case law has always faced heated debates on the subject. On the one hand, there were those who contended that the legal system does not provide any support for differentiated treatment between individual and collective dismissals; on the other hand, there were those who contended for the need for prior authorization from the labor union of employees in the category for the layoffs or even execution of a collective bargaining agreement to effect such a dismissal.

Extraordinary Appeal 999.435 was filed in a case regarding the dismissal of more than 4,000 employees of Empresa Brasileira de Aeronáutica S.A. (Embraer) which occurred in 2009. The TST decision that established, for future cases, the need for prior collective bargaining for layoffs was questioned.

According to the appellant companies, by establishing a condition for layoffs, the TST assigned to the Labor Courts the obligation to rule on a matter that the Federal Constitution restricted to supplementary law. Among the arguments of the appeal is the allegation that the decision would threaten the survival of companies in crisis, with undue interference in management power and affront to the principle of free enterprise.

As of 2017, with the enactment of the labor reform, the Consolidated Labor Laws (CLT) now states that "individual, collective, or group dismissals are equivalent for all purposes, without the need for prior authorization from a labor union or execution of a collective bargaining agreement." In other words, the legislation now expressly states that there is no need for prior authorization from the labor union for layoffs.

In view of this provision, the Federal Supreme Court (STF) decided that the prior authorization of the labor union entity would not be necessary, but clarified that prior negotiation would be required. According to the Court, this requirement would open up the possibility of "sitting at the negotiating table." The company could state its reasons for the layoff and, on the other hand, the labor union could speak on behalf of the workers. Prior negotiation is not to be confused, however, with prior authorization for dismissal, but is only a measure to stimulate dialogue.

Justice Dias Toffoli clarified, in this same sense, that it would not be a matter of a request for authorization from the labor union for the layoff, but of involving it in a collective process for the maintenance of jobs. He also discussed that the participation of labor unions in situations of possible layoffs could help to find alternative solutions that would contribute to the recovery and growth of the economy, besides valuing human labor.

The STF decided, by majority opinion, that the prior participation of labor unions in cases of layoffs is essential, not to be confused with the need for authorization. It established the following theory of general repercussion: "Prior labor union intervention is an essential procedural requirement for mass dismissal or layoffs of workers that cannot be confused with prior authorization by the labor union entity or execution of a collective bargaining agreement.

When ruling last April 25 on the motions for clarification filed by the parties, the STF softened the effects of the above decision.

- Category: Labor and employment

The Federal Supreme Court (STF) ordered on Thursday, May 25, national suspension of the processing of all labor executions related to the issue controverted in Topic 1.232 of the General Repercussion Issues Management, pending definitive judgment of the extraordinary appeal.

Extraordinary Appeal 1.387.795 (RE 1.387.795) is the leading case, handled by the labor law practice of Machado Meyer.

The subject under discussion is whether it is possible to include a company belonging to an economic group that did not take part in the trial phase as a defendant in the labor execution phase.

The decision handed down by Justice Dias Toffoli was based on the grounds presented in writing in the case, in which Machado Meyer was able to demonstrate, in the words of Justice Toffoli, "relevant grounds that call attention to the situation of dissenting case law in multiple labor claims that convey a matter pertaining to the subject, notably as to the application (or not), in the labor field, of article 513, paragraph 5, of the current Code of Civil Procedure - which provides that it is not possible to enforce a judgment against a co-liable party that did not participate in the trial phase."

The gravity of the situation was highlighted in the Justice's decision, since, in innumerous proceedings in the labor execution phase, the assets of companies that did not participate in the trial phase have been seized. In this manner, despite supposedly being part of an economic group, the company did not have the opportunity to, at least, respond previously regarding the specific and precise requirements that indicate it is (or is not) part of an economic labor group - which is only provided after the judicial bond, in a motion to stay execution.

Based on these arguments, one applies the provisions of article 1,035, paragraph 5, of the CPC, to suspend the processing of all labor executions proceeding in the national territory and dealing with the matter discussed in Topic 1,232.

The national suspension of proceedings is justified for reasons of legal security, stabilization of case law, equal protection, exceptional social interest, and procedural economy. The non-suspension of cases has triggered successive conflicting decisions in the non-plenary bodies of the Labor Courts. This situation aggravated the legal uncertainty, which had been spreading due to divergent case law on the merits of the matter.

Thus, the STF stops the proliferation of conflicting decisions that have caused harmful effects to legal and economic relations in the country. The order is that all bodies of the labor court system are to be informed of the decision.

- Category: Labor and employment

Published on April 24th, Law 14,553/23 brings in changes to the Racial Equality Act (Law 12,288/10). The new law creates an obligation to include employees' racial and ethnic information in corporate documents containing individualized information about them. The obligation also applies to administrative records directed to bodies and entities of the Public Administration.

The information must be filled out according to self-classification criteria based on previously delimited groups, that is, the employee must inform the employer of which ethnic and racial segment he identifies with.

According to the law, information about race must be included in the following documents:

- employment hiring and dismissal forms;

- work accident forms;

- registration done in the National Employment System (Sine);

- Annual Corporate Information Report (Rais);

- registration of insured persons and dependents with the National Institute of Social Security (INSS); and

- survey questionnaires conducted by the Brazilian Institute of Geography and Statistics (IBGE).

Law 14,553/23 also provides that the IBGE will carry out surveys, every five years, to identify the percentage occupation of each racial and ethnic group employed in the public sector. This information will serve as a basis for creating and implementing public policies that promote racial equality.

The changes brought about by Law 14,553/23 also serve as support for companies to monitor racial equity issues and promote an environment aligned with ESG issues.

The new law does not specify when this information will start to be required from companies. We believe, however, that any document containing individualized information on workers prepared after the law enters into effect must include a specific field for filling in ethnic and racial information.

- Category: Litigation

Issued on April 25, 2023 by the Secretariat of Management and Innovation of the Ministry of Management and Innovation in Public Services, Ordinance Seges/MGI 1,769, which repealed Ordinance Seges/MGI 720/23, provides for the transitional regime referred to in article 191 of Law 14,133/21 – the new Bidding Law.

The transitional regime was established so that the public manager can choose, until December 30, 2023, to bid and contract according to:

- the new Bidding Law;

- the previous Bidding Law (Law 8.666/93);

- the Auction Law (Law 10.520/02); or

- the Differentiated Regime of Public Contracting – RDC (Law 12.462/11).

In addition to these legally established hypotheses, Ordinance Seges/MGI 1,769/23 also refers to Decree No. 7,892/2013, which regulates the Price Registration System. In addition, the new Bidding Law also prohibits – in its article 191, paragraph 1 – the combined application of its rules with the provisions of any of the other rules mentioned.

Thus, Ordinance Seges/MGI 1,769/23 establishes that the bidding processes and contracts filed and instructed based on these previous rules are based on the assumptions that:

- "the publication of the notice or the authorizing act of direct contracting occurs until December 29, 2023" (article 2, I); and

- "the option chosen is expressly indicated in the notice or in the authorizing act of direct contracting" (art. 2, II).

In a didactic way, based on Ordinance Seges/MGI 1,769, public managers must observe the following schedule:

| RITE | DESCRIPTION | INSTRUMENT | DEADLINE FOR INSERTION INTO THE SYSTEM | DEADLINE FOR PUBLICATION IN THE OFFICIAL GAZETTE |

|

All bidding modalities provided for in Laws 8,666/93, 10,520/02 and 12,462/11, including bids for price registration. | Edict | Until December 28, 2023, at 4 p.m. | Until December 29, 2023 |

|

All waivers and unenforceability of bidding whose values do not exceed those provided for in items I and II of article 24 of Law 8,666/93 (according to Normative Guidance AGU 34/11). | Notice or act of authorization/ratification | Until December 29, 2023 | Not applicable |

|

All bidding waivers not contemplated in item (2). | Act of authorization/ratification | Until December 28, 2023, at 4 p.m. | Until December 29, 2023 |

|

All unenforceability not mentioned in item (2). | Act of authorization/ratification | Until December 28, 2023, at 4 p.m. | Until December 29, 2023 |

In addition to these deadlines, Ordinance Seges/MGI 1.769/23 establishes that:

- the minutes of price registration governed by Decree 7.892/13, during their validity, may be used by any organ or entity of the federal, municipal, district or state Public Administration that has not participated in the bidding process, with the authorization of the managing body (article 4);

- contracts entered into with an indefinite term of validity must be terminated by December 31, 2024 and subsequent contracts must be made in accordance with the new Bidding Law (article 5);

- the "accreditations carried out, pursuant to the provisions of the caput of article 25 of Law No. 8,666, of 1993, shall be extinguished by December 31, 2024" (article 6).

Thus, despite the survival obtained by the previous rules through Provisional Measure 1,167/23 – which extended them until December 30, 2023 – the situation is headed so that, based on the time limits mentioned above, the new Bidding Law becomes, finally, the only valid rule on the matter, which is already taking a long time to occur.

- Category: Tax

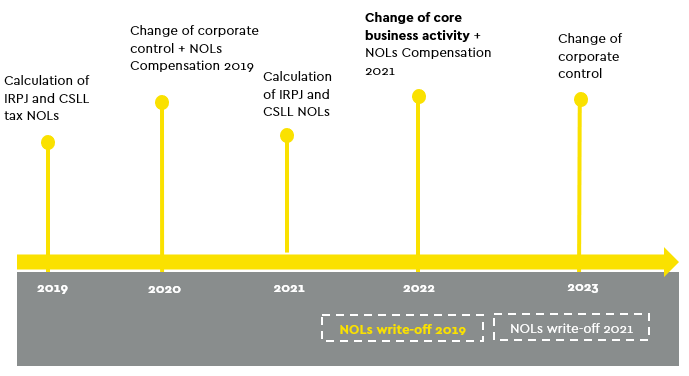

The Federal Revenue Service of Brazil (RFB), through its General Coordination of Taxation (Cosit), published, on April 12, the Private Letter Ruling Cosit 85/23 (SC Cosit 85/23), to determine the limits of the restriction on the use of tax Net Operating Losses (NOLs) in situations involving the change of branch of activity by a legal entity submitted to the real profit regime.

The compensation of tax losses, NOLs, of Corporate Income Tax (IRPJ) and Social Contribution on Net Income (CSLL) is subject to a series of limitations in the legislation – lock-limit of 30%, compensation of operating losses only with operating profits, restriction of compensation in case of corporate merger operations, spin-off or incorporation, write-off of the right to compensation in case of extinction, among others. We highlight here the situation that involves the change of corporate control and branch of activity (Decree-Law 2.341/87, art. 32).[1]

According to this rule, the legal entity cannot compensate NOLs of IRPJ and CSLL in case of cumulative change of corporate control and branch of activity. The idea behind this specific limitation is to make it impossible for third parties who did not participate in its generation to take advantage of losses and thus prevent the implementation of corporate operations that aim to allow the use of these amounts in transactions involving acts of simulation and abuse.[2]

The normative provision, however, gave rise to discussions about what would effectively be considered as modification of the branch of activity (for example, adoption of new activity, suppression of core or secondary activity, change of branch of business).

SC Cosit 85/23 is the first formal and binding manifestation of the RFB on the change of branch of activity and its impacts for the purpose of using NOLs credits by taxpayers. The issue had already been analyzed in some decisions of the administrative case law in Carf (Administrative Tax Court of Appeals).[3][4][5]

According to SC Cosit 85/23, the modification of the branch of activity that leads to the write-off (loss) of the right to compensation of tax NOLs of IRPJ and CSLL calculated in the period prior to the modification of the corporate control is that related to the main and core business activity. There is no limitation to compensation in situations where only some of the secondary activities are modified.[6]

Thus, according to RFB's position in this response to the consultation, if the legal entity has calculated IRPJ and CSLL NOLs and has undergone a change in its corporate control, it will lose the right to offset these credits calculated before the change of control, if it has also modified its activity of a core business nature. There are no negative impacts, however, in case of modification only of secondary activities.

The situation can be represented by the following timeline:

RFB follows interpretations given in similar situations

In our view, the understanding of the RFB is in line with other interpretations already adopted by the body in similar situations. Cases involving the analysis of the application of certain tax regimes linked to the main and core activity carried out by taxpayers.

This is, for example, the evaluation carried out by the RFB on the definition of the application of the so-called "payroll exemption regime", which implies the payment by legal entities of the Substitutive Social Security Contribution on Gross Revenue (CPRB) in replacement of the Employer's Social Security Contribution (CPP-INSS), which focuses on the payroll. In this situation, the taxpayer's framework is linked to the code of the core activity indicated in the National Classification of Economic Activities (CNAE).

In this case, analyzing the correct framing of a corporate taxpayer in the payroll exemption regime from the definition of its core business activity, the RFB understood that the core activity – or preponderant – should be understood as the one that represents the majority of the revenue earned in the previous calculation period or of the expected revenue for the current period – if it is the period of beginning of the company's activities (SC Cosit 106/17).

This understanding ensured the full application of the guidelines imposed by the National Classification Commission (Concla), of the Brazilian Institute of Geography and Statistics (IBGE), for the definition of the core activity in the CNAE (CNAE 2.0 Manual, items 1.6[7] and 1.7).[8]

Although it is recognized that SC Cosit 85/23 is an important manifestation of the RFB on the limitation related to the compensation of IRPJ and CSLL NOLs in cases of modification of branch of activity, we understand that this private ruling does not eliminate the discussion nor precisely delimit the scope of the expression "modification of the branch of activity".

There are situations in which all secondary activities are changed or even in which, due to market opportunity or economic moment, the secondary activity begins to overlap with the core activity, which leads to the need to change the company's CNAE.

These situations are not covered in the SC Cosit 85/23 analysis. Nor should they, in our opinion, trigger any prohibition regarding the use of IRPJ and CSLL NOLs, even if combined with a change of control.

Even with the direction of SC Cosit 85/23, it still seems important to consider the specific analysis of the peculiarities of each concrete case to evaluate the correct tax treatment.

Our team is available to review the understanding adopted by companies on the subject and help define the next steps.

[1] Decree-Law 2.341/87, "Art. 32. The legal entity may not offset its own tax losses if between the date of the calculation and the compensation there has been cumulatively a modification of its corporate control and the branch of activity."; Provisional Measure 2.158-35/01, "Art. 22. The provisions of the articles shall apply to the negative calculation basis of the CSLL. 32 and 33 of Decree-Law No 2,341 of 29 June 1987."

[2] Explanatory Memorandum 169/87, "Article 32 provides for the non-compensation of tax losses calculated by legal entities, when, after the calculation of losses, there has been a change in the corporate control and the company's branch of activity. That rule is intended to restrict the absorption of one legal entity by another for the purpose of compensating for tax losses."

[3] "COMPENSATION OF TAX LOSSES AND NEGATIVE BASIS. CHANGE OF CORPORATE CONTROL AND BRANCH OF ACTIVITY. CUMULATIVITY OF EVENTS. EFFECTS. (...) In the present case, in which the controversy rests only on the occurrence or not of a change of branch of activity, even if the objective elements revealing the questioned change (amendment of the Statute, of classification of economic activity in the CNAE and CNPJ) are disregarded, the data contained in the information statement submitted to the Federal Revenue Service leave out of doubt the occurrence of the fact imputed by the autuante authority." (Carf, Judgment 1302-000.333, August 4, 2010). In this case, the possibility of maintaining tax losses by a company with holding activity (investment in "companies that dedicate themselves: (i) to forestry projects; (ii) the manufacture and sale of forest products, including wood, newsprint, press papers or other types of paper, derived from wood pulp", etc.), which had already been submitted to the change of control and included new activities in its object ("production of press paper, industrialization and trade of wood, management of forest resources"). These new activities were included through the incorporation of other companies of the group, and the holding activity was maintained. As a result of the judgment, in the absence of proof by the taxpayer of the financial preponderance (assets and revenues) of the holding activity in relation to the others, the directors decided by majority (5x1) that the inclusion of new activities in these circumstances would characterize a modification of the branch of activity (holding company for paper production). Consequently, the rule limiting the compensation of tax loss and negative basis would apply.

[4] "I. R. P. J. — MODIFICATION OF SHAREHOLDING CONTROL AND CHANGE OF ACTIVITY — NON-EXISTENCE — Not materializing the imputed tax charge consistent in the cumulative change of branch of activity and shareholder control, does not proceed to gloss of the losses ascertained in previous years by the defendant itself. (...) The incorporation of its subsidiary, (...), on 12/30/94, whose object was insurance brokerage, did not imply a change of branch of activity, since, from then on, it became Rcte. to carry out jointly the activities and brokerage of insurance and interests in other companies, even if in some period of time, in view of the sale of the shareholding and, until the acquisition of a new interest, the income from participations has been temporarily replaced by financial revenues. The sale of the equity interest in (...) occurred in 1996 and the occasional absence of income from participations until the new payment of the capital of (a (...)), as found by the Fiscalização, without alteration of the bylaws, is not capable of changing the corporate purpose of the company." (Carf, Judgment 101-93.760, March 19, 2002).

[5] "COMPENSATION OF LOSSES AND THE NEGATIVE CALCULATION BASIS OF CSLL. INCORPORATION IN REVERSE. WRITE-OFF OF COMPENSATION. BURDEN OF PROOF. ART. 513, RIR/99. (...) If the appellant did not succeed in demonstrating the maintenance of corporate control, nor the absence of a change of branch of activity between the period of calculation of the tax loss and its compensation, the appeal claim does not deserve to be accepted. (...) Based on the ordinance collected above, what is verified is that in fact there was a change in the branch of activity of the incorporating company, with the authorization to operate with capitalization securities, between the date of calculation and the compensation of the tax loss." (Carf, Judgment 1301-005.767, October 18, 2021).

[6] Private Letter Ruling 85/23, "ACCUMULATED TAX LOSS. CHANGE OF BRANCH OF ACTIVITY. The legal entity will not be able to offset its own tax losses if between the date of the calculation and the compensation there has been cumulatively a modification of its corporate control and the branch of activity. The cessation of one of the secondary activities with the maintenance of the other activities already carried out by the legal entity does not correspond to a change in the branch of activity, for the purpose of compensation of accumulated tax loss."

[7] Manual of CNAE 2.0, Introduction to the National Classification of Economic Activities - CNAE 2.0, "1.6 Economic activity and statistical units. (...) Economic activity translates into the creation of added value through the production of goods and services, with the use of labor, capital and inputs (raw materials). The main activity of a statistical unit is defined as its main production process, which contributes most to the generation of added value. In item 1.7 it will be explained how, in practice, the main activity of a production unit must be determined to classify it according to the CNAE. The secondary activity is an activity whose production is intended for third parties, but whose added value is lower than that of the main activity. Most producing units carry out more than one activity and, therefore, have one or more secondary activities. Since, by definition, the unit of production must have a single main activity, in cases where it produces products (goods and/or services) associated with other classes of the classification of activities, these are considered secondary production (...)."

[8] Manual of CNAE 2.0, Introduction to the National Classification of Economic Activities – CNAE 2.0, "1.7 Methods of classification. (...) As recommended by CIIU/ISIC 4, the main activity of a unit with multiple activities is determined through the analysis of the composition of the value added, that is, the analysis of how much the goods and services produced contributed to the generation of this value. The activity with the highest added value is the main activity. In practice, however, data on the value added by individual goods and services are not available. It is recommended, in these cases, that the main activity be determined using an approximation to the value added. The variables used as substitutes for value added can be: on the production side: – the value of the production of the unit that is assigned to the goods and services associated with each activity; – the value of sales of the product groups (goods and services) in each activity. On the input side: – the proportion of people employed in the different activities of the unit – the wages and other remuneration attributed to the different activities (...)."