- Category: Tax

Brazilian legislation on the taxation of investments abroad will undergo major changes if Bill 4.173/23 is approved in its entirety. These changes could impact the way Brazilian investors and companies operate and invest in assets outside the country.

To help you understand the proposals under discussion and prepare for the possible impacts, we have prepared a detailed publication covering the main points of the bill and how they may affect your investments.

- Category: Life sciences and healthcare

As of August 1, 2023, the RDC Anvisa 786/23 introduced a new health regulation affecting the operations of clinical laboratories, anatomical pathology, and clinical analysis exams (EAC). The goal is to enhance the health safety standards of these activities and to allow specific tests to be conducted in pharmacies.

Businesses have up to 180 days to comply with the new rules. To understand what changes, download our exclusive publication on the topic and stay updated with the latest guidelines in the healthcare sector.

- Category: Litigation

Faced with the overloading and congestion[1] of the Brazilian judiciary – which slows down the achievement of judicial relief and hinders access to justice – it is urgent to seek and use other appropriate methods for dispute resolution – such as negotiation, conciliation, mediation, arbitration, and dispute board.

In some situations, it is also necessary to evaluate the possibility of customization and implementation of a unique system to prevent, manage, and/or resolve a range of disputes, establishing specific procedure(s). This is the case of Dispute System Design (DSD).[2] This solution deals with systems designed to handle specific situations and needs and, for this reason, usually presents satisfactory, efficient, and fast results.

One of the most emblematic and well-known cases[3] of the DSD is the September 11th Victim Compensation Fund (VCF). This financial compensation program was created to serve the victims and families of victims of the terrorist attack that hit the Twin Towers in New York in 2001.

Through the program, more than $7 billion was paid to surviving victims and representatives of victims who died in the bombing.[4] The VCF was considered a great success, as the beneficiaries were treated fairly, with respect, dignity, and compassion, and the adoption rate was very high.[5]

Change of mindset

Before addressing the stages of the design of a dispute system and presenting examples of Brazilian cases and the benefits of the solution, it is necessary to emphasize that the adoption of this method requires a change of mindset.

The overloading of the Judiciary is mainly caused by the litigious mentality of our society and of a good part of the lawyers, for whom the best way to resolve a dispute is through state adjudication, with a definition by a trial judgment. Something that in the words of the illustrious scholar Kazuo Watanabe can be defined as the "judgment culture".

Admitting the possibility and use of new, alternative, customized, and even faster systems often faces resistance from the stakeholders involved. This is most likely because "Narcissus finds ugly what is not a mirror ...", in the words of the poet Caetano Veloso.

There is no doubt that one of the starting points for unburdening the judiciary is to use appropriate methods of dispute resolution. Developing this alternative requires less formalities and belligerence from legal professionals and more sensitivity, creativity, and flexibility. This is the mindset shift we are referring to.

Instead of stimulating litigation, lawyers need to act as negotiators, using purposeful communication, with the goal of gaining empathy and trust. They should also encourage the parties to use appropriate methods for dispute resolution and, when applicable, act as designers of a unique system to prevent, manage, or resolve a range of disputes.

The stages of designing a dispute system

According to the doctrine of Diego Faleck, the stages of designing a dispute system are:[6]

- analysis of the dispute and of the interested and affected stakeholders;

- definition of the objectives and priorities of the system;

- consensus building and system development;

- dissemination, training, and implementation of the system; and

- constant evaluation of the system.

In the first phase of the process, the appropriateness of the DSD will be analyzed. To do so, it is necessary to ascertain who the affected parties are and what the interests of each one of them are. Next, it is necessary to understand what would encourage them to seek a composition rather than litigate.

Moreover, is important to identify the damages involved in this dispute and their extent. It should also analyze the possible means or systems for prevention and/or management and/or resolution of the dispute and what the pros and cons of each of them are. Based on this information, we assess the need for and feasibility of creating a specific system for the dispute and whether this system is, indeed, the most appropriate.

In the second phase, the main goals of the system and the guiding principles to achieve these objectives are defined. Considering that the system created will be a non-binding alternative for those involved (since the judicial route, constitutionally guaranteed, will always be available), it is necessary that everyone opt for the system and, therefore, trust it.

According to Diego Faleck,[7] in order for parties to trust the system, there are six key factors:

- transparency;

- equality;

- support in objective criteria;

- efficiency;

- dignified treatment for the parties, defining worthy values; and

- government participation.

In the specific case of a compensation program, the following should also be analyzed at this stage:

- admission criteria;

- list of documents that will be required from beneficiaries;

- pricing of compensation;

- legal certainty in the system; and

- measures that can be taken to mitigate and prevent fraud, among others.

In the third stage, it is necessary to build a relationship of consensus with all the interested and affected stakeholders, including the public authorities involved, such as the Public Prosecutor's Office and the Public Defender's Office. It is of utmost importance that everyone participates in the creation process and approves it.

In addition, at this stage, the system is also developed. For this, it is necessary for the designer to select, sequence, and/or combine the appropriate methods for dispute resolution that will be used.

According to Ury, Brett, and Goldberg, there is a "dispute resolution ladder" in which different methods can be selected and sequenced as steps (the lowest-cost mechanism should be prioritized):

- prevention mechanisms (consultations and incorporation of learning from a dispute);

- interest-based negotiation (manifested in different forms);

- mediation, by peers, by an expert, in the different modalities as the case may be;

- mechanisms for returning to interest-based procedures (sources of information and mechanisms involving non-binding opinions);

- mechanisms to support the lowest cost (rights-based – variations of arbitration – and power-based – voting, limited symbolic strikes, and rules of prudence).[8]

Once the system is developed, the fourth stage begins. At this stage, the system is, in fact, put into practice, with the dissemination of information to all involved. It is explained how the system will work and who can join, among other relevant information.

Subsequently, the system is implemented and everyone who has an interest in participating joins it. Then, the procedure created is executed.

In the case of compensation programs, after entry, the legal analysis will take place. If eligible, a proposal for an agreement will be submitted, which may or may not be accepted by the interested party.

The last and fifth phase is the continuous evaluation of the system, which allows improvements to be made based on the experience with various situations that may arise during the procedure.

Cases in Brazil

After this theoretical introduction with the step-by-step to design a dispute system, we present the Brazilian cases of the DSD. All of them illustrate in an extremely satisfactory way the many benefits of a system for resolution and/or management and/or prevention of disputes for those involved – whether based on the principles of access to justice, saving time, or efficiency.

The main cases of success of the DSD in Brazil – all out-of-court compensation programs – can be divided up based on the event that led to their design:

- aircraft accidents;

- dam collapse;

- involuntary eviction; and

- socioeconomic isolation.

1) AIR ACCIDENTS

TAM Case: Compensation Chamber 3054 (CI 3054)

- Context: aircraft accident occurred on July 17, 2007 (Flight 3054, which was en route Porto Alegre – São Paulo).

- Nature of damage: moral damage and material damage.

- Public agencies involved: Public Prosecutor's Office of the State of São Paulo, Public Defender's Office of the State of São Paulo, Procon/SP Foundation and Department of Consumer Protection and Defense of the Bureau of Economic Law of the Ministry of Justice.

- Acceptance of agreements: 92% acceptance (55 proposals accepted, 3 withdrawals, and 1 proposal rejected).

- Highlight: First Extrajudicial Compensation Chamber implemented in Brazil.

Air France Case: Compensation Program 447 (PI 447)

- Context: aircraft accident occurred on May 31, 2009 (Flight 447, which flew the route Rio de Janeiro – Paris).

- Nature of damage: moral damage and material damage.

- Public agencies involved: Public Ministry of the State of Rio de Janeiro, Ministry of Justice and Procon/SP Foundation.

- Acceptance of agreements: 95% acceptance (19 proposals accepted and 1 withdrawal).

- Highlight: the complexity for directly involving a foreign company and the relevance of having the participation of the Ministry of Justice.

2) DAM COLLAPSE

Vale Case: Brumadinho Compensation Chamber (CIB)

- Context: collapse of the Fundão dam in Mariana (MG), which occurred on November 5, 2015.

- Nature of damage: moral damage, material damage, and economic damage.

- Public agencies involved: Public Defender's Office of the State of Minas Gerais.

- Acceptance of agreements: 93% acceptance (12,136 proposals submitted and 11,497 proposals accepted).[9]

- Highlight: national relevance of the accident due to the number of people affected by the disaster.

3) INVOLUNTARY EVICTION

Subsidência Maceió (AL): Financial Compensation and Relocation Support Program (PCF)

- Context: eviction occurred in five neighborhoods of Maceió (Pinheiro, Mutange, Bebedouro, Bom Parto, and Farol), due to the geological phenomenon that generated the subsidence of the soil and cracking in properties in the region.

- Nature of damage: moral damage, material damage, and economic damage.

- Public agencies involved: Federal Public Prosecutor's Office, Public Prosecutor's Office of the State of Alagoas, Federal Public Defender's Office, and Public Defender's Office of the State of Alagoas.

- Acceptance of agreements: 94% acceptance (19,501 proposals submitted and 18,356 accepted).[10]

- Highlight: the first preventive extrajudicial compensation program in Brazil, with recognition from the National Council of Justice[11].

Madre de Deus Case (BA): Eviction Program for Environmental Treatment (PDTA)

- Context: eviction occurred in Madre de Deus/BA, due to the need for environmental remediation of land owned by Colloidal Carbon Company (CCC)

- Nature of damage: material damage and economic damage.

- Public agencies involved: Madre de Deus City Government, Bahia State Prosecutor's Office, and Colloidal Carbon Company (CCC).

- Acceptance of agreements: 100% acceptance (240 proposals submitted and accepted).[12]

- Highlight: the first extrajudicial compensation program in Brazil that obtained 100% acceptance.

4) SOCIOECONOMIC ISOLATION MACEIÓ (AL)

Flexal Case: Flexais Urban Integration and Development Project

- Context: the involuntary eviction of the neighborhoods affected by the geological phenomenon (which originated the PCF), led to the socioeconomic isolation of the neighborhood of Flexais.

- Nature of damage: moral damage, material damage, and economic damage.

- Public agencies involved: Municipality of Maceió, Federal Public Prosecutor's Office, Public Prosecutor's Office of the State of Alagoas, Federal Public Defender's Office.

- Acceptance of agreements: 97% acceptance (1,578 proposals submitted and 1,533 proposals accepted).[13]

- Highlight: in addition to compensating those affected who suffered from socioeconomic isolation, the program also aims to revitalize the area, with the development of actions to promote access to public services and stimulate the region's economy and thus reverse socioeconomic isolation.

When analyzing these cases, the success of Dispute System Design in Brazil is evident, especially when we observe the following points:

- the acceptance rate of the agreements is above 90%, which demonstrates the satisfaction of those involved and the efficiency of the systems;

- speed is another highlight, especially if compared to the time of processing of cases in the Judiciary[14];

- the reputational damages of the companies involved in using the DSD are mitigated, as the company, in general, assumes the strict liability that is due to it by force of law (regardless of the actual cause of the events). This demonstrates attitude, proactivity, and good faith, which are added to the quick action in the extrajudicial solution of the conflict – always considering parameters consolidated in the case law of the Brazilian courts;

- irrevocable and irreversible discharge, as well as full compensation of the damage suffered – it is, therefore, a definitive solution;

- predictability of the amount of liability involved, since the metrics and values to be compensated are based on objective and pre-defined parameters.

The instruments of agreement entered into in the DSDs mentioned above have already been tested and endorsed by the Judiciary. Although annulment actions for a few agreements were filed, none of these actions were successful in the Judiciary – which, upon confirming the seriousness of the compensation programs and correction of the values and parameters used, accepted the solution adopted and ratified the validity of the extrajudicial agreements.

Considering all the above, although the use of a Dispute System Design in Brazil is still in an early stage, the results of the existing programs are extremely satisfactory and demonstrate efficiency, speed, and several other benefits for all involved.

Because we believe that slow justice is not justice, we are not satisfied with the statistics: they indicate that, on average, the lawsuits take around five years. This prognosis motivated us to deepen our studies in alternative and appropriate methods for dispute resolution and in Dispute System Design. Therefore, we have become enthusiastic about applying these methods, recommending them whenever appropriate.

[1] According to the Justice in Numbers Report 2022 prepared by the National Council of Justice, the congestion rate (percentage of cases not resolved in relation to the total in process, fewer new cases, plus pending cases) in the Judiciary is 74.2%. The average processing time for pending cases is four years and seven months.

[2] This is how Stanford professors Stephanie Smith and Janet Martinez define it in the article An Analytic Framework for Dispute Systems Design: "A dispute system encompasses one or more internal processes that have been adopted to prevent, manage, or resolve a stream of disputes connected to an organization or institution."

[3] The movie "How Much Is It Worth?" on Netflix tackles the subject. Trailer is available on YouTube.

[4] Information taken from the book Dispute system design: preventing, managing, and resolving conflict, written by Lisa Blomgren Amsler, Janet K. Martinez, and Stephanie E. Smith, as follows: "The VCF was closed in 2004, having paid over $7,049 billion to surviving personal representatives of 2,880 people who died in the attacks and to 2,680 claimants who were injured in the attacks or the rescue efforts . . . thereafter."

[5] Information taken from the book Dispute system design: preventing, managing, and resolving conflict, written by Lisa Blomgren Amsler, Janet K. Martinez, and Stephanie E. Smith, as follows: "In retrospect, Feinberg concluded that the VCF was very successful under the circumstances but that he would not hold it out as a standard model for no-fault public compensation. The several success factors he highlighted seem relevant to other circumstances. Claimants were treated fairly and with respect, dignity, and compassion. Participation was very high."

[6] Brazilian Arbitration Magazine -v1, n. (jul/Oct 2003) – Porto Alegre: Synthesis; Curitiba: Brazilian Arbitration Committee, 04 -v.6, n.23. Introduction to Dispute System Design: Indemnity Chamber 3054.

[7] Revista Brasileira de Arbitragem -v1, n. (jul/Oct 2003) – Porto Alegre: Synthesis; Curitiba: Brazilian Arbitration Committee, 04 -v.6, n.23. Introduction to Dispute System Design: Indemnity Chamber 3054.

[8] URY, William L Brett, Jeanne M; Goldberg, Stephen B. Getting Disputes Resolved: Designing Systems to cut the Costs of Conflict. Cambridge: PON Books, 1993, p.41.

[9] Numbers updated Aug. 1. The program is still ongoing, so the numbers are subject to change.

[10] Official figures in news published by Braskem on August 10. The program is still ongoing, the numbers mentioned are therefore subject to change.

[11] https://www.cnj.jus.br/caso-pinheiro-a-maior-tragedia-que-o-brasil-ja-evitou/

[12] Numbers updated Aug. 21. The program has already been finalized, the result, therefore, is definitive.

[13] Numbers updated Aug. 21. The program is still ongoing, so the numbers are subject to change.

[14] According to the Justice in Numbers Report 2022 prepared by the National Council of Justice, the average processing time of pending cases is four years and seven months.

- Category: Life sciences and healthcare

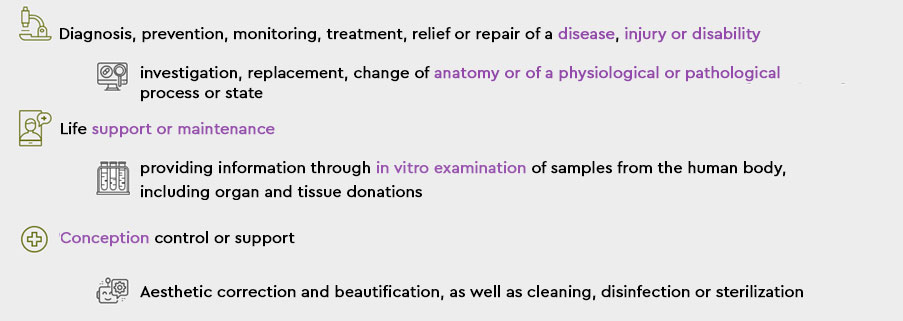

Twelve months after a substantial update of the regulatory framework for medical devices, the National Health Surveillance Agency (Anvisa) continues to prioritize the revision or drafting of rules related to this category. The goal is to modernize the Brazilian regulatory environment.

More than 20 years after the previous standard (Anvisa RDC 185/01 ), Anvisa RDC 751/22, which came into force on March 1st this year, updated the requirements on the risk class, regularization, labeling requirements and use instructions of medical devices.

According to the new rule, medical devices (formerly called a medical product or related), are defined as any instrument, apparatus, equipment, implant, in vitro diagnostic device, software, material or other article intended for use in humans, for any of the following purposes:

The applicable framework to each product considers 22 rules that assess the risk inherent in the functionalities, purposes and mechanisms of action of each device. According to the framework, the regularization regime at Anvisa is defined: whether the request for notification or marketing authorization (MA).

Medical devices fall into two subcategories:

In vitro diagnostic medical device: reagents, calibrators, standards, controls, sample collectors, software, instruments or other articles for the in vitro analysis of samples derived from the human body, with the aim of providing information for diagnosis (or aid), monitoring, compatibility, screening, predisposition, prognosis, prediction or determination of the physiological state. Activities involving these products is also regulated by Anvisa RDC 36/15.

- Medical software (also called Software as a Medical Device or SaMD): is the product or application intended for one or more of the purposes indicated in the medical device definition and performs its functions without being part of a hardware. Can have these possible characteristics:

- run on a general-purpose computing platform (non-medical purpose); and

- be used in combination (e.g. as a module) or interaction with other products.

Medical software is also subject to specific regulation – Anvisa RDC 657/22, which sets out the processes, documents and information needed to regularize these products.

More recently, Anvisa approved the first amendment in Anvisa RDC 751/22 to regulate the situations in which the importation of products with manufacturing date prior to the regularization date in Brazil would be allowed.

In addition, Anvisa's Collegiate Board recently opened a public consultation on the use of analyses carried out by an equivalent foreign regulatory authority (AREE).

Check out the details on the topic below:

- Regulatory convergence with foreign authorities

As of September 11, Anvisa will receive contributions to the Public Consultation 1,200/23, which intends to regulate the procedure for analysis and decision of petitions for medical devices registration, using the analyzes performed by AREEs.

AREEs are defined as regulatory authorities or foreign international entities recognized by Anvisa as being of regulatory reliance. Effectively, they are institutions considered capable of guaranteeing that products authorized for distribution have been properly evaluated and meet recognized quality, safety and efficacy standards.

General rules for admission of analysis performed by AREE were recently defined through Anvisa RDC 741/22.

The rules will be applicable to medical devices classified as risk classes III and IV, as well as to in vitro diagnostic medical devices (regulated by Anvisa RDC 36/15) – except when they have been authorized by AREE through an optimized analysis process.

The main points of the draft normative instruction presented in the consultation include:

- The applicant for registration must submit the following documents: specific declaration present in the normative; document proving registration or authorization issued by the foreign authority; and the product’s instructions of use, in addition to the other documents already required in the dossier.

- Only authorities in Australia, Canada, Japan and the United States are considered AREEs.

- The optimized analysis requirement does not prioritize the petition. The analysis should be maintained according to the petitions chronological order.

Anvisa's prediction is that the new rule anticipates the analysis of 1/4 of the requests that are currently in the queue.

Contributions can be made until October 25 through an electronic form that will be available on Anvisa’s website as of September 11.

- Update of the medical device regulatory framework

Anvisa RDC 810/23, approved in August and already in force, changes Anvisa RDC 751/22. The new resolution regulates the medical devices importation with a manufacture date prior to the regularization date in Brazil.

In the past, Anvisa imposed restrictions in these cases. However, considering the absence of restriction on the matter in the Imported Goods and Products Technical Regulation (Anvisa RDC 81/09), the agency began to allow products manufactured before obtaining the MA or notification to be placed on the Brazilian market, provided that they comply with the following requirements:

- a period of five years between the manufacture and regularization dates;

- compliance with the characteristics of its sanitary regularization; and

- presentation of a declaratory document issued by the notification or MA holder, attesting the compliance with the two requirements above-mentioned, as well as attesting that the product was manufactured according to the good manufacturing practices for medical devices.

- Cybersecurity will be subject to specific regulation

At the end of 2022, Anvisa held Public Consultation 1.112/22 to discuss the essential safety and performance requirements applicable to medical devices, including in vitro diagnostic (IVD).

Now, the agency is analyzing the contributions received and should issue an updated text until the end of the regulatory agenda.

The future standard is expected to update the requirements set forth in Anvisa RDC 56/01 – recently replaced by Anvisa RDC 546/21 during the "Review" process.

It is likely that the standard also aligns with the principles and elements adopted internationally, such as: requirements related to clinical evaluation, sterilization and contamination, the environment and conditions of use, chemical, physical and biological properties, labeling, among others that are necessary to ensure the safety and effectiveness of new technologies in the regulated market.

- Upcoming discussions

Anvisa's current 2021-2023 Regulatory Agenda foresees the discussion of other relevant topics regarding the medical device industry, including:

- review of the regulation on clinical trials with medical devices (Anvisa RDC 548/21);

- preparation of a new Documentation Specification Guide for the Medical Devices Electronic Petitioning; and

- updating the standard on in vitro diagnosis medical devices (current Anvisa RDC 36/15).

The Life Sciences & Healthcare practice can provide more information about products regulated by Anvisa.

- Category: Venture Capital and Startups

The agenda of the moment is undoubtedly the tax reform. Despite the wide-ranging debate on the subject in recent years, the most recent discussions in the National Congress make it clear that the proposal, in addition to lacking definitions on how various aspects of the new system will be implemented, is not being seen with a strategic eye by its debaters in relation to problems that could make the evolution of startups in Brazil unfeasible.

The list of tax reform proposals is long and there are many proposals, but for the point we want to analyze, the proposals for constitutional amendments 45 and 110 (PEC 45 and PEC 110) stand out.

These two texts propose the creation of a Value Added Tax (VAT), similar to that adopted in Europe, India, and Oceania. In an attempt to break paradigms, it is suggested to adopt a broad tax base, which considers transactions involving goods and services (as well as the rights related to them).

Despite the similarities between the two proposals, they differ in one fundamental aspect. While PEC 45 provides for the creation of just one VAT to replace ISS, ICMS, PIS, and Cofins (i.e. the taxes that are currently levied on consumption, services, or products), PEC 110 provides for the creation of a federal VAT and a state/municipal VAT (i.e. a dual VAT), with the same calculation bases.

Both proposals provide for the IPI (federal tax) to be abolished. On the other hand, a selective tax will be created, which will be levied on goods and services that may have harmful impacts on health and the environment, for example.

Given the need to make progress on the issue, a working group (WG) was set up in the Chamber of Deputies with the aim of combining the two proposals and resolving problems identified in the debates, in order to define the text (substitute) that will be sent to the floor. At the beginning of June, the WG presented a report with some guidelines.

Thus far, it is known that the substitute will include a kind of dual VAT. Standard and differentiated rates will be adopted for certain sectors and a broad right to credit will be guaranteed; in other words, the tax paid at one stage will be used to write off the tax due at the next stage.

Among these issues, the most worrying is the tax rate. The proposals stipulate that the tax will be levied on the basis of a standard rate, regardless of the sector, which will correspond to the sum of percentages defined by the entities. This percentage, however, remains unknown, with speculation that a rate of around 25% will be adopted. This is the big obstacle that startups have to face.

As is known, most startups are service providers, following the global trend towards the "servitization" of the economy.

Currently, services in Brazil are taxed at a rate that varies from 2% to 5%, depending on the municipality. To this must be added PIS and Cofins, which are also levied on service transactions, at the rates of 3.65% in the cumulative system and 9.25% in the non-cumulative system. Depending on their field of activity, startups can also be covered by the Simples Nacional system, which has rates similar to those mentioned above.

The definition of a rate higher than the aggregate rate of the taxes currently levied means, therefore, a clear increase in the tax burden.

It could be argued that the tax reform preserves the Simples Nacional system, which guarantees taxation more in line with small companies and to which some startups are subject.

Perhaps that is why there has not been much movement from this segment of companies around the reform. This is a worrying attitude, as it disregards its own growth in the short term, a fact that would limit the continuation of a Simples Nacional company.

It is clear that rapid growth, a characteristic (and objective!) of startups, will lead these companies to bear a higher tax burden, much higher than the one applied today when they leave Simples Nacional. This could even influence tax planning to keep companies in the most beneficial tax system, a very questionable initiative.

Proponents of the reform say that there will be no increase because there will be ample credit rights. However, this mechanism does not have much impact on the service sector for three reasons:

- the provision of services is not conditional on the large purchase of goods or services that could accumulate credits in this chain;

- the biggest expense in the service sector is labor, which does not generate credit - this impossibility of credit will induce more and more services provided through individually owned corporate entities in these chains; and

- the increase in the tax burden cannot be neutralized by non-cumulative taxation because, for the most part, services are provided directly to the end consumer.

The congressmen are aware of this, but they believe that, in general, it is the richest who consume services. However, even if this premise is true, the reality is changing. Startups operate on two major fronts which, indirectly or directly, promote consumption of services by a broad spectrum of the population.

Indirectly, startups develop technological and disruptive solutions to meet the needs of the productive sectors, making it possible to reduce the cost of end products. In a direct, and remarkable, way, they help to decentralize access to goods and services, favoring the most varied sections of the population.

A large increase in the tax burden, however, will certainly reduce the scalability potential of these solutions, not because of their nature, but because of the loss of competitiveness due to the market's inability to absorb the price increase.

Tax simplification, with the adoption of standard rates, cannot be a pretext for penalizing the services sector, especially startups, given their economic importance.

On this issue, sectors of the economy have managed to raise awareness among congressmen. Understanding the importance and effective impact of this increase, the congressmen included in the WG's report the possibility of establishing differentiated rates for certain sectors, such as health, education, and agricultural production.

Even if it is not possible to extend this mechanism to all sectors, it is necessary to look for other instruments to reduce this final cost. One of the alternatives suggested by the technology sector, through the Association of Brazilian Information Technology Companies (Assepro), is the adoption of a mechanism to exempt payroll. It is an interesting idea, as it avoids the proliferation of services provided through individually owned corporate entities} of the chain or the inclusion of employees in the corporate framework as a form of tax planning.

Another point is tax breaks, which, according to the proposals under discussion, should in principle be banned.

Therefore, whether through differentiated tax rates, payroll tax relief, or any other mechanism, such as tax benefits, it is certainly still necessary to deepen the debate regarding the proposals on the tax mechanisms that should be implemented. The discussion is fundamental for guiding tax policies to encourage investment in startups, whatever the sector in which they operate.

- Category: Labor and employment

On June 23, 2023, the Federal Supreme Court (STF) resumed the judgment of Argument of Breach of a Fundamental Precept (ADPF) 488, regarding the inclusion of companies from the same economic group in labor executions.

ADPF 488 was filed on October 11, 2017, for which the reporting judge is Justice Rosa Weber. The suit was filed by the National Transport Confederation (CNT) to challenge acts performed by labor courts and judges that include, in the enforcement of judgments or in the execution phase, individuals and legal entities that did not participate in the trial phase, on the grounds that they were part of the same economic group.

The CNT contends that the practice, in addition to not finding support in the current legal system, restricts the fundamental right to an adversarial process, a broad defense, and due process of law for those seeking to prove that they do not participate in economic groups.

This is because the mechanisms for producing evidence and the procedural channels in the execution phase are restricted, given that the labor appeals system itself does not allow infra-constitutional matters to be brought before the Superior Labor Court (TST) in the execution phase.

Among the infra-constitutional matters that should be analyzed in a case like this is the concept and definition of an economic group, based on the interpretation of article 2, paragraph 2, of the Consolidated Labor Laws. Accordingly, the party included only in the execution phase of the proceeding finds a restriction provided for by law with regard to the questioning of what an economic group would be, an essential discussion, since it is on this basis that they are included in the suit.

The CNT argues that the procedural and appellate characteristics of the labor enforcement phase restrict the right of defense, which affects the interest of people who did not participate in the trial phase of the proceeding.

The party included in the execution phase, without any opportunity for prior justification, is not summoned to submit a defense, but only to pay within 48 hours the amount ordered in a judgment handed down in a proceeding of which it was not even aware, and can only put forward its claims in defense after depositing in court the full amount of the execution or naming assets for attachment, which represents a huge obstacle for exercise of the adversarial process.

The practice also violates the fundamental right to due process of law. Execution of judgments against those who did not participate in the trial phase is expressly prohibited by article 513, paragraph 5, of the Code of Civil Procedure.

On December 14, 2021, the reporting judge, Justice Rosa Weber, issued her opinion, with Justice Alexandre de Moraes concurring, without assessing the merits of the issue, voting not to hear the ADPF on the grounds that the claim relates to a consolidated jurisprudential understanding of the TST, without having demonstrated the establishment of a relevant legal and constitutional dispute.

The opinion does not present any position on the merits of the issue, i.e. the possibility or lack of possibility of including companies from the same economic group in executions of labor claims, since it was handed down to the effect of not even hearing the ADPF, due to the lack of suitability of the procedural measure itself.

On that same date, in view of the opinions that have been issued thus far, Justice Gilmar Mendes asked to review the record, suspending the judgment. The ADPF, although a separate procedural measure, is related to Topic 1.232 of the Management by Topics of General Repercussion, leading case of the Extraordinary Appeal (RE) 1.387.795, the case, led by Machado Meyer's labor practice group, discusses the "possibility of including a company that is part of an economic group that did not take part in the trial phase" as a defendant in the labor execution proceeding.”

The judgment resumed on June 23, 2023, after an in limine decision was issued by Justice Dias Toffoli in RE 1.387.795, accepting a prayer for relief submitted by Machado Meyer. The Justice ordered a nationwide suspension of all labor executions that deal with the issue at stake in Topic 1.232, pending final judgment of the extraordinary appeal.

The judgment is expected to conclude on June 30, 2023, if there are no further requests for review of the record.

The debate resumed with the dissenting opinion of Justice Gilmar Mendes, who argued that the action should be heard and, on the merits, partially granted, in order to declare the incompatibility with the Federal Constitution of judicial decisions handed down by the Labor Courts that include, in the execution phase, subjects who did not participate in the trial phase, on the grounds that they are part of the same economic group, despite the absence of effective proof of fraud in the succession and regardless of their prior participation in the trial proceeding or in an incidental proceeding to pierce the corporate veil.

If Justice Gilmar Mendes' opinion is confirmed, the decision will be paradigmatic and will bring about legal certainty and encouragement to companies and investors.

The effect would be especially positive for the M&A and private equity market, whose transactions are often incorrectly interpreted by the labor courts.

- Category: M&A and private equity

On June 2, the Executive Branch, through the Ministry of Finance, submitted to the National Congress for deliberation the text of Bill 2.,925/23, which aims to amend Law 6,385/76 and Law 6,404/76 (the Brazilian Corporations Law). The aim is to deal with transparency in arbitration proceedings and the system of private protection of investors' rights in the securities market.

Spearheading Bill 2,925/23 is the Secretary of Economic Reforms, Marcos Barbosa Pinto, former chairman of the Brazilian Securities and Exchange Commission (CVM). The bill is considered one of the main changes to the Brazilian Corporations Law since the changes brought about by Law 10,303/01.

In general terms, Bill 2,925/23 sets out clearer parameters for bringing liability actions, increasing the possibility of compensation for investors. According to a note from the Ministry of Finance, the main innovation is the possibility for minority shareholders and debentureholders who are harmed by the illegal acts of controlling shareholders and administrators to have the right to bring a collective civil action for liability.

Below is a brief summary of the main changes proposed by the bill.

I. Amendments to Law 6,385/76

Expanded supervision: broadening the CVM's powers under article 9 of Law 6,385/76 to create more instruments for the CVM to investigate cases, including, among others, the power of the agency to:

- request a search and seizure warrant from the Judiciary in the interest of an investigation or administrative proceeding;

- request review of and copies of investigations and proceedings opened by other federal entities; and

- share access to information subject to confidentiality with monetary and tax authorities, provided that, with regard to the last two items, the CVM and these authorities respect the same secrecy restrictions applicable to the information at its source.

Civil liability: civil liability for losses suffered by investors as a result of the action or omission of issuers in breach of the laws and regulations of the securities market will apply to:

- officers and directors of securities issuers;

- controlling shareholders of the issuer, when the laws or regulations directly impose on them the duty to comply with the rule infringed on or when they contribute to the commission of the illicit act; and

- offerors and underwriters of public offers for the distribution of securities, as well as offerors and brokers of public offers for the acquisition of securities.

- Civil liability in the above cases will require proof of fault or intent.

Collective actions: change of criteria for investors to have standing to bring collective civil actions for liability for damages arising from breaches of securities laws or regulations, as well as individual compensation actions.

Publicity in arbitration proceedings: the possibility for the articles of association, bylaws, indentures, and instruments of issues of securities to provide for liability claims to be decided by arbitration, with the proviso that arbitration proceedings must be public.

II. Amendments to the Brazilian Corporations Law

Publicity in arbitration proceedings: obligation to publicly disclose arbitration proceedings relating to publicly-traded companies.

Closure of liability suits: expansion of the list of matters exclusive to the general meeting provided for in article 122 of the Brazilian Corporations Law to include, as a competence of the meeting, the authorization of a transaction aimed at closing liability suits provided for in articles 159 and 246 of the Brazilian Corporations Law. The transaction to close liability suits will not take effect if shareholders representing 10% of the voting capital stock decide to reject it.

Prohibition of voting by officers and directors: a prohibition on officers and directors voting, as shareholders or proxies, in resolutions on the exoneration of officers and directors and auditors from liability and on the filing of liability suits.

Limitation on the exoneration of officers and directors and auditors: amendment of the rules for exoneration of officers and directors and auditors for liability in relation to events occurring during their term of office. The automatic exoneration upon approval of the annual financial statements is eliminated.

Filing of liability suits: alteration of the criteria for shareholders to have standing to file the liability suits provided for in articles 159 and 246 of the Brazilian Corporations Law, as well as a prohibition on the company filing an independent liability suit in the event of a liability suit filed by a shareholder.

Rebalancing economic incentives in liability suits: change in the premium due to the plaintiff of the suit by the convicted officer or director or controlling shareholder, from 5% to 20% of the amount of the compensation.

With the approval of Bill 2,925/23, it will be incumbent on the CVM to regulate the changes in greater detail.

- Category: Environmental

In the first half of this year, Machado Meyer Advogados held a debate on environmental racism and the struggle for social justice. The event was organized by the affinity groups Green Team and [1] ID.Afro[2] and was attended by the master in Sustainability and PhD in Political and Economic Law from the Presbyterian University Mackenzie Waleska Batista and the Director of Operations of LabJaca, Mariana de Paula.

Environmental racism occurs when people from ethnic minorities or populations on the periphery suffer discrimination because of environmental degradation[3], such as pollution, deforestation, and other environmental problems. It is important to constantly debate this highly topic to raise awareness in society and seek viable solutions to a problem that affects several social minorities.

Origin of the concept of environmental racism

The term arose in discussions of environmental justice and was first debated by the black movement in the United States in the 1980s. Later, the concept was adopted by Brazilian scholars[4] and evolved over time. The term environmental racism was disseminated in the "First international colloquium on environmental justice, work and citizenship", held in 2001 in Rio de Janeiro, which encouraged the realization, in 2005, of the "First Brazilian seminar against environmental racism".[5]

Recognizing the existence of an environmental problem presupposes discussing the relationship between environmental degradation and the reproduction of social injustices in the Brazilian context.[6] Environmental justice, specifically in the context of environmental racism, seeks to understand how the quality of life of socially disadvantaged population groups (for example, the occupants of peripheries of urban centers) is related to the negative environmental effects of the industrial operations and the lack of public policies to neutralize any possible impacts.

These communities are often forced to live in areas more exposed to environmental impacts, which results in socio-environmental inequalities. In addition, it is not uncommon for political and economic decisions to disregard the impact on low-income and ethnic minority communities. This results in the creation of policies that maintain environmental inequality and may even increase discrimination against certain groups already at a social disadvantage.

From an environmental point of view, there is, in Brazil, an extensive legal framework to ensure the protection of traditional communities – historically most affected by environmental impacts – and mitigate any effects suffered by them as a result of the installation of potentially polluting projects or environmental crises.[7]

Combining current legislation, the development of public policies and the participation of society and traditional communities in decision-making has proven to be the most effective way to advance in the debate on combating environmental racism.

For example, the participation of any interested party in the environmental public hearings held within the scope of the environmental licensing processes of [8] activities considered effective or potentially causing great environmental degradation is guaranteed, subject to the preparation of the Environmental Impact Study and the respective Environmental Impact Report (EIA/Rima).

At these hearings, the entrepreneur presents to the interested parties the content of the environmental studies prepared for the project, clarifying doubts and collecting criticisms and suggestions for the improvement of the enterprise (article 1, Resolution 9/87 of the National Council of the Environment – Conama).

If the project involves any impact on traditional communities – including quilombola and indigenous communities – the licensing agency may involve in the environmental licensing process the intervening agencies,[9] responsible for ensuring the interests of these communities. These agencies must approve the environmental studies and the continuity of the environmental licensing, as well as collaborate for the due fulfillment of obligations imposed by the environmental agency.[10]

It is important that the combat against environmental racism is widely discussed, including in forums such as environmental licensing. This is because preventingenvironmental impacts in the most vulnerable communities necessarily involves eliminating information asymmetry.

The more communities are informed and participate in decisions, the greater the guarantee that potentially polluting projects, public policies and legislation will take into account the interests of these communities to prevent and mitigate the effects of environmental damage.

The importance of environmental crisis management

In addition to defining an action plan to prevent the occurrence of environmental damage, it is very important to establish projects and public policies for the management of environmental crises arising from natural events. Rainfall, prolonged droughts, ocean acidification, sea level rise, among other topics, are recurrent topics at international conferences on the environment[11] and can impact, especially, the most vulnerable communities.

When we talk about environmental racism, it is necessary to understand that eventual environmental crises go beyond the impacts on fauna and flora and also affect social organization. Heavy rains on the northern coast of the state of São Paulo in early 2023, for example, affected vulnerable areas with a majority black population. This demonstrates that the impact of these events is not restricted to the physical environment. It also extends to the social environment.[12]

As determined by the Brazilian Institute of Geography and Statistics (IBGE), there is great inequality in the representation of the white population in relation to the others in the Legislative Branch.[13] This indicates that the people most impacted by environmental degradation remain without decision-making power[14] and outside the center of the debates,[15] as they are not equally represented in the forums in which public policies are discussed.

This fact further highlights the repeated delegitimization of the speech of these minorities, as well as the difficulty of these groups to constitute themselves as subjects of law and not subject to administration.

Not for another reason, the impacts of heavy rains, floods, landslides, among other emergency situations, have as victims, in their majority, the black population, the quilombola, indigenous and riverine communities.

It is essential, therefore, that the agenda of the fight against environmental racism be present in dialogues signed by the most diverse groups and sectors in conjunction with the public sector, to implement specific public policies on the subject. In Brazil, it is possible to affirm that there are already movements to include the rights of minorities in environmental policies.

Combating environmental racism in the Legal Amazon

The reactivation of the Amazon Fund by Federal Decree 11,368/23 is a possible and important governmental instrument in this regard. The fund aims to raise donations for non-reimbursable investments in actions to prevent, monitor and combat deforestation, in addition to promoting the conservation and sustainable use of the Legal Amazon. Its reactivation can help combat environmental racism in the Legal Amazon, as the fund indicates in its schedule the analysis of projects to support indigenous populations and communities, with proposals for actions from various sectors.[16]

In addition, another important – and recent – initiative is the creation of the Committee for Monitoring the Black Amazon and Combating Environmental Racism, announced during the Amazon Dialogues[17], between August 4 and 6, in Belém/PA.[18] The committee will be created by the Ministry of Racial Equality in partnership with the Ministry of Environment and Climate Change and intends to propose measures to combat Environmental Racism in the Legal Amazon.

It is concluded that the combating environmental racism involves a multidisciplinary and multicultural debate. It is an effort that demands the joint action of society and government entities to prevent and mitigate the occurrence of environmental damage and its effects on the most vulnerable communities.

[1] The Green Team is an engagement group composed of the employees of the office, created from the campaign "Sustainable Machado Meyer", aimed at promoting sustainability actions in our workplace.

[2] The Afro Identity (ID.Afro) program makes up our Diversity Committee and represents the firm's commitment to ethnic-racial equity through the promotion of an open and welcoming environment.

[3] Journal of USP. Environmental racism is a reality that affects vulnerable populations. Accessed 9.8.2023.

[4] HERCULANEUM, Selene; PACHECO, Tania. "Environmental racism, what is it." Rio de Janeiro: Sustainable and Democratic Brazil Project: FASE, 2006.

[5] Silva, Lays Helena Paes and. Environment and justice: on the usefulness of the concept of environmental racism in the Brazilian context. 2012. Accessed 11.8.2023.

[6] SILVA, Lays Helena Paes e. "Environment and justice: on the usefulness of the concept of environmental racism in the Brazilian context". e-cadernos CES, n. 17, 2012.

[7] It is possible to mention the National Policy for the Sustainable Development of Traditional Peoples and Communities (Federal Decree 6.040/07), the regulation for the demarcation of quilombola communities (Federal Decree 4.887/03) and the Indian Statute (Federal Law 6.001/73).

[8] "The location, construction, installation, expansion, modification and operation of establishments and activities that use environmental resources considered effective or potentially polluting, as well as projects capable, in any form, of causing environmental degradation, will depend on prior environmental licensing by the competent environmental agency" (Article 2, caput, Conama Resolution 237/97).

[9] Among them, the National Foundation of Indigenous Peoples (Funai), to represent indigenous communities, and the National Institute of Colonization and Agrarian Reform (Incra), to represent quilombola communities.

[10] It is important to highlight that the licensing environmental agency is allowed to continue or not the environmental licensing process. However, considering the expertise of the intervening bodies and the primacy for the protection of traditional communities, the licensing body tends to adopt the recommendations of these intervening bodies.

[11] United Nations. What you need to know about the United Nations Conference on Climate Change (COP26). UNEP: 2021.

[12] "Inequalities by color or race are also expressed in access to sanitation services, which, in addition to the implications related to health and living conditions, also brings patrimonial impacts. Considering that the value of the residence is not only determined by the physical characteristics of the property itself, but also by the location and insertion in the urban infrastructure, lower rates of access to sanitation services indicate lower values of these properties." (Ibid., p. 7).

[13] "Political participation is one of the social dimensions where there are inequalities of access according to color or race and object of concern expressed in the Declaration and program of action adopted at the World Conference against Racism, Racial Discrimination, Xenophobia and Related Intolerance, held in Durban in 2001. In the first edition of this newsletter, an under-representation of the black or brown population was highlighted in the Chamber of Deputies, in the State Legislative Assemblies and in the Chambers of Councilors [...] despite constituting 55.8% of the population, this group represents 24.4% of the federal deputies and 28.9% of the state deputies elected in 2018 and by 42.1% of the councilors elected in 2016 in the country [...]" (IBGE, Coordination of Population and Social Indicators. Social inequalities by color or race in Brazil. Studies and Research: Demographic and Socioeconomic Information No. 48, Rio de Janeiro, 2nd ed., p. 13, 2022.

[14] Ditto.

[15] LOUBACK, Andrea Coutinho. COP26 is more representative in terms of climate justice. Le Monde Diplomatique Brasil, Nov. 12. 2021.

[16] The document "Guidelines and Criteria for the Application of the Resources of the Amazon Fund", established by the Steering Committee of the Amazon Fund on February 15, 2023, indicate that the analysis of projects on the subject is on the committee's agenda.

[17] General Secretariat. Amazonian Dialogues. Accessed 8.8.2023.

[18]Secretariat of Social Communication. Anielle Franco announces monitoring of the Black Amazon and confronting environmental racism. Accessed 6.8.2023.

- Category: Competition

The Tribunal of the Administrative Council for Economic Defense (CADE) dismissed, in August, an investigation regarding an alleged practice of resale price maintenance (RPM) in the Brazilian relevant market for watches. It concluded that the investigated company did not have market power. The investigation concerned the alleged implementation of a commercial policy that imposed on online resellers a minimum profit margin, with threats and retaliation in case of non-compliance. Although it did not condemn the investigated company, CADE signaled to the market its opinion about RPM practices.

RPM occurs when a company establishes a minimum, fixed or maximum resale price to distributors or resellers of its product, taking away their freedom to determine the price to their customers. Indirect practices such as establishing a profit margin can also be deemed as RPM.

RPM can be expressed in writing – established in an agreement or communication that indicates the price imposed and the sanction for non-compliance – or implicit – when the supplier constrains distributors or resellers to adopt the indicated prices.

CADE's main concern in such cases is the reduction of intra-brand competition, that is, the elimination of rivalry between distributors or resellers of a certain product/brand, which tends to reduce prices.

In this recent decision, CADE reiterated that the mere suggestion of a resale price (minimum or maximum) and maximum resale price maintenance raise less competition concerns than minimum resale price maintenance.

In addition, CADE kept the relative presumption of illegality of minimum resale price maintenance, a stricter position that has been adopted since 2013. In minimum RPM cases, the Brazilian antitrust agency assumes that the practice has an anticompetitive purpose and reverses the burden of proof: it is up to the investigated company to prove that such presumption is incorrect.

The competitive assessment of RPM practices comprises the following steps:

- to identify whether the conduct occurred;

- to define the relevant market and to assess whether the company under investigation has a dominant position/market power;

- identify the potential or actual competitive harm of the practice (e., the negative effects to the market); and

- to identify the economic rationale, efficiencies and adequacy of the practice to achieve the desired goal (e., its justification and pro-competitive effects).

The investigation may be dismissed if the practice did not actually take place or the investigated company did not have market power – which, in practice, would prevent it from potentially harming the market.

If, however, the company has market power, to avoid a condemnatory decision it will be necessary to prove that the conduct was supported by economic rationality (i.e., a legitimate goal) and produced clear benefits to competition.

Given this rigorous approach to the legality of minimum RPM, CADE pointed out that companies should be cautious when structuring their commercial policies. They must establish a well-defined and delimited scope, supported by robust economic analyses, based on the most complete data possible, that support the desired economic rationality and the alleged economic efficiencies.

- Category: Environmental

The virtual trial of Direct Action of Unconstitutionality (ADI) 7,321 was concluded on June 2, 2023. The action was proposed by the National Association of Mobile Operators (Acel) against provisions of Law 6.787/06 of the [1] state of Alagoas, which deals with the requirement of environmental licensing for the installation of Transmission Network of Telephone System and Base Radio Stations and Wireless Telephony Equipment.

According to Acel, the contested articles violate the exclusive competence of the Union to legislate on telecommunications, as well as to exploit these services, as provided for in the Federal Constitution. In addition, ACEL claimed that the contested provisions would be in dissonance with Federal Law 9,472/1997, General Telecommunications Law, and Federal Law 13,116/2015, known as the Antenna Law.

Based on these arguments, Acel requested the granting of a precautionary measure to suspend the effects of the contested provisions and, on the merits, the declaration of unconstitutionality of the legal provisions in question.

In a judgment initiated on May 26, 2023, by the rapporteurship of Justice Gilmar Mendes, the Plenary of the Federal Supreme Court (STF) decided, by majority, for the validity of ADI 7,321, declaring the unconstitutionality of the provisions of the Alagoas law.

In accordance with the vote of the rapporteur, the Arts. 19, X, and 150 of the General Telecommunications Law establish the competence of the National Telecommunications Agency (Anatel) to issue rules on the provision of telecommunications services and to regulate the deployment, operation and interconnection of networks, ensuring the compatibility of the networks of the different providers, aiming at their harmonization at the national and international level.

According to the rapporteur, the Union's exclusive competence to legislate on the subject stems from the need for a broad and deep integration of networks, equipment and systems at national and international levels.

Minister Gilmar Mendes also asserted that, despite the intention of protecting and defending the environment, the state law invades the private competence of the Union to legislate on the matter and directly interferes in the contractual relationship formalized between the granting authority and the concessionaires to the extent that it creates an obligation for companies providing telecommunications services and stipulates criteria for the installation of telecommunication infrastructures.

The rapporteur stated that the Supreme Court has extensive jurisprudence that state law should be declared unconstitutional when it provides for telecommunications, even for protecting health, the environment or consumers.

Minister Gilmar Mendes also stated that the state law is in dissonance with Federal Law 13.116/15, which provides for general rules applicable to the process of licensing, installation and sharing of telecommunications infrastructure to make it compatible with Brazil’s socioeconomic development.

In Article 7, the legal diploma mentioned provides that "the necessary licenses for the installation of support infrastructure in urban areas will be issued through a simplified procedure, without prejudice to the manifestation of the various competent bodies during the administrative process."

Article 8 of Federal Law 13,116/15 also determines that "the competent bodies may not impose conditions or prohibitions that prevent the provision of telecommunications services of collective interest, under the terms of current legislation." Therefore, according to the rapporteur, by subjecting the installation to new conditions, the state law enters into a normative domain reserved for the Union.

Finally, the rapporteur also declared the unconstitutionality, by dragging, of items 10.5. and 10.6 of Annex VI of State Law 6,787/06, which establish different sizes for telecommunications networks and stations and, consequently, offend the private competence of the Union.

In a dissenting vote, Justice Edson Fachin expressed the understanding that the declaration of unconstitutionality of the contested provisions would mean that any enterprise regulated by the Union would necessarily be licensed by it as if the private competence functioned as an attractive route of all environmental law.

According to Minister Edson Fachin, Complementary Law 140/11 and Federal Decree 8,437/15, which regulates some of its provisions, establish that infrastructure installation works to support communication networks are not the competence of the Union.

Thus, according to the dissenting vote, recognizing the private competence of the Union to license this type of enterprise would impact the way licensing has occurred in Brazil and reward the inaction of the Union, which could even represent the unconstitutional exemption of licensing for these activities.

Against the judgment were opposed embargoes of declaration, which still await trial.

[1] Items 10.5 and 10.6 of Annex I, object of article 4, paragraph 1 of said law.

- Category: Real estate

The National Council of Justice (CNJ) judged, on August 8, 2023, an administrative procedure regarding an article of the provision of the Court of Justice of Minas Gerais (TJMG) that deals with the procedure for the constitution of fiduciary alienations of real estate in Minas Gerais.

In a brief context, Joint Provision 93/2020 of the TJMG (Provision 93), regulated the execution of fiduciary alienation and limited the constitution by private instrument to the entities of the Real Estate Financing System (SFI), credit unions or real estate consortium administrator.[1]

This provision does not directly follow federal law on fiduciary alienation. Law 9,514/97, which provides for the SFI and instituted the fiduciary alienation of immovable property, in its article 22, paragraph 1, expressly allows individuals or legal entities, regardless of whether they operate in the SFI, to contract the fiduciary alienation.

The interpretation of the TJMG, however, is not followed by most of the country's courts of justice, whose regulations allow contracting by private instrument, without limiting such prerogative to the entities operating in the SFI. In this sense, by way of example, the Court of Justice of the State of São Paulo (TJ-SP) provides on the subject as follows:

Article 229 - The acts and contracts referred to in Law No. 9,514/1997, or resulting from its application, even those aimed at the constitution, transfer, modification or waiver of rights in rem over real estate, may be executed by public deed or by private instrument with the effects of a public deed.

In line with the interpretation of the TJMG, which limits the constitution of fiduciary alienation by private instrument to the entities operating in the SFI, only the Courts of Justice of the State of Bahia (TJBA), the State of Pará (TJPA), the State of Maranhão (TJMA), and the State of Paraíba (TJPB) impose a similar restriction.

Evolution of the TJMG regulation on the subject

When analyzing the wording of the provisions that dealt with the subject in the previous provisions of the General Council of Justice of Minas Gerais (CGJMG), it is verified that, at a certain moment, there was a change in the understanding about the imposition of limitation.

In 2013, Provision 260 of the CGJMG was regulated in a similar way to Provision 93, that is, limiting the constitution of fiduciary alienation through a private instrument to the entities operating in the SFI. However, in 2015 the CGJMG, pursuant to provision 299, removed the limitation from the wording and began to regulate the subject as follows:

"Art. 852. Acts and contracts relating to the fiduciary disposal of real estate and related businesses may be executed by public deed or private instrument, pursuant to article 38 of Law No. 9,514, of November 20, 1997."

This rule was in force for two years, until in 2017 the CGJMG resumed the wording that limits the use of the private instrument for the contracting of the fiduciary alienation. This regulation remained in force until the present day and has now been corroborated by the CNJ.

Competence of the CNJ

The CNJ is an organ of the Judiciary provided for in the Federal Constitution, which was established by Constitutional Amendment 45/04. Its 15 members are elected for a 2-year term, including ministers of the superior courts, judges of federal courts, members of the public prosecutor's office, as well as lawyers and citizens, as provided for in Article 103-B of the Constitution.

In the discussion in evidence, the CNJ is provoked to interfere in the case based on its competencies, which at the same time determines that the CNJ ensures the autonomy of the Judiciary and the legality of the administrative acts practiced by the organs of the Judiciary.[2]

Thus, in the case in question, the role of the CNJ was to judge the legality of the restrictions imposed by the TJMG and to understand whether the limitation imposed on entities not members of the SFI constitutes an administrative act of the body, perfectly legal, being supported its autonomy.

However, it is important to note that there is a limit to be respected, referring to the incompetence of the body to legislate on any subject. Under the terms of the Federal Constitution, the act of legislating is restricted to the Union and, in certain cases, the competence lies with the states and municipalities. The CNJ, among other functions, is responsible for regulating, but always under the terms provided by law.

In this sense, and based on the interpretation of article 22, paragraph 1, of Law 9,514/97 (that there is no limitation on the contracting of the fiduciary alienation), by limiting rights not expressed by current legislation, the decision of the CNJ may be discussed in the future, based on the restrictions inherent to its competence.

Decision of the CNJ on the subject

Due to the restrictions imposed by the TJMG described above, a company interested in entering into a private instrument of fiduciary alienation proposed an administrative control action to the CNJ. The objective was to annul the administrative act of the TJMG that limits the rights of individuals and legal entities that do not operate in the SFI.

In the understanding of such company, the normatization made by the TJMG is in clear disagreement with the provisions of the federal legislation on the fiduciary alienation of real estate and, because of this, it would be illegal to restrict the execution of fiduciary alienation by private instrument to the institutions of the SFI.

In short, in the view adopted, the administrative act of the TJMG could not impose restrictions that were not expressly provided for in federal legislation. This is due to the existence of a specific law that regulates the execution of the fiduciary alienation and that does not reflect the aforementioned limitation.

The TJMG, on the other hand, maintains that legislation must be interpreted in harmony, making use of the "theory of dialogue of sources" and, in this sense, based on the provision of article 108 of the Civil Code,[3] the prohibition disciplined in extrajudicial rules would be fair.

In the trial session, all the counselors of the CNJ accepted the arguments of the TJMG. Thus, the request of the company in question was denied and the contested restriction, which was considered reasonable, remained valid.

Thus, the restrictions on the possibility of entering into fiduciary alienation by private instrument remain in force in Minas Gerais (and other states that regulate the subject in a similar way).

The requirement to formalize fiduciary alienation by public deed affects the costs, deadlines and even the terms of the contract. This is because the notary needs to agree to the wording of the agreement.

Thus, it is essential to analyze the rules applicable to the place of the signed business and, if so, to evaluate the best option for the agreement.

[1] Joint Provision No. 93/2020 of the General Council of Justice ofTJMG: Art. 954. The acts and contracts related to the fiduciary sale of real estate and related businesses may be executed by public deed or private instrument, provided that, in the latter case, it is entered into by an entity that is part of the Real Estate Financing System – SFI, by Credit Unions or by a Real Estate Consortium Administrator.

[2] Art. 103-B. The National Council of Justice is composed of 15 (fifteen) members with a term of office of 2 (two) years, admitted 1 (one) renewal, being: [...]

- Article 4 - The Council is responsible for controlling the administrative and financial performance of the Judiciary and the fulfillment of the functional duties of judges, and it is incumbent upon it, in addition to other attributions conferred on it by the Statute of the Judiciary:

I - to ensure the autonomy of the Judiciary and compliance with the Statute of the Judiciary, being able to issue regulatory acts, within the scope of its competence, or recommend measures;

II - to ensure compliance with article 37 and to assess, ex officio or through provocation, the legality of administrative acts performed by members or organs of the Judiciary, and may disconstitute them, review them or set a deadline for the adoption of the necessary measures for the exact compliance with the law, without prejudice to the competence of the Court of Auditors of the Union;

[3] Art. 108. Unless the law provides otherwise, the public deed is essential to the validity of legal transactions aimed at the constitution, transfer, modification or waiver of real rights over real estate worth more than thirty times the highest minimum wage in force in the country.

- Category: Competition

The balance of environmental, social and governance (ESG) goals is becoming increasingly important in the agenda of companies, in Brazil and abroad. The number of ESG initiatives that require some degree of commercial strategy alignment or cooperation with competitors in order to achieve sustainability gains is also growing. These are situations that would classically raise concerns about collusive behaviour, concerted practices or the exchange of sensitive information.

For competition authorities, the issue is also on the agenda. The Administrative Council for Economic Defense (Cade) has recently discussed, in the scope of a merger filing, aspects to be considered when assessing agreements amongst competitors aiming at generating gains in environmental, social or governance sustainability.

This debate is more advanced in the European Union, where competition authorities of several countries have already been discussing, for some years, the competitive implications of issues related to ESG initiatives.

The European Commission has recently adopted guidelines allowing cooperation between competitors in initiatives of this nature, provided that certain conditions are met – including that the collective benefits arising from the ESG agreements outweigh the harms associated with the restraint of competition arising from such agreements.

The European Commission’s approach is aligned to some extent with that of the competition authorities in Austria and the Netherlands, where antitrust immunity for sustainability agreements has already been established based on an assessment of the positive sustainability effects and negative effects of the agreements on competition.

In the Netherlands, the positive effects were deemed to outweigh the negative effects in a case involving an agreement amongst certain beverage manufacturers and supermarket chains to stop using plastic handles in beverage multipacks, as well as in a case involving garden centers curtailing suppliers who use illegal pesticides.

In the United States, however, the stance on the subject has been more conservative. The Federal antitrust authorities have been indicating that there will be no special treatment for ESG initiatives that could be in violation of the antitrust law. This tends to discourage coordinated sustainability initiatives and has already led several insurers to depart from a United Nations-convened alliance created to encourage carbon emission reduction (the so-called Net-Zero Insurance Alliance).

CADE's Tribunal discussed ESG collaborations for the first time in June, when reviewing a merger filing involving the establishment of a joint-venture by agricultural commodities trading companies with global operations. The companies intend to create a platform to facilitate the standardization and management of sustainability measurement data at different stages of the food and agricultural supply chain.

Some of the Commissioners stressed that Cade's role is to protect competition. For them, by incorporating issues as environmental, social or governance sustainability gains in the analysis of the effects of transactions under their review, Cade could be overstepping its competence. Others argued that, although the ESG agenda is relevant, it should not influence the agency's technical and objective analysis. Other Commissioners, however, adopted an approach closer to that of some European competition authorities, pointing out that it is important for Cade to establish directives or guidelines for cases involving some sort of business cooperation mechanism among competitors for ESG initiatives.

The different approaches adopted abroad and the still incipient debate at Cade lead to legal uncertainty. Considering potential competitive risks when structuring ESG initiatives is, therefore, critical. Companies need to be even more careful and perform a detailed assessment to identify risks and adopt measures to mitigate them.

- Category: Intellectual property

The National Institute of Industrial Property (INPI) has published the four-year strategic plan for 2023-2026, presenting its mission, vision, and values, as well as its new strategic objectives.

As a mission, the Brazilian Patent and Trademark Office (BPTO) intends to "boost innovation through industrial property". As a vision, it seeks "to consolidate itself as a world-class industrial property office". As its values, the institute elects excellence, user-focus, public vocation, appreciation of people, innovative spirit and cooperation.

Together with these guiding elements, the BPTO presented the strategic objectives that will guide the actions to be taken and results to be sought in the next four years:

- Optimize quality and agility in the granting and registering industrial property rights, achieving performance standards of international reference;

- Promote culture and the strategic use of industrial property to improve competitiveness, innovation, and development of Brazil;

- Consolidate the insertion of Brazil as a protagonist in the international system of industrial property;

- Raise knowledge and recognition of the value BPTO brings to society;