- Category: Environmental

Two themes that have been effervescent in the industrial sector and in corporate world are green hydrogen and ESG (acronym for Environmental, Social and Governance, which, in Portuguese, corresponds to Ambiental, Social and Governança). Quite different at first glance, these two issues relate in a unique way and bring opportunities and advantages for entrepreneurs and investors, especially in Brazil.

Although the adoption of a business strategy based on the environmental, social and governance aspects and implications has been debated for some time, it is undeniable that this theme has gained greater relevance recently, when many companies and governments had to restructure and adapt to changes imposed by social isolation measures to contain the Covid-19 pandemic.

The health crisis on a global scale revealed the weaknesses of economic strategies currently adopted, highlighting the need of reviewing modes of production, consumption and, mainly, the relationship of people, companies, leaders and nations with the environment. Nowadays, much is said about economies’ "green recovery" and " stakeholder capitalism", in opposition to "shareholders capitalism". It is time for nations and corporations to take advantage of the crisis and the efforts undertaken in economic recovery and (re)affirm commitments and agendas in favor of sustainability.

The recent announcement of green hydrogen production initiatives and investments in Brazil and the imminent edition of a National Hydrogen Program, which should be approved by the end of 2021[1] by the National Congress, revived discussions on the feasibility of hydrogen and opportunities related to its use in various markets and sectors.

Hydrogen is one of the main industrial insums,[2] with wide application and aptitude to optimize several processes and products, but the high production cost has limited its use in the country. Obtaining hydrogen mostly involves using polluting energy sources such as oil, natural gas, or coal. The green variety corresponds to hydrogen produced by using energy from renewable sources (such as wind, solar and biofuels) and applying electrolysis to separate hydrogen from oxygen on water molecules.

However, the consortium of large-scale renewable energy generation projects with green hydrogen plants has proven to be an increasingly feasible way to overcome the obstacles to production and use of this element on a large scale, especially in face of the continuously price rising of fossil fuels and consequential increase in the competitiveness of alternative energy sources. In this context, Brazil has a frank and undeniable competitive advantage to this important global energy transition tool, with his 80% renewable sources composed energy matrix.

Green hydrogen, especially on energy sector, may be the key to guarantee Brazil’s protagonism on economical restructuring based on ESG strategies, assuming the role of a fundamental component of the Brazilian energy matrix.

As an environmental corporate strategy, green hydrogen is an important tool for decarbonization of the economy, industrial processes and transportation sector by reducing greenhouse gas (GHG) emissions and serving as a very interesting tool for achieving Sustainable Development Goals (SDGs)[3] and other sustainability goals, especially if positive aspects of reducing carbon emissions and the potential credit of renewable energy are observed.

In the social aspect, the production of green hydrogen on a commercial scale and the production, storage and distribution chains structuring in the country will demand large investments, resulting in thousands of new jobs and greater income generation.

Considering Brazil’s energy potential, especially the one concentrated in North and Northeast regions and focused on clean energy (wind, solar and hydro) production, the implementation of green hydrogen related initiatives can imply on an important economic development of these regions, with greater investment, better income distribution and the reduction of social inequalities. In addition, green hydrogen is expected to promote the unification of the fuel, industrial and electric markets, given its versatility and multiple application.

From the point of view of governance, while the production and distribution of green hydrogen in Brazil is moving towards becoming a reality, government institutions and instruments must prepare legal, economic and regulatory scenarios conducive to the integration of the green hydrogen chain to Brazilian energy policy, involving civil society and business sectors, as well as directing efforts and resources towards an economic restructuring integrated with the ideals and agendas aligned with the issue of sustainability.

It is necessary, therefore, to closely monitor the Brazilian regulatory scenario and the mobilization of its authorities to establish the National Hydrogen Program, as well as be open to the numerous opportunities of green recovery tied to green hydrogen as an important strategy to strengthen the ESG aspects and decarbonization initiatives of Brazilian economy.

[1] Regarding this theme, Resolution No. 6 of April 20, 2021, of the National Energy Policy Council, determined that Ministry of Mines and Energy submit a proposal of National Hydrogen Program guidelines within 60 days (counted from this resolution publication, which took place on May 17, 2021).

[2] Used in the food, agribusiness, petrochemical, mining, technology and energy industries.

[3] The Sustainable Development Goals are a global agenda agreed by the 193 United Nations (UN) member countries composed of 17 objectives and 169 goals to be achieved by 2030, with commitments aimed at eradicating poverty, food security, health, education, gender equality, reducing of inequalities, energy, water and sanitation, sustainable patterns of production and consumption, climate change, sustainable cities, protection and sustainable use of oceans and terrestrial ecosystems, inclusive economic growth, infrastructure, industrialization and others.

- Category: Institutional

Responsibility, ethics, listening capacity, appreciation of the other, strategic vision, innovation and broad legal knowledge. The list includes some of the qualities common to people who work in traditional leadership positions in the legal world. Let us add to them factors such as the unequal struggle to be successful, the permanent state of alertness caused by the increased collection related to unconscious biases, the awareness of being an exception and the role of inspiring and transforming reality. We will have, with a reasonable margin of reckoning, a black leadership.

Although such differences should not exist 133 years after Brazil was the last country to formally abolish slavery in the Americas, these have been common characteristics to black people in leadership positions in the judiciary and in large Brazilian law firms.

According to Brazilian Institute of Geography and Statistics (IBGE), 56% of the country's population declares itself brown and black. Despite this percentage, throughout the history of the Supreme Federal Court (STF), for example, only three blacks joined the court: Ministers Joaquim Barbosa, between 2003 and 2014; Hermegenildo de Barros, appointed in 1919 and retired in 1937; and Pedro Lessa, minister between 1907 and 1921. As for black women, so far none have been part of the Supreme Court – a reflection of our culture permeated by racism and sexism that is often unrecognized.

Already in the higher courts - Superior Court of Justice (STJ), Superior Labor Court (TST), Superior Electoral Court (TSE) and Superior Military Court (STM) –, only 1.3% declare themselves black and 7.6%, brown, according to the Judicial Census conducted in 2018 by the National Council of Justice. In the Public Prosecutor's Office, blacks are only 2% according to IBGE.

In the midst of the low representation of black leaders, we found, exceptionally, professionals committed to the change of scenery, such as the prosecutor Lívia Sant'Anna Vaz, who works in the Public Prosecutor's Office of the State of Bahia and was Recognized as one of the 100 most influential people of African descent in the world for the MIPAD award – Most Influential People Afro Descendent - Law & Justice Edition.

For Livia, although they represent 56% of the population, black people in Brazil are not represented in public and private institutions and in the spaces of power and decision, and this has a direct impact on the way the justice system offers its services to citizens. According to the jurist said in an interview given to the authors of the article, "the struggle is unequal, because black bodies cause strangeness even today, in spaces of power, especially the body of the black woman, an instrument that speaks before even opening the mouth". She believes that, only through alliances between institutions, there can be a strengthening that allows to overcome this solitary and exceptional condition in leadership spaces.

the lawyer and doctor of law at Harvard University in the United States, Adilson José Moreira, author of "Recreational Racism", states in interview to lexlatin portal that "the legal world, the Brazilian faculty is made up of white people. Today, 80% of Brazilian law professors are upper-class heterosexual white men. These people have never suffered discrimination in their lives, so on the contrary, they are systematically privileged by racism."

Published by the National Council of Justice (CNJ) in 2018, the latest report Sociodemographic Profile of Brazilian Magistrates, which seeks to identify who the Brazilian magistrates are in terms of demographic, social and professional characteristics, points out that only 14% of the magistrates are black, 64% of whom are white and the other classified as brown.

In the state of Bahia, a federal unit with one of the largest black populations in the country, only 5% of the magistrates are black, which reinforces the finding that the Judiciary, being an instrument for combating injustices, can and should expand the space of representativeness when it comes to afrodescent in leadership positions.

In private enterprise, when we look at a work published by IBGE in 2019, we have the following cutout: "Despite the fact that the black or brown employed population is higher than the white population, the proportion in management positions shows a significant majority of white people – 68.6% versus 29.9% in 2018. Such under-representation of black or brown employed people in this matter occurs in the five Great Regions of the country. Although in the North and Northeast regions there is a higher proportion of black or brown people than white people in managerial positions (respectively 61.1% and 56.3%), these percentages are lower than those observed in the general occupied population, in 2018 (respectively, 78.0% and 74.1%), characterizing the under-representativeness also in these regions."

Although blacks are the majority in public universities (50.3%), IBGE data show that they occupy only 30% of the leadership positions in the country.

With regard to lawyers, the Brazilian Bar Association (OAB) currently has more than 1.2 million registered. However, there are no data on the percentage of browns and blacks, as there has not been a census for racial analysis so far

Demonstrating the growing importance of the debate on institutional racism, however, in 2020 the I National Conference for the Promotion of Equality.

In line with the racial diagnosis made in law firms, the Center for the Study of Labor Relations and Inequalities (Ceert) conducted a survey in 2018 that showed the existence of less than 1% of black lawyers in large Brazilian law firms. The survey was conducted in partnership with the Legal Alliance for Racial Equity and analyzed nine newsstands in São Paulo.

We have made progress since then, but a coherent reading of the data provides us with the perspective that affirmative policies, although long publicized as essential for the development of a society that seriously seeks historical redress in relation to the black population, are still incipient and there is much to improve.

It is not just about reparation and justice: Brazil's development can be proportional to its wealth of diversity.

Research conducted by McKinsey, a global management consulting firm, revealed that companies with greater ethnic diversity in their executive teams are 33% more likely to profitability.

In order to achieve these goals that in everything prove beneficial, it is enough to stimulate a factor that at some point permeates the lives of all leaders, regardless of whether they are black or white: opportunity.

It is in this space of creating opportunities that some offices, like Machado Meyer, have stood out implementing internal policies aimed at minorities. The initiative aims to boost careers of black people through mentoring, educational incentives such as language courses and undergraduate studies, support for projects such as Include Law, and encourage the admission of black employees to management positions and white professionals engaged in anti-racist actions. This makes it possible not only to increase the number of black people in the staff, but also reaffirms the importance of the representativeness of these people in leadership positions.

The racial and social inequalities that have been open in the last year due to the covid-19 pandemic and the debates on racism make the adoption of actions to solve this historical-cultural situation even more pressing.

One of the ways to achieve a more responsible legal world on this issue is planning to expand the number of black leaders in the corporate world.

The question we all ask ourselves is: how can we accelerate the expansion of the black leadership contingent? The answer, as already pointed out in the article Structural racism is, "we need to act!". There are many actions that need to be taken, including:

- Racial literacy: the need to deconstruct ways of thinking and acting that have been naturalized – such as the logic of the Eurocentric perspective guided by white privilege – to implement actions to combat the structural racism present throughout Brazilian society and to curb any type or attempt of physical, psychological and intimidating violence.

- Debates on racial equality so that more blacks can report their difficulties and help raise employee awareness of the issue.

- Anti-racist protagonism of companies: commitment of companies and employees to racial equality through the adoption of anti-racist policies and practices such as:

- Acceleration of entry programs through specific training and training to provide internal reception and awareness of the entire organization

- Increase in the number of blacks in decent positions and salaries in companies to have conditions of education for themselves and their

- Training of black professionals so that they are more prepared and companies can maintain them at all levels and sectors of their staff, offering professional improvement, mentoring programs and international experiences

- Hiring blacks for the top management of organizations

- Encouraging the indication of black professionals

- Insertion in the labor market of black professionals already qualified and not absorbed by large companies

- Participation in forums that provide guidelines for advancing the theme of racial equity

- Promoting a culture in which employees help, encourage, and boost their black colleagues

- Adhering to programs aimed at racial change, such as the Legal Alliance for Racial Equity, the[1] and the Include Law project, an initiative of the Center for the Study of Law Firms (Cesa) to contribute to reducing inequalities and discrimination, promoting the inclusion of black students in the legal universe through an agreement with supporting offices and universities

The above initiatives are no longer isolated and have been implemented by several companies, as pointed out in the book The anti-racist company: how CEOs and senior leaders are acting to include blacks and blacks in large corporations.[2]

The trajectory of black leaders, in addition to breaking stereotypes and racial unconscious biases, also opens up space and encourages blacks to achieve their goals and reduce inequalities.

The intention of this article is not only to point out the causes of inequality or to highlight the status of a minority of the black race, even though this discussion has the utmost importance and is necessary in many layers of Brazilian society lacking information in several aspects. The article, written by three black lawyers in an exceptional position in an office that respects our place of speech and is willing to propagate our voices, aims to demonstrate that changes are urgent and it is essential that those in a position of privilege educate their gaze to observe that skills exist in all human beings , regardless of skin color.

Machado Meyer is part of the Legal Alliance for Racial Equity and reinforces, through ID.Afro, the Diversity and Inclusion Committee and all its members, the commitment to anti-racist initiatives.

REFERENCES

"Half the population, blacks are only 1% of the lawyers of the big offices," Conjur, 12/6/2020, https://www.conjur.com.br/2020-jun-12/negros-sao-somente-advogados-grandes-escritorios

"With the blackest capital of the country, Bahia wins free application for registration of complaints against racism and religious intolerance", G1, 19/11/2018, https://g1.globo.com/ba/bahia/noticia/2018/11/19/com-a-capital-mais-negra-do-pais-bahia-ganha-aplicativo-gratuito-para-registro-de-denuncias-contra-racismo-e-intolerancia-religiosa.ghtml

"Social inequalities by color or race in Brazil", IBGE, Studies and Research - Demographic and Socioeconomic Information, no. 41, 2019, https://biblioteca.ibge.gov.br/visualizacao/livros/liv101681_informativo.pdf

"The top has color: blacks are still a minority in leading positions in the food industry," The tares and wheat, 29/10/20, https://ojoioeotrigo.com.br/2020/10/o-topo-tem-cor-negros-ainda-sao-minoria-em-cargos-de-lideranca-da-industria-alimenticia/

"Black Women's Leadership Survey", Restless, 04/29/21, https://inquietaria.99jobs.com/pesquisa-mulheres-negras-na-lideran%C3%A7a-3E6DFB5CCA95

"Ambev, Carrefour and other giants create project of R $ 45 mi against racism", UOL, 08/06/21 https://economia.uol.com.br/noticias/redacao/2021/06/08/mover-empresas-se-unem-em-movimento-por-equidade-racial.htm?cmpid=copiaecola

"Launch of the Legal Alliance for Racial Equity", FGV, 03/21/19, https://direitosp.fgv.br/evento/lancamento-alianca-juridica-pela-equidade-racial

"Black Consciousness Day: is the law sector inclusive?", Folha OAB, 20/11/20, https://folhadirigida.com.br/oab/noticias/politica-e-mercado-oab/dia-consciencia-negra-setor-advocacia-inclusivo

"I National Conference for the Promotion of Equality, National OAB, 19 and 20/11/21" https://centraleventos.oab.org.br/event/291/i-conferencia-nacional-de-promocao-da-igualdade

"Video of the 1st National Conference for the Promotion of Equality, OAB Nacional, 19 and 20/11/21"

https://www.youtube.com/watch?v=88PhOVT80Ls

"IBGE: 64% of the unemployed are black and informality reaches 47%," Brazil in fact, 11/13/19, https://www.brasildefato.com.br/2019/11/13/ibge-64-dos-desempregados-sao-negros-e-informalidade-alcanca-47

"CNJ research: how many black judges? How many women?", CNJ News Agency, 3/5/18,

https://www.cnj.jus.br/pesquisa-do-cnj-quantos-juizes-negros-quantas-mulheres/

"Racial literacy: a challenge for all of us, Portal Geledés, 28/10/17, https://www.geledes.org.br/letramento-racial-um-desafio-para-todos-nos-por-neide-de-almeida/

"Black jurists and the struggle for spaces in the world of law", Folha de Pernambuco, 09/07/20, https://www.folhape.com.br/noticias/juristas-negras-e-a-luta-por-espacos-no-mundo-do-direito/146536/

"Sociodemographic Profile of Brazilian Magistrates", CNJ, 2018, https://www.cnj.jus.br/wp-content/uploads/2011/02/5d6083ecf7b311a56eb12a6d9b79c625.pdf

[1] The movement aims to work on three pillars: leadership, employment and training and awareness. In the first, the signatory companies commit to create a total of 10,000 new positions for black people in leadership positions (such as supervisors, coordinators, managers and directors) by 2030. In the pillar of employment and training, the planned actions aim to generate opportunity for three million people, through the offer of courses and network of relationships with black entrepreneurs. In the last pillar, the movement proposes to be a tool to support awareness of racism. The initiative aims to carry out advertising campaigns on the theme [...] - See more in https://economia.uol.com.br/noticias/redacao/2021/06/08/mover-empresas-se-unem-em-movimento-por-equidade-racial.htm?cmpid=copiaecola

[2] PESTANA, Mauritius. The anti-racist company: how CEOs and senior leaders are acting to include blacks and blacks in large corporations. 3rd ed. Rio de Janeiro: Agir, 2021

- Category: Banking, insurance and finance

Eduardo Castro, Flávia Ferraz, Melissa Moreira and Tathiana Bussab

Legal entities and investment funds incorporated in Brazil must submit a report to the Central Bank of Brazil, detailing investments in their quotas and/or shares held by foreign investors, or the outstanding short-term trade debts owed to non-residents, on December 31 of the previous fiscal year, in the following situations:

- Legal entities must submit this report when, on December 31, 2020, they had a net worth equivalent to or above USD 100 million and, simultaneously, any direct ownership held by non-resident investors in their capital stock, regardless of the amount;

- Legal entities must submit a report concerning their current liabilities with non-resident lenders through debt instruments when, on December 31, 2020, they had an outstanding balance in short-term trade debts (due within 360 days) equivalent to or above USD 10 million, regardless of any foreign equity ownership in their capital stock; and

- Investment funds must submit a report when, on December 31, 2020, they had a net worth equivalent to or above USD 100 million and, simultaneously, quotas directly held by non-resident investors, regardless of the amount.

The reporting obligation mentioned above does not apply to the following persons and administrative bodies:

- individuals;

- direct administrative bodies of federal, state, Federal District, and municipal governments;

- legal entities who are debtors in the transfer of foreign loans granted by institutions headquartered in Brazil; and

- nonprofit entities maintained by the contributions of non-residents.

The report must be electronically submitted to the Central Bank through the website www.bcb.gov.br between July 1, 2021, and August 16, 2020, at 6 PM.

The manual containing detailed information on the content and requirements of the report is available on the same website.

Those responsible for this report must store the supporting documentation for five years (counted as of the base date of the report) and make them available for submission to the Central Bank upon request.

Failure to submit the report (or submitting it without complying with the applicable regulations) subjects the violator to a fine of up to BRL 250,000.00, under article 60 of BCB Circular No. 3,857, of November 14, 2017.

The Census of Foreign Capital in Brazil aims to compile statistics of the external sector, especially the International Investment Position, to subsidize the development of the economic policy and support the activities of the economic researchers and international agencies.

(BCB Circular No. 3,795, of June 16, 2016, Law No. 13,506, of November 13, 2017; and BCB Circular No. 3,857, of November 14, 2017.)

- Category: Environmental

On February 26, the government of Minas Gerais published State Decree No. 48,140/2021, the second of a set of three decrees to regulate State Law No. 23,291/2021, which instituted the State Dam Safety Policy (Pesb). The initiative seeks to strengthen the rigor of dam safety in the territory of Minas Gerais.

The first decree - State Decree No. 48,133/2021 - had the objective of changing the wording of Articles 11 and 24 of State Decree No. 48,078/2020, which regulated the procedures for the analysis and approval of the Emergency Action Plan (PAE).[1] The most significant modification refers to paragraph 2 of article 24. Originally, the Military Office of the Governor/State Civil Defense Coordination (GMG/Cedec) was assigned the role of coordinating public meetings on preventive actions. The new wording established that the meetings should have the participation of a representative of the public authorities, with procedures to be defined in a specific act, apparently without any coordination function. In addition, State Decree No. 49,190/2021 also brought about minor changes to the original text of State Decree No. 48,078/2020, especially with regard to the deadline for the adaptation of the PAE to current state standards. Originally scheduled to take place within one hundred and eighty days from the entry into force of State Decree No. 48,078/2020, the deadline for adaptation of the PAE must now respect the timetable provided for in Article 20, according to the new wording brought in by State Decree No. 49,190/2021, according to criteria that take into account the degree of potential risk of the structures.

The second decree - State Decree No. 48,140/2021 - regulated the provisions of the Pesb and established measures to implement Article 29 of State Law No. 21,972/2016.[2] It applies particularly to entrepreneurs who have dams in Minas Gerais subject to risk classification, inspection, and monitoring by the State System of Environment and Water Resources (Sisema) until possible decommissioning.

The purpose of this second decree is to standardize mechanisms of:

- classification of dams by risk category and associated potential environmental damage;

- stages of the decommissioning of dams raised by the upstream method;[3]

- providing information on the volume of the reservoir, characteristics of the material disposed of, and monitoring of water and soil quality; and

- works and emergency interventions to reduce or eliminate serious risk to human lives and the environment, among others.

Regarding the risk classification, State Decree No. 48,140/2021 provides that the dams will be classified according to the information provided by the entrepreneur himself, considering:

- category of risk and associated environmental damage potential, taking into account the physical aspects of the structure (which may influence the possibility of accidents);

- potential for loss of human lives and economic, social, and environmental impacts resulting from its potential rupture (existence of a community in the flood spot, service and urban infrastructure, water sources, or water reservoirs, etc.); and

- storage capacity of the reservoir, according to the standards of the State Environmental Policy Board (Copam).

If the entrepreneur does not present the information necessary for the risk classification of the dam or does not present a technical justification considered valid by the State Environmental Foundation (Feam), the maximum risk score will be assigned. Before that, however, the entrepreneur will receive a notice for him to resolve any irregularities or omissions of information within ten days.

State Decree No. 48,140/2021 also contemplated the need to conduct technical audits for safety assessment in dams classified by Sisema. The technical person responsible for the audits must necessarily be accredited by Feam and may not have an employment relationship or have provided services of a similar nature to entrepreneurs and/or their subsidiaries or affiliates within the three years preceding the audit.

The requirement aims to ensure the independence and impartiality of the process. The decree also establishes that the costs related to the hiring of the auditor by Feam, the performance of audits, and the preparation of reports will be at the sole expense of the entrepreneur.

According to the mandate conveyed by Pesb, all dams in Minas Gerais built by the upstream method should be decommissioend by February 2022,[4] and National Mining Agency (ANM) Resolution No. 13/2019 established specific deadlines and conditions at the national level (September 15, 2022, to September 15, 2027), taking into account the volume of the dam.[5]

The legislation of Minas Gerais, however, provides for specific steps and criteria for decommissioning of upstream dams involving structural safety factors, protocols to reduce the impacts resulting from disruption during the decommissioning works, and plans to mitigate environmental impacts caused by these works.[6]

These provisions are contained in Chapter IV of State Decree No. 48,140/2021. It establishes the steps that must be fulfilled and funded by the entrepreneur for the decommissioning process, according to criteria defined in the reference sheet – approved and made available by Feam – which establishes the minimum requirements of a project for the decommissioning of dams raised by the upstream method in Minas Gerais.

These demands may delay the deadline for decommissioning, especially because it requires a formal response from Feam so that the structure can be considered decommissioned.[7]

The dam will only be considered decommissioned after formal response by the competent body, when it will be deregistered from the Feam database - without, however, exempting the entrepreneur from the civil responsibilities associated with environmental aspects and the maintenance of safety of the areas where the dam was located.

If the upstream dam presents a serious or imminent risk to human lives and the environment in its surroundings, it is incumbent on the entrepreneur to adopt the emergency measures necessary, immediately, regardless of prior environmental licensing or authorization for intervention.

Pursuant to Article 25 of State Decree No. 48,140/2021, however, the measures considered to be emergencies will depend on:

- prior and justified communication to the responsible state environmental agency;

- the submission of monthly periodic reports indicating the interventions carried out and the measures taken to mitigate the associated risks; and

- final report proving the cessation of the emergency situation.

In cases of intervention in which the emergency issue is not found or in the absence of compliance with the requirements set out in article 25 mentioned above, the enterprise will be subject to the application of the appropriate administrative sanctions, and the fact must be reported to the Public Prosecutor's Office for it to take the measures it deems necessary.

Any extraordinary expenses incurred by the government in response to emergencies caused by accidents or disasters should be reimbursed by the entrepreneur within 30 days, counted from the final and unappealable administrative decision handed down in the record of the separate administrative proceedings, which will be opened by Feam.

Last are the inclusions made in State Decree No. 47,383/2018 by State Decree No. 48,140/2021.[8] Article 80-A establishes new criteria for calculating the fines imposed on entrepreneurs, according to the potential for environmental damage of the dam and the economic capacity of the offender. In the inclusion of paragraphs 6 to 8 to article 113, we highlight the mandate to allocate 50% of the amounts collected as administrative fines to the municipalities affected by the dam rupture.

As stated, State Decrees No. 48,133/2021 and No. 48,140/2021 aim to regulate the Pesb's provisions. It will be incumbent on the entrepreneurs to adapt to the new regulations established for the dams located in Minas Gerais proactively and within the deadlines established.

The expectation is that a third decree related to the socioeconomic aspects of State Law No. 23,795/2021, which instituted the State Policy for Persons Affected by Dams in Minas Gerais (Peab) will be issued. Issues such as the hiring of independent technical advisory services for affected persons (article 3, VIII), definition of other beneficiaries of Peab (article 6, paragraph 1), and duties of the representative committee to monitor the actions provided for in the Peab (article 7).

From a joint analysis of the state standards mentioned herein, published since mid-2019, one perceives an increase in rigor in the requirements of public environmental agencies, in the means of supervision, and in the penalties applied to entrepreneurs who possess dams, especially those built by the upstream method. The motivation seems to be nothing other than an attempt by the state executive branch to respond to the events that occurred in recent years in Minas Gerais involving ore dams.

[1] The obligation to prepare and approve the PAE by the competent state agency was established in Article 9 of State Law No. 23,291/2019, which instituted the State Dam Safety Policy.

[2] State Law No. 21,972/2016 deals with the State System of Environment and Water Resources (Sisema) and provides for other measures. For the purposes of this article, Article 29 provides that: "Among the environmental control measures determined for the environmental licensing of an activity or enterprise that may endanger human lives or the environment, characterized as such by the competent environmental agency, the entrepreneur shall be required to develop and implement an Emergency Action Plan, Contingency Plan and Risk Communication Plan."

[3] That in which the raising of massifs rely on the tailings or sediment previously released and deposited.

[4] As set out in Article 13, paragraph 2, State Law No. 23,291/2019.

[5] Article 8, III, of ANM Resolution No. 13/2019.

[6] Forecast brought in the arts. 18 to 21 of State Decree No. 48,140/2021.

[7] According to Art. 22 of State Decree No. 48,140/2021.

[8] Establishes standards for environmental licensing, typifies and classifies violations of environmental and water protection standards, and establishes administrative procedures for the supervision and application of penalties.

- Category: Infrastructure and energy

The recent disclosure of the Revive Program by the National Bank for Economic and Social Development (BNDES) is a good opportunity to revisit Law No. 14,011/20, which is highly important for the management of the Federal Government's real estate assets and which, promulgated almost a year ago, received little fanfare, despite its remarkable short-term results.

This law introduced, fundamentally, three axes of innovations to the framework of Law No. 9,636/98, today the main piece of legislation dedicated to the topic of federal real estate:

- facilitation for the removal of the annual rent (consolidation of useful and direct areas) of Federal Government buildings submitted to the emphyteutic rent system;

- The provision of an exemption from bidding for the hiring of BNDES to carry out studies and execute plans for the privatization of real estate assets of the Federal Government (which may involve any modalities of privatization admitted by law, such as the sale, exchange, assignment, granting of real right of use or even the creation of real estate investment funds); and

- The possibility of submitting, by any interested party, a proposal for the acquisition of Federal real estate (provided that they are not registered in an emphyteutic rent system or occupied), by means of a specific request to the Bureau of Federal Government Assets (SPU) – thus settling old debates as to the feasibility of boosting the process of disposal of public property on the initiative of the individual interested in its use.

Specifically as to the presentation of offers by interested parties, if the property does not have a valid appraisal, the applicant may provide, at his own expense, an evaluation prepared by an appraiser or specialized firm. Even if the SPU is not obliged to conduct or complete the bidding procedures for the sale of the property subject to the proposal, if the appraisal is duly approved and supports the holding of an effective bidding process, the individual who paid it may acquire the property on an equal basis with the winner of the bidding process – or be reimbursed for the cost of the appraisal if it decides not to exercise its right of preference.

The new legislation aimed to boost and expedite the divestiture of Federal real estate, in order to ensure greater liquidity to its assets and streamline the use of these assets as a public management strategy.

Measurements come at a convenient time. It is estimated that the Federal Government owns more than 750,000 properties – many of which are the result of executions of federal tax debts and seizure and confiscation of assets acquired with funds from criminal practices. Contingent size invariably constitutes a significant burden on the Federal Budget, demanding expenses with the maintenance, supervision, and safety of real estate – although they do not necessarily serve any specific purpose for the government or the public interest more broadly.

Legislative changes already have positive results. While, throughout 2020, about 60 Federal properties have been sold, since the enactment of Law No. 14,011/20, 192 properties have already been the subject of this new type of direct purchase proposal and should go to auction soon.

In this trend, BNDES is preparing to take an active role in increasing the efficiency of the management of the Federal Government's real estate assets. A few months ago, the bank announced the execution of a technical cooperation agreement with the Brazilian Air Force (FAB), with the objective of planning real estate structuring projects that can not only rationalize the real estate expenses of the Air Force Command, but also generate complementary revenues for the FAB, bringing about greater efficiency and economics to the administration of its assets.

The Revive Program, recently published, is a part of this movement. An initiative of the Ministry of Tourism in partnership with the Ministry of Economy of Portugal, the program developed by BNDES is intended for the recovery of federal historical heritage with the support of the private sector. For its viability, the bank intends to structure plans for the concession of cultural goods. A similar action has already transferred, in Lusitanian lands, approximately two dozen properties to private management, allowing the mobilization of at least 150 million euros in investments in the buildings granted. It is a stimulus, undoubtedly, that is very significant for the preservation of historical and cultural heritage, as well as for the tourism economy.

It is expected that, in the course of the current trend, Law No. 14,011/20 and the resulting series of initiatives will reduce the gigantic portfolio currently managed by the SPU, unlock the enormous socioeconomic and cultural potential contained in the real estate heritage of the federal government, and concretely enable the use of highly attractive properties and land for the use of new developments in the country, in the real estate, tourism, and even infrastructure areas – such as the construction of port terminals or other facilities with a multimodal logistics vocation – serving as a valuable tool to attract investments and boost national development.

- Category: Litigation

Contracts[1] of various natures have been broken in Brazil due to the covid-19 pandemic. The defaults, when not solvable amicably by mutual concessions, have been submitted to the judiciary (or an arbitral tribunal, where applicable) to be litigated and resolved there.

In early February of 2020, Federal Law No. 13,979/20 established measures to address the public health emergency resulting from the coronavirus outbreak. Similarly, state and municipal governments have issued decrees to reduce the transmission of the new coronavirus, which was approved in a decision by the Supreme Court (STF)[2] where their competence over public health was upheld.

The government of the state of São Paulo, for example, issued Decree No. 64,881/20, which ordered suspension of in-person service to the public in commercial establishments and service providers, especially nightclubs, shopping malls, galleries, and similar establishments, gyms and fitness clubs, in addition to on-site consumption in bars, restaurants, bakeries, and supermarkets (Article 2). The bans followed the same path in the state of Rio de Janeiro. With Decree No. 46,973/20, the state government imposed suspension of various activities, including the operation of shopping malls, shopping centers, and similar establishments (Article 4, XIV).

Other rules were also issued in the states of São Paulo and Rio de Janeiro disciping measures to prevent covid-19 and deferred the deadlines originally set for suspension of non-essential business activities.[3] The enactment of these normative acts, although essential for the preservation of human health, caused, and have been causing, deleterious effects on the economy. Entrepreneurs in activities considered non-essential were prevented from carrying out their activities and earning income. And this issue, as in a cascading effect, led to default on a series of labor, tax, and contractual obligations, among others.

With regard to contractual obligations, in cases where there was the mutual will of the parties and reciprocal desire to preserve the contractual relationship in place (attribute of the social function of the contract),[4] contractual amendments were entered into in order to redo and/or relax specific obligations whose compliance proved unfeasible, at first, in the face of the severe economic crisis caused by the pandemic.

However, there have been situations where renegotiation of obligations was not possible. In these cases, the economic impact often led to the closure of commercial activities. As a consequence, contractual default and related penalties are being brought to court.

There were also situations in which the parties used the judiciary to seek judicial protection that would allow them to reduce or re-negotiate certain obligations, at least while social isolation policies were in force and, above all, the closure of commerce ordered by the Government. This practice took place on a considerable scale in rental relations.

In order to maintain the contractual relationship with significant changes in the obligations established, tenants of business establishments joined the Judiciary seeking suspension and/or renegotiation of rent. Lawsuits with this claim, based on what objective contractual good faith (Civil Code, Article 422) and the social function of the contract provide for, address, in common, that the suspension or, at the limit, the reduction of rent is admissible to realign the economic and financial balance (Civil Code, Articles 478 to 480).

The case law has addressed, on a case-by-case, the state intervention and the gradation in which it should take place, when and if applicable, for the readjustment of the economic and financial balance of lease agreements. According to the case law, it is necessary, among other factors, to analyze whether the financial difficulty of the lessee to bear its obligations has been unequivocally demonstrated, that is, whether covid-19 (and the resulting administrative acts) caused, in fact, significant shocks in the economic situation. That, moreover, is the factor of analysis without which there is no claim to review rents. After all, contractual clauses must be complied with (principle of pacta sunt servanda).

When encountering one of these scenarios, the Court of Appeals of São Paulo ordered temporary reduction of the rental amount, at 50% of the original value, in the period between March and December of 2020.[5] The Court of Appeals of Rio de Janeiro has also already ruled to this same effect, highlighting that the "discount in the value of rental during the stoppage of activities is being given to ensure the viability of the enterprise in this specific interregnum, and not to create a new debt required in the troubled scenario of loosening that begins or in the future post-pandemic period".[6]

The TJSP,[7][8] in specific situations, has found that there may even be the temporary exemption from the payment of rent, as in the cases of rental of commercial establishments located in shopping malls, during the period in which commerce had to remain closed and bearing monthly expenses (promotion and advertising budget, employees, condominium fees, security, franchisors, taxes, suppliers, etc.) by force of determination of the Public Power.

In these cases, however, given the particularity of rent contracts in shopping malls, which hold "an intrinsic and very intense need for intersubjective cooperation",[9] although even temporary suspension of rents has been accepted, the case law of the TJSP has preserved the obligation of the lessee to pay the condominium expenses, since , "in addition to being expenses common to all shopkeepers of the mall, they are intended for the maintenance of the place and the payment of employees".[10]

The advent of the pandemic and the resulting administrative acts – those that ordered closure of of commercial establishments considered "non-essential services" – led to a significant increase in lawsuits in which tenants seek exemption from or renegotiation of rent, even for a temporary period.

The judiciary, in turn, has addressed these cases specifically and and on a case-by-case basis. Thus far, there is no consensus as to the assumptions that the exemption or reduction of the lease should take place and at what percentage. However, the case-by-case analysis is based on consolidation of the understanding that, in certain situations, the pandemic justifies state intervention to ensure financial balance in commercial leases.

[1] In the exact words of Maria Helena Diniz, the "contract constitutes a kind of legal deal, of a bilateral or multilateral nature, depending, for its formation, on the meeting of the will of the parties, because it is a regulating act of particular interests, recognized by the legal system, which gives it creative force" (In fashion Brazilian Civil Law Course, Volume 3: Theory of Contractual and Extracontractual Obligations. 20th ed. São Paulo: Saraiva, 2004, p. 23).

[2] STF, ADI no. 6.341/DF, en banc, opinion drafted by Justice Marco Aurélio.

[3] The decrees, in general, stipulated as essential activities: supermarkets, pharmacies and health services (hospitals, clinics, laboratories, and similar establishments).

[4] In the words of Carlos Roberto Gonçalves, "the attendance to the social function can be focused on two aspects: one individual, relative to contractual parties, who use the contract to satisfy their own interests, and another, public, which is the interest of the collective in the contract. To this extent, the social function of the contract will only be fulfilled when its purpose – distribution of wealth – is achieved fairly, that is, when the contract represents a source of social balance" (In fashion Brazilian Civil Law, Volume 3: Contracts and Unilateral Acts. 9th ed. São Paulo: Saraiva, 2012, p. 26).

[5] TJSP; Internal Civil Injury 2191227-50.2020.8.26.0000; Rel. des. Walter Exner; 36th Chamber of Private Law; DJ: 10/29/2020

[6] TJRJ; Instrument Injury No. 0053875-79.2020.8.19.0000; Rel. des. Nilza Bitar; 24th Civil Chamber; DJ: 16.09.2020

[7] TJSP; AI no. 2118168-29.2020.8.26.0000, 32nd Chamber of Private Law, rel. des. Luis Fernando Nishi, j. 15.07.2020, DJe 15.07.2020.

[8] TJSP; AI no. 2104141-41.2020.8.26.0000, 32nd Chamber of Private Law, rel. des. Kioitsi Chicuta, j. 25.06.2020, DJe 25.06.2020.

[9] MARTINS-COSTA, Judith. "The contractual relationship of shopping center". Lawyer's Magazine, year XXXII, vol. 116, Jul. 2012, p. 110. Available in: https://aplicacao.aasp.org.br/aasp/servicos/revista_advogado/paginaveis/116/2/index.html

[10] TJSP – AI nº 2125636-44.2020.8.26.0000, 33rd Chamber of Private Law, rel. des. Mario A. Silveira, DJ 01.07.2020.

- Category: Tax

The Ministry of Economy presented last friday (25) a proposal of tax reform, including certain rules regarding the taxation of individuals, legal entities and financial investments. We highlight above the main points of the Bill of Law presented to the Chamber of Deputies:

1. Corporate taxation

Dividends

- Taxation of dividends at 20% rate, as general rule. 30% rate imposed to beneficiaries that are resident or domiciled in low tax jurisdictions (“LTJ”) or subject to privileged tax regime (“PTR”).

- Creation of a credit mechanism for avoiding tax cascading.

- New hypothesis of the application of Disguised Distribution of Profit (“DDL”) rules.

- Profits and dividends distributed to small business are exempt up to BRL 20 k each month.

Corporate Income Tax (“IRPJ”)

- Reduction of the corporate rate from 15% to 12.5% in 2022 and to 10% as of 2023.

- Maintenance of the additional IRPJ rate of 10% applicable to profits exceeding BRL 20 K each month.

- Social Contribution on Net Profits (“CSLL”) 9% rate which is also imposed on profits would not be changed. Thus, the corporate rate would be reduced from 34% to 29% as of 2023.

- End of the annual regime for the assessment of the real profits, maintaining only the quarterly regime. In this regime, it will be possible to offset 100% of the net operational losses (“NOLs”) from one quarter in the following three quarters.

- Obligation to access IRPJ and CSLL under the real profit regime for the following business activities: (i) credit securitization; (ii) more than 50% of the revenues are derived from remuneration of royalties or management, rent or buy and sale of own real estate properties; or (iii) exploitation of property rights, copyrights, picture rights, trademarks or voice rights. This new rule would not be applicable to companies that distribute, license or assign the right of using software and real estate development.

- Entities opting for the presumed profit regime would no longer be waived from bookkeeping.

- IRPJ and CSLL taxable basis would be equated.

Interest on Net Equity (“JCP”)

- JCP would no longer be deductible in the assessment of IRPJ and CSLL under the real profit regime.

Goodwill

- End of the regime that allows the deductibility of the goodwill for tax purposes for acquisitions occurred after 12/31/2021 and merger and spin-off events occurred after 12/31/2022.

Acquisition of additional investment in controlled company

- New rule that allows the recognition of the value exceeding the net equity value in the accounting value of the investment. Imposition of restrictions similar to the ones attributed to the goodwill.

Deductibility of intangible assets

- Establishment of the minimum term of 20 years, which is not applicable to the cases with the term is determined by the legislation or the agreement (these ones prevail over the 20-year term, regardless of the fact they are higher or lower).

Foreign exchange variations of investments held abroad

- Foreign exchange gains and losses underlying foreign investments will not be considered as part of the cost of acquisition for the purpose of assessment of capital gains or losses upon disposition.

Share-payment

- Restriction to the deductibility of payments based on shares which have officers and managers as beneficiaries.

Capital reductions of Brazilian companies and capital increases made in legal entities and other legal entities held abroad

- Obligation to adopt market parameters in said transactions and taxation of the respective capital gain.

Special participation company (“SCP”)

- SCP would be obliged to adopt the same taxation regime of the ostensive partner.

Indirect disposition taxation

- Creation of rules imposing income tax on the capital gains assessed in indirect sales of a Brazilian equity investment.

2. Transactions in the financial and capital markets

Investments in securities

- Extinction of the Income Tax regressive rates, which are applicable to fixed income or variable rate transactions. Creation of a fixed Income Tax rate of 15% applicable regardless of the transaction term or kind of operation (including day trade and negotiation of investment fund quotas in the stock exchange).

- End of the Withholding Income Tax (“IRRF”) imposed at the sale of shares at 0.005% rate (general rule) or 1% rate (day trade transactions).

Investment in open-end investment funds

- Extinction of the WHT anticipation of May (the so-called “come-cotas”). Creation of a fixed rate of 15% imposed in November or in the date of redemption, if it occurs before November.

- In relation to the Mutual Funds which invest in the entry market and comply with certain governance rules set forth by Section 18 of Law no. 13.043/2014, the rule exempting individual investors would only be applicable up to 12/31/2023 and as of 01/01/2024, the rules of open-end funds would be the ones applicable.

Investment in close-end investment funds

- Introduction of the same treatment of open-end funds: 15% rate, imposed as WHT anticipations – “come-cotas” in November or upon income distributions, amortization or redemption of quotas, if these events occurred before November.

Investment in Real Estate Funds (“FII”)

- End of the exemption applicable to individuals in relation to FII quotas negotiated in the stock exchange.

- Reduction from 20% to 15% of the Income Tax rate imposed on income distributions, amortization and disposition of quotas.

3. Individual’s taxation

Readjustment of the progressive Income Tax table

- The proposal includes the increase of the exemption range of up to BRL 1.9 k to up to BRL 2.5 k and the readjustment of the taxation ranges:

|

Income ranges (now) |

Income ranges (proposal) |

Rate |

|

Up to BRL 1,903.98 |

Up to BRL 2,500.00 |

0% |

|

BRL 1,903.99 - BRL 2,826.65 |

BRL 2,500.01 - BRL 3,200.00 |

7,5% |

|

BRL 2,826.66 - BRL 3,751.05 |

BRL 3,200.01 - BRL 4,250.00 |

15% |

|

BRL 3,751.06 - BRL 4,664.68 |

BRL 4,250.01 - BRL 5,300.00 |

22,5% |

|

Exceeding BRL 4,664.68 |

Exceeding BRL 5,300.01 |

27,5% |

Restriction of the deduction of expenses by means of the simplified regime

- The simplified regime applicable for deductions would be available only to the individuals that receive up to BRL 40 k each year. The deduction of expenses under the “complete tax return” would be maintained.

Anti-deferral rules

- Automatic taxation of the profits accrued by legal entities located in LTJ or benefiting from PTRs controlled by Brazilian individuals.

Savings account

- Maintenance of the exemption of the income derived by individuals.

Revaluation of real estate properties

Possibility of updating the acquisition cost of the real estate properties located in Brazil, with the taxation of the respective capital gain at a 5% rate.

Restriction of the deduction of expenses by means of the simplified regime

- The simplified regime applicable for deductions would be available only to the individuals that receive up to BRL 40 k each year. The deduction of expenses under the “complete tax return” would be maintained.

Anti-deferral rules

- Automatic taxation of the profits accrued by legal entities located in LTJ or benefiting from PTRs controlled by Brazilian individuals.

Savings account

- Maintenance of the exemption of the income derived by individuals.

Revaluation of real estate properties

- Possibility of updating the acquisition cost of the real estate properties located in Brazil, with the taxation of the respective capital gain at a 5% rate.

- Category: Capital markets

The Investment Fund in Agroindustrial Production Chains (Fiagro), created in the first quarter of this year through Law No. 14,130/21, is an investment instrument focused on financing agribusiness production chains. Its creation, driven by the sector, followed a rapid process of the bill in the National Congress and allows the transition of the financing model of Brazilian agribusiness, today based mainly on government subsidies, to a model that increasingly includes private credit.

Faced with the high indebtedness of the federal government, fiscal restrictions and major socioeconomic issues to be faced, there are indications of an increasing shortage of public resources for the sector in the coming years, which had already been perceived and eventually drove the creation of the fund. It opens up the possibility for private investors to make a strategic and valuable contribution to the country's productive sector.

In the face of several climate changes in various agricultural regions and population growth on a global scale, Brazil has remained one of the main suppliers of agricultural commodities in the world, thanks to the increasing efficiency of Brazilian agribusiness, which increasingly relies on technology as an ally. The expectation is that the sector will continue to grow, but its development, which involves continuous investment in modernization, requires funding.

Fiagro allows investments in the following listed assets, directly related to agribusiness financing:

- properties, which may be leased or disposed of by the fund;

- participation in companies that explore activities that are part of the agro-industrial production chain;

- financial assets, credit securities or securities issued by individuals and legal entities that are part of the agro-industrial production chain (including the Rural Product Note (CPR), the Agribusiness Credit Rights Certificate (CDCA), the Agribusiness Letter of Credit (LCA), the Agricultural Deposit Certificate (CDA), the Warrant Agricultural (WA), the Rural Real Estate Note (CIR);

- agribusiness credit rights and securitization securities issued with ballast in agribusiness credit rights, including Agribusiness Receivables Cerificates (CRAs) and quotas of Investment Funds in Credit Rights (FIDCs) – standardized and non-standard – that apply more than 50% of their equity in said agribusiness credit rights;

- real estate credit rights related to rural real estate and securitization securities issued with ballast in these credit rights, including CRAs and quotas of FIDCs – standardized and non-standard – that apply more than 50% of their assets in said real estate credit rights; and

- investment fund quotas that apply more than 50% of their equity to the assets listed in the assets listed above.

However, as Law No. 14,130/21 was partially sanctioned, with a veto of important provisions that conferred fiscal attractiveness to the fund, the use of the instrument in question was called into question in the last two months. There was great expectation in the market, especially among entrepreneurs and agribusiness investors, about the overthrow or not of vetoes in the National Congress, on which the economic viability of the instrument depended as a true alternative to attract private investment.

On June 1, however, the vetoes were all overturned by the National Congress, and Fiagro became in fact an excellent alternative for the agribusiness sector, with real fiscal attractiveness for investors, namely:

- Withholding Income Tax exemption for incomes earned by Fiagro whose quotas are traded on a stock exchange or over-the-counter market and are distributed to individuals, provided that the following requirements are met. As in the Real Estate Investment Fund - FII, in order to obtain this benefit, Fiagro must have at least 50 quota holders, and the individual enjoying the benefit may not have (i) quotas representing 10% or more of all quotas issued by Fiagro or (ii) quotas entitled to receive income greater than 10% of the total income earned by Fiagro;

- deferral for payment of income tax arising from the capital gain on quotas paid with rural property by natural or legal person to (i) the date of sale of these quotas or (ii) the date of redemption of these quotas, in the case of liquidation of the fund. The payment of such deferred tax shall be proportional to the amount of quotas sold. This provision is a great stimulus for the payment of FIAGRO quotas with rural properties, allowing the structuring of FIAGRO by rural owners in a less costly way, once there will be no need for payment by the quotaholder of the capital gain at the time of the payment of the quotas with the rural property (but only at the time of sale or redemption of the quotas), which makes the structure more affordable;

- the investment, through the Fiagro structure, in Agricultural Deposit Certificate (CDA), Warrant Agricultural (WA), Credit Rights Certificate (CDCA), Agribusiness Letter of Credit (LCA), Agribusiness Receivables Certificates (CRA) and Rural Product Note (CPR) becomes attractive, since it will be up to the same Withholding Income Tax exemption applicable to the individual. The Withholding Income Tax incentive is quite similar to that granted to the Real Estate Investment Fund to invest in securities related to real estate financing, which, at that time, led to the broad adoption of Real Estate Investment Funds structures.

additionally it is also worth remembering that the taxation of Fiagro's earnings and income may be postponed to the time of amortization, redemption or disposal of its quotas, since, unlike the Real Estate Investment Fund, Fiagro is not obliged to distribute to its quota holders a minimum of 95% of the profits earned, calculated according to the cash regime, based on balance sheet or semiannual balance sheet.

Because they are securities, Fiagro's quotas attract the regime of Law No. 6,385/76 and the competence of the Brazilian Securities and Exchange Commission (CVM) to regulate the form of constitution, operation and administration of the fund. It is expected that, soon, the CVM will edit a regulation on Fiagro, which should comply with the guidelines of Law No. 14.130/21. The expectation is that this will give way to the creation of several funds of such type.

With the initiative, agribusiness now has an important private financing instrument to enhance its growth at a time of strong fiscal constraints, while the capital market now has a new and attractive financial product.

For more information on the characteristics of Fiagro, please visit our article Fiagro: new alternative of private financing for Brazilian agribusiness.

- Category: Litigation

After more than two decades of consideration, Brazil finally has a new bidding law. Published on April 1, 2021, Law No. 14,133 incorporates a series of successful and unsuccessful experiences verified during the almost three decades of validity of Law No. 8,666/1993, in addition to demands from public managers and those who make contracts with the Public Administration.

Although it cannot be said that the new law completely abandoned the maximalism that marks Law No. 8,666/1993, the new law tried to create mechanisms that enable the public manager to carry out not only simple contracts, such as the provision of care services, but also more complex services, such as telecommunications, information technology, etc.

One of the most celebrated innovations is competitive dialogue, bidding modality for contracting works, services, and purchases, applicable in contracts that involve cumulatively:

- technical or technological innovation;

- lack of solutions available on the market;

- inability of the administration to precisely define the technical specifications of the object to be contracted; or

- the need to define technical means and alternatives to the solutions already defined and the legal and financial structure of the contract.

Inspired by European legislation, competitive dialogue takes place in two phases:

- dialogue between bidders who meet minimum criteria determined by the Administration and

- competition from the specification of the solution that meets the needs of the Administration according to the objective criteria published in the notice and that will be used for the selection of the proposal.

It will be up to the Management to define the winning proposal according to criteria disclosed at the beginning of the competitive phase, ensuring the most advantageous contracting.

The new bidding modality innovates by promoting a greater interaction between the Administration and bidders in the definition of the object to be contracted and aims to break the traditional way of public procurement.

The old bidding law, passed in 1993, brought strict procurement procedures to meet the principles of legality and impersonality. Thus, it attributed to the bidders a passive role throughout the procedure since they should manifest and submit proposals in strictly accordance with the law and the tender notice.

The Law on Public Service Concessions (Law No. 8,987/1995) and the Public Companies Law (Law No. 13,303/2016) already increased the dialogue and cooperation between the Administration and private companies, by introducing the expression of interest procedure (PMI) and the possibility of strategic partnerships between state and private companies respectively.

The rupture of the traditional paradigms of public procurement by these instruments and the introduction of the modality of competitive dialogue brings important points of reflection about its operationalization. The application of a procedure similar to competitive dialogue in the member countries of the European Union points to an accumulation of experiences and diagnoses that deserve to be carefully analyzed by the Brazilian public manager.

A survey of members of the European PPP Expertise Centre[1] points to the significant use of the competitive dialogue in complex public procurement, such as public-private partnerships. Aware of the limits of this first essay on the subject, we bring briefly the main positive and negative elements pointed out by this research.

The interviewees indicated that the competitive dialogue increased the communication between the Administration and the proponents, which allows to define more precisely the needs of the Administration and present a more appropriate design and innovative solutions. They also mention greater competitive tension during the dialogue period, which enables management to obtain a better cost-benefit ratio and agree on all vital commercial issues as long as there is competition between bidders. Moreover, there seems to be a general perception that the competitive dialogue does not expose the Administration to a greater risk of legal challenges than alternative procurement procedures.

On the other hand, the respondents also expressed many concerns regarding the new procedure, especially regarding the complexity, the cost and time of acquisition. The process is considered costly in terms of resources and time, and most managers who are interviewed admit that their staff are not well prepared to conduct such complex processes, so they would rely heavily on external consultants. Moreover, according to the managers interviewed, the modality does not present flexibility and/or clarity and cannot fit different circumstances.

The European experience shows that the adoption of an innovative instrument in the field of public procurement requires an experimental period by Brazilian public managers and, mainly, supervision by internal and external control bodies, which commonly base their audits on the more traditional criteria of public procurement (lower price or better technique and price).

It is interesting to note that the study itself highlights that the competitive dialogue procedure is not widely used by the European community, only the United Kingdom, France and Ireland use the procedure on a sufficient scale to carry out a reliable study.

The study also identified that competitors sometimes retain most competitive and innovative solutions until the last stage of the procedure to avoid risks and leak these solutions to their competitors. This tends to make the procedure more time consuming and less effective, by not encouraging dialogue and cooperative construction of the best solution for public administration.

In addition to the practical issues related to the European experience, some theoretical problematizations were also brought in Brazilian essays on the subject.

In recent text published on the site jota, Edcarlos Alves[2] points out the lack of capacity of the public manager to make the choice of the best solution presented by the participants of the dialogue in an impartial and technical way.

If the competitive dialogue is used in contracts where the Public Administration does not have the ability to accurately indicate the technical specifications or knowledge about the solutions offered in the market, how to ensure that the public manager will make the best choice among those offered by competitors? The challenge lies not only in choosing the best solution proposed but also in the choice of the competitors themselves who will participate in the discussions, when the Administration itself does not have sufficient knowledge about the market.

The Competitive dialogue, more than any other type of competition for public procurement, presupposes a disparity of information and knowledge between the public authorities and private companies. Law No. 14,133/2021 itself directs this problem by providing for the possibility of hiring technical advisory professionals (item XI, of art. 32).

Although the technical advice can solve the issue of lack of knowledge on the subject, ends up generating new public procurement, demanding more time and resources from the Administration.

In addition to all the issues mentioned above, there is a clear discrepancy between the robustness of the European rule compared to the lack of sufficient provisions to regulate the issue in the new Brazilian legislation. While Directive 2014/24 of the European Union contains broad provisions on the subject, Law No 14,133/2021 summed up to address the issue specifically in only one of its provisions (art. 32).

The lack of robust or rigid regulation may result from an attempt to increase flexibility in future public procurement, which is one of the objectives proposed by the new law. The public manager was given the freedom to define their selection criteria, requirements, and choice of the winning proposal, establishing only that the final proposal should be the more advantageous, not defining whether the advantage should be in economic, technical or innovation terms. In other words, there was clear scope for the public manager to define the criteria of this procedure, which, although it can be seen as an advantageous flexibility, is still a lack of specific regulation, something that has already been criticized in studies on the subject[3].

From a practical point of view, experience has shown that the lack of regulation and excessive discretion of the public manager have led the Courts of Auditors to act more strongly in order to suppress the lack of regulation or penalize excessive discretion, which may lead to more impositions or penalty by the control bodies. This creates legal uncertainty to the public manager and to the private companies that are not able to predict the future decisions of the Courts of Auditors.

Since the new Law No. 14,133/2021 was too brief in terms of regulations of this new competitive modality, public managers will have to define the issue, being susceptible to supervision and possible sanction by the control bodies, which may hinder or even prevent the use of this modality, depending on the caution of the manager who will evaluate its fit. Let us remember that the lack of clarity in the terms used by the law was also criticized for the use of this type of competition in Europe.

The critics made above were not made with the intention of discourage the use of this modality or to take credit from the innovation brought by law. They raise points that can still be the subject of legislative improvement. The diversity of practices should occur in a safe environment that allows the public manager to "risk" a more flexible procedure without having to worry about possible further accountability.

We understand that the title of this paper brings a rhetorical question, once only the courage of innovation of public managers, the technical preparation of public and private lawyers and the flexibility of the control bodies can enable the implementation and improvement of the instrument of the competitive dialogue in the country.

[1] European PPP Expertise Centre. Procurement of PPP and the use of Competitive Dialogue in Europe: A review of public sector practices across the EU. Available in: https://www.eib.org/attachments/epec/epec_procurement_ppp_competitive_dialogue_en.pdf. Accessed May 20, 2021.

[2] LIMA, Edcarlos Alves( "Competitive dialogue and the practical challenges of its operationalization – An innovative bidding modality, but which requires care to be used correctly by the public manager." Article published on 11/05/2021.

[3] Question scored by Celso de Almeida Afonso Neto in "Competitive dialogue: a stillborn in Brazilian law", text included in the work Limits of control of public administration in the rule of law / coordination of Fabrício Motta, Emerson Gabardo - Curitiba: Íthala, 2019.

- Category: Environmental

The new Law on Administrative Procurement and Contracts, published on April 1 (Law No. 14,133/2021), was well received by the market upon reiterating the need to insert the issue of sustainable national development into public procurement processes in Brazil.

Although the term "sustainable development" has already been addressed in other normative acts relating to procurement, as in Law No. 12,462/2011, which deals with the Differentiated Procurement Regime, the new procurement law promotes inclusion of sustainability in public tenders in a practical way, since it provides more specifically for the environmental issues that must be taken into account so that the concepts of the Brundtland Our Common Future Report of 1987 can actually be adopted.

During the preparatory phase of the procurement, it is necessary to prepare a technical study, which should contain, among other items, details on potential environmental impacts and respective mitigating measures and issues related to reverse logistics, energy consumption, and other natural resources.

The new law on procurements provides for greater environmental control in the criteria for publishing the notice, such as the requirement that the contractor obtain environmental licenses. The law also establishes that the processing of environmental licensing processes of works and services tendered must occur as a priority before the environmental agency.

In order to guarantee sustainable procurements, Law No. 14,133/2021 innovates and surprises positively in establishing the possibility of using the criterion of best sustainable price, instead of lower price, in order to define the winning company. That is, the preference for goods and/or services that have less environmental impact on the production process is established.

Another innovation is the possibility of dispensing from the bidding process the services of collection, processing, and marketing and sale of recyclable or reusable municipal solid waste conducted by associations or cooperatives formed by low-income individuals.

It is noted that the public administration follows the global market trend in requiring enterprises to take environmental, social, and governance criteria, known as ESG, and meet environmental and alternative laws aimed at lessening impact on the environment.

The new procurement law has a clear concern with the environmental impacts arising from the services to be contracted and establishes measures that will contribute to sustainable national development. In this scenario, ventures that show an interest in winning procurements processes should be adapted to environmental legislation.

- Category: Real estate

Brazil stands out in the international market as one of the main exporters of agricultural products in the world. In 2020, agribusiness represented 26.6% of the Brazilian GDP.[1] Climate and soil conditions have become major attractions for foreign investments in rural activities conducted in the country. The problem, however, is that Brazilian legislation provides for restrictions on the acquisition and leasing of rural properties by foreign companies or individuals authorized to operate in Brazil.

The restrictions on the acquisition of rural properties by foreign individuals or legal entities and the persons treated thereto are provided for in Federal Law No. 5,709/71 and Decree No. 74,965/74. In addition to regulating the conditions that allow this acquisition, the two rules stipulate the need for a prior procedure to obtain authorization for the business that involves acquisition of rural properties.

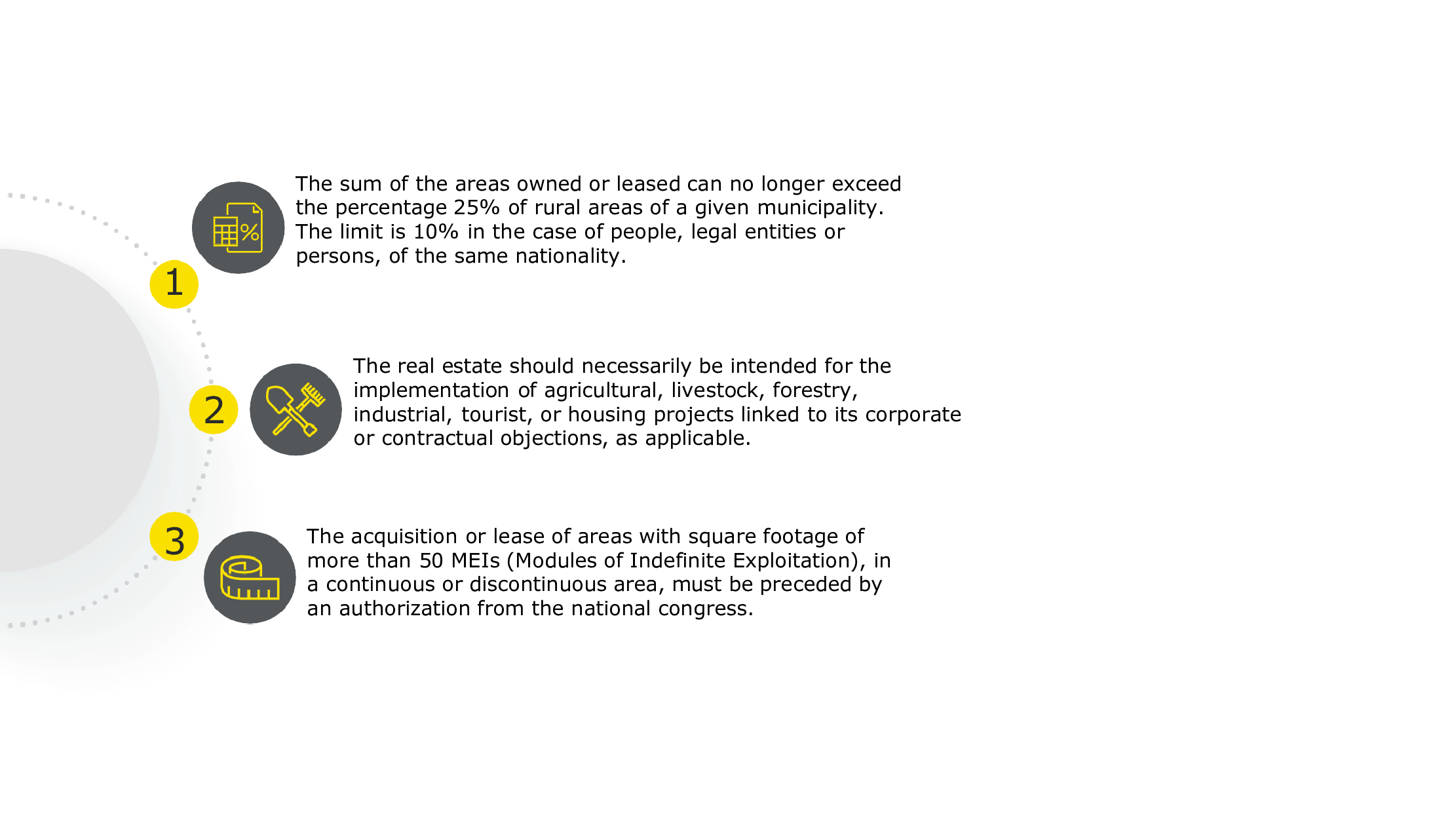

Among the restrictions brought in by the legislation, the following limiting parameters stand out:

The discussions began when Federal Law No. 5,709/71, in its article 1, paragraph 1, extends such limitations to Brazilian companies that have foreign control, equating them to foreign companies and individuals for the purpose of acquiring rural real estate.

Much was discussed regarding the applicability of this law to Brazilian companies with foreign control, especially after the entry into force of the Federal Constitution of 1988, since some legal scholars believed that the new Constitution had not adopted paragraph 1 of article 1 of the law.

However, in 2010, the Federal Attorney General's Office issued opinion AGU LA 01/10 through which it recognized the possibility of applying restrictions to Brazilian companies with foreign control.