Publications

- Category: Life sciences and healthcare

On June 21, 2024, the Ministry of Health (MoH) published MS Ordinances No. 4,472/2024 and No. 4,473/2024, which regulate Productive Development Partnerships (PDP) and the Local Innovation Development Program (PDIL), respectively.

The new regulations result from Public Consultations No. 53/23 and No. 54/23, which received contributions between December 2023 and March 2024.

According to the MoH's announcement during the Health Industrial Complex (CEIS) Executive Group meeting on June 18, 2024, entities will have until the end of September to submit PDIL and PDP project proposals.

Current priority areas include preparation for health emergencies (e.g., dengue fever), products at risk of shortages, digital health, and contributions to More Access to Experts and Queue Reduction Programs (e.g., oncology, cardiology, orthopedics, and ophthalmology).

Main aspects of the new PDP regulation

According to Ordinance No. 4,472/2024, PDPs will involve cooperations between public institutions, ICT(s), and private entities(ies) for the development, transfer, and absorption of technology, as well as productive and technological capacity, having local production of strategic technologies and products to meet the demands of the SUS.

PDP solutions must be listed in the Matrix of Productive and Technological Challenges in Health and meet the following requirements to become eligible projects:

- existing or expectation of marketing authorization within thirty-six months from the project proposal's submission date.

- absence of a patent restriction affecting the proposed arrangement or loss of the restriction within thirty-six months from the project proposal's submission date.

- possibility of centralized procurement by the MoH within the scope of CEIS; and

- high dependence on importation or expected discontinuation of the product.

Public institutions (IPs) or Scientific, Technological, and Innovation Institutions (ICTs) and private entities that develop, own, transfer, or receive technology (EPs) are eligible to participate in PDPs. The EP may simultaneously act as a recipient and transferor of the technology in the same PDP project, as long as production occurs locally.

According to Ordinance No. 4.472/2024, the phases of the PDP will be as follows:

PDP project proposal. Submission of projects, analysis by the MoH, the Technical Evaluation Commission (CTA), and the CEIS Deliberative Committee (CD), with publication of the results and signing of the terms of commitment for approved projects.

PDP project. Preparation for technology transfer between the partners, including training and completion of product development to absorb the scientific and technological knowledge involved in the partnership. This phase begins with publishing the statement of commitment in the Federal Official Gazette (DOU) by the MoH and ends with the publication of the instrument formalizing the first purchase of the product.

Technology transfer and acquisition by the MoH. The technology transfer stage involves national production, the acquisition of the product or service by the MoH, and the supply of the product covered by the PDP by the public institution/ICT. This phase begins with the publication of the instrument formalizing the first product acquisition by the MoH and ends after the deadline for the internalization of the technology has elapsed.

Verification of the internalization of the technology. Proficiency proof of the technology/strategic platform. This phase begins immediately after phase III and ends with the publication of the resolution extract in the DOU to internalize the technology.

In the process of evaluating and classifying PDP project proposals, the following criteria stand out:

- shortest timeframe for internalization of technology and production by IP/ICT;

- history of PDP internalization for products into the IP/ICT portfolio;

- public investment forecast for the execution of the PDP, as well as investments by the EP;

- availability of certified technological and production platforms compatible with the proposed project and activities to be carried out;

- lowest overall price proposal, taking into account an initial and descending scale of prices throughout the PDP;

- presentation of productive and technological solutions for the SUS that are additional to the transfer of technology, with synergy for future technologies;

- Shorter timeframe for production of API, component or device;

- alignment with the Production and Technological Development Program for Neglected Populations and Diseases (PPDN) or the Program for the Preparation of Vaccines, Serums and Blood Products (PPVACSH).

- degree of verticalization of the production stages of the API(s), component or device associated with the pharmaceutical form for the national manufacturing park.

Main aspects of the PDIL regulation

MoH Ordinance No. 4,473/2024 establishes that solutions included in the Matrix of Productive and Technological Challenges in Health, and that promote production, technological, territorial development, and local innovation are eligible for PDIL. Projects must also promote training actions for ICTs, public laboratories, non-profit organizations, startups, and public companies, as well as contribute to the digital and ecological transformation and sustainability of the CEIS.

Local innovation under this new setting means the introduction of a novelty or improvement in the productive and social environment that results in new products, services, or processes or that comprises the addition of new features or characteristics to an existing product, service, or process that can result in improvements and have an effective gain in quality or performance for production in Brazil.

According to the new rule, PDIL can be implemented by promoting local innovation projects through arrangements, decentralized execution terms (TED), technological orders (which is not defined in the rule), public agreements for innovative solutions (CPSI), technological compensation agreements, or other instruments.

The following criteria will be considered when assessing the PDIL project proposals:

- the excepted timetable for carrying out each of the project's stages and a detailed plan regarding necessary resources.

- the technological and productive capability of the entities to carry out the project proposal, considering existing capabilities and the investments planned by the partners.

- availability of qualified human resources to carry out the project.

- innovative nature, clinical benefit, or relevance to the health system.

- relevance of the counterparts for the SUS.

- forecast of other sources of funding to make the project feasible; and

- the technical and economic details of the proposed implementation plan.

The new rule authorizes the MoH to contract the supply of technologies or products resulting from the PDIL for a period of up to ten years, counting from the completion of the solution, provided that the stages and requirements relating to the technology development process, the regularization, the local production, and incorporation the solution into the SUS are met.

Impacts on current PDPs and strategic alliances

According to the new ordinances, technological development partnerships and technology transfer agreements entered until December 31, 2022, or those with a product acquisition instrument currently in force and aiming to supply products to the SUS must be adapted to the PDP model. These partnerships must be informed to the MS by August 22, 2024.

Similarly, existing strategic alliances for the local development of innovative solutions aimed at supplying products to the SUS can be adapted to the PDIL model until June 2025.

History

It's worth mentioning that a few days after the government announced the new strategy for the Health Industrial-Economic Complex (CEIS) last October, the Federal Audit Court (TCU) recommended the MoH to suspend new PDPs until measures were adopted to evaluate technological transfers and objective criteria for selecting private partners (case TC 034.653/2018-0) (check out our full analysis here). The Federal Attorney General's Office (AGU) filed a request for reconsideration of the decision.

On April 15, 2024, the MoH’s Secretariat of Science, Technology, and Innovation and CEIS department presented partial clarifications on the measures taken by the MoH to comply with the TCU's determinations, specifically that:

- opened public consultations on the matters to promote dialogue, and legitimize transparency and social participation to obtain information, opinions, and criticisms regarding the PDP Program.

- the internal regulations of the Technical Evaluation Commission (CTA) and the Deliberative Committee (CD) will be updated after the publication of the new ordinances.

- considers that the points of merit that were the subject of the TCU's determinations were addressed in the draft ordinance that was the subject of the public consultation; and

- all public institutions were informed, by means of a letter via e-mail, about the need to carry out a selection process, pre-qualification of the private partner, or adequate justification in the event of unfeasibility.

In addition, the MoH requested that the 180-day deadline for verifying compliance with the principles of public law among the criteria for approving PDPs - particularly those of publicity, legality, and morality - start to run from the publication of the new regulations. (Check out our previous analysis on the subject here).

Case TC 034.653/2018-0 had been included in the plenary agenda for April 17, 2024, but was then withdrawn without justification. No further developments have been announced so far.

The Life Sciences & Healthcare practice can provide more information on the subject.

- Category: M&A and private equity

On June 4, the Brazilian Securities and Exchange Commission (CVM) released CVM Resolution 204, which implements adjustments to the rules for participation and voting in digital, face-to-face or hybrid shareholders’ meetings. The aim is to encourage higher shareholder participation in these meetings.

One of the main changes brought about by this reform is the expansion of the use of the remote voting form, which is now mandatory for all shareholders' meetings, whether general or special, ordinary or extraordinary. This reform aims to ensure higher participation of shareholders in the strategic decisions of publicly-held companies.

On the other hand, the rule now expressly provides for cases in which the mandatory use of the remote voting form is waived. In particular, companies that have not received votes through remote voting form since the realization of their last annual general meeting are considered. The waiver may be disregarded if shareholders holding 0.5% of the share capital object until 25 days before the realization of the meeting.

In addition, the reform of the rule also establishes new procedures for the realization of shareholders' meetings. Among them, the extension of the deadline for shareholders to send the voting instruction, which is now four days before the realization of the meeting.

It was also established the deadline of:

- 21 days for the submission of the remote voting form for the extraordinary general meetings; and

- until 20 days for the company to resubmit the remote voting form for inclusion of candidates to the board of directors and fiscal council.

Another relevant point of the reform is the introduction of specific rules for digital meetings, considering the increasing use of digital technologies and the need to fit to new ways of realization of meetings in the digital environment. Among the measures established is the facilitation of the use of electronic systems to send remote voting forms directly to the company and remote participation during the meeting.

The rule also clarifies a long-standing question of the companies - he situation in which there is a request for the installation of a fiscal council without, however, having candidates nominated for the body.

In this case, the request for the installation of the fiscal council will be prejudiced. Likewise, there is an express provision for requests for the adoption of multiple vote to be void, if there are no candidates other than those indicated by the management or the controlling shareholder.

Finally, the rule clarifies that, in cases of face-to-face or hybrid meetings, the presence of the chairman of the meeting, the secretary of the meeting and, at least one member of the administration of the company is mandatory.

To summarize the main changes brought about by Resolution 204, we present the summary table below:

| CVM Resolution 80, 29 March 2022 | |

|

Periodic Information (Art. 22, RCVM 80) |

The company is now required to submit the following periodic information to CVM:

|

|

Eventual Information (Art. 33, RCVM 80) |

The company registered in A category is now required to submit the following information to CVM:

|

| CVM Resolution 81, 29 March 2022 | |

|

Call Notice (Art. 5º, RCVM 81) |

It is now mandatory to include in the call notice of meetings:

The company will now have to present, in the call notice or in the other documents provided to shareholders, the reasons why it deems it more appropriate to accomplish the meeting face-to-face , partially digital or exclusively digital. The com’any's headquarters or the place where the meeting is held shall be the main place for conducting the work and generating sounds and images of partially digital meetings, being possible to make available one or more accessory physical locations, including in city other than that of the com’any's headquarters, to which shareholders may attend in person to participate in the meeting. The chairman of the meeting, the secretary and at least one member of the company’s administration must participate in person at the company's headquarters or, as the case may be, in loco where the meeting is held, except if the meeting is held exclusively digitally. Participation at a distance will be allowed by third parties authorized to participate and persons whose attendance is mandatory at the meetings, notwithstanding in the manner of realization of the meeting. |

|

Documents proving ownership of the shares held by shareholders (Art. 6º, RCVM 81) |

Companies that condition the exercise of rights by shareholders at a shareholders' meeting are now prohibited from presenting documents to prove circumstances related to the ownership of shares that can be objectively verified based on the ownership records already held by the company. This includes documents that have been transmitted by the central depository and the bookkeeper. |

| Deadline for making the remote voting form available (Art. 26, RCVM 81) |

In addition to the one-month deadline to provide the remote voting form effective for the annual general meeting, the general meeting with the aim of electing members of the fiscal council and the board of directors and the annual and extraordinary general meeting held on the same date and time, the companies now have a period of until 21 days to make the remote voting form available for the other shareholders' meetings. Companies will also have a period of 20 days before the date scheduled for the realization of the meeting, to include candidates nominated to the board of directors and to the fiscal council. It is now forbidden for the company to promote the reordering, renumbering or any format of reorganization of items in the remote votingform that induces the shareholder to error about the matters to be deliberated. |

| Deadline for submission of the remote voting form by the shareholder (Article 27, RCVM 81) |

The deadline for the shareholder to send the remote voting form to the company, which was previously seven days, was reduced to four days before the date of the meeting. The company that provides electronic mail or electronic system for sending the remote voting form may establish that these will be the only ways and means for sending the remote voting form directly to the company, excluding the possibility of sending it by post office. The company and service providers able to provide collection services and conveyance of instructions for filling out the remote voting form shall adopt ways and means to ensure shareholder identity and ensure genuineness and security in the conveyance of the information. |

| Electronic system available for sending remote voting form (Art. 28, RCVM 81) | The electronic system made available for sending remote voting forms may enable shareholders to sign the form and other shareholder representation documents directly in the electronic system itself. The signatures, in this case, must be made by means of digital certification or recognized by another means that guarantees their authorship and integrity in a format compatible with the one adopted by the company for the realization of the meeting. |

| Security of shareholder data (Art. 29, RCVM 81) | The company now has to take into consideration the ability of the contracted third parties to process and to hold secure and confidential the data of the identity of the shareholders and the voting instructions issued. |

| Hypotheses of exemption from the provision of remote voting form (Art. 30-A, RCVM 81) |

The provision of the remote voting form by companies is now waived when the following conditions are cumulatively met:

Shareholders holding 0.5% or more of the capital stock may oppose the dismissal by means of a written expression, until 25 days before the date of the realization of the meeting. In the event of exemption from remote voting form by the company, any requests for inclusion in the remote voting form of candidates for the board of directors and the fiscal council or for a proposal for a resolution must be submitted together jointly with the opposition mentioned above. In the event of expression of opposition by the shareholders, the company must submit the remote voting form until 17 days before the realization date of the meeting. |

| Absence of candidates for the board of directors (Art. 34, RCVM 81) | If, at the time of the realization of the meeting, there are no candidates for the board of directors other than those indicated by the management or the controlling shareholder, the request for the adoption of the multiple vote process made through the remote voting form will be void. |

| Absence of candidates for the fiscal council (Art. 36, RCVM 81) | If, at the time of the realization of the meeting, there are no candidates for the fiscal council, the request for the installation of the fiscal council made through the remote voting form will be void. |

| Remote voting exercised by service providers (Art. 42, RCVM 81) | In addition to custodians and bookkeepers, central depositories may now receive instructions for filling out the remote voting form and related proceedings, as provided for in Subsection V of RCVM 81. |

| Deadline for submission of voting map by the custodian (Art. 43, RCVM 81) | The 6-day deadline has been reduced to three days before the realization date of the meeting for the custodian to forward a voting map indicating the shareholders' voting instructions to the central depository in which the shares are deposited for trading. |

| Deadlines and procedures of the central depository (Art. 44, RCVM 81) |

The 5-day deadline was reduced to 48 hours before the date of the realization of the meeting, for the central depositary to forward to the company:

The analytical statement of the central depositary and the statement of share position shall indicate:

|

| Obligation of the company to compile the instructions it has received directly (Art. 46-A, RCVM 51) |

The company shall compile the voting instructions it has received directly and produce:

The statements shall consider the to entertain to hold in mind the shareholding position, rank, status, standing of each shareholder in relation to the base date of the analytical statements of the central depositary and the bookkeeper. |

| Obligation of the company to disclose the summary maps (Art. 46-B, RCVM 51) |

The company shall disclose, by means of an electronic system on the CVM website and on the company's own websiteuntil 24 hours prior to the meeting:

The company that discloses, within 24 hours, the summary maps of the central depository, the bookkeeper and the votes sent directly to the company and obtains, as a result, a summary map consolidated will be exempt from disclosing the summary maps in a separate format. |

| Consolidation of the maps by the company (Art. 46-C, RCVM 81) |

By the beginning of the meeting, the company shall consolidate, making the necessary conciliations and rejecting the conflicting voting instructions:

The chairman of the meeting, at the beginning of the meeting, shall announce that the summary voting map consolidated is available for consultation and proceed to read it, if requested by any shareholder. |

| Calculation of votes at the meeting (Art. 48, RCVM 81) |

The company now has to compute votes according with:

The company shall disclose, by means of an electronic system on the CVM website and on the company's own website:

The company that discloses the final detailed voting map until the business day following the realization of the meeting will be exempt from delivering the final summary voting map. When the presentation of the remote voting form is waived, the disclosure of the final summary voting map and the final detailed voting map will also be waived, provided that the minutes of the meeting indicate the quantity of votes computed in favor or against and abstentions in relation to each proposal contained in the agenda of the meeting. The breakdown of the quantity of votes may be made in the text of the minutes themselves or in an attachment. |

| Case of justified postponement of a meeting already called by the company (Article 49, RCVM 81) | Voting instructions that have already been sent before the date of realization of the meeting originally indicated in the first call may be considered normally in the event that the second call of the meeting, provided that the installation of the meeting in the second call does not exceed 30 days from the original date and the contents of the remote voting form has not changed. |

| Serious violations, for the purposes of Law 6.385/76 (Art. 81, RCVM 81) | For the purposes of Law 6,385/76, the violation of the obligations provided for in article 2 and in arts. 6, § 5,[1] 9 to 25, 26 to 28, 30 to 37, 39 to 49, 54 to 60, 71, 74, 75 and 79 of RCVM 81 are considered as a seriour violation |

| Annex M of RCVM 81 (items 11 and 20) |

The remote voting form model (Annex M) now provides that:

|

| Annex O of RCVM 81 – percentages of share capital |

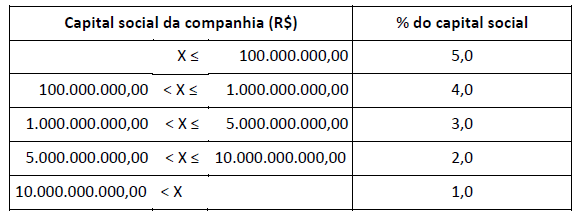

Annex O of RCVM 81 (inclusion of proposals in the remote voting form) had the percentages of the share capital updated:

|

Due to the need to adapt systems and companies’ routines, Resolution 204 enters into force on January 2, 2025.

[1]Question of the restrictive conditions of the exercise of rights by shareholders at a meeting to the presentation of documents to prove circumstances related to the ownership of shares that can be objectively verified based on the ownership records already held by the company, including those that have been transmitted by the central depositary and the bookkeeper.

- Category: Tax

The Attorney General's Office for National Treasury and the Special Secretariat of the Federal Revenue of Brazil have issued two notices with proposals for the settlement of federal tax credits. The aim is to offer new methods for taxpayers and companies to regularize their tax situations. Below are the main aspects and implications of the new rules.

Notice PGDAU 2/24

The Attorney General's Office for National Treasury published Notice PGDAU 2/24 on May 13, which presents proposals for the negotiation of credits enrolled in the Union's active debt.

According to the notice, the following are eligible for negotiation: credits enrolled in the Union's active debt, even if in the stage of a filed lawsuit or subject to previous rescinded installment, with suspended or unsuspended enforceability, whose consolidated value is equal to or less than R$ 45 million.

The notice provides for three types of negotiation:

- enrollment in the Union's active debt collection;

- small value dispute related to the Union's active debt collection processes; and

- registrations secured by guarantee insurance or surety bond.

Among the main requirements for joining the negotiation, the provisions of article 3 stand out:

- for the negotiation of already installment credits, joining is conditioned on the prior withdrawal from the ongoing installment;

- the negotiation must cover all eligible registrations that are not secured, installment or suspended by judicial decision. Partial joining is prohibited, but the combination of one or more available types is allowed;

- joining related to credits enrolled in the Union's active debt subject to judicial discussion is subject to the presentation of withdrawal from the actions, objections, or appeals related to the negotiated enrolled credits;

- if the taxpayer is part of an economic group, whether recognized or not in an administrative or judicial decision, they must list all related parties and allow their inclusion as co-responsible in the active debt systems.

The notice provides for discounts of up to 100% on interest, fines, and legal charges according to the taxpayer's payment capacity and the recoverability degree of the tax credit. Regarding the debt installment, it is possible to settle the debt in up to 133 months.

It is also noteworthy that, by joining the negotiation, the taxpayer is obliged to authorize, at the time of effective financial availability, the offsetting of values related to:

- refunds, reimbursements, or reimbursements recognized by the Special Secretariat of the Federal Revenue of Brazil, with installments of the signed agreement, due or to become due; and

- federal court orders.

Furthermore, the negotiation provided for in Notice PGDAU 2/24 does not include the use of credits resulting from tax loss and negative calculation base of the Social Contribution on Net Profit (CSLL).

Interested taxpayers can already join the negotiation, exclusively through the Regularize portal, until August 30.

Notice PGDAU 6/24

On the other hand, Notice PGDAU 6/24, jointly published by the Attorney General's Office for National Treasury and the Special Secretariat of the Federal Revenue of Brazil on May 17, deals with the possibility of negotiating tax credits "whose collections are the subject of administrative or judicial dispute related to discussions on the Withholding Income Tax (IRRF), the CIDE, the PIS, and the COFINS on remittances abroad, resulting from the bipartition of the legal business agreed upon in a charter party contract for vessels or platforms and another for service provision" under the terms of Law 9,481/1997.

Therefore, it is a proposal by the tax authorities for the negotiation of debts of relevant and widespread legal controversy related to the oil sector, commonly known as split contractual.

According to the notice, taxpayers who join the program can pay the tax credits under the following conditions:

- after the automatic conversion of deposits into final payment, a 65% discount on the total debt value or eligible entry for negotiation. The remaining amount is paid as follows:

- a minimum initial payment of 30% of the debt or eligible entry for negotiation, after the application of the 65% discount mentioned above; and

- payment of the remaining balance in up to six monthly installments.

- 35% discount on the debt value or eligible entry for negotiation. The remaining amount is paid as follows:

- a minimum initial payment of 10% of the debt or eligible entry for negotiation, after the application of the 35% discount mentioned above; and

- payment of the remaining balance in up to 24 monthly installments.

The negotiation allows the use of tax loss and negative calculation base of CSLL credits owned by the taxpayer, the controlling legal entity, or controlled entities - directly or indirectly - or companies controlled - directly or indirectly - by the same legal entity, calculated and declared to the Federal Revenue of Brazil, regardless of the business line, up to the limit of 10% of the remaining balance after the application of the discounts indicated above.

Finally, we highlight some points of attention:

- according to item 1.2 of the notice, the taxpayer must include in the negotiation all tax debts related to the subject;

- item 2.14 of the notice indicates that joining the negotiation implies the taxpayer's or the responsible party's compliance with the tax administration's understanding of future or unconsummated triggering events, related to the incidence of IRRF on the portion of the charter party or rental contract for maritime vessels that exceeds the percentages established in §§ 2, 9, and 11 of article 1 of Law 9,481/97, with the wording given by Law 13,586/17; and

- for the purpose of joining the negotiation program, the taxpayer must waive the administrative and judicial processes related to the tax debts subject to the negotiation. However, in the judicial sphere, the waiver or withdrawal of the action would imply the condemnation of the party to the payment of attorney's fees, calculated based on the updated value of the debt. The notice does not provide for the waiver of the payment of the costs of losing.

Joining the negotiation provided for in Notice PGDAU 6/24 must also be done through the Regularize portal. The deadline is August 31.

Our tax team is fully available to address in more detail and depth the aspects, requirements, and points of attention of the two notices.

- Category: Labor and employment

The applicability and sovereignty of collective bargaining agreements were examined by the Brazilian Supreme Court (STF) under general repercussion, Theme Theme 1.046. In the decision, the constitutionality of collective bargaining agreements that establish restrictions or exclusions of labor/employment rights was recognized, as long as absolutely non-negotiable rights are complied with.

Recent verdicts from the Brazilian Superior Labor Court (TST) have reflected the STF position, with particular attention to rights that would be considered absolutely non-negotiable. The official TST website frequently publishes news related to the matter, including a recent decision involving the collective bargaining agreement (CBA) of the banking category.

In the decision[1], published on April 10, the TST validated the application of the first paragraph of Clause 11 of the CBA of the bank employees category, which establishes the possibility of offsetting the amounts paid as a function bonus with the 7th and 8th overtime hours, in the event of a judicial decision that mischaracterizes the employee's framework as an exception in article 224, §2, of the CLT.

The pronouncement of the Third Panel of the TST was unanimous and emphasized that the applicability of Clause 11 of the CBA is in line with STF Theme 1.046.

Furthermore, it was emphasized that there is no violation of article 7, item VI, of the Federal Constitution, as alleged by the employee in his appeal, as the provision itself establishes an exception to salary non-reducibility in the case of provision in a CBA.

According to the reporting minister, José Roberto Freire Pimenta, it is not a not-negotiable right, as it “does not violate the minimum civilizational standard, linked to human dignity, citizenship, especially from the perspective of its social dimension in the labor field, and the minimum valorization of their work”.

Before Theme 1.046 of general repercussion of the STF, the TST understanding was consolidated in Precedent 109 of the TST[2], which expressly provided for the impossibility of offsetting the mentioned amounts, based on the impossibility of offsetting amounts with different legal nature.

However, the Fifth Panel of the TST[3] also ruled in the same terms as the decision mentioned above. In this case, the reporting minister, Breno Medeiros, pointed out that the issue does not involve workers' waiver of rights. He also said that, although contrary to the TST consolidated understanding in Precedent 109 of TST, the provision for offsetting is not related to absolutely non-negotiable rights and is not an illicit object - justifying the application of Theme 1.046 of general repercussion of the STF.

Therefore, after the decision with general repercussion issued by the STF, it is observed that the judgments of the Labor Court are in opposition to the previously consolidated understanding by the TST itself in Precedent 109. Now, the negotiated prevails over the legislated, as established in Theme 1.046.

The TST precedents express the expectation that negotiated matters will prevail over the legislated matters in the Labor Court. This is extremely relevant for the legal certainty of companies in negotiating CBA, in addition to standardizing case law on the application of Theme 1.046 of general repercussion of the STF.

[1] Process Ag-RR-868-65.2021.5.13.0030. Judgment published on December 7, 2023, and reanalyzed after motion of clarifications, with a new publication on April 10, 2024.

[2] Precedent 109 of the TST: "Bank employees not classified under § 2 of article 224 of the CLT, who receive a bonus payment, cannot have the salary related to overtime hours offset with the value of that benefit”.

[3] RR-1000315-49.2020.5.02.0383

- Category: Labor and employment

The Electronic Judicial Domicile (DJE) is a 100% digital, free solution and an integral part of the Justice 4.0 Program, which aims to provide everyone with faster and more practical access to the services of the Judiciary. The DJE centralizes all communications from Brazilian courts in one place to make their management simpler and more efficient.

Understanding how this tool works is important because adherence to it has become mandatory for a wide range of companies and institutions.

This eBook not only explains how to register, but also details the adherence schedule and clarifies a series of doubts about the system.

- Category: Labor and employment

The registration and use of the Electronic Labor Domicile (DET) have been mandatory since March 1st of this year for some companies, bringing new challenges and obligations that can be complex.

To facilitate the adaptation to the new process, our eBook answers the 15 main questions about the system, to ensure that companies are fully informed and prepared.