- Category: Tax

A growing number of Brazilians have opted to live abroad in recent years. The reasons for this choice are manifold: while in previous decades they were linked to employability and formation of equity, today they are more related to quality of life, economic stability, and security.

Itamaraty estimates that there are currently 3 million Brazilians living outside Brazil, either for work or studying. The number already seems significant even considering only citizens in good standing in their new jurisdictions. And the trend is growing, as 62% of Brazil's young population indicates that they want to live abroad at some point in their lives, according to research by Datafolha.

The information provided by the Federal Revenue Service of Brazil (RFB) confirms this phenomenon. Brazil's declarations of definitive departure more than doubled between 2011 and 2018: they went from less than 10,000 to 22,400, an increase of 165 percent, according to the RFB.

Currently, the most sought after countries by Brazilians are the United States, Portugal, Canada, and Japan. That is, cultural issues are decisive in choosing the new country of residence.

In order to avoid potential discussions with the Brazilian tax authorities in the event of changing countries, some procedures need to be observed.

Tax residence, double taxation, and declaration of departure

The first point to keep in mind is that citizenship differs from tax residence, which in turn is different from physical residence.

Physical residence is where the individual actually lives, resides. Citizenship, in general, is linked to an individual’s nationality, which may be given based on the place of birth or blood ties. The rules of tax residence, in turn, are provided by the domestic legislation of each country. The independence of these concepts makes several scenarios possible, among them: (i) citizenship in one country and tax residence in another; (ii) physical residence in one country and tax residence in another; (iii) tax residence in more than one country and physical residence in another; or (iv) physical residence in one country and no defined tax residence, stateless from a tax point of view.

Thus, the risk of double taxation should not be disregarded in the event of changing countries. To avoid this, it is essential to present a declaration of definitive departure to the RFB. This document closes tax residence in Brazil, but does not have an impact on the citizenship of the individual. In Brazil, formalization of departure occurs in two stages. The first is the presentation of notice of definitive departure, which must be sent by February of the year following departure from Brazil. By April of the following year, the declaration of departure must be formalized with the RFB.

If the declaration of departure is not filed, the individual continues to be a tax resident of Brazil for the first 12 consecutive months from the date of departure from Brazil. Failure to present these documents also generates collection of a fine. If there is a tax due, a fine of 1% per month or fraction over the arrears is calculated over the amount of the tax due, subject to the minimum amount of R$ 165.74 and the maximum of 20% of the tax due. If there is no tax due, the minimum fine of R$ 165.74 applies.

One must also take into account the existence or lack thereof of a Treaty to Prevent Double Taxation between Brazil and the new country of residence. The rules of tax residence and the tiebreaking criteria[1] in the event of any double residence (the treaty does not allow a person to reside in both States) are governed by these treaties and, if such a protocol exists between the two countries, this rule prevails over local law. Considering the countries most sought after by Brazilians, Brazil has a treaty with Canada, Japan, and Portugal.

Investments in Brazil - possible change in taxation

In addition to the formalization of departure from Brazil with the RFB, income-paying sources and financial institutions responsible for current accounts and investments should also be notified.

This is because, for assets that will remain in Brazil, the form of taxation of income and gains may be changed due to the change from tax residence status to non-resident. Generally speaking, non-resident taxation is equated to that of a resident individual.[2] However, specific rules, which are sometimes even more beneficial, may apply. This is the case, for example, with investors who, upon becoming non-residents, now hold investments in the Brazilian financial and capital markets through CMN Resolution No. 4,373/14. The so-called “4,373 Investors” are entitled to a zero rate for income tax (IR) tax on capital gains earned on stock exchange transactions and reduced IR rates for other transactions. These tax benefits are only available to non-residents who are not domiciled in jurisdictions considered by Brazil as having favored taxation.[3]

Individuals leaving Brazil should also consider that there is a possibility that the tax authorities may require IR tax at the time of migration of the nature of the investments from resident to non-resident. This position was stated by the RFB in Interpretive Declaratory Act No. 1/16, according to which, in the case of an individual resident in Brazil who acquires the status of non-resident, for the purposes of applying the special tax regime, the taxpayer shall require from the individual (i) proof that he/she has submitted the notice of definitive departure to the RFB and (ii) the withholding and payment of income tax on income earned up to the day prior to the acquisition of non-resident status.

Although, in our view, it is possible to debate the legality and even the constitutionality of this declaratory act, the risk arising from this interpretation by the RFB cannot be ruled out.

Need for prior review of destination country’s legislation

In addition to the Brazilian issues in changing countries, it is always important to consult an expert advisor in the destination jurisdiction.

In this sense, the starting point before the change should be mapping of the individual's assets in order to assess the changes necessary in the investment structure and asset management. After this mapping, this study is discussed with a legal advisor in the destination jurisdiction.

Some jurisdictions require prior reorganizations in order for individuals to enjoy a more beneficial tax regime. This is the case of Portugal and its non-habitual resident tax (RNH) regime. Income from tax havens is taxed in Portugal at the rate of 35% and is not subject to the exemption rule provided for by the RNH regime.

In the event of prior restructuring, depending on the alternative chosen, income or gains taxation in Brazil may be triggered, even if there is no immediate economic availability of cash.

International information exchange procedures and their potential impacts

The pursuit of international tax and banking transparency is already a reality. Information exchange agreements are encouraged by nations as a way to combat tax evasion, money laundering, fraud, and tax evasion.

In Brazil, Decree No. 8,842/16 promulgated the text of the Convention on Mutual Administrative Assistance in Tax Matters. Since then, the first automatic exchange of this information has already taken place in an agreement involving 100 countries signed by the Organization for Economic Co-operation and Development (OECD). Brazil received financial information for 2017 from Brazilians living in 85 countries, including Argentina, Andorra, Bahamas, Cayman Islands, Portugal, Japan, and Uruguay. By contrast, it has provided 54 countries with information on foreigners living here. It is necessary to be aware of these changes and the current ease of obtaining information that would previously be covered by bank and tax secrecy rules.

Given the interest in living abroad, it is therefore essential to plan moves carefully, analyzing national and international impacts and complying with the requirements of the respective laws.

[1] The tiebreaking criteria are, in this order: (i) permanent housing, (ii) center of vital interests, (iii) habitual presence, (iv) nationality, and (v) decision by mutual agreement between States.

[2] Article 18 of Law No. 9,249/95.

[3] The list of jurisdictions considered as having favored taxation is found in article 1 of Normative Instruction No. 1,037/2010.

- Category: Environmental

Cetesb (São Paulo State Environmental Company) approved new procedures for the incorporation of reverse logistics in the state environmental licensing process, by means of the Board Decision (DD) No. 114/2019/P/C, published on October 25th of this year. The rules enter into effect in November, 30 calendar days after the date of publication.

The new DD No. 114/2019, republished with corrections on October 30, revoked Cetesb DD No. 76/2018. In compliance with article 4 of State Bureau of the Environment (SMA) Resolution No. 45/2015, which defines the guidelines for implementation and operationalization of post-consumer liability in the state of São Paulo, DD No. 114/2019 establishes that the fulfillment of the procedures provided for for structuring, implementation, and operation procedures is a requirement for issuing or renewing the operating license.

Under SMA Resolution No. 45/2015, reverse logistics systems should be implemented in the state of São Paulo for post-consumer product and packaging waste with significant environmental impact. Such products and packaging must be returned independently from the public urban sanitization and solid waste management service. In addition to those sectors already covered by article 33 of Federal Law No. 12,305/2010[1] (Brazilian Solid Waste Policy - PNRS), SMA Resolution No. 45/2015 included the following sectors: edible oil; automotive lube oil filter; home remedies, expired or in disuse; packaging of food, beverages, toiletries, perfumery, and cosmetics; and real estate paints.

Waste covered by DD 114/2019 is that which is generated by the final consumer, thus defined as “the one who purchases the product or service for person consumption, and does not use it as an input in the production process, in the rendering of services, or for replacement in the market.” (item 1.6 of the Sole Schedule of DD No. 114/2019).

The implementation of reverse logistics by manufacturers, importers, distributors, and traders of such products and packaging is linked to Cetesb's ordinary environmental licensing. Demonstration of compliance is a requirement for issuing or renewing operating licenses. It is also stated as a technical requirement, according to the guidelines and conditions set forth in DD Cetesb No. 114/2019.

Fulfillment of obligations may occur through the signing of a Reverse Logistics Commitment Agreement (TCLR) or individual or collective instruments. In the case of the TCLR, those responsible for them shall enter the Reverse Logistics Plans (PLR) into the e-environment system (while the Sigor system is not yet available), demonstrating by March 31 of each year the achievement of the goals established through the Annual Results Report.

Due to the provisions of Federal Decree No. 9,177/2017 (Equal Protection Decree), if the company chooses not to sign the TCLR, it must meet proportional targets. In this case, registration of the PLR in the e-environment system must occur concurrently with the request for renewal of the venture’s Operating License.

The procedure approved by the DD refers to the first stage of reverse logistics systems, expected to last until December 31, 2021. Annual results reports for the year 2021 must be delivered by March 31, 2022. As of the following year, the quantitative and geographic goals will be evaluated again, through a new Cetesb DD.

In setting the targets, Cetesb relied on existing benchmarks and the respective quantitative and geographic targets, taking into account sectoral agreements and federally agreed-upon consent orders, specific laws applicable, existing TCLRs, and call for sectoral agreements. In the case of electronic products specifically, the targets were based on the draft of the Federal Sector Agreement, already submitted for public consultation and signed at the end of October, and the TCLR of the sector in force in São Paulo.

In DD No. 114/2019, the concept of “manufacturer” was regulated, which was generally provided for in Federal Law No. 12,305/2010. Manufacturers are considered to be the holders of the brand of their respective products and/or those who, on their behalf, fill in, assemble, or manufacture the products (topic 1.3 of the Sole Schedule of DD No. 114/2019). However, there is a provision for manufacturers who do not own a particular brand to ensure that their product and/or packaging is covered by a reverse logistics system. Otherwise, they will be responsible for the reverse logistics of the respective products or packaging.

The persons responsible for the reverse logistics systems were also assigned the obligation to keep a copy of the proof of environmentally appropriate final destination for a period of five years. In the case of sale of recyclable materials from packaging in general, this proof will be done through invoices and/or Certificate of Recycling of General Packaging (CRE). For the purpose of meeting reverse logistics tarets, the CRE must be individualized by project subject to environmental licensing and will have a maximum validity of one year. The respective tax invoice shall be issued only by proving reinsertion of the packaging into the production cycle for transformation into an input or new product, via approval of the parties.

Cetesb made it explicit that, for waste from selective municipal collection (including waste that goes to waste pickers' cooperatives, whose rejects are disposed of by the municipal sanitation service), manufacturers, importers, distributors, or traders should promote compensation for waste from the city government, in accordance with a commitment agreement or prior sectoral agreement that establishes mechanisms for such compensation.

Cetesb DD No. 114/2019 does not intend to regulate sectors that already have a commitment agreement or sectoral agreement signed. It only requires compliance with it for issuing environmental permits, in addition to formalizing procedures and establishing complex criteria for the implementation of reserve logistics under state environmental licensing.

[1] Article 33. They are required to structure and implement reverse logistics systems, upon return of products after consumer use, independently of the public urban sanitization and solid waste management service, manufacturers, importers, distributors, and traders of:

I - pesticides, their wastes and packaging, as well as other products whose packaging, after use, constitutes hazardous waste, observing the hazardous waste management rules provided for by law or regulations, rules established by Sisnama, SNVS and Suasa, or in technical standards;

II - batteries;

III - tires;

IV - lubricating oils and the waste and packaging thereof;

V - fluorescent, sodium, and mercury vapor and mixed light lamps;

VI - electronic products and their components.

- Category: Environmental

Executive Order (MP, in its abbreviation in Portuguese) No. 884/19, converted into law last October 17th, amended the Forest Code (Law No. 12,651/2012) so as to provide that registration in the Rural Environmental Registry (CAR) shall be mandatory for all rural properties and holdings.

As a result of this conversion into law, Federal Law No. 13,887/19 maintained the amendment brought in by MP 884 to the third paragraph of article 29 of the Forest Code, reinforcing that registration in the CAR, besides being mandatory, has an indefinite term.

The cut-off date for enrolling in the CAR was being extended by various regulatory changes since the register was established. The period initially established in the Forest Code for adhesion was one year as of the approval of the code, with possible extension for an equal period.

With the enactment of Law No. 13,295/16, the deadline for enrollment in the CAR was changed and the deadline of December 31, 2017, was set. As provided for in the initial wording of the Forest Code, Law No. 13,295/16 also allowed extension of the deadline for another year and provided for enrollment in the CAR by December 31, 2018.

After the deadline established by Law No. 13,294/16, Executive Order No. 867/18, approved on December 31, 2018, postponed registration in the CAR until December 31 of this year. However, the MP was not converted into law, which gave rise to questions related to the validity of the extension.

After various debates, MP 884 was approved on June 14th of this year, aiming to make the CAR a more effective and permanent tool for management of rural farms through establishing a system open to updates and new enrollments at any time. The MP extinguished the deadline for registration in the CAR, which was formalized in Law No. 13,887/19.

That same law included paragraph 4 in article 29 of the Forest Code to establish that landowners and owners of rural properties that enroll in the CAR by December 31, 2020, will be entitled to adhere to the Environmental Regularization Program (PRA). Established by article 59 of the Forest Code, the PRA must be implemented by the Federal Government, the states, and the Federal District. The objective is to adapt consolidated rural areas in permanent preservation areas (PPAs) and legal reserves to partial restoration parameters established in the Forest Code.

Since the original publication of the Forest Code, it was provided that enrollment in the CAR is a basic requirement for the adhesion to the PRA by owners and holders of rural property.

New deadline for adhesion to the PRA

Considering the new provision and the determination that CAR members will be entitled to adhere to the PRA until December 31, 2020, it was also necessary to amend article 59 of the Forest Code. The new wording of the provision establishes that owners and holders of rural properties may adhere to the PRA within two years from the registration of the rural property in the CAR, subject to the provisions of paragraph 4 of article 29. Thus, those who register with the CAR on the last day of the deadline (December 31, 2020) will have up to December 31, 2022, to apply to adhere to the PRA.

This adhesion, in addition to ensuring the regularization of rural areas that are currently in disagreement with the provisions of the Forest Code, will suspend any administrative sanction arising from this situation during the implementation of the measures proposed. When the measures are fulfilled, fines for irregular interventions in APP and legal reserves will be converted into services aimed at environmental preservation and recovery, which is beneficial to all.

The constitutionality of the PRA was recognized by the Federal Supreme Court in the judgment of direct suits of unconstitutionality of No. 4,901, 4,902, 4,903, and 4,937 and Declaratory Action No. 42/19, the judgment of which was published on August 12th of this year. With the new period for adhesion to the PRA and confirmation of its constitutionality, it is expected that the environmental agencies will actually work to implement these programs in order to allow effective adhesion of owners and holders of rural property to alternatives in order to regularize the environmental situation of rural areas.

- Category: Labor and employment

As part of our series of articles on the changes implemented by Executive Order 905/19, we highlight the following points that may affect trade union organization and relations.

Negotiations for profit sharing

The waiver of participation of representatives of trade unions in negotiations relating to profit sharing (PLR) made by commission may generate important effects for labor relations. The amendment was specifically analyzed in another article on this portal and will take effect only after an act by the Ministry of Economy.

Since the approval of Law No. 10,101/2000, which deals with the issue, trade union participation in PLR negotiations was mandatory. Employers were forced to deal with intervention by the trade union often detached from corporate reality and misaligned with the workers' own desires. In addition, there were not rare cases of trade unions that refused to participate in the negotiation or made the signing off on a PLR program conditioned on approval of a contribution to the trade union.

In the manner proposed by MP 905, employers interested in implementing a PLR program should: a) coordinate the formation of a joint committee between representatives of the company and employees, who are to be appointed in an election process; and b) promote committee negotiation meetings.

Thus, if this aspect of MP 905 is approved, the negotiation process will be conducted directly with employees, who generally know the reality of the company and have a better perception of the proposed criteria and goals for the PLR program. Once approved and signed off on by the committee, the PLR program will be in place.

Union organization

In relation to Brazilian trade union organization, paragraphs or subsections of articles 543, 545, and 553 of the CLT were amended in order to refer to new fines for violations of labor law (article 634-A of the CLT, also proposed by MP 905).

Previously, the fine in the event of violation of principles related to “Chapter I - The Institution of Unions” of Title V of the CLT could vary between R$ 2.12 and R$ 106.41. 90 days after the publication of MP 905, the amount will be from R$ 1,000 to R$ 100,000. The grading of violations of this article between light and very serious and the amounts applicable will be defined by the Federal Executive in due course.

Among the rules contained in this chapter,[1] those cited by the very articles 543, 545, and 553 of the CLT stand out:

- Article 543: Prohibition on companies seeking to prevent an employee from joining a trade union, organizing a professional or trade union association, or exercising rights inherent to the condition of membership in a trade union.

- Article 545: Obligation to transfer and not retain trade union contributions discounted by employers from the salaries of their employees.

- Article 553, letter “f”: refers to the sole paragraph of article 529, which imposes on trade union members the obligation to vote in union elections.

The proposed changes on this topic are in line with the government's intent to approve a trade union reform. The increase in the amount of the fine may help to prevent acts contrary to full freedom of association, the essence of the proposal defended by the government base.

We will cover the main changes of MP 905 in the next articles in this series. Click here to read prior analyses.

[1] Part of the legal scholarship argues that some of the articles in this chapter were not accepted by the Federal Constitution of 1988.

- Category: Labor and employment

Companies no longer need to be inspected by the competent labor authority in order to begin their operations and/or undertake structural changes. Executive Order No. 905/19 (MP 905), which instituted the Green and Yellow Employment Contract, repealed article 160 the Consolidated Labor Laws (CLT), which contained rules relating to the inspection of companies before they may start operations.

Effective since November 12, the date of publication of MP 905, the change reduces bureaucracy and optimizes the process of business operation, especially new establishments.

Article 160 of the CLT mandated that no new establishments could begin operations without a prior inspection and approval of their premises by the regional occupational safety and health authority responsible for the matter. The provision also established that any substantial modification to the facilities, including equipment, should be reported to the Regional Labor Office for a new inspection to be conducted.

Accordingly, establishments no longer need to be inspected by the competent labor authority in order to begin their activities and/or undertake structural changes. This reduces bureaucracy and optimizes the process of business operation, especially new establishments.

Another provision that has been modified is article 161 of the CLT, which deals with the stop work orders and work halt orders for activities, establishments, sectors, machinery, or equipment.

Although unnecessarily, the MP included in article 161 of the CLT assigning the topic (stop work orders and halt work orders) to regulations by the Special Bureau of Social Security and Labor of the Ministry of Economy (SEPRT). Currently, the issue is addressed, within the scope of SEPRT, by Regulatory Standard No. 3 (which establishes the guidelines for finding serious and imminent risk and objective technical requirements for stop work and work halt orders) and by SEPRT Ordinance No. 1,069/19 (which regulates stop work and halt work orders).

Another amendment of the MP was the modification of paragraph 2 so as to eliminate the provision that allowed labor inspection agents or trade union entities to request stop work and halt work orders. A request is not to be confused with the possibility of actually issuing stop work and halt work orders; SEPRT Ordinance No. 1.069/19 expressly authorizes labor inspection agents to do so.

The MP also established a deadline (until then nonexistent in the CLT) of five business days, counted from the filing, for a review of appeals filed against stop work and halt work orders. SEPRT Ordinance No. 1.069/19 already established various deadlines to be complied with in proceedings relating to stop work and halt work orders, including a longer period for review of the appeal. There are no sanctions in the law or the ordinance for non-compliance with the deadlines, but non-compliance may be used as an argument for judicial measures to challenge the stop work and halt work orders.

The changes in article 161 of the CLT regarding stop work and halt work orders come into force only 90 days after the publication of MP 905.

We will cover the main changes of MP 905 in the next articles in this series. Click here to read our other analyses on the topic.

- Category: Litigation

With the consolidation of the use of arbitration by the Federal Government as an alternative, and often preferable, means for the Judiciary to settle disputes, several normative acts have been issued over the last years to recognize and regulate the use of this mechanism to settle conflicts relating to alienable property rights.

Law No. 13,129/15 amended the Arbitration Law (Law No. 9,307/96) to include an express provision that "[the] direct and indirect public administration may use arbitration to resolve disputes relating to alienable property rights" in the Arbitration Law (paragraph 1 of article 1). Similarly, the Ports Law (Law No. 12,815/13) already provided for the use of arbitration to settle disputes with the Federal Government regarding the debts of concessionaires, lessees, permittees, and port operators, while Law No. 10,233/01 already provided for the possibility of including arbitration clauses in water and land transport contracts entered into with ANTT and Antaq. More recently, the States of Rio de Janeiro and São Paulo also regulated the use of arbitration in contracts signed by the state direct and indirect Public Administration and its instrumentalities (through the Decrees No. 46,245/18 and No. 64,356/19, respectively).

In this context, on September 20, 2019, Decree No. 10,025 (the "Decree") was issued, which brings important news regarding the use of arbitration to resolve conflicts involving, on the one hand, the Federal Government or entities of the Federal Public Administration and, on the other, concessionaires, sub-concessionaires, permittees, lessees, authorizees, or operators in the port, road, rail, waterway, and airport sectors.

The Decree entered into force on the date of its publication, on September 23, 2019, and will apply, as a rule, only to future arbitrations arising from arbitration commitments entered into while it is in force. However, the legislature has included an express provision that existing administrative contracts may be amended in order to include arbitration clauses, or parties may enter into arbitration commitments in order to submit existing disputes to arbitration in the absence of an arbitration clause (article 5, paragraph 3, and article 6, head paragraph, of the Decree). In such cases, the Decree provides that the Public Administration must give preference to arbitration: (i) "in the cases in which the dispute is based on eminently technical issues"; and (ii) "whenever delay in the final settlement of the dispute may cause damage to the adequate provision of the service or operation of the infrastructure, or inhibit investments considered to be priorities" (subsections I and II of paragrah 1 of article 6).

Pursuant to the Arbitration Law, the Decree recognizes that only disputes over alienable property rights may be submitted to arbitration. But the Decree went beyond and, through the sole paragraph of its article 2, the legislature sought to present an exemplary list of alienable property rights that may be subject to arbitration, namely: (i) "questions related to the restoration of the economic and financial balance of contracts"; (ii) "calculation of compensation resulting from the extinction or transfer of partnership contracts"; and (iii) "default in contractual obligations by any of the parties, including the application of penalties and the calculation thereof."

In addition to encouraging the use of arbitration, the Decree also provides that parties to administrative contracts may use other alternative dispute resolution methods in order to resolve their disputes, such as direct negotiation with the Public Administration and the submission of disputes to the specialized chamber for prevention and administrative resolution of conflicts of the Federal Attorney-General’s Office (the creation of which is provided for in subsection II of the head paragraph of article 32 of Law No. 13,140/15).

In its articles 3 to 7, the Decree regulates some procedural issues that must be observed in the arbitrations governed by it and guides the drafting of arbitration commitments. Among the rules listed in the Decree, we highlight that:

- the chambers chosen must be accredited by the Federal Attorney-General’s Office (AGU);[1]

- the law applicable to the merits of the dispute must be Brazilian law;

- the arbitrations will be based in the Brazilian territory;

- as a rule, information regarding the arbitrations will be public (except to preserve industrial or commercial secrecy and confidential information under the law) and the arbitration chambers will be required to disclose information regarding the arbitrations, unless otherwise agreed upon by the parties; and

- a minimum period of 60 days for the presentation of a defense and a maximum period of 24 months for the presentation of the arbitral award (extendable once for an equal period) must be observed.

By regulating the use of arbitration to settle disputes related to administrative contracts within various infrastructure sectors, as well as helping to unburden the Judiciary, the legislature gives contracting parties greater legal certainty regarding arbitration against the Federal Government and consolidates a growing confidence placed in the institution of arbitration, especially as a faster and more specialized means of resolving complex and predominantly technical conflicts. Thus, the measure has the potential to encourage investment in Brazil and contracts with the Federal Government.

However, individuals wishing to enter into contracts with the Public Administration should note that the costs of the arbitrations governed by Decree No. 10,025/19, including the costs of commencing arbitration, the fees of arbitrators, and the costs associated with the production of expert evidence, must always be advanced by the service provider (as provided for in the head paragraph and paragraph 4 of article 9) and may only be reallocated after the final decision by the arbitral tribunal. This rule may discourage or even make it impossible for private parties to initiate arbitration proceedings, especially in the case of companies with low liquidity or that are insolvent. The financial burden on the service provider is aggravated by the fact that the payment of any monetary obligation by the Federal Government or its instrumentalities will, as a rule, be done via a court-issued registered warrant (precatório) or petty claim (head paragraph of article 15).

To circumvent the problem of delays associated with the payment by the Federal Government of monetary obligations, the legislature also provided that the parties may agree that the execution of an adverse arbitration award shall be done by (i) mechanisms of economic and financial rebalancing alternative to the monetary compensation; (ii) offsetting of non-tax assets and liabilities; or (iii) assignment of the payment to a third party. Given these options, private parties who contract with the Federal Government may contractually provide for alternative forms of compensation, in order to avoid delay in payments via court-issued registered warrants (precatórios).

Access the full text of decree No. 10,025/19 here.

[1] The Decree provides that accreditation of the arbitration chambers shall be carried out by the AGU and shall require the meeting of the minimum requirements listed in the same provision, among them: the chamber must have operated regularly for three years and be of good repute and experience. However, there is still no clear information on how accreditation will take place, which may compromise the implementation of arbitration commitments under the Decree.

- Category: Labor and employment

Changes range from establishing objective inspection criteria to limiting the size of fines

Executive Order (MP) No. 905, published in the Official Federal Gazette on November 12, 2019, promotes a series of changes to the Consolidated Labor Laws (CLT), especially regarding labor inspection rules and the application of administrative fines.

Most of the amendments proposed in MP 905 were already contained in Executive Order No. 881/19 (as its text was approved by the Senate Constitution and Justice Committee - CCJ), which reaffirms President Jair Bolsonaro's government's proposal to reduce bureaucracy in labor relations, with the ultimate goal of promoting job openings and generating economic growth.

The provisions on labor inspections were not approved in the final text of MP 881/19 when it was converted into Law No. 13,874/19.

In this article, we review the main provisions of MP 905 relating to the changes in labor inspections and the application of administrative fines. They may be divided into changes (i) in the inspection procedure; (ii) the administrative procedure and valuation of fines; and (iii) the rules of settlements signed between the inspection entities and the companies.

(i) Changes in the inspection procedure

Double visit criteria

As provided for in MP 881, MP 905 proposes a change in the wording of article 627 of the CLT, which establishes the need for the labor inspection auditor to observe the double visit criteria. In the current wording of the CLT, this criteria would only apply in cases of: (i) promulgation or issuance of new laws, regulations, or ministerial instructions and (ii) first inspection of newly opened or begun establishments or businesses.

Decree No. 4,552/02 (the Labor Inspection Regulation), in its article 23, also points out two other situations for the application of the double visit criteria: (iii) when dealing with an establishment or business with up to ten workers, except when there is a violation due to lack of employee registration or annotation in the employee's work booklet (CTPS) or when recurrence, fraud, resistance, or blocking of the inspection occurs; and (iv) in cases of micro or small businesses.

MP 905 maintains the first two scenarios, but establishes that the double visit criteria will only be observed within 180 days from the effective date of the new normative provisions (item “i” above) or the effective date of the operation of the establishment/business (item “ii” above).

With regard to micro and small businesses, the MP promotes changes in current legislation by stipulating a limit for the application of the criteria to micro and small businesses with up to 20 workers, a provision that did not exist previously.

In addition, MP 905 reproduces the provision found in MP 881 that the double visit criteria would be applied in the case of infractions graded as light against legal or regulatory principles relating to occupational safety and health, according to a regulation issued by the Special Bureau of Social Security and Labor of the Ministry of Economy.

The last scenario in which the double visit criteria apply is the previously scheduled informational technical visits, which was also not provided for by laws and regulations.

Other innovations brought about by MP 905 are the need to analyze the double visit criteria for each item supervised by the labor auditor and the nullity of the infraction notice if the prior requirement is not met. Both innovations were not provided for in the wording of article 627 of the CLT.

Labor auditor's conduct

MP 905 also provides for the inclusion of article 627-B in the CLT, which establishes the need for labor inspection in order to include the planning of labor inspection actions, through the preparation of special sectoral inspection projects for the prevention of accidents, work-related diseases, and labor irregularities involving these issues.

If labor auditors find the existence of repeated irregularities and high levels of accidents or a large number of occupational diseases, they must indicate collective actions in order to prevent and remedy irregularities at the time of the inspection.

In addition, the MP provides for penalties applicable to labor auditors if bad faith in their performance is proven. In this case, they will be held liable for serious misconduct and may be suspended for up to 30 days, in addition to the opening of an administrative inquiry if the conduct of bad faith recurs.

Electronic labor domicile

MP 905 also innovates by reproducing a provision contained in MP 881 instituting the electronic labor domicile with the purpose of: (i) informing employers of administrative acts, oversight actions, subpoenas, and notices; and (ii) allowing the receipt of electronic documentation during the course of inspections or when presenting an administrative defense or filing an administrative appeal.

The reports transmitted in this system, the use of which will be mandatory for employers, do not require publication in the Official Federal Gazette and the sending thereof via mail. They will be considered personal for all legal purposes.

Employers must access this system within a period of ten days from the date of notice through a registered e-mail address. At the end of this period, the electronic report will be automatically considered performed.

The need to use this electronic system does not preclude the use of other legal means of reporting between the competent authority and the employer.

(ii)Changes in the administrative procedure and valuation of fines

Deadlines in administrative procedure

MP 905, as MP 881 provided, also amends the CLT as to the time limit for filing an administrative defense and for filing an administrative appeal. Prior to the date of entrance into force of the MP, the period was ten days from the receipt of the infraction notice or the decision by the trial level administrative court. With the proposed change, the time limit for filing an administrative defense and filing an administrative appeal will be 30 days.

Waiver of acknowledgment of signature

Another innovation that was also addressed in MP 881 and reproduced in MP 905 is the exemption from authentication of copies of documents sent in Brazil to be attached in administrative proceedings and waiver of acknowledgment of signatures. These formalities should be observed only when there is doubt about the authenticity of the documents.

Analysis of administrative defenses and appeals and parity appeal board

MP 905 provides for the deterritorialization requirement for the review of administrative defenses. This means that, if an objection is filed against a particular tax assessment notice, another state in the Federal Government other than the one that issued the assessment will be responsible for reviewing the administrative defense. The objective is to confer greater impartiality in the judgment of administrative proceedings.

In addition, the MP establishes the creation of a system of random distribution of cases for review, decision, and imposition of administrative fines, which favors the principle of adversarial proceedings by disengaging the administrative decision from the person directly responsible for the assessment.

Another innovation introduced by MP 905 which was also provided for in MP 881 is the creation of a tripartite joint committee, composed of representatives of workers, employers, and labor inspectors, to review appeals against infraction notices in the second and last level of administrative appeals.

Criteria for application of administrative fines

MP 905 also innovates by including article 634-A in the CLT, setting forth the criteria for the application of administrative fines in the event of issuance of infraction notices for non-compliance with labor standards.

Under this new provision, fines must be applied according to the nature of the offense (light, medium, severe, or very severe). The amounts of the infractions are subject to a variable fine (R$ 1,000.00 to R$ 100,000.00) or a fine per capita (R$ 1,000.00 to R$ 10,000.00).

The classification of fines, the nature of the infraction, and the classification by economic size, which is one of the criteria for setting the penalty, still require specific regulations, to be defined in an act by the Federal Executive.

MP 905 also provides for the possibility of paying an administrative fine with a 50% discount for individually owned companies, microenterprises, and small businesses with up to 20 employees, in the event of waiver of the right to file an administrative appeal. For other companies, the discount is 30% in this same scenario, when they give up their right to file a voluntary appeal.

The prior rule made no distinction as to the type/size of the company. Any employer assessed would be entitled to a 50% discount over the administrative fine if they paid within 10 days of receiving the notice, provided that they have not appealed.

(iii)Change in the rules regarding settlements between supervisory entities and companies

Consent Orders and Consent Decrees

MP 905 also provides that, in the event of the filing of a special procedure for an oversight action that will advise on the correct criteria for application of the law, Consent Orders and Consent Decrees signed shall have a maximum term of two years, and may be renewed for two more years when there is justification based on a technical report.

This provision benefits signatory companies inasmuch as they will no longer be compelled to comply with the obligations contained in these documents perpetually, given the existence of a maximum period for their validity.

MP 905 also innovates by providing that companies cannot be required to enter into two extrajudicial settlements (one with the Labor Attorney's Office - Consent Orders - and one with the Ministry of Economy - Consent Decrees) based on the same violation of labor laws or regulations.

- Category: Litigation

The Third Panel of the Superior Court of Justice (STJ) assigned the judgment of Special Appeal No. 1.797.924/MT to the Second Chamber of the court on October 10. The discussion revolves around the continuation of lawsuits and executions filed against jointly and severally liable debtors, when cancellation of the creditors' guarantees is provided for in the judicial reorganization plan.

The judgment before the Second Chamber began on October 23, when Justice Nancy Andrighi voted for dismissal of the appeal, concluding that the suppression of guarantees can only be allowed in the event that the holders thereof assented to the provision, with a manifestation to that effect at the general meeting of creditors.

According to Justice Andrighi, the rights, privileges, and guarantees of those who do not agree with the suppression thereof should be preserved intact, since there is an express rule to that effect. Thus, in a confrontation between the provisions of the plan and those expressed in the law, the provisions of the law shall control. As requested by Justice Luis Felipe Salomão, the judgment was suspended and a settlement of the understanding on the subject is expected.

Article 49, paragraph 1, of Law No. 11,101/05 provides, expressly, that the creditors of a debtor in judicial reorganization retain their rights against the co-obligors, guarantors, and recourse obligors. In addition, the head paragraph of article 59 provides for the express exception that the novation of credits caused by approval of the plan, while obliging all creditors subject thereto, does not extinguish the guarantees.

Thus, considering the provisions of both articles, it is possible to find that the suspension provided for in articles 6, head paragraph, and 52, III, of Law No. 11,101/05, and the novation provided for in article 59, head paragraph, of the same law do not apply to the guarantors and any co-obligors.

This was the understanding of the STJ in the judgment on Special Appeal No. 1.333.349/SP, upon stating that “the judicial reorganization of the principal debtor does not prevent the continuation of executions or induce suspension or extinguishment of lawsuits filed against third party joint or several or co-obligor debtors in general, by foreign exchange, in rem, or in personam guarantee, as they are not subject to the suspension provided for in article 6, head paragraph, and article 52, item III, or the novation referred to in article 59, head paragraph, by force of the provisions of article 49, paragraph 1, all of Law No. 11,101/2005.”

Along the same lines, the Federal Judicial Review Board approved Restatement of Law No. 43, in the First Conference on Business Law, according to which “the suspension of the actions and executions provided for in article 6 of Law No. 11,101/2005 does not extend to the debtor's co-obligees."

Although the subject seems to have already been settled in the case law, in September of 2016, in the judgment of Special Appeal No. 1.532.943/MT, the Third Panel of the STJ found, in a non-unanimous opinion, that judicial reorganization plans that provide for the suppression or replacement of guarantees binds all creditors, including those absent and those who voted against approval, provided that it is approved by the majority of the creditors, that is, a majority vote at the general meeting of creditors has the effect of suppressing guarantees.

The judgment gained relevance, inasmuch as it was contrary to the previously prevailing understanding that guarantees are preserved, although the reorganization plan causes novation of the debts submitted to it.

In April of this year, in the judgment of Special Appeal No. 1.700.487/MT, also via a unanimous opinion, the Third Panel of the STJ again ruled that reorganization plans approved by the majority of creditors of a company undergoing judicial reorganization may suppress all personal or secured guarantees, even without the consent of all secured creditors.

In this judgment, Justices Marco Aurélio Bellizze, Moura Ribeiro, and Paulo de Tarso Sanseverino defended the theory of the majority principle, to the effect that the decisions by the general meeting must bind all creditors. On the other hand, Justices Ricardo Villas Bôas Cueva and Nancy Andrighi defended the theory that the novation must affect only the creditors who voted for its approval, without any type of proviso. Thus, the issue has not yet been settled, given the disagreement among the Justices of the Third Panel themselves.

Considering the divergence regarding the continuation of actions and executions filed against third party joint and several debtors, it will be necessary to await the judgment by the Second Section of the STJ to clarify definitively the interpretation to be given and the prevailing understanding in the confrontation between preservation of the creditors' guarantees and preservation of the company.

- Category: Tax

Beginning the series of articles on the changes implemented by Executive Order No. 905, published on Tuesday, November 12, we review below changes in the rules for creating and paying a Profit Sharing Plan (PLR).

Granted by companies to their employees as a means of integrating capital and labor and as an incentive for productivity gains, PLRs are not included in the calculation basis of social security contributions, provided that the legal requirements are duly fulfilled. Currently, Law No. 10,101/2000 regulates the matter and expressly provides for, in its articles 2 and 3, the requirements for the implementation of PLR plans.

Despite the existence of clear regulations on the subject, companies are often surprised by assessments based on requirements that are not found in the law.

The Superior Chamber of Tax Appeals (CSRF), often based on the casting vote, has ratified some of the theories and requirements created by the tax authorities, thus assuming the position of a veritable legislator, which seems to go beyond its jurisdictional function.

In this scenario, MP 905 comes to the aid of taxpayers in order to combat and eradicate illegalities perpetrated by the CSRF. In general, the various changes promoted by MP 905 seek to clarify the text of the rules used as a basis for constructing restrictive interpretations of the legislation by the tax authorities and administrative courts.

The table below compares, briefly, the position that was being consolidated before the CSRF with the new rules introduced by MP 905:

|

Legal requirement |

CSRF majority position |

Rules established by MP 905 |

|

Participation by the labor union |

||

|

Implementation of PLRs through collective bargaining agreement or joint committee chosen by the parties, also including a representative appointed by the labor union. |

The absence of labor union participation from the same territorial base, even in the event of refusal on the part of the union, entails disqualification of PLR payments. |

Implementation of PLRs through collective bargaining agreement or joint committee chosen by the parties. Labor union participation is waived if the PLR is implemented by a committee elected by the parties. |

|

Definition of rules |

||

|

PLR plan should contain clear and objective rules. |

Disqualification of PLR payments where, based on a subjective interpretation, the board considered the targets not clear or objective. |

In establishing substantive rights and ancillary rules, including the setting of amounts and the exclusive use of individual goals, the autonomy of the will of the parties to the contract must respected and prevail vis-à-vis the interest of third parties. |

|

Prior negotiation of rules |

||

|

The PLR plan may be based on previously agreed-upon schedules of goals, results, and deadlines. |

The PLR plan must be signed before the start of the period for measuring targets (i.e., before the start of the calendar year, if it is an annual plan). |

The rules set in a signed instrument are considered previously established: (i) prior to advance payments, when provided for; and (ii) at least 90 days in advance of the date of payment of the lump sum or final installment, if there is advance payment. |

|

Frequency of payment |

||

|

It is prohibited to pay any advance or distribution of funds as profit sharing of the company more than two (2) times in the same calendar year and at a frequency of less than one (1) calendar quarter. |

All PLR installments should be disregarded and not only those that exceeded the frequency. Social security levied on all amounts paid in the period. |

Noncompliance with the frequency of payments only disqualifies payments made in violation of the rule, thus understood to be the following: (i) payments in excess of the second, made to the same employee, within the same calendar year; and (ii) payments made to the same employee at a frequency of less than one calendar quarter from the previous payment. |

Despite the good news for taxpayers, the provisions related to the payment of PLR, according to MP 905, will only have effects when an act of the Minister of Economy attests to compatibility with the tax results targets provided for in the schedule of the Budgetary Guidelines Law itself and compliance with the provisions of Supplementary Law No. 101/2000 and the provisions of the Budgetary Guidelines Law related to the matter.

Still, MP 905 indicates that the interpretations that were being adopted by CSRF were not in line with the spirit of the law, which may be used as an additional argument by taxpayers in pending administrative and judicial proceedings.

We will continue to monitor the evolution of the subject and its potential developments.

- Category: Tax

Continuing the series of articles on the changes implemented by Executive Order No. 905, published last Tuesday, we review below the changes regarding the payment of premiums by companies to their employees.

As already discussed in this article, the Brazilian Federal Revenue Service, upon publishing Cosit Response to Public Inquiry No. 151/2019, created difficulties for companies in paying premiums and went against the provisions of article 28, paragraph 9, "z", of Law No. 8,212/1991, which expressly excludes premiums from salary for the purposes of contributions. Instead of clarifying the issue and establishing guidelines on the use of premiums, the body maintained the confusion and lack of legal certainty, because, although it does not have the force of law, Cosit’s resolution of public inquiry binds the Public Administration and guides the actions of tax inspectors.

In summary, according to the restrictions imposed by Cosit Response to Public Inquiry No. 151/2019, only payments made spontaneously and unexpectedly that (i) were not due to contractual agreements (contracts, policies, job postings, etc.) could be considered premiums and (ii) derive from performance above what is ordinarily expected, objectively proven by the employer.

Aiming to restore legal certainty on the subject and remove the obstacles created by the Federal Revenue Service, MP 905 established the validity of the premiums dealt with in paragraphs 2 and 4 of article 457 of the Consolidated Labor Laws (CLT) and item “z”, paragraph 9, of article 28 of Law No. 8,212/1991, regardless of the respective form of payment and means used to fix it. Even unilateral acts of the employer, agreements between the employer and the employee or group of employees, and collective bargaining rules, including when premiums are paid by foundations and associations, are valid, provided that:

the payment is made exclusively to employees, individually or collectively;

the payment of any advance or distribution of funds is limited to four times in the same calendar year and once in the same calendar quarter;

the premiums result from performance higher than what is ordinarily expected, evaluated at the discretion of the employer, provided that ordinary performance has been previously defined; and

the rules for the premium are established prior to the payment.

From an analysis of MP 905, it is evident that the intent of the changes is to make it clear that the parties may fix the terms and conditions for payment of premiums through a written document, via a bilateral act (contract, agreement, or collective bargaining agreement) or unilateral act (internal or communicated policy).

The rules regarding payment of premiums must be filed by any means for a period of six years from the date of payment.

In our view, this point resolves the controversy over the requirement of "liberality." Based on MP 905, the understanding that we defended in a prior article prevails, to the effect that liberality is all that is granted by the company beyond what is required by law. Therefore, premiums cover any and all forms of variable remuneration, even if contractually agreed upon, provided that the other requirements set forth in article 457 of the CLT are observed.

Another important issue addressed by MP 905 is the requirement of “payment due to performance higher than that which is ordinarily expected.” According to the changes implemented, this assessment may be done at the discretion of the employer, provided that the ordinary performance has been previously defined by it, unilaterally or by agreement.

MP 905, however, brought in restrictions on frequency of the payment, which directly impacts on companies that have been making monthly premium payments.

We will continue to monitor the evolution of the subject and its potential developments.

- Category: Capital markets

It is increasingly important for publicly traded companies to dedicate themselves to fully complying with the obligations imposed by current laws and regulations, keeping themselves up to date, and having an adequate Investor Relations Department and legal support structure. Important changes have been observed in sanctions rules, as well as a significant increase in the obligations to be fulfilled, which increases the risks of non-compliance. We emphasize the sanction actions of the Brazilian Securities and Exchange Commission (CVM) for companies listed as public companies and the regulations of B3 S.A. - Bolsa, Brasil, Balcão (B3) for companies listed in the B3.

Recent changes in the rules for CVM sanctions procedures include profound changes by Law No. 13,506/17 (which followed Executive Order No. 784/17, which expired without being converted into law). The topic was dealt with in this portal in two articles:

- An analysis of the “new” administrative sanctions procedures of Bacen and CVM

- Law No. 13,506 and the actions of the Central Bank and CVM

In 2019, due to these legislative changes, CVM sought to consolidate the normative acts that regulated its sanctions procedures by publishing CVM instructions 607, 608, and 609, already dealt with in the Legal Intelligence Portal:

- CVM publishes new framework to regulate its sanction actions

- What changes in practice with the new regulatory framework for CVM's sanction actions

Regarding corporate governance, there have also been recent changes to applicable rules and regulations, among which one may highlight:

- Amendments to the provisions of the “novo mercado” regulation;

- Mandatory distance voting and its recurring updates; and

- The requirement to publish corporate governance reports.

- After so many changes, how are CVM's sanctions activities and B3's regulatory actions having an impact on companies?

In an analysis of the report on CVM’s sanctions activities, the 140% increase in the number of sanctions imposed by the authority in the year 2018, compared to 2017, is striking. Of particular note is the substantial increase in the number of warnings (342%) and fines (133%). In 2019 (until June 30), 106 sanctions were applied (72 of them in the form of fines), a number similar to the total recorded in 2017 (128 sanctions).

Another noteworthy fact is the increase in the average amount of the fines imposed by the authority (as a result of the increase allowed by Law No. 13,506): while in 2017 and 2018 the average amounts of the fines imposed by CVM was, respectively, R$ 1.5 million and R$ 1.4 million, in the first six months of 2019 it reached R$ 10.7 million.

Thus, the total amount of the fines imposed by CVM in the first half of this year already exceeds R$ 770 million, more than double what was collected via fines in 2018 and almost four times more than in 2017.

There was also a strong increase in the number of consent decrees approved by CVM joint board. In 2018, the increase was 56% over 2017, totaling 179 consent decrees. In addition, the amounts involved also increased, which we believe to be a reflection of the increase in the fines provided for in Law No. 13,506: in 2017, the total was R$ 20.7 million, with an average amount of R$ 180 thousand per consent decree; In 2018, it was R$ 41.2 million, with an average of R$ 230 thousand per consent decree; and, in 2019, only in the first half of the year, the total was R$ 25.1 million (considering the 73 consent decrees approved up to June), with an average unit value of R$ 344 thousand.

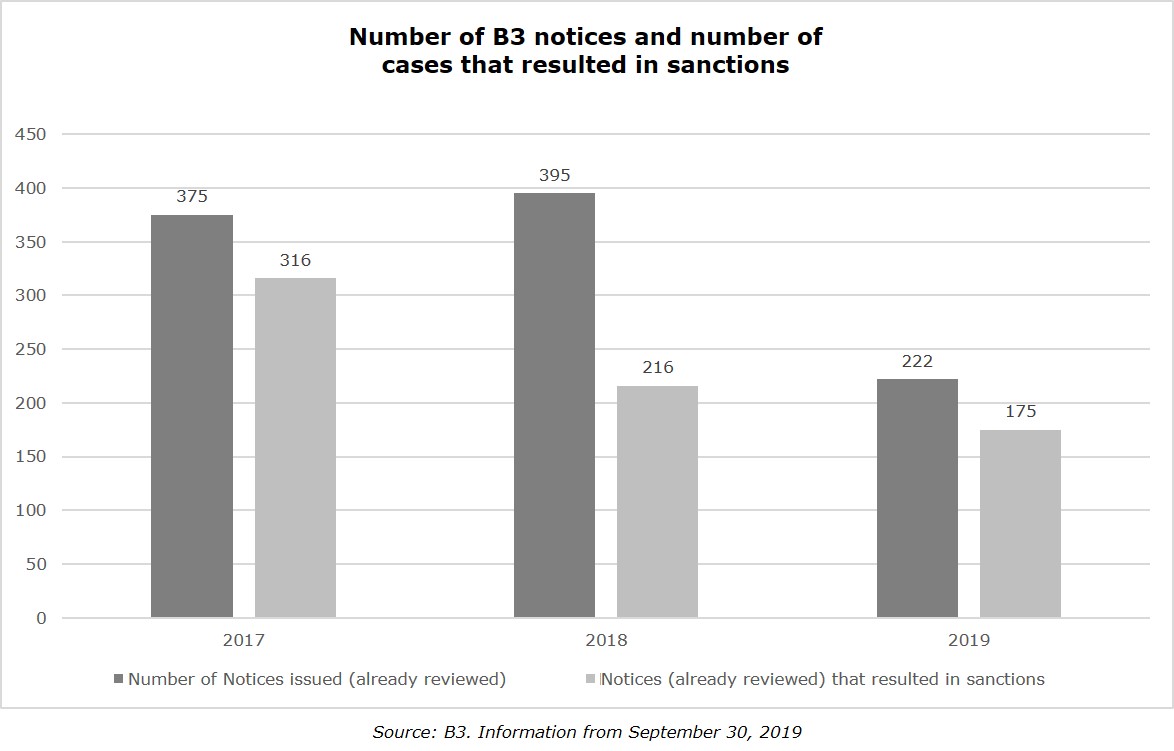

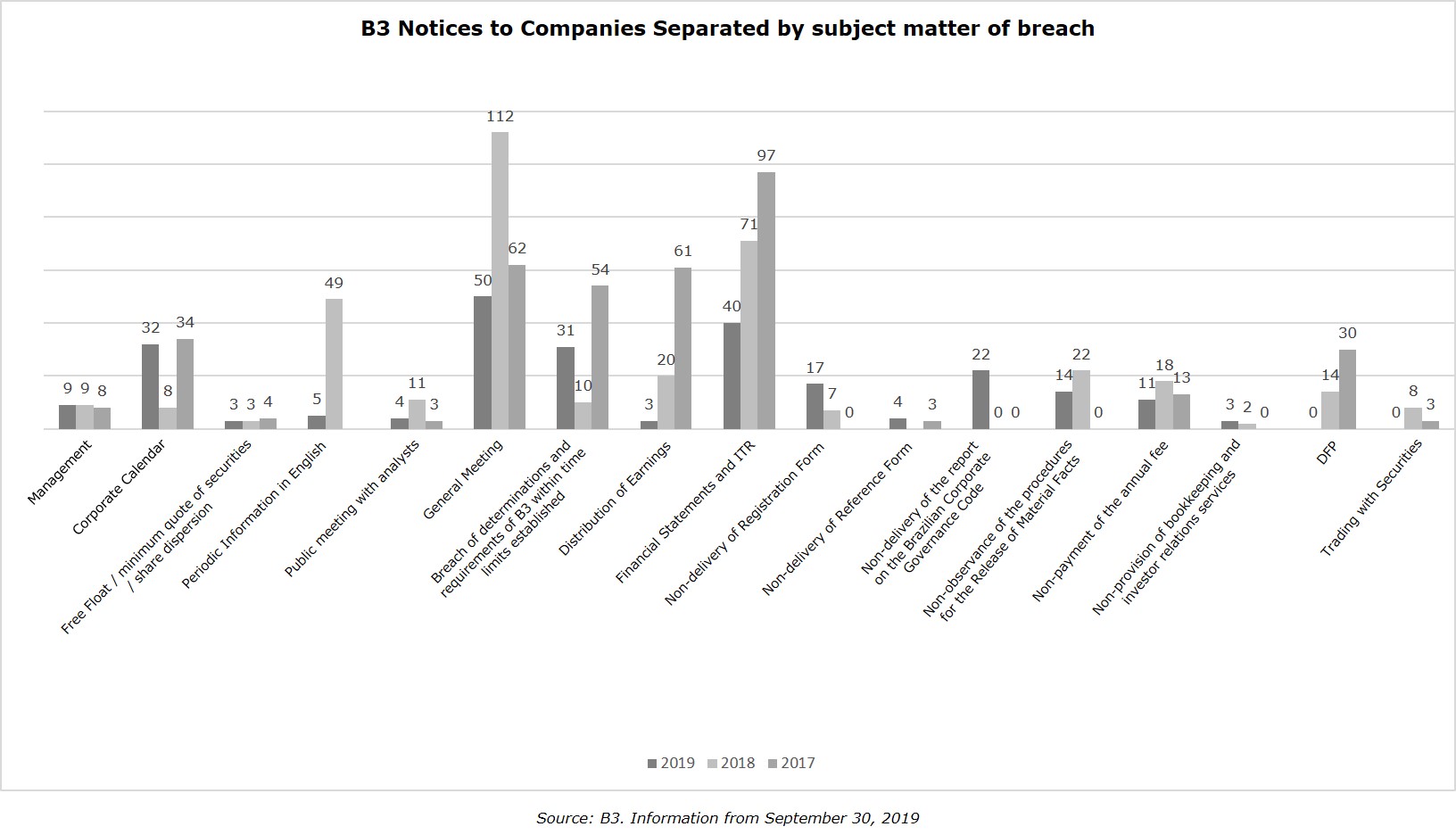

Regarding the regulatory action of B3, we review the enforcement report available on the Internet, which shows the number of notices sent by B3 to companies, and we find that there is not a significant variation from one year to another, as happened with CVM:

However, the variation in the most recurring matters related to notices sent by B3 in 2017, 2018, and in the first nine months of 2019 is significant.

The evolution in the numbers shows the importance that companies and managers must give to the full compliance with regulations for public companies in order to avoid heavy fines and other penalties. It is important to remember that the opening of investigations and proceedings also represents expense for and attention from management, which may divert its focus from executing the company's business strategy.

In addition, the increasing sanction actions of CVM and other self-regulatory entities, with concomitant increases in fines, may result in higher premiums in the purchasing of directors & officers (D&O) insurance and increased use of indemnity agreements by the companies in question, in substitution for insurance. In this sense, it is worth observing the dictates of CVM Guidance Opinion No. 38/2018, the subject of analysis by another article in this portal.

- Category: Labor and employment

In addition to instituting the Green and Yellow Employment Contract and implementing various significant changes in labor and social security laws and regulations and in the rules regarding payment of Profit Sharing, Executive Order (MP) No. 905, published last Tuesday, November 12, amended article 224 of the Consolidated Labor Laws (CLT) relating to the working hours of bank employees.

Before the publication of the executive order, the normal duration of working hours of employees at banks, banking houses, and Caixa Econômica Federal was six continuous hours on business days, with the exception of Saturdays, totaling 30 hours of work per week.

With the publication of MP 905, the normal working hours for bank employees became six hours per day exclusively for those who work as a teller, expressly excepting the possibility of agreeing on longer working hours, at any time, via individual written agreement or collective bargaining agreement. In relation to other bank employees, working hours will be eight hours per day.

In the previous wording, article 224 of the CLT expressly stated that the normal working hours of bank employees did not include Saturdays, since activities should be performed from Monday to Friday. However, the new wording made no provisos/exceptions regarding the subject. Accordingly, there is no longer a legal prohibition on having bank employees work on Saturdays, subject to the limit of the 30-hour workweek.

However, the discussion regarding bank employees' ability to work on Saturdays is not limited to the wording provided for in article 224 of the CLT. This is because, according to Precedent No. 113 of the Superior Labor Court (TST), which is still in force, the bank employees' Saturday is an unworked business day.

In this sense, the amendment by MP 905 of article 224 of the CLT should lead to the cancellation of TST Precedent No. 113, since it denotes an apparent incompatibility with the Court’s summarized understanding, especially if the MP is approved by the Brazilian Congress.

Another issue that may give rise to debate is whether the weekly working hours of bank employees, with the exception of tellers, are 40 or 44 hours per week, as there is no express provision on the subject in article 224 of the CLT, as is the case with 30-hour work week shift for tellers.

Considering the limitation of 30 hours per week for tellers, it could be interpreted logically that, for other employees with a daily shift work of eight hours, the work week would be 40 hours.

However, in addition to the fact that article 224, head paragraph, of the CLT does not exclude Saturday from bank employees’ working hours, TST Precedent No. 124 provides for the application of divider of 220 in calculating bank employees' overtime hours with eight hour work days. Using the divisor 220 for the 30 days of the month we get 7.33 hours per day, which, multiplied by 6 days a week, results in a 44-hour weekday, which is why the discussion on the bank employees' weekly working hours has not yet been overcome.

With regard to the express authorization for working hours over six hours per day for bank employees working as tellers, it is important to remember that this possibility was already being defended by the labor courts, based on the systematic interpretation of articles 59 and 225 of the CLT.

Article 225 of the CLT provides that bank employees may work overtime on an exceptional basis, and article 59 of the CLT provides that daily working hours may be increased with overtime, not exceeding two hours, pursuant to an individual agreement or collective bargaining agreement.

That is, the only way to preserve both provisions in the legal system would be to find that bank employees may work overtime (i) exceptionally, even if there is no agreement in this regard; and (ii) habitually, when the agreement is formalized in the course of the employment contract, since article 225 of the CLT itself states that the general principles regarding the duration of work should be observed, such as the possibility of formalizing extension of working hours provided for in article 59 of the CLT.

This interpretation has not yet settled by the labor courts, but has been reinforced by MP 905, as article 225 of the CLT remained unchanged, thus maintaining the provision regarding the exceptionality of extension of bank employees' working hours. In view of the limitation of the special working hours to bank employees working as tellers, it should be considered that the wording provided for in article 225 is also limited to these professionals.

In addition to the amendment of article 224, head paragraph, of the CLT, and the inclusion of paragraph 3 mandating an eight-hour workday for other bank employees, paragraph 4 was also included in article 224 of the CLT, establishing that, in the event of a judicial decision that rules out an employee's classification within the exception provided for in paragraph 2 of article 224, the amount due by virtue of overtime and consequential payments must be fully deducted or offset in the amount of the bonus for the position and consequential payments.

This change was possibly the least impactful for this group of employees, as it only reproduces the first paragraph of section 11 of the Bank Employees’ Collective Bargaining Agreement (CCT), which since 2018 has governed any possible offsetting between overtime hours and position bonuses, in the event of de-qualification, in a labor claim, of the position with the bank as being one of trust.

The provision set forth in the CCT is now applicable to labor claims filed as of December 1, 2018, and, therefore, has been known to this group of workers for at least one year. However, the reproduction of this provision in the CLT is important in settling its application, since the validity of section 11 of CCT 2018/2019 has not yet been consolidated by the labor courts. The reason for this is the fact that some judges demonstrated a certain resistance to applying it, arguing that the provision constitutes intervention into the role of the judge, which is exclusive to the Judiciary, and, therefore, is not a question of the prevalence of what is negotiated over what is legislated.

Some judges also contend that employees hired before the effective date of the provision may not undergo prejudicial changes in the conditions of the labor contract, under the terms of article 468 of the CLT.

The matter was apparently settled with the publication of MP 905, which is immediately effective in relation to article 224 of the CLT.

The term of duration of MP 905 is 60 days, extendable once for the same period. If not converted into law during this period, the text will lose its effectiveness. This means that although the changes in bank employees' working hours indicate a positive and expected change, especially given that the activity of this group of employees in modern society does not have the same peculiarity that supported its special framework, it is possible that the text suggested by MP 905 not be converted into law, as we observed in relation to MPs 808/17 and 873/19.

Accordingly, we recommend that prior to making any changes to employees' employment contracts, even if via contractual amendment, financial institutions should be properly advised by their legal department in order to avoid undue or inapplicable changes in view of the still provisional nature of the executive order.

We will cover the main changes of MP 905 in the next articles in this series. Click here to read the analyses already published.

- Category: Environmental

One of the most important changes brought about by Federal Law No. 13,874/19, known as the Economic Freedom Law and arising from the conversion into law of Executive Order No. 881/19, is the waiver of prior licensing for the exercise of economic activities defined as being “low risk." Subsection I of article 3 of the law provides for the possibility of waiving the presentation of prior licenses, authorizations, registrations, or permits for the regular operation of low-risk economic activities that may be performed by any individual or legal entity essential to Brazil’s development and economic growth.

In order to determine what constitutes a low-risk economic activity, the law, in its paragraph 1, provides that this classification must be the result of an act of the Federal Executive Branch, in the absence of specific state, federal district, or municipal legislation. It is worth remembering, on this point, that the competence for land planning and defining activities is, in general, assigned to municipalities.

In order to comply with the provision of law with a general and subsidiary standard, the Steering Committee of the National Network for the Simplification of Registration and Legalization of Companies and Business (CGSIM) published, on June 12, 2019, in the Federal Official Gazette, Resolution No. 51, which deals with the definition of low-risk economic activities in order to comply with MP 881/19.

The resolution conceptualizes low-risk (or “low-risk A”) economic activities as those that do not call for a site visit for their continuous and regular exercise, and classifies 287 activities into this concept. Comparatively, in the city of São Paulo, low-risk activities are classified in Decree No. 57,298/16 and conceptualized in Law No. 16,402/16. Under the new legislation, they must prevail for the purpose of dispensing with the documentation necessary for the regular performance of these activities.

As for the scope of the waiver of licensing, the law is clear in providing that “public acts of liberation of economic activity” are waived. Thus, in a restrictive interpretation, the waiver of licensing may conceptually encompass municipal business licenses, but should not, in theory, encompass Fire Inspection Reports and the Certificate of Completion of Works (Inhabit), since both refer to the good standing of the building and not just the activities to be performed there.

In this respect, although the law does not expressly provide for its application in environmental issues, there is also room to hold that, in relation to these “low impact” activities, there is also no need to submit to environmental licensing.

For situations that require release from the Federal Public Administration or even from states and municipalities that have voluntarily bound themselves to this procedure, subsection IX of article 3 provides that, after the presentation of all the necessary supporting elements for the procedure to release the economic activity, the applicant will be informed of the maximum period stipulated for the review of its application. In addition, once the deadline has elapsed without a response from the competent authority, silence will imply tacit approval for all purposes, except in cases expressly forbidden by law, such as the in the case of a financial commitment by the Public Administration or when the procedure relates to tax issues.

The base text sent for presidential signature provided a caveat to this provision regarding environmental licensing, providing that the specific deadline was not to be confused with those of Complementary Law No. 140/11, which regulates the competence for licensing and defines the deadlines for processing environmental licensing proceedings. However, this caveat was the subject of a presidential veto, on the grounds that the provision was unconstitutional because it violated the government's duty of environmental prevention.

Complementary Law No. 140/11 provides that expiration of the licensing deadlines, without the issuance of an environmental license, does not imply tacit issuance thereof, thus representing a prohibition expressed in law. Therefore, the provisions of Law No. 13,874/19 regarding deadlines for public acts of release, although it may raise doubts, will not apply to environmental licensing.

These changes should expedite the opening of low-impact establishments, generally related to office activities and the provision of technical services, such as engineering, architecture, advertising, and general administrative support. The changes should also affect administrative licensing procedures, as they provide that the licensing agency is bound to meet deadlines vis-à-vis the interested party. Under the law, however, the loosening of the system is not complete. The competent supervisory bodies will continue to be in charge of supervising and assessing establishments that are in disagreement with the law, either sua sponte or as a consequence of a complaint sent to the competent authority.

Another aspect of the Economic Freedom Law to be highlighted is article 3, subsection XI, which eliminates the requirement for abusive compensatory or mitigating measures against private parties in impact studies or other releases of economic activity under urban planning law. The requirement of execution or provision of any kind for areas or situations beyond those directly impacted by the economic activity, as well as unreasonable or disproportionate measures, are classified as abusive, as are those that were already planned before the requirement of the private party, except in cases of impact from the activities in this planned measure.

- Category: Environmental

In an extra edition of the Official Federal Gazette of September 20, Law No. 13,874/19 was published, establishing the Declaration of Rights of Economic Freedom, arising from Executive Order No. 881. Although the law does not explicitly mention its application in environmental law, we must understand that this is a transdisciplinary branch and permeates the discussion of various other areas. For this reason, the Economic Freedom Law will also be applied in environmental issues.

Its changes in this area address, in short, authorizations in general and the licensing process. First of all, the law provides for the right of every person, whether an individual or legal entity, to carry out low-risk economic activity without the need for any public acts in order to authorize the economic activity, including environmental licensing and any other authorization on the part of the Public Administration. When not provided for by law, the classification of such activities will be done by an act of the federal Executive Branch. As a result, there will be less involvement of environmental agencies and their staff in determining which activities will be exempt from licensing, which may be questioned before the Judiciary.

Another point is that the supervision of the exercise of these activities will be carried out later, which may be considered contrary to the principle of prevention. On the other hand, this measure reduces discretion and varying interpretations. If the classification of activities is drafted well, it will facilitate supervision by environmental agencies and planning and prevention by developers, increasing legal certainty.

For activities that are not low risk, it is worth mentioning the provision of an express deadline for the review of requests for public acts of authorization as an essential right for Brazil's development and economic growth, except for the legal prohibitions. Once the deadline has expired, if the competent authority does not rule on the request, it shall be deemed to have been tacitly approved for all purposes.

The base text sent for presidential signature provided a caveat to this provision, providing that the specific deadline was not to be confused with those of Complementary Law No. 140/11, which defines the deadlines for processing environmental licensing proceedings. However, this caveat was the subject of a presidential veto, on the grounds that the provision was unconstitutional because it violated the government's duty of environmental prevention.