The future of distributed generation: proposed revision of system rules goes for public consultation

- Category: Infrastructure and energy

Distributed generation (DG) allows consumers to generate their own electricity from renewable sources or qualified cogeneration and, where possible, provide the surplus to their own local distribution grid. The system has two modes: distributed microgeneration (with installed power less than or equal to 75 kW) and distributed mini-generation (with installed power greater than 75 kW and less than or equal to 5 MW) of electricity. With the possibility of new regulations for DG, the innovations expected may combine financial economy, social and environmental awareness, and self-sustainability.

The National Electric Energy Agency (ANEEL) regulates the generation of electricity in the DG modality through Normative Resolution No. 482/2012 (REN 482/2012). In 2015, REN 482/2012 was revised with the purpose of increasing the limit power from 1 MW to 5 MW and creating the modalities of multiple consumer units and shared generation projects. Since then, Aneel has shown interest in modifying, by the end of this year, the terms and conditions governing DG. On October 15, the agency announced the opening of Public Consultation No. 25/2019, in order to receive contributions to proposed revision of REN 482/2012 and to open discussion with the industry players about the rules to be applied to distributed micro and mini-generation. In this sense, Aneel held a public hearing (in person session) to discuss the issue at its headquarters in Brasília, in November 7, 2019.

According to public information provided by the agency, the majority (75%) of power generation via DG is local, that is, in systems installed in a single residence, condominium, business, or industry. The other 25% is allocated to remote DG, that is, two or more units in different locations, belonging to the same holder. In this last modality, we highlight large consumers who seek to reduce expenses and social and environmental awareness.

The crucial point of the revision of REN 482/2012 is the DG Energy Offset System. Under the current rule, the deduction of the energy injected takes into account not only the Energy Tariff (TE), but also the TUSD Wire A and Wire B tariff components. Thus, offsets for DG projects that inject energy into the system include tariffs on the wire, and the costs of using the grid are currently apportioned by other consumers who do not consume the energy generated via DG. Although DG projects generate their own electricity, the distribution grid continues to be used by them anyway, causing undue tariff compensation and burdening all other consumers who will have to apportion the costs of using the grid.

For this reason, after public discussion, the following proposal was reached: for local DG, existing consumers and those who file an access request prior to the publication of the standard continue with the offset rules currently in force until the end of 2030. From the following year, only the power component of the TE will be offset. Consumers filing a request for access after publication of the standard will not offset the TUSD Wire B and Wire A tariff components, but only the TE tariff component when the additional installed capacity of 4.7 GW is reached (article 7-D of the draft amendment to REN 482/2012).

For Remote DG, existing consumers and those filing a request for full access prior to the publication of the standard also continue to be subject to the offset rules currently in force until the end of 2030. After that, only the TE tariff component will be in force. Consumers filing a request for access after publication of the standard will offset only the TE tariff component (article 7-D of the draft amendment to REN 482/2012).

Regarding distributed mini-generation, the understanding was that the mini-generator, when using the grid to consume and inject energy through the same connection point, should enter into a Distribution System Use Agreement (CUSD), including the MUSD values (Amount of Use of the Distribution System) contracted for each tariff station and referring to the consumer unit, according to the choice of tariff modality and the amount of MUSD contracted referring to the generating center (article 4, paragraph 4-B, of the draft amendment to REN 482/2012).

Although the measure does not mean the regulatory classification of mini-generation as a generating unit, the result will be the application of the generation tariff (TUSDg) to the respective MUSD of contracted generation. In this respect, it is important to highlight that, despite the application of TUSDg, the consumer with mini-generation is still not entitled to the incentivized source discounts provided for by Law No. 9,427/96.

Per the new regulations, therefore, even offsetting all the energy consumed (through the energy injected or credits from past months), the consumer still has to pay for the other components of the tariff, which, in the vast majority of cases, may surpass the minimum amount to be invoiced at the consuming unit. Thus, the draft amendments to REN 482/2012 suggest that offsetting should be limited to the completeness of the consumption in the billing cycle (Article 7-C of the draft amendment to REN 482/2012).

ANEEL has affirmed that its studies would indicate that even with the implementation of the amendments to REN 482/2012, the return on investment in DG would remain very attractive, with an estimated payback of between four and five years. However, industry players do not seem to have the same perception. It is expected that the contributions to be made in Public Consultation No. 25/2019 will be taken into account in order that any changes to the draft resolution make investments in DG attractive to the market.

- Category: Real estate

The opportunity for regularization of buildings granted by the São Paulo City Government, through Law No. 17,202/19, should benefit more than 750,000 irregular properties in the state capital. The Amnesty Law, as it is popularly known, meets the provisions of the Strategic Master Plan of the Municipality of São Paulo and establishes the subordination of regularization of buildings, when necessary, to the execution of works.

Promulgated by Mayor Bruno Covas last October 16, the new law aims to regularize buildings built before the enactment of the 2014 Strategic Master Plan and, to that end, establishes three distinct procedures.

One of them is the automatic procedure, in which the owner needs not perform any act or take any action to ensure regularization. This procedure only includes low and medium grade properties, which were exempt from the payment of the Urban Property Tax (IPTU) in 2014 (occupied by retirees and pensioners with income below three minimum wages, under the terms of Municipal Law No. 15,889/13).

The second procedure is the regularization by declaration of the owner. This category includes properties up to 1,500m² and up to 10 meters high, for residential use, multifamily properties (up to 20 units), Social Interest Housing (HIS), and Popular Market Housing (HMP), but they must still meet other requirements of the law. The interested party may file the request for regularization on a website created by the City Government and present simplified technical documents, signed by the person responsible for the building, as well as documents relating to the property itself and the construction.

To perform this procedure, one must pay a fee of R$ 10.00 per square meter regularized. HIS and HMP developments are exempt from this payment.

For buildings that do not fit into any of the above scenarios, the Amnesty Law creates the possibility of regularization through a common procedure, by presenting the same list of documents required for the declaration procedure. The fee charged for this procedure will also be R$ 10.00 per square meter regularized. In practice, therefore, the legislation does not differentiate much between the declaratory and common procedures.

Moreover, depending on the constructive potential stipulated by municipal zoning (relationship between the size of the built area and that of the land area), it might be necessary to pay for an authorization to ensure regularization. That is, the city government stipulates the maximum constructive potential for the buildings in each zoning, allowing payment of remuneration for construction above this limit, the so-called paid authorization. However, there is a limit for the acquisition of additional constructive potential. If the building is above the maximum limit (already considering the paid authorization), it cannot be regularized. The paid authorization will be calculated in accordance with the Amnesty Law, and payment thereof may be made within up to 12 fixed monthly installments.

Other cases not covered by the new law: (i) works completed after July 31, 2014; (ii) works built on areas of dams, lakes, streams, and electric transmission lines; (iii) works carried out on public municipal land, including state or federal grounds; (iv) constructions that have been subject to an Integrated Operation or Urban Consortium Operation; (v) areas affected by a road improvement provided for in municipal laws; and (vi) areas that do not fit within the city government’s subdivision restrictions.

It is worth mentioning the levying of Tax on Services of Any Nature (ISS) in the regularization of buildings. Payment of the tax is one of the requirements of the law.

The Amnesty Law also provides for the issuance of a regulatory decree to clarify specific issues. The decree must be promulgated by the Executive Power within 60 days from the publication of the legislation, that is, by December 17 of this year.

Only after the enactment of the regulatory decree and the entry into force of the law, scheduled for January 1, 2020, will the amnesty program be open for interested parties to join and submit their applications, where appropriate, to the city government. The initial period for issuing the decree is 90 days and may be extended three times for the same period of 90 days.

With the regularization of a building, it will be possible to issue a completion report, a requirement for the construction to be recorded in the registration of the property with the competent Real Estate Registry Office. This is also a requirement for obtaining the an operating license and inspection report from the Fire Department for functional buildings.

More information may be found on the website of São Paulo’s city government: https://meuimovelregular.prefeitura.sp.gov.br/

- Category: Tax

Executive Order (MP) No. 899/19, already known as the Legal Taxpayer's Executive Order, was published on October 17 of this year with the purpose of reducing tax litigation and recovering debts classified as irrecoverable or difficult to recover. To this end, the MP provides for the possibility of settlement to end administrative or judicial disputes at the federal level.

The possibility of settlement between public authorities and taxpayers in tax matters has been allowed since 1966 by article 171 of the National Tax Code (CTN),[1] which, however, requires a specific provision of law for the competent entity.

The scenarios for and modalities of settlement that are now admitted, and the peculiarities thereof, shall be analyzed below. The conditions are still subject to regulations and a framework to be established, as appropriate, by the authorities indicated in the MP.

- Settlement in relation to the outstanding debt with the Federal Government

Assumes the existence of debt already registered as outstanding debt, whether or not of a tax nature. It may be proposed by the competent prosecutor, individually or by adhesion, or by the debtor.

The transaction may relate to: (i) the granting of discounts for debts classified by the tax authority as irrecoverable or difficult to recover; (ii) term or method of payment, including deferral and default fine; and (iii) offering, substituting, or disposing of guarantees or encumbrances.

Therefore, this scenario for settlement only allows for proposal of a reduction of amounts for debts considered irrecoverable or difficult to recover, according to criteria that will be established in an act by the attorney general of the National Treasury (PGFN), and provided that there is no evidence of fraudulent depletion of assets.

The total amount of the debt may be reduced by up to 50%, with the possibility of payment within up to 84 months, for companies in general. For individuals, small businesses, and microenterprises the reduction may reach 70%, with a payment term of up to 100 months.

The MP prohibits reduction in principal, settlements for fines for fraud, evasion, collusion, or any penalty of a criminal nature, in addition to settlements for debts related to the Simples Nacional tax system [“Simplified Tax Regime”] or FGTS payments.

The individual settlement must be signed by the PGFN or an authority delegated by the PGFN.

- Settlement for adherence in tax litigation to a relevant and widespread legal controversy

Settlement for adherence is that which is proposed by the government and subject to the acceptance of taxpayers that meet the conditions and requirements in that regard. It shall be conducted exclusively by adherence to be formalized electronically, as proposed by the Minister of Economy to terminate tax or customs disputes. The settlement should always deal with disputes considered relevant and whose legal theory under discussion involves a considerable number of taxpayers. The existence of an ongoing administrative or judicial proceeding is, therefore, a condition for entering into the settlement in this scenario.

The settlement proposal must be disclosed in the official press and on the respective agencies' website, with a notice specifying the conditions and requirements, including any reductions or concessions offered, terms, and forms of payment. Settlement regard debts related to the Simples Nacional or FGTS is forbidden, and the maximum time limit for discharge may not exceed 84 months.

- Other provisions and points for attention

In any scenario for settlement, the good faith of the government and the taxpayer must prevail. Therefore, settlement is prohibited in the case of intent, fraud, sham transactions, malfeasance, graft, or passive corruption and fraudulent depletion of assets, among others.

In entering into a settlement to terminate a tax dispute, the debtor must waive all the legal claims that underlie the judicial or administrative proceedings.

Specifically in the case of lawsuits, the waiver must also involve collective actions, and the debtor must request that the judge terminate the case with a resolution on the merits, by ratification of waiver of the claim brought.

This is a point for attention, which is expected to be corrected in the regulations of the standard: the MP deals with a true scenario of settlement, with express reference to article 171 of the National Tax Code (CTN). Settlements are a mechanism of self-composition, whereby the parties provide mutual concessions in order to settle the dispute.[2] Therefore, the most appropriate approach would be that the claim submitted to the court have the purpose of terminating the case with a resolution of the merits for approval of the settlement. The MP itself refers to judicial ratification of the settlement for the purpose of forming a enforceable judicial instrument.

Far from nitpicking, the clarification is necessary in order to avoid parallel disputes between the government and taxpayers, as the treatment of liability for costs and attorneys' fees is different in each case: in the case of pure and simple waiver, procedural costs and fees shall be paid by the waiving party. In the case of a typical settlement, with mutual concessions from one party to another for termination of the dispute (reduction of debt with the termination of the proceeding), a judgment to pay fees for loss of suit cannot be considered.

Another obscure issue concerns the treatment of tax debts not yet enrolled as outstanding debt but for which the administrative proceeding has already been completed. Apparently, per the framework of the MP, this debt would not be subject to settlement. The same seems to occur in relation to a tax obligation challenged in court by the taxpayer via a preventive measure (writ of mandamus or declaratory action, for example), but for whom a tax credit has not yet been created.

There does not seem to be any reason to exclude these situations from the settlement field. Nor could it be said that the Federal Government would have no interest in entering into a settlement with the private individual in that scenario because there was no proceeding to be closed, in the first case, and a credit created, in the second.

The objection cannot be sustained because litigation does not end simply because the judicial sphere has not yet been activated. Likewise, it exists when one disputes in court a tax obligation not yet created. If, after all, the goal sought is to reduce litigation, it is as important to close ongoing proceedings as it is to avoid the initiation thereof. And it is also irrelevant, for this purpose, whether or not the credits have been created.

Still in the scenario of settlement via adherence, special attention should be paid, with regard to the tax litigation over widespread and relevant legal controversy, to the need for waiver of rights in all proceedings involving the same theory. In principle, it would not be possible to select specific cases.

Having discussed the guidelines of the MP, the framework that will established by the competent authorities, as the case may be, the Minister of State for the Economy, Federal attorney general, attorney general of the National Treasury, and special bureau of the Federal Revenue Service of Brazil, will shape the success or failure of the objectives sought.

[1] Article 171. The law may provide the option, under the conditions it establishes, for taxpayers' with tax debts or credits to enter into a settlement which, through mutual concessions, may result in the termination of litigation and consequent extinction of the tax debt.

Sole paragraph. The law shall designate the authority competent to authorize the transaction in each case.

[2] The only scenario contemplated in the MP that does not represent a typical settlement scenario is the possibility of a settlement over the offering, replacement, or disposal of guarantees and encumbrances, which constitutes a kind of procedural legal settlement, pursuant to article 190 of the Code of Civil Procedure.

- Category: Corporate

With the enactment of the Economic Freedom Law (Law No. 13,874/19), which establishes the Declaration of the Rights of Economic Freedom and whose purpose is to establish free market guarantees, new rules have been in place since September 20 which should simplify the daily life of Brazilian businessmen and reduce bureaucracy in the Brazilian business environment.

In order to make these measures viable, specific rules and laws (including the Civil Code) were also amended, the nature and purpose of which directly affect corporate law and, consequently, the form and conduct of business by entrepreneurs in Brazil.

The Economic Freedom Law created the business form of a “sole proprietorship,” that is, a limited liability company with a single partner. Formerly, in order to open a limited liability company, in which the use of the partners' equity to settle the company's liabilities is limited to the amount of their contribution to the capital stock, it was necessary to resort to a limited company (Ltda.) or an individual limited liability company (Eireli).

However, neither of these two corporate types really met the needs of entrepreneurs in Brazil. The limited company, by its nature, required at least two partners in its membership. According to data from 2014,[1] 85.7% of limited companies in Brazil had only two partners. The survey does not report, but a simple observation of the market shows that, in the vast majority of limited companies, the second partner holds a merely symbolic interest, such as 0.1% of the capital stock, just to satisfy the rule of a plurality of partners.

Eirelis, in turn, as the name implies, are formed by only one person, but represent a vehicle little used in Brazil, as they are required by law to pay in capital of at least one hundred minimum wages (currently, R$ 99,800) at the time of their organization. That is, by trying to solve the problem of plurality of partners with an Eireli, the legislator ended up creating a financial barrier for the vast majority of small businesses in Brazil, which, according to data released by Sebrae in 2018,[2] represent almost 99% of enterprises, split between micro and small businesses, a significant portion, therefore.

With the creation of a sole proprietorship, the incorporation of a limited liability company by a single person is now permitted, without the requirement of minimum or maximum capital, pursuant to article 1,052 of the Civil Code.

Another long desired measure concerns piercing of the corporate veil. In companies in which the assets of the partners and the company are divided, with the limitation of their liability vis-à-vis third parties (as in limited companies, for example), the law provides that the corporate veil of the company is pierced when it is subjected to abuse by officers and directors and/or partners, such that they are held liable for the obligations of the company.

This piercing of the corporate veil is due “in cases of abuse of legal personality, characterized by misuse of purpose, or mixing of assets.” Since the Civil Code does not specify what constitutes misuse of purpose or mixing of assets, legal scholarship and case law have been assigned the task of defining such concepts over the years. In addition, by providing that piercing the corporate veil is due in order that “the effects of certain and determined relations of obligations of the company be extended to the private property of the officers and directors or partners of the legal entity,” the legislature ended up leaving sufficient room for partners and officers and directors who had nothing to do with the abusive act to be held liable as well, like minority partners with no power of management, for example.

Therefore, the innovation brought in by the Economic Freedom Law is praiseworthy, which amended article 50 of the Civil Code in order to restrict its interpretation. With the new wording, it was specified that piercing of the corporate veil must occur in order to reach the private assets of officers and directors or partners of the legal entity who "benefited directly or indirectly from the abuse." The concepts of “misuse of purpose” and “mixing of assets” were also defined in order to ensure equitable treatment of the matter before the various courts of Brazil and greater legal certainty for the Brazilian business environment.

In addition to setting clearer parameters for the application of piercing of the corporate veil, the Economic Freedom Law sought to clarify that it may only be applied on an exceptional basis and that the mere existence of an economic group does not authorize application thereof. The new law also elevated the principle of the equity autonomy of legal entities as a lawful instrument of risk allocation and segregation. In a previous article on this portal, the new rules for piercing of the corporate veil are addressed in more depth.

With the Economic Freedom Law, the interpretation of business contracts must comply with new rules, which value more what was agreed upon between the parties (pacta sunt servanda). This gives the parties greater autonomy to freely agree upon rules of construction to the detriment of legal stipulations in order to impose certain limits on judicial intervention in the construction of such contracts.

According to some principles stipulated by the new law, the construction of the contract must take into account the meaning that:

- is confirmed by the behavior of the parties subsequent to the execution of the deal;

- corresponds to market usages, customs, and practices relating to the type of business;

- corresponds to good faith;

- is more beneficial to the party who did not write the provision, if identifiable; and

- corresponds to what would be the reasonable negotiation of the parties on the matter debated.

It is also defined that, in private contractual relations, the principle of minimum State intervention and the exceptionality of blue penciling shall prevail, thus assuming symmetry and balance in civil and business contracts until proven otherwise. It is also ensured that the risk allocation defined by the parties must be respected and observed.

With these changes, doubts regarding the constructions of civil and commercial contracts in the light of applicable laws, which previously could have the effect of restricting the entrepreneur's freedom of contract, will now be guided by more objective criteria, given the greater autonomy of the parties at the time of drafting of the document. The change will avoid often unfavorable interpretations of ambiguous meanings or those not provided for by law.

Following the recent wave of modernization of the State and digitization of data and information, the Economic Freedom Law also states that public or private documents may be stored in electronic media, in which case they will have the same probative value as physical documents for all legal purposes and to prove any act of public law. The originals of such documents may even be destroyed after their digitalization, provided that the integrity of the digital document is verified, under terms that will be established in a regulation to be promulgated by the federal government.

The Law of Public Registration of Mercantile Companies (Law No. 8,934/94) was also amended in order to ensure greater speed and efficiency in the incorporation and termination of companies and in the registration and filing of corporate acts. Boards of trade must now review and record such acts within specific time frames, as otherwise they will be considered filed.

|

Automatic registration |

· Acts, documents, and statements containing merely registration information. · Corporate acts in general (except incorporation of S.A.’s and corporate reorganizations), provided that a standard instrument established by the National Department of Corporate Registration and Integration is used. |

|

Registration within 2 business days |

Corporate acts in general, except (i) acts, documents, and statements containing mere registration information and (ii) acts for which the law stipulates a period of 5 business days (listed below). |

|

Registration within 5 business days |

· Incorporation of S.A.’s · Corporate reorganizations (corporate-type conversion, merger, amalgamation, and spin-off of companies). · Incorporation and amendments of consortiums and groups of companies. |

Upon establishing that acts, documents, and statements containing mere registration information must be automatically registered if it is possible to obtain them from other databases available from public agencies, the law created the system for automatic registration of information, thus transferring from the individual to the State part of the burden of maintaining registration data up to date.

Another long-awaited change was the permission for limited companies to issue debentures (securities) via private offerings, currently the exclusive right of corporations. It had been included in the text of Executive Order No. 881/19 in the mixed committee of Congress, but was removed from the legal text by the Chamber of Deputies. It is hoped that the topic will be discussed again by the Legislature, given the positive impact it can have on the Brazilian capital markets.

The main beneficiaries of the simplification and cutting of the red tape brought about by the Economic Freedom Law should be small businesses (including startups), which will likely have an impact on job creation over the years. The measures also create an environment more conducive for innovation and business, which may boost the economy and contribute to making Brazil more competitive on the international stage.

[1] Source: Radiography of limited companies, performed by the Center for Research on Markets and Investments (Núcleo de Estudos em Mercados e Investimentos), FGV Law SP, published in October of 2014: https://direitosp.fgv.br/sites/direitosp.fgv.br/files/arquivos/anexos/radiografia_das_ltdas_v5.pdf

[2] Source: Market study: Small businesses in numbers, http://www.sebrae.com.br/sites/PortalSebrae/ufs/sp/sebraeaz/pequenos-negocios-em-numeros,12e8794363447510VgnVCM1000004c00210aRCRD

- Category: Environmental

If viewed as a country, the international civil aviation sector would have the world's 20th GDP but would be among the top ten polluters, with over 2% of global greenhouse gas emissions. It is a significant and rapidly growing environmental impact, with consequences not only for accelerating climate change, but also for the image of the sector in the public eye.

Concerned with changing this scenario, civil aviation companies have been moving to propose measures that contribute to the achievement of the goals set out in the Paris Agreement, a global climate treaty signed during the 2015 United Nations Climate Change Conference (COP 21).

Approved by the 195 nations that are part of the United Nations Framework Convention on Climate Change (UNFCCC), the agreement contains measures for “holding the increase in the global average temperature to well below 2°C above pre-industrial levels,” a limit pointed to as safe by the Intergovernmental Panel on Climate Change (IPCC) to avoid much of the unwanted consequences of global warming.

The agreement only entered into force in November of 2016, after ratification by at least 55 countries responsible for 55% of global greenhouse gas (GHG) emissions. Brazil concluded its ratification process on September 12 of the same year.

In addition to establishing national commitments, the Paris Agreement has also triggered a number of movements among private companies. In the civil aviation sector, Icao (International Civil Aviation Organization), represented by 191 countries, launched the first global agreement to reduce emissions in this segment. In October of 2016, the entity approved the “Carbon Offsetting and Reduction Scheme for International Aviation” (Corsia) through Resolution A 39-3.

The resolution clarifies that in order to achieve the goals of reducing greenhouse gas emissions, a “basket of mitigation measures” was adopted, which includes:

- development of technologies and new standards for aircraft;

- improved air traffic control and ground operations for fuel economy; and

- use of biofuels.

Given the growth in international air traffic, however, Icao recognizes that the measures detailed above are not sufficient to achieve the desired reduction in CO2 emissions. To do so, it is necessary to implement emissions trading and offset mechanisms, just as Corsia also provides, by purchasing carbon credits generated by other sectors and initiatives.

The scheme was structured in three phases, having as a reference (or baseline) the projection of emissions for 2020. From this level, any increase in emissions found must be offset.

The first two phases will be voluntary participation by countries and companies: a “pilot” phase between 2021 and 2023, followed by an “initial” phase between 2024 and 2026. From 2027 to 2035, “Emission reduction measures and targets will apply to all countries except least developed countries, small developing islands, and countries that do not meet a minimum percentage of contribution to total emissions of the sector.”

Study of the Institute for Conservation and Development of the Amazon (Idesam) states that “by July of 2018, 72 countries had committed to voluntarily participating in Corsia from its pilot phase, which represents 70% of international aviation-related activities. Brazil has not yet acceded to the agreement and has pledged to participate only in the mandatory phase starting in 2027.”

Under the rules of the mechanism, the countries of origin and destination of the flight must accede to the agreement for the obligation to reduce and offset emissions from the flight between the two countries to apply at either stage of the scheme. If Brazil does not participate in the voluntary phases between 2021 and 2026, airlines from other countries are exempt from offsetting their emissions in travel to Brazil during this period, which tends to attract foreign competition to Brazil.

Offsetting is an old instrument that began to be used with the approval of the Kyoto Protocol in 1997 and now has a new incentive to be employed on a large scale through Corsia.

This mechanism is basically through the purchase of certified carbon credits, which may be issued by different project types, such as:

- forest projects, involving replanting forests or measures to prevent deforestation;

- energy projects, which may be related to renewable sources of energy or energy efficiency; and

- exchange of non-renewable and high-emission greenhouse gas fuels for renewable fuels.

The voluntary accession of Brazil and Brazilian companies to Corsia will undoubtedly produce environmental benefits by sponsoring carbon credit generating projects and contributing to the central objective of the Paris Agreement, which is to curb global warming.

It is a movement that can have a positive impact on the image of these companies, considering that most passengers on international flights care about global warming and would even be willing to pay more for an airline ticket in order to offset the emissions from the flight.

One of the most attractive incentives for Brazilian companies to voluntarily join Corsia, however, would be the increased competitiveness that the measure can provide, as it forces foreign companies to do the same, incurring costs many times higher than domestic ones.

- Category: Banking, insurance and finance

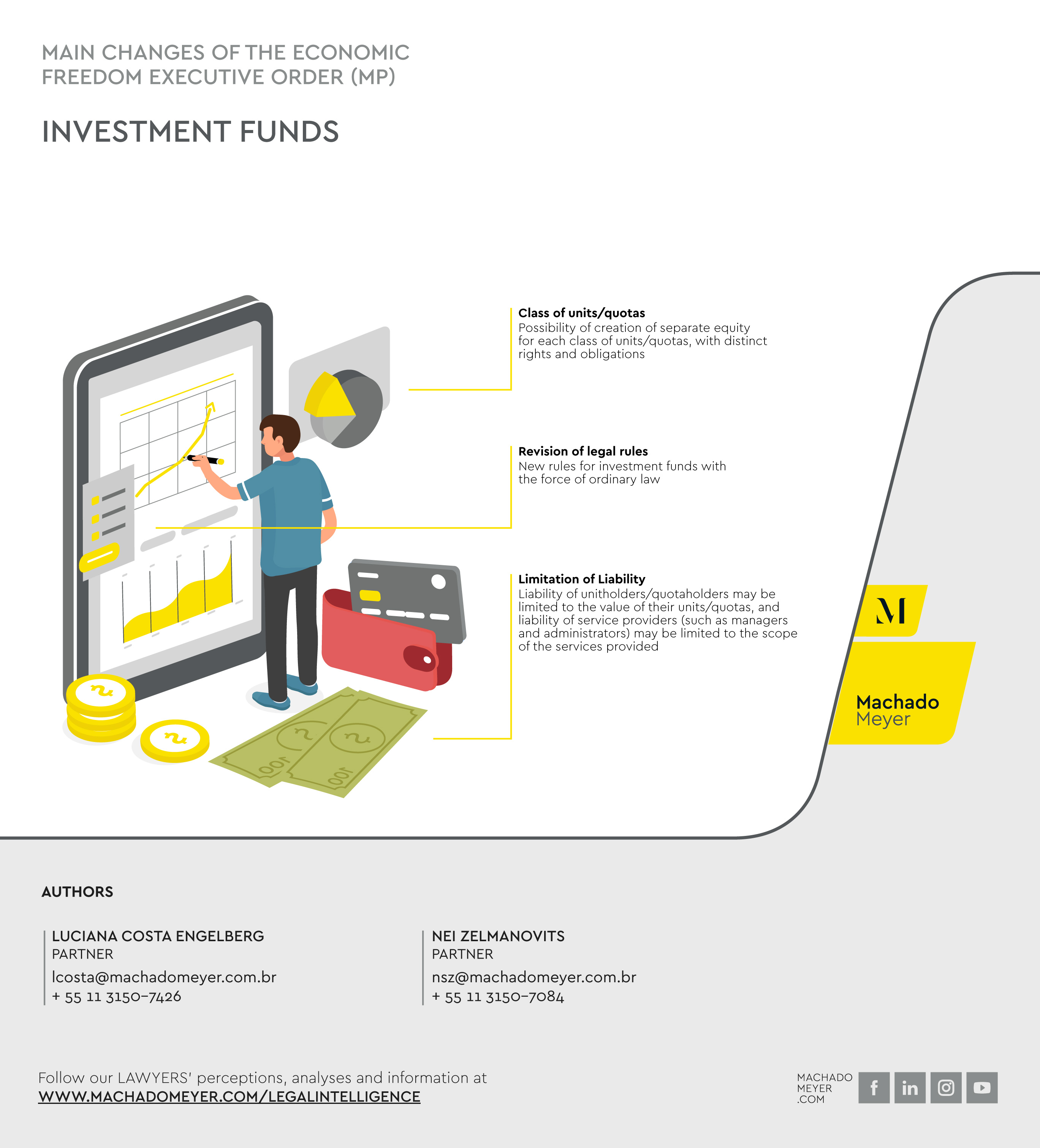

Investment Funds

On September 20, 2019, Federal Law No. 13,874/19 was enacted, setting forth the Declaration of Rights of Economic Freedom. Among the changes promoted by the new law, we highlight innovations for the investment fund industry, with the introduction of a new chapter in the Brazilian Civil Code on the subject (articles 1,368-C to 1,368-F).

The law defined investment funds as a condominium of a special nature, intended for investment in financial assets, property, and rights of any nature, having expressly excluded the application to investment funds of the rules related to condominiums in general provided for in articles 1,314 to 1,358-A of the Civil Code, an understanding that had been adopted by the industry until recently.

The removal of the application of the rules dealing with condominiums in general is in line with the changes brought about by the law regarding the possibility of limitation of the liability of investment fund unitholders. This is so because, according to the interpretation of the general rules on condominiums (and applied to investment funds), unitholders should have unlimited liability for the obligations undertaken by the investment fund (which does not have corporate existence). In that respect, article 15 of CVM Instruction No. 555, of December 17, 2014 (“CVM Instruction 555”), provides that unitholders are liable for any negative equity of the fund.

In addition, Law No. 13,874/19 confirmed the jurisdiction of the Brazilian Securities and Exchange Commission (CVM) to regulate investment funds defined by law and the changes brought in by the new law.

Below we highlight the main aspects of Law No. 13,874/19 dealing with investment funds.

Recording

Pursuant to the third paragraph of the new article 1,368-C of the Civil Code, the recording of investment funds’ bylaws with the CVM is a condition sufficient to ensure their publicity and effectiveness vis-à-vis third parties.

With this change, it will no longer be necessary to record the bylaws of investment funds with a register of deeds and documents, as was previously provided for in CVM regulations.

This was the first issue to be regulated by CVM since the promulgation of Law No. 13,874/19. On October 2, 2019, CVM issued CVM Instruction No. 615, which amends several Instructions issued by the CVM, so as to revoke the requirement of a certificate of recording of an investment fund’s bylaws with the register of deeds and documents.

The change meets the demands of the industry for reducing paperwork and costs.

Limitation of liability of unitholders and unit classes

In line with protecting investors and limiting their liability with respect to the obligations of the investment fund, Law No. 13,874/19 innovated by providing that a fund's bylaws may provide for a limitation on the liability of investors to the value of their units, thereby protecting investors from being liable for obligations of the fund that exceed their holding in the fund.

Also, the bylaws may establish unit classes with distinct rights and obligations, with the possibility of setting up segregated equity for each class, and such segregated equity will only be liable for obligations linked to the respective class, under the terms of the bylaws.

Please note that the adoption of the principle of limited liability by an investment fund originally formed without a limitation is possible but in this case the limitation will only cover events taking place after the respective change in its bylaws. That is, until the matter is regulated by the CVM and the fund's bylaws are amended so as to include a limitation of liability, unitholders will be liable, in proportion to their holding, for the fund's obligations regarding facts that occurred prior to the amendment of the bylaws.

Currently, CVM regulations applicable to private equity investment funds (CVM Instruction 578 of August 30, 2016) allow, in certain situations, for the fund's bylaws to assign to one or more classes of units different economic and financial rights. As a general rule, the different economic rights of the unit classes are limited to the fixing of administration and management fees and order of preference in the payment of income, amortization, or liquidation balance of the fund. In turn, for funds intended exclusively for professional investors[1] or those receiving direct financial support from funding organizations, it is permitted to assign one or more different classes of units economic rights different from those provided for above.

Until the enactment of Law No. 13,874/19, however, there was no specific provision regarding the possibility of setting up segregated equity for each class of unit and limitation of liability of the unitholder for the obligations linked to the respective class. This is one of the major advances the new law brings to the fund industry, which not only allows for cost savings (often via the choice of new fund structures for each investment strategy), but also greater legal certainty for to investors.

It is worth noting that the limitation of unitholder liability and segregation of fund assets by different unit classes are still subject to CVM regulations.

Bankruptcy System

Also in the context of the unitholders' limitation of liability, Law No. 13,874/19 provides that investment funds are directly liable for the legal and contractual obligations assumed by them, and if the limited liability fund does not have sufficient equity to settle its debts, the insolvency rules contained in articles 955 to 965 of the Civil Code shall apply.

Insolvency may be requested in court by creditors, per a resolution by the investment fund's unitholders, pursuant to its bylaws, or by the CVM itself.

The new article 1,368-E of the Civil Code also provides that service providers of the investment fund are not liable for the fund's obligations (except for the losses they cause when they act under willful misconduct or bad faith).

Thus, any liability of the fund could not directly affect the equity of the unitholders, nor the service providers of the fund, as it is mandatory to follow the bankruptcy process for the fund if it does not have sufficient equity to settle its debts.

The table below summarizes the main aspects of the bankruptcy system provided for in the Civil Code:

|

Rules of the bankruptcy system |

|

|

Declaration of Bankruptcy |

Bankruptcy is declared whenever debts exceed the amount of the debtor's assets. |

|

Preferences |

ü If there is no legal title to preference, creditors shall have equal rights over the assets of the common debtor. ü Legal titles to preferences are in rem privileges and rights. ü In rem claims have preference over in personam of any kind; in personam claims have preference over simple claims; and special privileges are over general ones. ü When two or more creditors of the same specially privileged class compete for the same assets, and with like title, there shall be a pro rata apportionment among them in proportion to the value of the respective claims, if the result is not sufficient for the full payment of all of them. ü The special privilege includes only the assets subject, by express provision of law, to the payment of the claim which it favors; and the general privilege includes all assets not subject to in rem claim or special privilege. |

The application of the new bankruptcy rules to investment funds is also subject to regulations in due time by the CVM.

Liability of service providers

In addition to limiting the liability of unitholders, Law No. 13,874/19 contemplates the possibility of limiting the liability of investment fund service providers to the fulfillment of their particular duties, without joint and several liability.

Currently, CVM Instruction 555 and CVM Instruction 578 provide for joint and several liability between the fund manager and third parties hired by the fund for any losses caused to unitholders as a result of conduct contrary to law, regulation, or normative acts issued by the CVM. The regulations applicable to receivables investment funds (FIDC) and real estate investment funds (FII), on the other hand, have no such provision, such that for FIDCs and FIIs it would already be possible to apply the limitation of liability provided for in Law No. 13,874/19.

Conclusions

The changes brought about by Law No. 13,874/19 are an important milestone in the evolution of the fund industry in Brazil, aiming at reducing bureaucracy, costs, and greater investor security, bringing the industry closer to practices adopted in other jurisdictions.

However, changes to the new law are still subject to CVM regulations for their effective application. In this context, the CVM will submit for public hearing an instruction to amend the current regulations in accordance with the provisions of the new law.

[1] Per the terms of article 9-A of CVM Instruction Instruction No. 539, of November 13, 2013, the following are considered professional investors:

I - financial institutions and other institutions authorized to operate by the Central Bank of Brazil;

II - insurance companies and capitalization companies;

III - open-ended and closed-ended supplementary private pension entities;

IV - individuals or legal entities who have financial investments in the amount of more than ten million Brazilian Reais (R$ 10,000,000.00) and, in addition, attest in writing to their status as a professional investor through a separate instrument, in accordance with Exhibit 9-A;

V - investment funds;

VI - investment clubs, provided they have a portfolio managed by a securities portfolio manager authorized by the CVM;

VII - independent investment agents, portfolio managers, analysts, and securities consultants authorized by the CVM, in relation to their own funds;

VIII - non-resident investors.

- Category: Litigation

When property owners decide to file an eviction action against tenants, all means of repossessing the property have generally been exhausted. This indicates the urgency that lessors have in obtaining a preliminary court order that the property be returned.

However, this judicial relief may sometimes take longer than expected, frustrating property owners' expectations and possibly exposing them to irreparable damage, especially where the lease does not have one of the forms of guarantee (security deposit, surety, surety insurance, for example) set forth in Article 37 of the Lease Law (Law No. 8,245/91).

In view of this situation, the Lease Law, amended mainly by Laws 12,112/09 and 12,744/12, now allows property owners to obtain injunctions for eviction of properties within 15 days, regardless of the tenant's response in the proceeding and provided that a deposit equivalent to three months' rent is made. This prerogative applies to eviction actions that are based solely on non-payment of lease payments and ancillary fees, in lease agreements without any guarantees, pursuant to Article 59, item IX, of the Lease Law.

Although, at first, the case law did not take an incisive position as to the applicability of this legal provision, the Judiciary seemed to have understood the spirit of innovation intended by the Lease Law, aiming at noticeable evolution of the topic over time.

Upon reviewing the case law of the São Paulo State Court of Appeals (TJ-SP), for example, one notes that many judicial decisions use this legal provision as grounds for granting an injunction sought by the lessor and order eviction from the property by lessee within 15 days.[1] The Rio de Janeiro State Court of Appeals (TJ-RJ) has been following the same understanding.[2]

In only one of several judgments on the matter in recent years, the TJ-SP acknowledged that the requirements set forth in Article 59, item IX, of the Lease Law were met, but upheld the lower court’s decision that had dismissed the injunction for eviction in 15 days, arguing that “given the specific situation, the granting of the injunction for eviction would be premature, without enabling the hearing/defense of the opposing party” (Interlocutory Appeal No. 2078843-81.2019.8.26.0000, 32nd Chamber of Private Law, decided on April 25, 2019).

That is, the prevailing position in the case law is that, given the authorizing legal requirements, the injunction provided for in Article 59, item IX, of the Lease Law must be granted and the property must be vacated by the lessee within 15 days. In other words, the case law has evolved over time to reflect the change in the Lease Law and to ensure its application and the effectiveness of its provisions. In this respect, it provides less protection to the tenants and is more directed to addressing the rights and interests of lessors harmed by default in lease payments that do not have the provision of guarantees in their favor.

Thus, it is possible to state that the advance in the case law regarding effective application of the provisions of Article 59, item IX, of the Lease Law is positive for lessors and generates a greater supply of properties for lease, resulting in an impact on average market prices. Indirectly, therefore, it also benefits tenants, as property owners are more secure in renting them out to those who are unable to provide a guarantee at the time of the lease agreement, or in maintaining the deal already entered into if the guarantee comes to be terminated during the term of the contract.

[1] TJ-SP: Interlocutory Appeal No. 2273636-54.2018.8.26.0000, 25th Chamber of Private Law, decided on May 28, 2019; Interlocutory Appeal No. 2064553-61.2019.8.26.0000, 32nd Chamber of Private Law, decided on May 10, 2019; Interlocutory Appeal No. 2053445-35.2019.8.26.0000, 31st Chamber of Private Law, decided on July 25, 2017; and Interlocutory Appeal No. 2267446-75.2018.8.26.0000, 32nd Chamber of Private Law, decided on April 11, 2013.

[2] TJ-RJ, Interlocutory Appeal No. 0026990-62.2019.8.19.0000, 22nd Civil Chamber, decided on September 10, 2019; Interlocutory Appeal No. 0051387-88.2019.8.19.0000, 6th Civil Chamber, decided on June 28, 2019; Interlocutory Appeal No. 0067138-52.2018.8.19.0000, 15th Civil Chamber, decided on May 21, 2019, and Interlocutory Appeal No. 0023138-30.2019.8.19.0000, 19th Civil Chamber, decided on August 6, 2019.

- Category: Competition

The Administrative Council for Economic Defense (Cade) has reviewed about 40 merger filings involving the so called associative agreements since Resolution No. 17/2016 entered into force on November 25, 2016. These filings refer to agreements between companies from the most varied of industries (such as food and beverage, cement, pharmaceuticals, shipping, and telecommunications) and with different subject matter (distribution, supply, infrastructure operation, commercial partnerships, co-development, and joint marketing, among others). Despite these precedents, in practice there is still much uncertainty regarding the configuration of associative agreements.

Under the terms of the resolution, agreements with a duration of two years or more that establish a joint enterprise to conduct an economic activity shall be considered associative agreements, provided that the agreement establishes sharing of risks and results of the economic activity that makes up its subject matter and, cumulatively, the parties are competitors in the relevant market subject to the agreement. These agreements must be reported to and approved in advance by CADE when at least one of the parties’ economic group involved had gross revenues or volume of business in Brazil equal to or greater than R$ 750 million in the year prior to the transaction, and another economic group involved had revenues or volume of business in Brazil of at least R$ 75 million.

Cade has addressed the requirements of joint enterprise and sharing of risks and results, which involve a high degree of subjectivity, in a number of merger reviews thus far.

Regarding the first requirement, the agency found the existence of a joint enterprise depends on the degree and manner in which the cooperation is exercised between companies. In this regard, Cade considered that there was a joint enterprise, for example, in agreements that established coordination of the parties to market and sell a specific product; influence of one party on the business decisions of another; coordination of relevant issues related to the offering of products/services, such as quality, prices, and other commercial conditions involved in the deal; interdependence in the provision of services; and some types of governance structures to discuss relevant issues and regulate joint decision-making. In addition, Cade noted in some precedents that the concept of a joint enterprise is directly linked to the idea of conducting an economic activity, since the associative agreement must specifically address the acquisition or supply of goods or services in the market.

With regard to the sharing of risks and results, the case law indicates this requirement goes beyond profit or cost sharing. Cade has already understood that mere cost sharing is not enough to meet this requirement Sharing of risks and results is not to be confused with the mere existence of income, revenues, and losses from an accounting point of view. This requirement will be met when it is possible to identify participation by one party in the results obtained by the other, such as payment for performance or based on sales revenue of the party receiving the supplied products . Sharing may be implicit in the purpose of the agreement, for example, when two companies coordinate to expand their services, share capacity, or minimize costs, and ultimately dilute the risks associated with the business.

Cade further analyzed in other cases, a more objective requirement provided in the Resolution – which is the competitive relationship between the parties in the relevant market subject to the agreement, that would be satisfied even in the event of potential competition between the parties. This position was adopted in at least two precedents involving the pharmaceutical industry where the products subject to the agreements were not yet marketed in Brazil or were still under development (pipeline) but were conservatively considered potential competitors of the products already marketed by the other party in Brazil.

Cade's position in this set of cases establishes some guidelines that help, to some extent, to assess the need to report associative agreements in specific situations. However, this task is far from trivial, as the agency's understanding is closely linked to the content of certain contractual provisions, which are generally kept confidential. This makes it hard to fully understand the reasoning supporting the agency’s decisions. In addition, contractual relations between economic agents have increasingly diversified and innovative content, which makes the assessment of mandatory submission to Cade's scrutiny even more complex.

- Category: Infrastructure and energy

After more than six years under discussion, Bill No. 6,407/13 (the Gas Bill) was approved by the Chamber of Deputies' Mines and Energy Committee on October 23rd. The text amends provisions of Law No. 11,909/09, which establishes the legal framework for the natural gas sector in Brazil.

With this approval, the Gas Bill will now pass on for review by three other committees of the Chamber of Deputies: that of Economic Development, Industry, Trade, and Services; Finance and Taxation; and Constitution and Justice (unless the case is placed under a regime of urgency, and the Bill goes directly for a floor vote). After final approval by the committees, the bill will be submitted to the Senate for review.

The text approved by the Mines and Energy Committee preserved most of the latest amendments to the bill, presented on the same day as the approval. Among the modifications, the exclusion of article 45 from the amended version stands out. The provision provided that the share of natural gas thermoelectric power in Aneel auctions should take into account the cost and availability of fuel traded by natural gas distributors. In the final text, definition of the ceiling prices for thermoelectric energy would be assigned to the Energy Research Company (EPE). According to the deputies, the prior wording of the article was contrary to the main motivation of the Gas Bill, which is the opening of the market.

Among the main modifications brought in by the Gas Bill, the following stand out:

- The implementation of an entry and exitmodel for contracting transportation capacity . Within the current legal framework, natural gas transportation has transportation models known as the postal or point-to-point model, where the molecule's path from the point of entry into the system to the point of exit is relevant for the gas transportation agreement. In the new model proposed by the Gas Bill (entry and exit model), the physical flow of the gas molecule is delinked from its contractual flow. With this new model, common in the European market, the ease of trading at distant points in the network should generate greater liquidity in the natural gas market.

- The application of the regime of authorization for the transport and storage of natural gas. Currently, the activity of transportation of natural gas may be carried out pursuant to a concession (for new pipelines) or pursuant to permit (for existing pipelines or those being deployed at the time of enactment of the law). However, due to the bureaucratic difficulties of the concession model, no pipeline has been built or operated pursuant to a concession since the enactment of the current law. Under the new framework intended, the activity of transportation of gas will no longer be carried out pursuant to a concession, only permits. Similarly, underground storage of natural gas will now be performed under the permit regime with a future promulgation of the Gas Bill.

- The unbundling of the activities of transportation of natural gas from other activities in the industry. In order to curb self dealing and preserve competition in the industry, the Gas Bill contains a provision that prohibits natural gas carriers from directly engaging in competitive activities in the industry (trading, production, liquefying, and importing) or from having direct or indirect ownership interest in companies that perform these activities. The unbundling of market players is already a reality in Brazil in the regulation of the electricity sector.

- The creation of market areas and reinforcement of the issue of organization of gas transport in a network. Although it no longer provides for the creation of a specific agency to coordinate gas transportation throughout the Brazilian territory (similar to the ONS in the electric energy industry), as had been discussed in the Gás para Crescer [“Gas to Grow”] initiative, the Gas Bill has provisions for market areas, coordinated by a market area manager. The Gas Bill also has self-regulatory mechanisms in order to put into operation the interaction between industry players and transport network control (such as common network codes created by market area managers).

- Expansion of the list of infrastructure considered essential. In the current legal framework, only transport pipelines are treated as essential facilities. This means that their operators/owners must grant access to these facilities to interested third parties through regulated access. Although it has not proposed regulated access to other infrastructure, the Gas Bill, based on the doctrine of essential facilities (already present in Brazil in industries such as electricity, railways, and telecommunications), provides for negotiated and non-discriminatory access to other structures in the industry (i.e., outflow pipelines, processing units, LNG terminals, and their respective gas pipelines). This change also seeks to increase the competitiveness of the industry to prevent the reserve of the market by the owners of these infrastructure items.

Despite the changes brought in by the Gas Bill for implementing the new model for purchasing transport capacity for entries and exits, article 44 of the Bill itself ensures preservation of the economic balance of the contracts in force at the time of the promulgation of the new law.

- Category: Litigation

With the extinction of so many airlines in Brazil over the last 20 years, it is essential to conduct an analysis of the factors that led these companies to fail, one after the other, unable to reorganize financially in order to continue operating in the market.

TransBrasil, in 2002, Viação Aérea de São Paulo (Vasp), in 2008, and Viação Aérea Rio Grandense (Varig), in 2010, are examples of large airlines that were declared bankrupt. They all filed for judicial reorganization, which ended up being converted into bankruptcy. In 2007, BRA Transportes Aéreos also requested the processing of its judicial reorganization and then permanently suspended all its flights and sold its aircraft.

The most current case of this kind is that of Oceanair Linhas Aéreas, known as Avianca Brasil, which filed for judicial reorganization in December of 2018 and has since faced serious financial difficulties that cast doubt on its effective ability to continue operating in the market. Of concern are the significant number of laid-off employees, high indebtedness, the repossession by lessors of most of the company's aircraft, and the uncertain existence of assets, even more so after the redistribution of their slots (flight schedule for take-offs and landings at airports) by the National Civil Aviation Agency (Anac).

It is undeniable that high operating costs are a relevant factor for the difficulties that airlines face. To make up their fleet, for example, they need to purchase or lease aircraft that are expensive and subject to exchange rate variation and have high maintenance costs. As an aggravating factor, they still suffer from the high competitiveness in the civil aviation market, translated into ticket price wars.

These factors, however, are not the only ones behind the financial difficulties faced by airlines. To understand the problem further, one needs to look closely at the legal issues surrounding the subject.

When the processing of judicial reorganization is granted to a company, all existing actions and executions against the debtor are suspended for a period of 180 days (article 6, paragraph 4, of the Judicial Reorganization and Bankruptcy Law - LRF). During this period, it is prohibited to remove from the debtor’s place of business “capital assets essential to its business activity” (article 49, paragraph 3, of the LRF).

In the judicial reorganization of airlines, however, the LRF establishes a relevant exception: leased aircraft may be retaken at any time by the lessors, who are their actual owners, in the event of default on the consideration due for the use of the aircraft. That is, the lessors do not have their rights suspended (article 199, paragraph 1, of the LRF), even though the aircraft are well known to be the most essential assets for the airlines’ activities.

Although it seems contradictory, there is no antinomy or conflict between the rules. In fact, the LRF has established a specific and peculiar scenario in which the legislator's intent was to remove absolutely unviable airlines from the judicial reorganization system - those which, in addition to not being in minimum conditions to acquire their own aircraft to make up their fleet, they do not even have the financial capacity to keep up with the payments for the lease of aircraft.

This debate arose this year in the context of the judicial reorganization of Avianca Brasil. The trial judge chose to mitigate the exception expressly provided for in article 199 of the LRF, which gives the lessor the right to immediately retake the aircraft in the event of default on the lease, by virtue of the principle of preservation of the company and the social function of contracts. After several months of suspension of the lessors' rights, however, the São Paulo Court of Appeals (TJ-SP) reinstated the application for the exception provided for in the LRF, thus allowing for the immediate reinstatement of possession of the aircraft, regardless of the impact this measure would have on Avianca Brasil. The decision was based on the assumption that if the company does not have the resources to continue to regularly perform under lease agreements, maintaining its business activities would no longer be viable.

In this case, in addition to not being able to repossess their aircraft for several months, the lessors had to allow Avianca Brasil to use their assets without any consideration.

The situation worried the lessors and the international aviation market, as it spread fears that, in Brazil, airlines could use the judicial reorganization system as a means of transferring the risks of their commercial activities to aircraft lessors. This would make the costs and charges resulting from lease agreements in Brazil more costly and would have negative consequences for other Brazilian airlines and consumers, to whom part of these costs is passed on.

Avianca Brasil's case also had repercussions in the international legal community, as it also represented violation by Brazil of the Cape Town Convention. Upon formalizing its adherence to this treaty, Brazil promulgated Decree No. 8,008/13, pursuant to which it opted for “Alternative A” provided for in the convention. Under this alternative (article XI(2) of the treaty), in a scenario of insolvency, the airline is required to return aircraft subject to a non-performing lease within 30 days. As the case of Avianca Brasil represented the first airline reorganization after Brazil's accession to the Cape Town Convention, the repercussion was negative, and the Brazilian Judiciary was seen as being in breach of international treaties.

Following the return of the aircraft to the lessors and the redistribution by Anac of Avianca Brasil’s slots, the company's financial difficulties worsened. With the suspension of commercial activities and the absence of relevant assets that could ensure the continuity of operations, the TJ-SP then considered converting the judicial reorganization into bankruptcy, even though the judicial reorganization plan had been approved by the creditors. However, by a majority opinion, the TJ-SP found that the conversion, sua sponte, of the judicial reorganization into bankruptcy was impossible, given the absence of an express request by the lessors, who had only challenged the legality of the judicial reorganization plan submitted by Avianca Brasil (Interlocutory Appeal No. 2095938-27.2019.8.26.0000 filed by Swissport Brasil Ltda. and Interlocutory Appeal No. 2098259-35.2019.8.26.0000 filed by Petrobras Distribuidora S/A).

The case reinforces the idea that, once the return of the aircraft to the lessors is ordered, the airlines are unlikely to be able to lift themselves. The alternatives available are only the conversion of the judicial reorganization into bankruptcy or the termination of commercial activities. This is mainly due to the fact that the airlines were late in filing for judicial reorganization, only when they were already in a dramatic and unsustainable financial situation, where there was no possibility of resuming commercial activities and insolvency was irreversible due to the high degree of indebtedness.

- Category: Tax

One issue that is the subject of frequent debate in the administrative courts with jurisdiction to decide issues raised against infraction notices is the possibility for the administrative authority, after drawing up the infraction notice, to modify the grounds invoked by the authority or even introduce new elements of evidence to strengthen the grounds thereof.

The administrative act formalizes the tax obligation and show the authority’s understanding regarding the law applied on the case. Upon performing the act, the administrative authority reveals its interpretation of the law that is applicable to such cases and entails the collection of the tax plus a penalty. The exercise of the taxpayer's guarantee of a full defense and an adversarial proceeding is directed to a comparison between the grounds presented by the complaint, which has the effect of setting the criteria that will be subject to analysis by the court.

The Brazilian Tax Code (CTN) provides in article 146[1] that modification of the legal criterion adopted in infraction notice, whether the result of an act by the legal authority or by virtue of a decision issued by an administrative or judicial court, may be applied only in relation to the future. This means that, after setting the new way of interpreting the provisions at stake, such new position only be binding for the next facts, not for the past.

In other words, once an infraction notice has been carried out, the legal criterion reflected therein may not be changed with respect to the facts contained in that document. Thus, even if the Public Administration itself finds that a mistaken understanding has been adopted, amendment thereof in order to justify an act already performed is prohibited.

Control of the legality of the infraction notice is carried out solely on the basis of the administrative act performed and, therefore, does not have the function of requiring the Administration to follow that understanding for subsequent periods. Modification of the legal criterion adopted on the infraction notice is forbidden. With regard to subsequent facts, the new criterion may be employed and there is no required binding effect for the past.

According to CTN in articles 145 and 149, there are specific and limited scenarios in which the infraction notice may be changed. However, there is no situation among them that authorizes a change in the interpretation of the provisions of law invoked by the agent who performed the act, nor is there the possibility of adding elements of evidence in the event of a mistake in the infraction notice.

This issue is of great relevance because, when challenging an infraction notice, taxpayers present the reasons that justify the conduct they adopted and the documents that support their allegations. Thus, after the taxpayer's answer, the administrative authority will not be able to spontaneously review the act and implement adjustments.

The Federal Administrative Court of Tax Appeals (“CARF”) has dealt with many trials on the subject and there is no uniformity among them. An example of the correct application of the obstacle imposed by article 146 of the CTN regarding changes of the infraction notice after the taxpayer's defense is found in decision 3401-005.943, when the reporting judge Lázaro Soares correctly argued that it was not possible to modify the legal reasons explained in the infraction notice. However, the reporting judge clarified that the prohibition concerns only the past, and does not prevent the Administration's activity with regard future audits. Note a clarifying passage from the appellate decision:

(...) 34. What is not allowed is that the Tax Authority may, identifying an infraction notice with the wrong legal basis, with an error of law having occurred, change that basis, replacing it with another and thus causing a worsening in the taxpayer’s situation in that same assessment, referring to the same taxable event, on the pretext of adapting the administrative act to the applicability of laws and regulations. However, nothing prevents future entries from performing such a correction, even for past triggering events. (...)

Furthermore, decision 1401-002.822 also faced a similar situation in which the infraction notice was canceled because the first instance decision relied on a basis that had not been raised by the original tax assessment notice. This circumstance, as stated by the decision, breaches taxpayer's right of defense, since the defense necessarily addresses the arguments to challenging the reasons invoked by the infraction notice, not for the new ones.

However, despite the aforementioned decisions, which applied well the emerging mandate of article 146 of the CTN, there are recent decision in which one may find mistakes of two types: i) the assessment must take as a reference a previous infraction notice; and ii) the conclusion that new arguments invoked, provided that they ratify the assessment described in the complaint, do not constitute alteration in legal criteria. The understanding reflected in decision 9303-008.195[2], at the same time, contradicts the objective set out in article 146, since it invokes as a comparison criterion a previous infraction notice and also states that modification of the legal basis, provided that the factual description is maintained, does not constitute change of legal criterion.

Although CARF’s case law shows that the issue is not settled, we believe that there are positive signs and examples of the correct application of the prohibition on modifying the legal criterion adopted by the infraction notice. With respect of applying the guarantee of due process of law, the connection with article 146 of the CTN concerns the precise identification of the complaint, which will allow taxpayers to fully exercise their right.

It is not consistent with the guarantee of due process of law, when Administration performing its function of creating infraction notices, to change the grounds of the complaint whenever taxpayers defend themselves and present arguments and documents that demonstrate the correctness of their conduct. The accusatory body, supported by the ultimate objective of maintaining the infraction notice, is not allowed to invoke new grounds at various times. The infraction notice must be precise and contain all the elements of evidence when it is presented and, in tax matters, the limit is provided for in article 146 of the CTN, with an express rule that prohibits modification of the grounds of the infraction notice.

[1] “Article 146. The modification introduced, ex officio or as a result of an administrative or judicial decision, in the legal criteria adopted by the administrative authority in the exercise of the entry may only be effected, in relation to the same taxable person, as to taxable events occurring after its filing.”

[2] “The change in legal criteria that prevents the drawing up of another Assessment Notice refers to a change in the laws and regulations applicable to the same fact for the same taxpayer. Maintaining the description of the fact and the assessment imputed to it, additional arguments that lead to the same assessment do not constitute alteration of legal criteria.”

- Category: Capital markets

As of October 14, mandatory publications by corporates must be carried out via the Public Digital Bookkeeping System (SPED), in the case of privately-held companies, and Empresas.NET, for publicly-held companies, in addition to the websites of these organizations themselves, and no longer in major newspapers.

Ministry of Economy Ordinance No. 529/19 and CVM Resolution No. 829/19, published in the Official Federal Gazette on September 30, regulated the new form of disclosure of publications ordered by article 289 of the Brazilian Corporations Law (Law No. 6,404/76), as amended by Executive Order No. 892/19.

According to the ordinance, "the publication of acts of privately-held companies and the disclosure of their information (...) shall be done in the Balance Sheet Center (CB) of the Public Digital Bookkeeping System (SPED)", but privately-held companies should also make this information available on their websites.

The SPED, as defined by article 2 of Decree No. 6,022/07, which institutionalized it, is “an instrument that unifies the activities of receipt, validation, storage, and authentication of books and documents that make up the accounting and tax bookkeeping of businessmen and legal entities, including those that are immune or exempt, through a single computerized flow of information.” Developed by the federal government, the system has long been known to corporate accounting departments, which use it to send tax and accounting information to the tax authorities.

With the new rules, therefore, the flow of corporate and accounting publications required by the LSA, in privately-held companies, of large-circulation newspapers and official bodies of the Federal Government, states, or the Federal District is shifted, depending on where the company's headquarters are located, to the SPED, with the simplification of the publication procedure and the elimination of the costs previously associated with publication in newspapers. In this sense, paragraph 4 of article 1 expressly states that no fees shall be charged for the aforementioned publications.

In turn, publication of the acts of publicly-held companies will take place, according to CVM Resolution No. 829/19, through the Empresas.NET System, another system long known in the market. It is used by companies registered with the CVM to send to the authority and B3 information of interest to the regulatory bodies, self-regulatory bodies, and the market in general. Under the same terms as privately-held companies, the resolution also provides that a company, when publishing its acts, must disclose them on its own website.

The use of the Empresas.NET System, in addition to maintaining the principle of publicity of corporate acts, previously exercised through mandatory publication in newspapers, reduces the cost of disclosing information, like what occurs with privately-held companies, in addition to simplifying the process.

The resolution also changed the disclosure of publications related to companies, but previously performed by third parties, such as in the case of resignation of an officer or director and public offers for acquisition of control. As provided for in item III of the standard, these publications will be done by the company itself. Accordingly, the offeror in proposals for acquisition and control (article 258 of the Brazilian Corporations Law) and officers or directors who resign from their position (article 151 of the Brazilian Corporations Law) must forward these acts to the company, which will be disclosed on Empresas.NET.

Both standards entered into effect on the date of their publication, but disclosures via SPED and Empresas.NET will only begin on October 14. Prior to this, companies should continue to publish their legal acts in widely circulated newspapers and the official gazette.

Promulgated on August 5 of this year, Executive Order (MP) 892 will be effective for a maximum of 60 days, renewable automatically for the same period. If not converted into law, it will lose its validity and, consequently, so will the normative acts of the Ministry of Economy and the CVM.

- Category: Tax

Since the STF settled the theory that the ICMS tax is not included in the taxable base for the levy of the PIS and Cofins, in the judgment of Extraordinary Appeal (RE) No. 574,706, many taxpayers had a definitive resolution in their individual cases on the topic, which gave room to new controverted issues. One of the most relevant controversies, due to the cash effects found, concerns when to tax by the IRPJ and CSLL the amount of credits recognized in court and which will be subject to administrative offsetting.

The matter is controversial because it is impacted by different relevant events: (a) the final judgment on the individual lawsuit filed by the taxpayer; (b) the effective measurement of credits by the taxpayer and the accounting recognition of recoverable amounts as an asset, in consideration for revenue; (c) the qualification of credits with the Brazilian Federal Revenue (RFB) as a condition for performing the offsetting; (d) the effective offsetting of credits with other federal taxes, as regulated by the Federal Revenue Service; and (e) the ratification of the compensation by the Federal Revenue Service.