- Category: Labor and employment

The seven public civil actions filed by the Public Labor Prosecutor’s Office (MPT) against Brazil’s main banks for alleged liability for their clients' social and environmental risks are beginning to unfold.

The case actually began in 2016, when the MPT instituted a prosecutorial procedure to monitor the Social and Environmental Responsibility Policies (PRSA) required by Resolution No. 4,327/14, of the National Monetary Council (CMN), in relation to the main banks operating in Brazil.

In addition to implementing the guidelines for the PRSA, the resolution establishes the requirements to be met by financial institutions in social and environmental actions both in relation to their own businesses and in relation to deals entered into with interested parties, that is, companies that consume the products and services offered.

According to the MPT, the intent of Resolution No. 4,327/14 is to require financial institutions to plan actions to prevent or remedy the supply of credit to enterprises involved in the exploitation of slave labor, child labor, or serious violations of health and safety standards. However, during the proceeding initiated, the agency found that the social and environmental responsibility actions announced by the financial institutions investigated did not correspond to reality and were not converted into concrete actions.

Given the outcome of the investigations and after fruitless negotiations with the banks involved, in May of this year the MPT filed seven public civil actions in the Labor Courts against these institutions, arguing that the guidelines provided for by the resolution had not been met. The actions are based, among other things, on the idea that if the financial institutions had compelled the companies benefiting from their services and products (especially credit) to comply with social and environmental responsibility policies, many disasters would not have occurred.

This responsibility was imputed by the MPT to the main banks operating in Brazil, as the social and environmental engagement of the beneficiary clients was supposedly based exclusively on operating licenses issued by environmental agencies and voluntarily disclosed documentation, without any questions into labor issues or checks into serious violations of labor rights, for example.

In this context, the seven public civil actions filed sought, in short, to demand that the institutions: (i) prepare new social and environmental responsibility policies in order to ensure effective identification of the social and environmental risks to which clients and users of the products are exposed; (ii) no longer used voluntary disclosure as the sole source for identifying social and environmental risks; and (iii) include social and environmental obligations in credit agreements.

However, Resolution No. 4,327/14 does not rule out voluntary disclosure as a source of identification of social and environmental risks by financial institutions, and does not provide for the inclusion of social and environmental obligations in credit agreements, which may have a great impact on the limits on the MPT's actions and the responsibility of companies and financial institutions for the social and environmental risks to which their clients and users/consumers are exposed.

This same discussion was already raised in November of 2018, when Federal Decree No. 9,571 was published, which directed companies to monitor their entire operation, including the production chain, to promote human rights not only within the scope of their own employees. At the time, in the first article written in the Legal Intelligence Portal regarding the topic, we emphasized that, until then, the justification used by the oversight bodies, notably the MPT, to impute corporate liability for the chain of production was based on principles, encompassing the Federal Constitution, international conventions, the Civil Code, and the Consumer Defense Code, among others. However, we anticipated that, although companies could voluntarily comply with the guidelines provided, the MPT would begin to use the decree as a legal basis, and no longer a principle, for imputing liability for the chain of production.

A few months later, the MPT filed the seven public civil actions, with requests directly related to the liability of the institutions for the social and environmental risks of their clients and users. Once again, the MPT imputed an obligation not provided for by law to the parties involved in the transaction.

That is, although the MPT did not expressly mention Federal Decree No. 9,571/2018 in the public civil actions filed, the fact that the agency has used a more specific rule causes the imputation of liability to companies throughout the transaction and even risks exposed to by clients and users become even more recurrent by the oversight bodies, based on the presumption of liability established for the first time in Federal Decree No. 9,571/2018, even though there is no provision of law on the matter.

In any case, it is important to consider that Resolution No. 4,327/14, used to support the MPT's claim, has a more limited scope than that attributed to it by the oversight body, which may still generate important debates on the subject.

In August of this year, the public civil actions filed by the MPT registered their first development: the Labor Courts declared their lack of subject-matter jurisdiction to adjudicate the matter in one of them, on the grounds that review of the violation, or lack thereof, of the norms relating to social and environmental responsibility policies is the responsibility of the Federal Courts of common jurisdiction, as it involves rules related to actions of a social and environmental nature that would impact on the National Monetary System, in the interest of the Federal Government.

This means that the debate regarding the imputation of liability to companies throughout the transaction may still persist also in the Federal Courts of common jurisdiction, such that Federal Decree No. 9,571/2018 may have only indicated the future behavior of the oversight bodies both in the labor sphere as well as in the civil sphere.

- Category: M&A and private equity

Law No. 13,874/19 which established the Declaration of Rights of Economic Freedom,[1] was enacted in order to address many claims of the business community to improve the business environment in Brazil. Among the principle based provisions and legislative changes, it should be highlighted the new rules inserted into the Civil Code relating to investment funds,[2] in particular the possibility of limiting the liability of quotaholders and service providers of the investment fund.

In this sense, new article 1368-D of the Civil Code states that the by-laws of investment fund may, subject to the regulations of the Brazilian Securities and Exchange Commission (CVM), limit the liability of quotaholders to the value of their quotas and the liability of service providers of the fund,[3] before the condominium (the fund) and among them, to the performance of their respective duties, without joint and several liability. Although this new provision is not immediately effective due to to the lack of regulations by CVM, such provision establishes the legal basis for the regulator to update the current rules aligned with the most advanced regulatory models.

In the Brazilian legal system, investment funds have always been considered as condominium, as originally referred to in article 49, II, of Law No. 4,728/65 and subsequent legal and infralegal rules, such as CVM Normative Instruction No. 555/14,[4] related to investment funds in general, Law No. 8,668/93[5] and CVM Normative Instruction No. 472/08,[6] both applicable to real estate investment funds (FIIs), and CVM Normative Instruction No. 578/16,[7] relating to private equity investment funds.

As for the liability of the investment fund's quotaholders, civil law establishes that the condominium members are liable, in proportion to their shares, to bear the burdens and debts to which the condominium’s assets are subject to (articles 1,315 and 1,317 of the Civil Code) unless joint and several liability among them is stipulated. In compliance with these legal limits, CVM’s regulations applicable to investment funds generally require quotaholders to be liable for any negative net worth of the fund (article 15 of CVM Normative Instruction No. 555/14). On the other hand, the quotaholders of real estate investment funds are an exception to the rule, supported by the express legal provision limiting their liability to the payment of the subscribed quotas (article 13, II, of Law No. 8,668/93), which, in turn, was mirrored by CVM in the respective regulations regarding FIIs (article 8, II, of CVM Normative Instruction No. 472/08).

Therefore, the Economic Freedom Act established the legal grounds enabling CVM to regulate investment funds more freely, by amending the Civil Code (i) affirming the condominium nature of investment funds, but expressly carving out the applicability of the general rules on condominiums (new article 1368-C) and (ii) allowing investment funds’ by-laws to limit the liability of quotaholders and their service providers, to the extent CVM’s regulations are complied with (new article 1368-D).

It is reasonable to expect that the regulator will consider in the new rules criteria such as the type of investment fund, the assets and investments within the investment fund's portfolio, and the target investors, i.e., the investor profile and the degree of risk exposure that such investors are willing to take, or should take. In any case, particular attention shall be devoted to private equity investment funds (FIPs), either because of the role they play in business activity or because of the diversity of investments types they may encompass.

Regarding business activity, FIPs essentially invest in publicly-held companies, privately-held companies, or limited liability companies, and should influence the strategy and management of the invested companies. In this respect, FIPs differ from other funds, which may hold passive equity interests in listed companies for speculative purposes. Therefore, FIPs embody the most entrepreneurial side of the investment fund industry and, as such, these investment vehicles, their managers, administrators and investors should be treated in order to ensure competitiveness in their business activities. Drawing a parallel with an investment holding company, whose partners’ liability is limited to the value of the subscribed capital in the holding company, except in cases of piercing of the corporate veil, there is no reason why the quotaholders of a FIP should be required to cover the negative net worth of the investment fund on an unlimited basis.

As for the various facets that a FIP may adopt, CVM Normative Instruction 578/16 establishes different categories, such as FIP-Seed Capital, Infrastructure, among others and, especially, the FIP-MultiStrategy, intended for FIPs that are not classified into other categories. It is entirely possible for a FIP to invest in special purpose companies focused solely in real estate enterprises, which makes its portfolio potentially identical to that of a FII. Therefore, it is worth considering whether this FIP should not be allowed to adopt a liability regime to its quotaholders similar to the one applicable to FIIs’ quotaholders. Should it be the case that, in these scenarios, the regulations prioritize the essence of the investment over its form and, consequently, grant the FIP’s quotaholders the same liability regime applicable to FII’s quotaholders?

Specifically in relation to the possibility of segregating the liability of the fiduciary service providers, eliminating the joint liability among them, this provision seeks to solve an increasingly frequent obstacle in the relations among agents in the sector. Over the years, the investment fund industry has become more sophisticated, resulting in a more segregated and specialized way its agents operates. In this sense, joint and several liability among investment fund service providers has served as a disincentive for the most capable and competent agents to perform these functions, leading to race to the bottom.

With the Economic Freedom Act, the basis for a change have been laid, and it will be up to the regulator to analyze and, together with the market players, consider the paths in which regulation should follow. Regardless of the course chosen, it is clear that one cannot delay or waste the opportunity to improve outdated rules and to sort out relevant issues to the investment fund industry, promoting economic activity and fostering the development of Brazil’s capital markets.

[1] Derived from Executive Order No. 881/19.

[2] New Articles 1368-C to 1368-F of Law No. 10,406/02 (the Civil Code).

[3] Fiduciary service providers are understood to be administrators, asset managers and custodians.

[4] Article 3. The investment fund is a communion of resources, organized in the form of a condominium, intended for investment in financial assets.

[5] Article 1. Real Estate Investment Funds are established, without legal personality, characterized by the communion of funds raised through the Securities Distribution System, in the manner set forth in Law No. 6,385, of December 7, 1976, intended for application to real estate developments.

Article 2. The Fund shall be organized in the form of a closed-end condominium, prohibited the redemption of quotas, with a determinate or indeterminate term of duration.

[6]Article 2. The FII is a communion of funds raised through the securities distribution system and intended for investment in real estate developments.

Paragraph 1. The fund shall be organized as a closed-end condominium and may have an indeterminate term of duration.

[7] Article 5. The FIP, organized as a closed-end condominium, is a communion of funds intended for the acquisition of shares, subscription warrants, simple debentures, other securities convertible or exchangeable into shares issued by companies, publicly or privately held, as well as as securities representing participation in limited liability companies, which must participate in the decision-making process of the invested company, with effective influence on the definition of its strategic policy and its management.

- Category: Litigation

Two ordinances amended the rules governing recall campaigns in Brazil earlier this half of the year. The standards modernize the regulations of the procedure imposed by the Consumer Protection Code (article 10, paragraphs 1 and 2) whenever the supplier becomes aware of the possibility of having introduced into the Brazilian market a product or service that poses a risk to the health or safety of the consumer.

The consumer protection agencies responsible for ascertaining the need for a recall are often quite strict in this analysis: if there are doubts about the lack of safety of a particular product, the tendency is for them to decide to perform the campaign.

According to Brazilian law, the main objectives of a recall are to ensure the protection of consumers against risks to their health and safety caused by a product or service offered to them, and to provide the public with comprehensive and correct information about the fact that triggered the recall.

It is precisely in the form of communication that the new Ordinance No. 618/19, promulgated by the Ministry of Justice and Public Safety replacing Ordinance No. 487/12, now repealed, presents the greatest advance compared to the previous rule. The paragraphs of article 4 open the possibility of running the campaign through the company's website and digital media on the Internet, in addition to the radio and TV communication previously provided for.

Through this communication, the supplier must inform consumers of the potential risk they are exposed to when using the defective product or service. To do so, they need to present a media plan with a detailed description of the product or service and the defective component, details about the frequency of disclosure, costs involved, campaign start and end dates, and more. The supplier must also highlight that consumers will incur no costs in joining the recall campaign.

Another change made by the new ordinance causes concern. It is the rule that establishes a period of 24 hours for the supplier to inform the National Consumer Bureau (Senacon) of the beginning of investigations regarding the possible introduction of a product or service into the Brazilian consumer market that presents danger or harmfulness. Upon completion of the investigations, the supplier has two business days to report the reasons why the recall campaign will not be necessary or, if necessary, to report this to Senacon and the appropriate regulatory or rulemaking body.

The previous ordinance provided that the initial report of the fact by the supplier, which should then be addressed to the Department of Consumer Defense and Protection (DPDC), must be done “immediately.” Although the standard did not establish what would be interpreted as “immediately,” the prevailing understanding was that the supplier should carry out this report as soon as it became aware of the problem and then start the recall campaign as soon as possible.

While the legislator's attempt to establish a more objective criterion for verifying a supplier’s compliance with the deadlines is laudable, experience shows that the decision to conduct a recall requires an evaluation of often subjective variables, which can hardly be adequately ascertained and addressed within such tight deadlines.

Another novelty in this area was the publication of Joint Ordinance No. 3/19, an initiative of the Ministries of Infrastructure and Justice and Public Safety. It sets forth provisions for recall procedures specifically for the vehicle market. In compliance with this standard, defective vehicle recall campaigns should be reported not only to Senacon but also to the National Traffic Department (Denatran). Once this is done, at most every 15 days, suppliers must provide information on the updated universe of vehicles served, in accordance with the terms of the manual for registration of recalls in the National Vehicle Registration System (Renavam).

The holding of a recall is mandatory in any event where the supplier becomes aware of a potential health or safety risk arising from a product or service offered by the supplier. Failure to conduct the campaign voluntarily and in a timely manner will result in administrative, civil, and criminal sanctions.

- Category: Litigation

The Brazilian Securities and Exchange Commission (CVM) and the Superior Court of Justice (STJ), in two decisions in the first half of the year, made it clear that hotel operators may only be held liable for irregularities or damages in the offering of condo hotels if they participated actively in the efforts to sell the ideal fractions to buyers.

Used in the structuring of these developments, Collective Hotel Investment Agreements (CICs) are securities consisting of a series of contractual instruments publicly offered to investors. These contracts contain a promise of compensation linked to the profit sharing of the development, which is organized through a building condominium.

This development model was driven in Brazil mainly by the need to expand the country's hotel network to meet demand related to the 2014 World Cup and the 2016 Olympics.

Despite the numerous structuring models for this type of development, it is common for construction of the condo-hotel to be made possible through the establishment of a Special Partnership Company (SCP). It is made up of an general partner and other investors who become partners of the SCP at the time of the acquisition of a real estate unit of the development. The company acts as the manager of the finished project and is required to render accounts and pay dividends to investors.

Other relevant participants are the developer, responsible for developing, building, and selling the development, and hotel operators, hired to manage the day-to-day activities of the condo-hotel. The second group of companies is usually formed by large players in the hotel industry with a lot of know-how and prestige. They provide hotel management services and sometimes technical advice during construction, but generally do not participate in the process of buying and selling the ideal fractions by investors.

The filing of administrative proceedings to investigate irregularities in the offering of condo-hotels and the filing of lawsuits by investors who had their expectations frustrated and who seek termination of contract and repair of material and moral damages caused the CVM and the Judiciary to study further the liability of hotel brands in the context of collective investment agreements.

The CVM issued Normative Instruction No. 602/18 in order to define the concept of “offeror” as being the party that, in fact, makes distribution efforts for the CIC hotel. The authority also stated that the hotel operator “usually” is not responsible for the sales efforts of hotel CICs and, consequently, does not fit within the concept of offeror.

Thus, an objective criterion was established to assess the liability of the hotel manager for irregularities in the offering of condo-hotels. According to the standard, it is necessary to review the behavior of the manager during the process of selling the development's units and analyze whether it actually and provenly participated in acts of public distribution of the condo-hotel. Only if it has actively participated in the sales efforts may the operator be held liable.

The CVM applied this understanding in deciding sanctioning proceeding No. 19957.011318/2017-00. In that case, the liability of a hotel operator and its managers for an irregular offering of a condo-hotel was ruled out, given the lack of evidence that it participated in the distribution of the development’s units.

The STJ, in turn, in a recent judgment on the subject (REsp No. 1.785.802/SP), found the lack of standing to be sued of the hotel operator to be liable to the purchasers for losses and damages resulting from non-construction of a development.

According to the STJ, as the operator only undertakes to manage the hotel services after the completion of the construction, it is not part of the supply chain related to the real estate development, and for this reason it cannot be held liable for damages caused to third-party purchasers.

- Category: Labor and employment

In order to encourage the creation of new jobs and inject money into the market, the Ministry of Economy plans to present a package of measures that, among other actions, authorizes the replacement of funds paid by employers as appeal deposits with judicial performance bonds.[1]

The payment of an appeal deposit is a mandatory requirement for the judgment of appeals filed by employers in labor claims. The objective is to ensure that employers initiate payment of judgments, in advance and in part, if the higher courts do not reverse an unfavorable decision.

Currently, for the employer to appeal to the appellate court, the deposit must be made into a judicial account linked to the case, in the maximum amount of R$ 9,828.51. To appeal to the Superior Labor Court (TST), the appeal deposit is limited to R$ 19,657.02.

Deposits are adjusted based on the savings account interest rate, which results in financial losses for employers: while interest for the Labor Courts is 12% per year, appeal deposits have been adjusted at 4.62% over the past 12 months.[2] Such a difference shows that the appeal deposit does not lend itself to guaranteeing payment of the judgment, since it depreciates in relation to the amounts due. It would be more favorable for companies to invest funds in financial investments.

With the entrance into force of the Labor Reform (Law No. 13,467/17) and the inclusion of paragraph 11 into article 899 of the Consolidated Labor Laws (CLT), employers were allowed to use judicial performance bonds to lodge appeals with the higher courts rather than make the appeal deposit with financial institutions.

Thus, in order to appeal against an unfavorable judgment, companies may now purchase a judicial performance bond, keeping their funds invested in more profitable investments or investing such funds in new jobs or in the modernization of their business activity.

Due to internal rules of the Labor Courts, however, employers are not yet allowed to substitute judicial performance bonds for deposit amounts paid prior to the Labor Reform, which remain pending in the accounts linked to the labor claims.

Trial and appellate judges argue that replacement of deposits made before November 11, 2017, would not be possible, as the Labor Reform did not give retroactive effect to paragraph 11 of article 899 of the CLT for appeals filed under the previous law. Such a position was even endorsed by the TST:[3]

"Article 20: The provisions contained in paragraphs 4, 9, 10, and 11 of article 899 of the CLT, as amended by Law No. 13,467/17, shall be observed for appeals against decisions rendered as of November 11, 2017.”

Studies conducted by the Ministry of Economy[4] indicate that the possible replacement of appeal deposits made with judicial performance bonds would free up for employers about R$ 65 billion that is idle in the Labor Courts and could be invested in more advantageous financial investments, in creating new jobs, and in moving the economy forward.

With the proposal of this measure, the federal government has shown its intent to stimulate Brazil’s economy through changes in regulations to create opportunities for employment and consumption.

In order to withdraw the amounts deposited, however, companies will have to file in court a petition for replacement and prove the purchase of a judicial performance bond. They will also need to satisfy the other requirements of the Labor Courts, as well as requirements possibly included in the package of measures being proposed by the Ministry of Economy.

For more information on the topic, please see:

How does one safely substitute an appeal deposit with a performance bond?

[1] Folha de S. Paulo, “Unemployment reduction package releases R$ 65 billion to companies and creates labor agency.” https://www1.folha.uol.com.br/mercado/2019/09/pacote-de-combate-ao-desemprego-libera-r-65-bi-para-empresas-e-cria-agencia-de-trabalho.shtml

InfoMoney, “Guedes says economic team working on package to incentive employment.” https://www.infomoney.com.br/mercados/noticia/9336933/guedes-diz-que-pacote-de-incentivo-ao-emprego-ainda-esta-em-gestacao

[2] https://www.bcb.gov.br/estatisticas/remuneradepositospoupanca

[3] Normative Instruction No. 41 of the TST.

[4] Estado de S. Paulo. "Guedes receives menu of measures for employment that includes release of R$ 65 billion to companies." https://economia.estadao.com.br/noticias/geral,guedes-recebe-cardapio-de-medidas-para-emprego-que-inclui-liberacao-de-r-65-bi-para-empresas,70002999711

- Category: Labor and employment

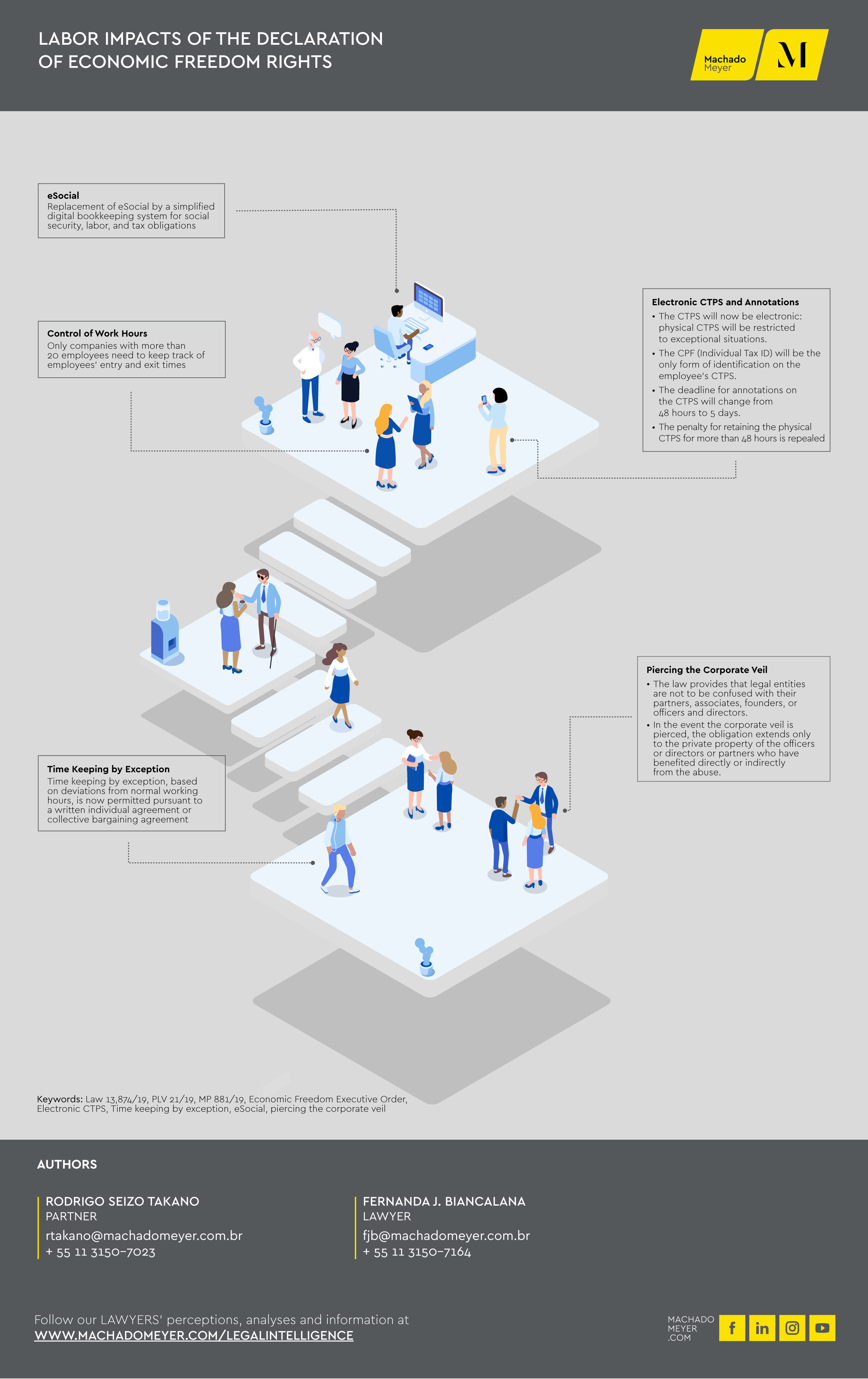

Law No. 13,874/19, enacted on September 20 after the conversion into law of the Economic Freedom Executive Order (MP 881/19), amended various points of labor and employment laws with the main objective of reducing bureaucracy in the procedures to be followed by employers.

The labor and employment impacts of the Declaration of Economic Freedom Rights are as follows:

- Category: Labor and employment

In prior articles, we discussed some preventive measures that startups can take to adjust their internal procedures and thereby avoid possible breaches of labor laws and regulations. Startups may, however, face labor claims filed by their former employees or even by third parties who were not even their direct contractors.

There is an explanation: labor liability may overstep the boundaries of the customer-provider relationship, reaching companies or people who often did not even participate in the irregularities alleged in the case. In the labor courts, in addition to the principal debtor, usually the employer itself, third-party liability can take two forms:

- Secondary liability

In this case, the company must only pay the labor debt if the principal debtor does not. The labor courts are charged with exhausting all attempts to execute against the principal before turning against the secondarily liable party.

There are two main scenarios in which this liability is recognized in the labor courts:

- Liability of the recipient of services from the third-party workers; and

- Liability of partners, officers and directors, investors, and executives for the company's labor debts.

The first situation stems from the mere work done by third parties via the hiring of a service provider. In this scenario, the company receiving the services (customer) is understood to be liable for the sums due from the service provider (vendor) to the outsourced service providers. This is the case, for example, of a company hiring security guard services, which is now liable for the labor sums due to any of its outsourced security guards, even if it is not their employer.

The second scenario, especially relevant in the context of startups, is the individual liability of key persons for the company's labor debts. In some situations and upon due determination, partners, officers and directors, investors, and executives may be personally liable for such debts after attempts to execute against the company have been exhausted.

Given the instability surrounding some startups in their early years, it is only natural that the personal liability of their investors may discourage capital contributions. However, in order to minimize investment risks, shield investors' personal assets, and stimulate capital contributions, in 2016 there was an important amendment to the National Simplified Tax System Law.

With this change, capital contributions to micro and small businesses, the main models for creating startups, do not make up the respective capital stock. Thus, such investors, also known as “angel investors,” are liable for the company's debts up to the limit of the capital contributed. Those who choose to contribute in such conditions will have greater legal certainty and confidence in making investments in startups still in the development phase.

- Joint and several liability

Unlike in the case above, the company jointly and severally liable may be executed simultaneously with the other companies sued in the labor claim. There is therefore no order to be respected by the judge, who may execute any one or even all of the companies at the same time. The main assumptions for joint and several liability in the labor courts are as follows:

- Economic group;

- Succession of companies;

- Agreements among the parties or express legal provision; and

- Fraudulent practices during the term of the agreement.

The concept of an economic group, one of the most frequent cases in labor courts, is present in the Consolidated Labor Laws (CLT), in its article 2 and relevant paragraphs. Although the text has undergone various changes over the years, the current wording requires that, to establish an economic group, it is necessary to prove: (i) a relationship of direction, control, or management between companies; (ii) integrated interest; (iii) an effective communion of interests; and (iv) joint action by the companies.

In addition, with the conversion into law of Presidential Decree No. 881/19 (the Economic Freedom Executive Order), it is expected that the mere existence of an economic group will no longer be sufficient for the recognition of joint and several liability. If the new wording is approved by the National Congress, it will also be required to prove abuse of legal personality, identified by the misuse of its purpose or the mixing of assets. This is a highly relevant change that will have various consequences for the way the labor courts review the subject.

Thus, with regard to secondary liability, startups will have to redouble their care in selecting and hiring service providers, opting for those with better financial health and a high reputation in the market. Investors are advised to exercise caution not only in selecting startups but also, and especially, in choosing the best form of contribution of funds, safeguarding their personal assets.

With regard to joint and several liability, startups will have to closely monitor the financial health of related companies, since under current laws and regulations just a few elements are enough for the establishment of an economic group. It is worth remembering that this scenario may be changed significantly with the conversion into law of the Economic Freedom Executive Order.

- Category: Infrastructure and energy

The legalization of cannabis sativa for medicinal purposes is a controversial topic that has been debated for a long time in Brazil and in other countries. Despite criticism, some favorable points of the measure need to be considered, especially at this time when bills on the subject are pending before Congress and Anvisa (National Health Surveillance Agency) is spearheading public consultations on the regulation of controlled cultivation of the plant for medicinal use.

The Cannabis sativa market moves billions of dollars annually in countries where regulations are already in place. According to Beau Whitney, vice president and economist at New Frontier Data, an American data analysis firm specializing in this industry, Cannabis sativa trade has moved $ US10.4 billion and created at least 250,000 jobs in 2018.

-In addition, use of the plant for medicinal purposes has provided benefits to numerous patients, such as people suffering from diseases such as schizophrenia, multiple sclerosis, seizures, and not responding to conventional treatments.

Uruguay and Mexico, in Latin America, treat the issue more liberally, attracting the attention of companies in the field. Many have already expressed public interest in investing in these countries, although neither has a broad internal market.

Brazil, in turn, has 3.4 million potential consumers of this type of medicine. A market of this size could move about US$ 1.4 billion a year, which makes it very attractive.

In an economic scenario of low economic activity such as the present one, numbers like these are in favor of investments in the Cannabis sativa-based pharmaceutical industry, not only for the financial return, but also for the reduction of treatment costs and the generation of the jobs that it may provide.

To date, legislative and judicial delays placed some obstacles for investment plans. This, however, may change, among other factors, due to the existence of three bills pending before the National Congress and ongoing lawsuits.

We highlight bills No. 7,187/2014, No. 7,270/2014, and No. 10,549/2018, which aim to regulate the use of Cannabis sativa for medicinal or recreational purposes, and Direct Unconstitutionality Action (ADI) No. 5,708, pending before the Federal Supreme Court (STF) and filed by political parties that defend decriminalization of the plant for therapeutic uses.

On another front, pressure from patients to release Cannabis sativa-based medicines has led the Federal Council of Medicine to authorize neurologists and psychiatrists to prescribe them. Anvisa has implemented registration and control for access to these pharmaceuticals, which currently need to be imported, thus considerably increasing the cost of treatment.

Recent government initiatives to regulate the use of cannabis sativa for medicinal purposes show that the opportunities for opening this market in Brazil are real. In June of 2019, Anvisa's collegiate board approved two public consultations regarding the regulation of controlled cultivation of Cannabis sativa for medicinal and scientific use.

The purpose of the initiative is to make room for the population, other government agencies, the pharmaceutical industry, and society in general to give their opinions on two proposed resolutions.

Public Consultation No. 654, of June 13, 2019, aims to discuss the proposal for a specific procedure for the registration and monitoring of Cannabis sativa-based medicines, its derivatives, and synthetic analogues. Public Consultation No. 655, of the same date, deals with the technical and administrative requirements for cultivation of the plant for medicinal and scientific purposes.

Both are open to receive contributions until today (August 19th). It is an important opportunity for the public as a whole to contribute to the debate and to regulate the controlled cultivation of cannabis sativa for medicinal and scientific use to standards that protect public health and at the same time meet the needs of the market.

- Category: Infrastructure and energy

The Federal Government published on, August 7, Decree No. 9,957/19, which regulates the procedure for the rebidding of partnership contracts in the highway, railway, and airport sectors. The rules complement the provisions of Chapter III of Law No. 13,448/17, which already provided for the possibility of rebidding, but lacked specific regulations, a fact that had been causing concern for various market players, especially those linked to the highway and airport sectors.

The new decree details the requirements that need to be met by those interested in requesting the rebidding, which in practice is the return of the venture to the Government, which will undertake a new bidding procedure to maintain the regularity of the provision of services.

The request must be accompanied by a series of technical information and documents. The government’s objective is to collect justifications and elements that allow one to identify the real need for and viability of the rebidding procedure. Details to be provided by interested parties include:

- information regarding the property to be returned;

- financing instruments;

- contracts in force with third parties;

- ownership status of the areas affected by the venture; and

- any judicial, administrative, or arbitral disputes involving the contractor and the granting authority.

In addition to this information, interested parties should demonstrate in a justified manner the conditions proposed in order to ensure continuity and security in the services until the completion of the rebidding procedure and transfer of the venture to the new contractor.

The detailed description of the information and documents that will support the application is not repeated in the articles that address how the information will be evaluated by the granting authority and its bodies. Section II of the decree is limited to addressing the powers of each of the bodies, leaving a certain degree of subjectivity regarding the process of granting or denying the application.

For example, a request for rebidding will be examined in advance by the regulatory agency responsible for the sector, which will be responsible for ascertaining the technical and legal feasibility of the request. Following the response of the regulatory agency, the request will be sent to the Ministry of Infrastructure, tasked with analyzing the compatibility between the request for rebidding and the scope of the public policy formulated for the corresponding sector. It is specifically in this passage that the wording makes room for different interpretations, because it is missing clear identification of criteria to be observed by the Government to deliver its decisions, whether granting or denying the right to rebid.

Following the response by the Ministry of Infrastructure, the proceeding will be forwarded for deliberation by the Investment Partnership Committee of the Federal Executive, which will be charged with opining, before the President's decision, on the appropriateness and advisability of the rebidding, in a clear exercise of the discretionary power conferred on the Government.

Once the rebidding is found to be viable, the granting authority will suspend any forfeiture proceedings and enter into an addendum with the rebidder that will regulate all its activities until the completion of the rebidding process and the execution of a new contract.

The addendum will contain a series of requirements that must be complied with by the rebidder, under penalty of disqualification of the venture, a fact that would entail the immediate initiation or resumption of the forfeiture proceeding and restoration of the existing charges and obligations before the execution of the addendum. Mandatory requirements of the addendum include:

- not reduce capital stock;

- offer no new guarantees on behalf of third parties except those proven to be essential and after approval by the regulatory agency;

- not alienate, assign, transfer, dispose of, or create any encumbrances on the assets and rights linked to the venture, except those that are justified, and after approval by the regulatory agency; and

- not apply for bankruptcy or judicial or extrajudicial reorganization of the special purpose entity.

It is undeniable that the decree represents a significant change and will have practical consequences, especially in the discussions regarding the judicial reorganization process for the Aeroportos Brasil Viracopos concessionaire and others in the highway sector that have already expressed their intention to return ventures. The consequences are still uncertain, but the market players in the highway, railway, and airport sectors will certainly find a new legal and, especially, economic scenario over the next few years.

- Category: Labor and employment

Share-based incentive plans are long-term mechanisms that allow employees to participate in the valuation of the company according to previously established criteria. As a rule, implementing these plans results in greater alignment of interests between employees and the company, which helps retain talent, boosts workforce performance and, consequently, business performance, and indirectly leads to company valuation.

Among the stock-based incentives, in addition to stockoptions plans, which were already discussed in a prior article, it is worth mentioning restricted stocks and/or stock units (commonly called RSUs), restricted shares, phantom shares, and phantom stock options.

Each of these incentives has specific characteristics that may be more or less appropriate for the timing and situation of each startup. The definition of which incentive best fits the reality and daily life of a startup depends precisely on an analysis of these characteristics. There is no correct formula, much less a recipe that fits for all companies. We shall review each of these incentives below.

Restricted stock or restricted stock unit plans consist of a commitment to issue or transfer shares (or units, as the case may be) to the beneficiary, provided that certain conditions are met, especially maintenance of the employment relationship during the vesting period. Once all these conditions are met, the shares (or units, as the case may be) are transferred to the beneficiary employees.

As the transfer is free of charge, the majority understanding[1] is that this type of incentive is remunerative in nature. By virtue of this, the value of the shares or units, on the date of transfer, must be considered for the payment of labor and social security charges by the company and income tax by the employees.

Performance share plans consist of a commitment to issue or transfer shares on behalf of the employee, provided that certain performance conditions (individual, group, or corporate) are met and the employment relationship is maintained throughout the vesting period.

The nature of these plans follows the same logic as RSUs. Since the shares are transferred free of charge and the delivery of the shares is directly or indirectly dependent on employee performance, the majority understanding[2] is that this type of incentive is also remunerative in nature for labor, social security, and tax purposes.

Both in the RSUs and in the performance shares plans, there is an effective transfer of shares to the beneficiaries, who, therefore, become partners of the company at the end of the plan vesting period. Once partners, these beneficiaries are entitled to vote and to receive any dividends that may be distributed. The rights and payments arising from the status of shareholder, however, are not to be confused with the employment relationship (that is to say, just because an employee has become a partner does not mean that the employee loses an employment link with the company). In any case, dividends are not included in employee compensation for any purpose.

The phantom shares plans, in turn, allows the granting of “virtual” shares that guarantee to beneficiaries the right to a cash payment in the future equivalent to the value of one share multiplied by the number of virtual shares granted, provided that the employment relationship is maintained throughout vesting period.

Technically, this payment is a kind of adjusted bonus linked to the value of the shares. Thus, it is also remunerative in nature and, therefore, makes up the compensation of beneficiaries for labor, social security, and tax purposes.

Phantom stock options plans, finally, combine two incentives already discussed, stock options and phantom shares. Phantom stock options are “virtual” stock options. Through this incentive, if the beneficiary elects to exercise the virtual options after the vesting period, the company will make a cash payment to the beneficiary equivalent to the difference between the exercise price of the virtual options and the value of one share of the company, multiplied by the number of virtual options exercised.

As with phantom shares, this payment is a kind of agreed-upon bonus linked to the appreciation of shares during the vesting period. If the share appreciates, the employee shall be entitled to receive an amount to be paid by the company. Similarly, this payment is also remunerative in nature.

In both phantom share and phantom stock option plans there is no actual transfer of shares to beneficiaries, but only cash payments. These plans therefore do not allow employees to become partners of the companies, which is why they differ from RSUs and performance share plans.

Although all the incentives discussed here are included in employee compensation, each has its own peculiarities and may be more or less recommendable depending on the timing of each startup. Mistaken definitions of the characteristics of the plans may create considerable liabilities, causing financial impacts, and even alienating investors. The choice of incentive and its mode of implementation and treatment are therefore essential and should be done with caution.

[1] However, there are already decisions to the contrary: Application for Mandamus No. 5002951-79.2017.4.03.6105.

[2] Idem.

- Category: Labor and employment

Even without the consent of the trade union, the Superior Labor Court (TST) approved requests for withdrawal by employees in a collective suit filed against two companies. The recent decision was delivered in Case No. 0010795-82.2015.5.03.0179.

The Trade Union of Employees in Data Processing Companies, Computer Services, and Similar Services of the State of Minas Gerais (Sindados/MG) filed collective suits seeking enforcement of provisions of collective bargaining agreements. In defense, the companies submitted requests for withdrawal made by the employees, which were ratified by the trial court, resulting, consequently, in extinguishment of the case against them.

In accepting the trade union's appeal, the Court of Labor Appeals (TRT) for the 3rd Circuit annulled the ratification of the withdrawals, on the grounds that the waiver of the rights claimed in the suit for enforcement is ineffective due to the principle of inalienability of labor rights by employees.

The companies appealed against this decision to the TST, which found that the trade union has extraordinary standing to defend the collective and individual interests of the category as a procedural substitute. However, the employees continue to be the holders of the substantive right and, as a result, may have the right to sue, that is, withdraw from the claim regardless of the agreement of the trade union.

The TST stated that the owner of the right is assured the right to bring an individual suit or benefit from the effects of the decision on the collective suit, pursuant to article 104 of the Consumer Protection Code. The court also clarified that there was no evidence in the record that the declarations of withdrawal had any defect in consent or were the result of pressure, ruling out any possibility of recognition of invalidity of these documents.

In times of repercussion of the effects of the Labor Reform, the relevance of this decision is accentuated, since it exalts the concept of the autonomy of the will of the parties and the prevalence of the interest of the holder of the right, in this case, the employees. This concept was even highlighted by the Labor Reform, especially considering the provisions of article 444 of the CLT.

- Category: Infrastructure and energy

Law No. 13,848/19, enacted in June, established the new framework for regulatory agencies in Brazil. Originating from Bill No. 52/13, the text signed into law differs very little from what was initially approved by the Senate, in spite of a few presidential vetoes and specific changes introduced by congressmen.

With regard to the vetoes, the Presidency rejected the application of a public pre-selection process for candidates to the boards of commissioners and the commissions of regulatory agencies, as well as extended the rule that members of these bodies (with very few exceptions) may not be reappointed for terms of office that started before the law entered into force. It also excluded the prohibition on having a person linked to a company that carries out activities regulated by the agency be appointed to its top position.

Among the pointed changes to the original bill introduced in Congress, the following stand out:

- The inclusion of the National Mining Agency (ANM), which was created to replace the former DNPM, in December of 2017;

The assimilation of the Administrative Council for Economic Defense (Cade) to a regulatory agency for certain purposes, such as recognition of its functional, decision-making, administrative, and financial autonomy; the subjection to external control by the National Congress, with the assistance of the Federal Audit Court; the obligation to prepare strategic plan, annual management plan, and regulatory agenda; and

In line with the State-Enterprises Law is the obligation for regulatory agencies to implement their own internal compliance and corporate governance programs.

During the legislative process, the Chamber of Deputies had attempted to remove the prohibition on appointing party leaders and relatives of politicians to both the governing posts of regulatory agencies and to the management and boards of state-owned enterprises. The amendment even affected the State-Enterprises Law in this sense. The Senate, in approving the final text, rejected the amendment, so that the prohibitions on appointment under the State-Enterprises Law were unchanged and were repeated and even extended to regulatory agencies.

Congress also added reinforcement to the rule against simultaneous terms of office of agency leaders, stating that those who fail to be filled in the same year as their vacancy will be shortened. The congressmen also extended the list of scenarios for loss of office for the leaders of agencies, increasing the number of situations that objectively constitute a conflict of interests, compliance obligations, and professional duties.

As may be seen, the main foundations of the original bill, characterized by a commitment to modernization, standardization, and professionalization of regulatory techniques, were preserved in the Regulatory Agencies Law. Some pending issues have not yet been resolved, but the enactment of this important new law will provide encouragement to investors and financiers of companies operating in regulated sectors.

- Category: Environmental

Federal Decree No. 9,760, published in April of this year, amends certain provisions of Federal Decree No. 6,514/08, which deals with environmental infractions and sanctions and establishes the federal administrative procedure to investigate them.

Effective as of next October 8 (180 days after its publication), the text provides for the creation of the Environmental Conciliation Center (NCA) and modifies the Environmental Fines Conversion Program.

The first big change presented was a summons for the defendant to appear at the establishment of the responsible environmental agency in order to participate in an environmental conciliation hearing. This summons will be sent after the preparation of an infraction notice and preferably by electronic means (when there is express agreement by the defendant and technology available confirming the receipt thereof). With the ultimate goal of closing administrative proceedings quickly, the defendant should attend a single hearing.

It is important to note that the 20-day time limit for filing a defense against the infraction notice is stayed until the date of the conciliation hearing. Only if the hearing is unsuccessful will the time limit be counted per the terms of Decree No. 6,514/08.

The NCA was created precisely to conduct a preliminary review of assessments and to hold environmental conciliation hearings. The body will be composed of at least two permanent public servants, at least one of them being part of the federal environmental Public Administration entity responsible for drawing up the assessment in question. On the date of the hearing, the NCA will: present the reasons of fact and law that led to the issuance of the infraction notice; explain the possible legal solutions for termination of the proceeding (for example, discounts on payment, payment via installments, or conversion of the fine into rendering of services, improvement, and recovery of environmental quality); and carry out any approval of detailed consent orders indicating the choice made by the defendant.

Detailed consent order resulting from conciliation hearings shall contain the solution chosen and the commitments assumed by the defendant to fulfill the obligation. It is the responsibility of the defendant to file a request for termination of the proceeding, with a resolution on the merits against any lawsuits filed within 15 days of the hearing.

In the event that a hearing is not held, either due to non-attendance by the defendant or lack of interest in environmental conciliation, the defendant may opt for legal remedies through the website of the responsible entity of the federal administration.

Under the Environmental Fines Conversion Program, the decree establishes the possibility of converting simple fines into the rendering of services, improvement, and recovery of environmental quality. An exception is fines resulting from violations that have caused human deaths.

If a defendant chooses to convert a fine, the procedure may be requested of the NCA during the environmental conciliation hearing, as mentioned above. The request may also be made to the adjudicating authority (until the issuance of the trial level decision) or to higher authority (until the appellate level decision is issued).

Discounts from the fine will be staggered according to the phase of the proceeding in which conversion of the penalty was requested. If the request is made during the environmental conciliation hearing, the discount will be 60%; if it is referred to the adjudicatory authority, it will be 50%; and if addressed to the higher authority, it will be 40%.

The taxpayer may also adhere to the conversion of fines through the implementation of a project for services for the preservation, improvement, and recovery of environmental quality or by joining a project previously prepared by another public or private body, as may be decided by the environmental body.

Finally, defendants who have requested the conversion of a fine under Decree No. 9,179/17, in any of its modalities, may request adjustment of the request for conversion, guaranteeing the 60% discount, or report withdrawal of the request, whereupon they may opt for one of the other alternatives in order to terminate the proceeding by the cut-off date of January 6, 2020. If the defendant does not submit a request by that date, the environmental agency will consider it to constitute tacit waiver of the request for conversion of a fine and notify it of the regular continuation of the administrative proceeding.

Keywords:

- Category: Infrastructure and energy

The financing of infrastructure projects in Brazil has been undergoing important changes in recent years, caused, among other factors, by redefinition of the role of the National Bank for Economic and Social Development (BNDES) in this type of transaction.

On the one hand, Law No. 12,431/11 boosted the financing of large infrastructure projects and restructured the payment of large construction projects by issuing debt securities (incentivized debentures). The greatest attraction with this type of financing is the tax exemption it provides when it is intended for priority projects, that is, those regulated by Decree No. 8,874/16.

BNDES, on the other hand, has taken up less space in infrastructure investments: around 1% of GDP, much less than in 2008-2017, when this share reached 5% of GDP.

Brazil's political and economic crisis and the restrictions imposed on BNDES in granting new financing led to a shrinking of the bank's operations and made more room for the capital markets to issue incentivized debentures.

According to Anbima’s bulletin (the Brazilian Association of Financial and Capital Markets Entities), the total fundraising of Brazilian companies via the capital markets reached R$ 144.5 billion in the first half of this year, exceeding the average of R$ 122.5 billion for the same period in the last seven years. Another highlight was the large jump in issuances of infrastructure debentures: from R$ 4.6 billion in 2016 to R$ 21.6 billion in 2018.

At the moment, there are prospects for further changes in Law No. 12,431/11 and transactions with a certain degree of innovation. Long-term issues related to Law No. 12,431 are beginning to emerge in the market, some of them even for the purpose of prepaying long-term bank debts that did not compete with the capital markets.

There are reports that a draft bill that would positively amend the text of Law No. 12,431/11 is practically ready to, among other modifications, increase from 24 to 60 months the time limit for reimbursement of expenses that may be covered by the issuance of incentivized debentures.

With these changes, it is expected that these long-term securities will increasingly be used to finance large infrastructure projects in Brazil.

- Category: Labor and employment

With technological advances, work done at home offices or locations other than the place of business, has multiplied, which has reinforced the importance of adopting legal guidelines and measures to give greater predictability and security to parties involved in this type of working relationship.

Seeking to regulate such relationships, Law No. 13,467/2017 (the Labor Reform) added to the CLT (Consolidated Labor Laws) articles 75-A to 75-E regarding teleworking, defined as the provision of services by an employee “predominantly outside the premises” of the employer, through the use of information and communication technologies which, by their nature, do not constitute outside work,” pursuant to article 75-B of the CLT.

Despite various advantages for employer and employee, including reduced commuting time, commuting costs, and possibly infrastructure costs, teleworking is very much questioned due to the risk of employer liability for accidents suffered by employees while working, even when outside the company's premises.

It is important to highlight that this work regime is subject to the same rules as are applied to services provided by employees within the company’s establishment, including workplace safety rules.

In the case of work done within the employee's home, there is no doubt that the concept of the work environment needs to be expanded and also applied to the worker's private environment, which must be in accordance with the legally established health and safety rules.

Although the work is performed outside the company's physical space, that is, away from its immediate control, it is important to clarify that the CLT, in its article 75-E, obliges employers to expressly and ostensibly instruct employees with respect to precautions against occupational diseases and accidents.

Although it is possible to abstractly hold companies liable for proven damage to teleworkers, the difficulty in proving both a causal link and the employer's fault is undeniable. That is: not all accidents should be treated the same. Case law, for example, tends to regard mishaps during working hours as an occupational accident, but it is important that each case be reviewed taking into account the activities performed at the employee's residence.

In order to avoid accidents and contribute directly to employee health, it is recommended that the company develop a “Workplace Health and Safety Standards Manual,” which will serve as a reference for good practices and provide employees with information about the rules to be followed and the risks to which they are subjected.

The standards should be available for consultation by employees with easy and unrestricted access. Regularly, to demonstrate their concern with this topic, employers should reinforce the importance of compliance with the standards, preferably by updating the training provided. They should also require employees to expressly and in writing state that they are aware of and commit to abide by the rules established, which may include issues such as:

- Use of ergonomic equipment (provided by the company or purchased by the employee), such as ideal type and height of chair and correct type of headphones;

- Prohibition on the use of splitters and extension cords to avoid short or shock by contact with equipment;

- Responsibility for setting up the office in the employee's home environment, or at least clear information on the rules and procedures to be followed; and

- Adequate training regarding the practices to be maintained in order to fulfill occupational health and safety regulatory standards.

The purpose of the measures is to protect employers in the event of legal claims in which employees allege ignorance of the rules or technical inability to comply with them. In the event of a labor claim due to an accident, it will be up to employees to demonstrate that they did not receive adequate training in seeking to hold an employer liable.